Annual report - Alcopa

Annual report - Alcopa

Annual report - Alcopa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

E. Financial Statements Parent Company<br />

F. Comments on the Financial Statements<br />

of the Parent Company<br />

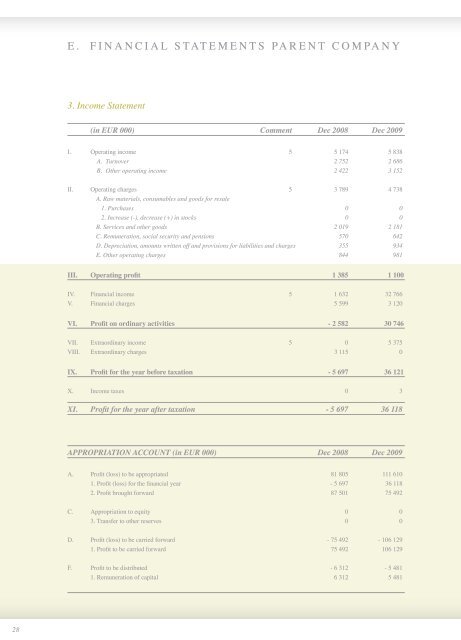

3. Income Statement<br />

(in EUR 000) Comment Dec 2008 Dec 2009<br />

I. Operating income 5 5 174 5 838<br />

A. Turnover 2 752 2 686<br />

B. Other operating income 2 422 3 152<br />

II. Operating charges 5 3 789 4 738<br />

A. Raw materials, consumables and goods for resale<br />

1. Purchases 0 0<br />

2. Increase (-), decrease (+) in stocks 0 0<br />

B. Services and other goods 2 019 2 181<br />

C. Remuneration, social security and pensions 570 642<br />

D. Depreciation, amounts written off and provisions for liabilities and charges 355 934<br />

E. Other operating charges 844 981<br />

III. Operating profit 1 385 1 100<br />

IV. Financial income 5 1 632 32 766<br />

V. Financial charges 5 599 3 120<br />

VI. Profit on ordinary activities - 2 582 30 746<br />

VII. Extraordinary income 5 0 5 375<br />

VIII. Extraordinary charges 3 115 0<br />

IX. Profit for the year before taxation - 5 697 36 121<br />

X. Income taxes 0 3<br />

XI. Profit for the year after taxation - 5 697 36 118<br />

1. Fixed assets<br />

Tangible fixed assets decreased with € 789 K mainly<br />

as result of further refurbishments at the site in<br />

Vilvoorde € 540 K in combination with € 1,300 K<br />

depreciations.<br />

The capital increases at the affiliates ACC (€ 31,750 K),<br />

Alcadis (€ 54,893 K) and Moteo (€ 37,946 K) were<br />

the main drivers for the increase of the financial<br />

assets.<br />

The amounts receivable from affiliated companies<br />

remained stable.<br />

2. Current assets<br />

Investments in own shares € 3,462 K are responsible<br />

for the increase in current assets.<br />

3. Capital and reserves<br />

The capital and reserves of <strong>Alcopa</strong> increased<br />

with € 30,637 K due to the profit of the year of<br />

€ 36,118 K and because of the appropriation of a<br />

dividend to the shareholders of € 5,481 K.<br />

4. Creditors<br />

The aforementioned capital increases at ACC, Alcadis<br />

and Moteo resulted in an increase of the funding<br />

from € 77,000 K to € 173,000 K.<br />

5. Income statement<br />

Higher other operating income offset by higher services<br />

and goods resulted in a stable operating result<br />

compared to 2008,<br />

The financial income amounted to € 32,766 K due<br />

to the dividend from ACC to <strong>Alcopa</strong>. Despite the<br />

increased outstanding loans the lower average interest<br />

rates resulted in a decrease of the financial<br />

charges of € 2,284 K.<br />

The extraordinary income for 2009 consisted of the<br />

reversal amounts written off on investements for<br />

€ 3,002 K and gains on the sale of the investment in<br />

Moorkens Luxembourg to Abelim € 2,359 K.<br />

All of this resulted in a profit of the year after<br />

taxation of € 36,118 K.<br />

APPROPRIATION ACCOUNT (in EUR 000) Dec 2008 Dec 2009<br />

A. Profit (loss) to be appropriated 81 805 111 610<br />

1. Profit (loss) for the financial year - 5 697 36 118<br />

2. Profit brought forward 87 501 75 492<br />

C. Appropriation to equity 0 0<br />

3. Transfer to other reserves 0 0<br />

D. Profit (loss) to be carried forward - 75 492 - 106 129<br />

1. Profit to be carried forward 75 492 106 129<br />

F. Profit to be distributed - 6 312 - 5 481<br />

1. Remuneration of capital 6 312 5 481<br />

28 29