A N N U A L R E P O R T 1 9 9 9

A N N U A L R E P O R T 1 9 9 9

A N N U A L R E P O R T 1 9 9 9

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

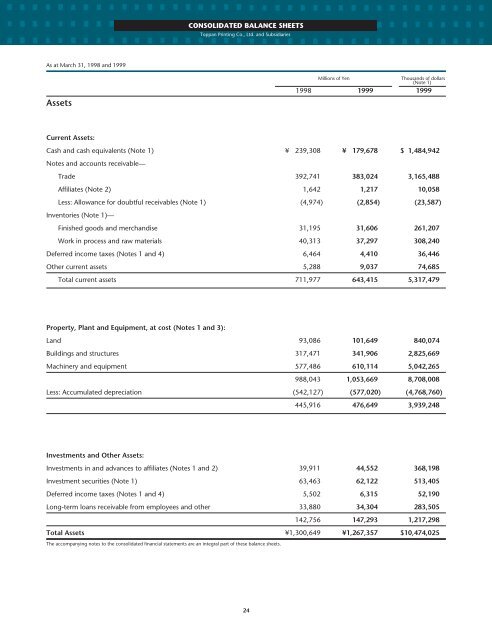

CONSOLIDATED BALANCE SHEETS<br />

Toppan Printing Co., Ltd. and Subsidiaries<br />

As at March 31, 1998 and 1999<br />

Assets<br />

Millions of Yen<br />

Thousands of dollars<br />

(Note 1)<br />

1998 1999 1999<br />

Current Assets:<br />

Cash and cash equivalents (Note 1) ¥ 239,308 ¥ 179,678 $ 1,484,942<br />

Notes and accounts receivable—<br />

Trade 392,741 383,024 3,165,488<br />

Affiliates (Note 2) 1,642 1,217 10,058<br />

Less: Allowance for doubtful receivables (Note 1) (4,974) (2,854) (23,587)<br />

Inventories (Note 1)—<br />

Finished goods and merchandise 31,195 31,606 261,207<br />

Work in process and raw materials 40,313 37,297 308,240<br />

Deferred income taxes (Notes 1 and 4) 6,464 4,410 36,446<br />

Other current assets 5,288 9,037 74,685<br />

Total current assets 711,977 643,415 5,317,479<br />

Property, Plant and Equipment, at cost (Notes 1 and 3):<br />

Land 93,086 101,649 840,074<br />

Buildings and structures 317,471 341,906 2,825,669<br />

Machinery and equipment 577,486 610,114 5,042,265<br />

988,043 1,053,669 8,708,008<br />

Less: Accumulated depreciation (542,127) (577,020) (4,768,760)<br />

445,916 476,649 3,939,248<br />

Investments and Other Assets:<br />

Investments in and advances to affiliates (Notes 1 and 2) 39,911 44,552 368,198<br />

Investment securities (Note 1) 63,463 62,122 513,405<br />

Deferred income taxes (Notes 1 and 4) 5,502 6,315 52,190<br />

Long-term loans receivable from employees and other 33,880 34,304 283,505<br />

142,756 147,293 1,217,298<br />

Total Assets ¥1,300,649 ¥1,267,357 $10,474,025<br />

The accompanying notes to the consolidated financial statements are an integral part of these balance sheets.<br />

24