AWB Limited - 2004 Annual Report

AWB Limited - 2004 Annual Report

AWB Limited - 2004 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

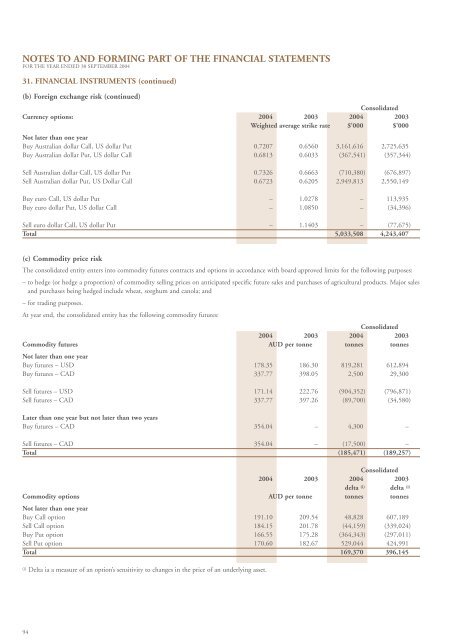

NOTES TO AND FORMING PART OF THE FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 SEPTEMBER <strong>2004</strong><br />

31. FINANCIAL INSTRUMENTS (continued)<br />

(b) Foreign exchange risk (continued)<br />

Consolidated<br />

Currency options: <strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

Weighted average strike rate $'000 $'000<br />

Not later than one year<br />

Buy Australian dollar Call, US dollar Put 0.7207 0.6560 3,161,616 2,725,635<br />

Buy Australian dollar Put, US dollar Call 0.6813 0.6033 (367,541) (357,344)<br />

Sell Australian dollar Call, US dollar Put 0.7326 0.6663 (710,380) (676,897)<br />

Sell Australian dollar Put, US Dollar Call 0.6723 0.6205 2,949,813 2,550,149<br />

Buy euro Call, US dollar Put – 1.0278 – 113,935<br />

Buy euro dollar Put, US dollar Call – 1.0850 – (34,396)<br />

Sell euro dollar Call, US dollar Put – 1.1403 – (77,675)<br />

Total 5,033,508 4,243,407<br />

(c) Commodity price risk<br />

The consolidated entity enters into commodity futures contracts and options in accordance with board approved limits for the following purposes:<br />

– to hedge (or hedge a proportion) of commodity selling prices on anticipated specific future sales and purchases of agricultural products. Major sales<br />

and purchases being hedged include wheat, sorghum and canola; and<br />

– for trading purposes.<br />

At year end, the consolidated entity has the following commodity futures:<br />

Consolidated<br />

<strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

Commodity futures AUD per tonne tonnes tonnes<br />

Not later than one year<br />

Buy futures – USD 178.35 186.30 819,281 612,894<br />

Buy futures – CAD 337.77 398.05 2,500 29,300<br />

Sell futures – USD 171.14 222.76 (904,352) (796,871)<br />

Sell futures – CAD 337.77 397.26 (89,700) (34,580)<br />

Later than one year but not later than two years<br />

Buy futures – CAD 354.04 – 4,300 –<br />

Sell futures – CAD 354.04 – (17,500) –<br />

Total (185,471) (189,257)<br />

Consolidated<br />

<strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

delta (i) delta (i)<br />

Commodity options AUD per tonne tonnes tonnes<br />

Not later than one year<br />

Buy Call option 191.10 209.54 48,828 607,189<br />

Sell Call option 184.15 201.78 (44,159) (339,024)<br />

Buy Put option 166.55 175.28 (364,343) (297,011)<br />

Sell Put option 170.60 182.67 529,044 424,991<br />

Total 169,370 396,145<br />

(i) Delta ia a measure of an option’s sensitivity to changes in the price of an underlying asset.<br />

94