Consolidated financial statement 2011 - Aquafin

Consolidated financial statement 2011 - Aquafin

Consolidated financial statement 2011 - Aquafin

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

72<br />

<strong>Consolidated</strong> <strong>financial</strong> <strong>statement</strong> <strong>2011</strong><br />

Calculated on a daily basis, the weighted average of<br />

the number of shares over <strong>2011</strong> amounted to: 810,495 shares.<br />

After all:<br />

• 800,000 shares x 346 days = 276,800,000<br />

• 1,001,613 shares x 19 days = 19,030,647<br />

• Total: 295,830,647<br />

295,830,647 : 365 days = 810,494 shares (weighted<br />

average)<br />

n<br />

Dividend per share<br />

On 3 May <strong>2011</strong>, a total dividend of €6,723,734 was paid out<br />

over <strong>financial</strong> year 2010, equivalent to:<br />

• €10.93 for shares fully paid in on 25 April 1990<br />

• €8.40 for shares that have not been fully paid in during<br />

the <strong>financial</strong> year.<br />

If the General Meeting of 17 April 2012 approves the<br />

proposed allocation of profits for <strong>2011</strong>, then the following<br />

gross dividend will be paid out on 23 April 2012:<br />

• €10.09 for shares that have been fully paid in<br />

• €0.12 for shares that have not been fully paid in.<br />

Explanation to the consolidate cash flow overview<br />

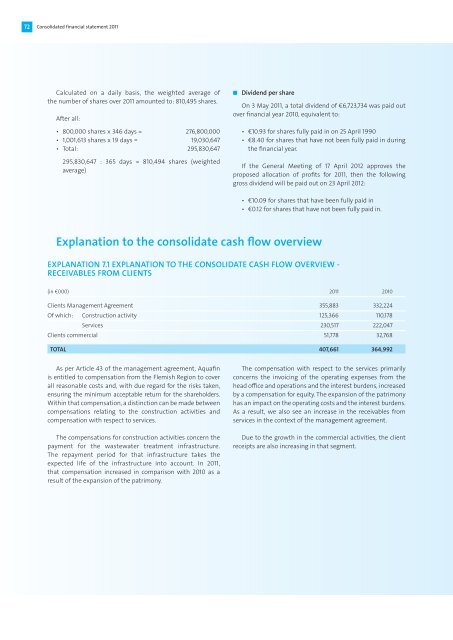

EXPLANATION 7.1 EXPLANATION TO THE CONSOLIDATE CASH FLOW OVERVIEW -<br />

RECEIVABLES FROM CLIENTS<br />

(in €000) <strong>2011</strong> 2010<br />

Clients Management Agreement 355,883 332,224<br />

Of which: Construction activity 125,366 110,178<br />

Services 230,517 222,047<br />

Clients commercial 51,778 32,768<br />

TOTAL 407,661 364,992<br />

As per Article 43 of the management agreement, <strong>Aquafin</strong><br />

is entitled to compensation from the Flemish Region to cover<br />

all reasonable costs and, with due regard for the risks taken,<br />

ensuring the minimum acceptable return for the shareholders.<br />

Within that compensation, a distinction can be made between<br />

compensations relating to the construction activities and<br />

compensation with respect to services.<br />

The compensations for construction activities concern the<br />

payment for the wastewater treatment infrastructure.<br />

The repayment period for that infrastructure takes the<br />

expected life of the infrastructure into account. In <strong>2011</strong>,<br />

that compensation increased in comparison with 2010 as a<br />

result of the expansion of the patrimony.<br />

The compensation with respect to the services primarily<br />

concerns the invoicing of the operating expenses from the<br />

head office and operations and the interest burdens, increased<br />

by a compensation for equity. The expansion of the patrimony<br />

has an impact on the operating costs and the interest burdens.<br />

As a result, we also see an increase in the receivables from<br />

services in the context of the management agreement.<br />

Due to the growth in the commercial activities, the client<br />

receipts are also increasing in that segment.