AWB Limited - 2004 Annual Report

AWB Limited - 2004 Annual Report

AWB Limited - 2004 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO AND FORMING PART OF THE FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 SEPTEMBER <strong>2004</strong><br />

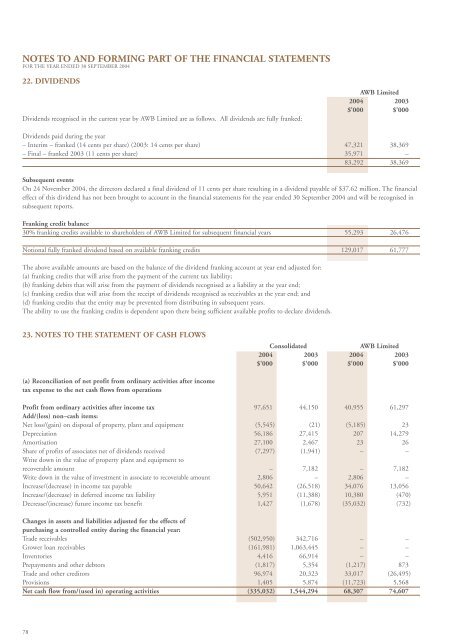

22. DIVIDENDS<br />

Dividends recognised in the current year by <strong>AWB</strong> <strong>Limited</strong> are as follows. All dividends are fully franked:<br />

<strong>AWB</strong> <strong>Limited</strong><br />

<strong>2004</strong> 2003<br />

$'000 $'000<br />

Dividends paid during the year<br />

– Interim – franked (14 cents per share) (2003: 14 cents per share) 47,321 38,369<br />

– Final – franked 2003 (11 cents per share) 35,971 –<br />

83,292 38,369<br />

Subsequent events<br />

On 24 November <strong>2004</strong>, the directors declared a final dividend of 11 cents per share resulting in a dividend payable of $37.62 million. The financial<br />

effect of this dividend has not been brought to account in the financial statements for the year ended 30 September <strong>2004</strong> and will be recognised in<br />

subsequent reports.<br />

Franking credit balance<br />

30% franking credits available to shareholders of <strong>AWB</strong> <strong>Limited</strong> for subsequent financial years 55,293 26,476<br />

Notional fully franked dividend based on available franking credits 129,017 61,777<br />

The above available amounts are based on the balance of the dividend franking account at year end adjusted for:<br />

(a) franking credits that will arise from the payment of the current tax liability;<br />

(b) franking debits that will arise from the payment of dividends recognised as a liability at the year end;<br />

(c) franking credits that will arise from the receipt of dividends recognised as receivables at the year end; and<br />

(d) franking credits that the entity may be prevented from distributing in subsequent years.<br />

The ability to use the franking credits is dependent upon there being sufficient available profits to declare dividends.<br />

23. NOTES TO THE STATEMENT OF CASH FLOWS<br />

Consolidated<br />

<strong>AWB</strong> <strong>Limited</strong><br />

<strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

$'000 $'000 $'000 $'000<br />

(a) Reconciliation of net profit from ordinary activities after income<br />

tax expense to the net cash flows from operations<br />

Profit from ordinary activities after income tax 97,651 44,150 40,955 61,297<br />

Add/(less) non–cash items:<br />

Net loss/(gain) on disposal of property, plant and equipment (5,545) (21) (5,185) 23<br />

Depreciation 56,186 27,415 207 14,279<br />

Amortisation 27,100 2,467 23 26<br />

Share of profits of associates net of dividends received (7,297) (1,941) – –<br />

Write down in the value of property plant and equipment to<br />

recoverable amount – 7,182 – 7,182<br />

Write down in the value of investment in associate to recoverable amount 2,806 – 2,806 –<br />

Increase/(decrease) in income tax payable 50,642 (26,518) 34,076 13,056<br />

Increase/(decrease) in deferred income tax liability 5,951 (11,388) 10,380 (470)<br />

Decrease/(increase) future income tax benefit 1,427 (1,678) (35,032) (732)<br />

Changes in assets and liabilities adjusted for the effects of<br />

purchasing a controlled entity during the financial year:<br />

Trade receivables (502,950) 342,716 – –<br />

Grower loan receivables (161,981) 1,063,445 – –<br />

Inventories 4,416 66,914 – –<br />

Prepayments and other debtors (1,817) 5,354 (1,217) 873<br />

Trade and other creditors 96,974 20,323 33,017 (26,495)<br />

Provisions 1,405 5,874 (11,723) 5,568<br />

Net cash flow from/(used in) operating activities (335,032) 1,544,294 68,307 74,607<br />

78