A N N U A L R E P O R T 1 9 9 9

A N N U A L R E P O R T 1 9 9 9

A N N U A L R E P O R T 1 9 9 9

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

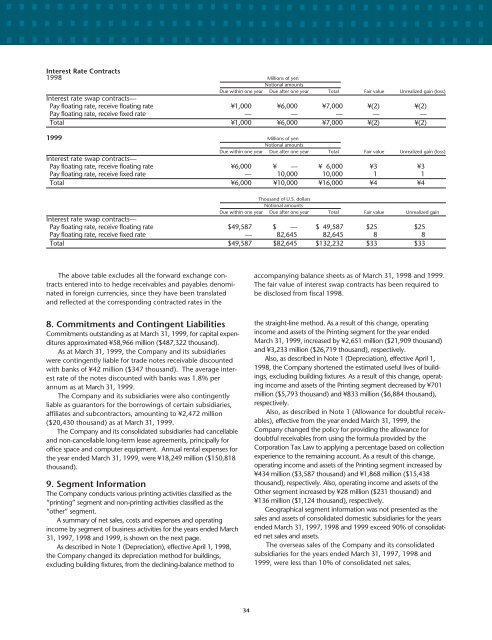

Interest Rate Contracts<br />

1998 Millions of yen<br />

Notional amounts<br />

Due within one year Due after one year Total Fair value Unrealized gain (loss)<br />

Interest rate swap contracts—<br />

Pay floating rate, receive floating rate ¥1,000 ¥6,000 ¥7,000 ¥(2) ¥(2)<br />

Pay floating rate, receive fixed rate — — — — —<br />

Total ¥1,000 ¥6,000 ¥7,000 ¥(2) ¥(2)<br />

1999 Millions of yen<br />

Notional amounts<br />

Due within one year Due after one year Total Fair value Unrealized gain (loss)<br />

Interest rate swap contracts—<br />

Pay floating rate, receive floating rate ¥6,000 ¥ — ¥ 6,000 ¥3 ¥3<br />

Pay floating rate, receive fixed rate — 10,000 10,000 1 1<br />

Total ¥6,000 ¥10,000 ¥16,000 ¥4 ¥4<br />

Thousand of U.S. dollars<br />

Notional amounts<br />

Due within one year Due after one year Total Fair value Unrealized gain<br />

Interest rate swap contracts—<br />

Pay floating rate, receive floating rate $49,587 $ — $ 49,587 $25 $25<br />

Pay floating rate, receive fixed rate — 82,645 82,645 8 8<br />

Total $49,587 $82,645 $132,232 $33 $33<br />

The above table excludes all the forward exchange contracts<br />

entered into to hedge receivables and payables denominated<br />

in foreign currencies, since they have been translated<br />

and reflected at the corresponding contracted rates in the<br />

accompanying balance sheets as of March 31, 1998 and 1999.<br />

The fair value of interest swap contracts has been required to<br />

be disclosed from fiscal 1998.<br />

8. Commitments and Contingent Liabilities<br />

Commitments outstanding as at March 31, 1999, for capital expenditures<br />

approximated ¥58,966 million ($487,322 thousand).<br />

As at March 31, 1999, the Company and its subsidiaries<br />

were contingently liable for trade notes receivable discounted<br />

with banks of ¥42 million ($347 thousand). The average interest<br />

rate of the notes discounted with banks was 1.8% per<br />

annum as at March 31, 1999.<br />

The Company and its subsidiaries were also contingently<br />

liable as guarantors for the borrowings of certain subsidiaries,<br />

affiliates and subcontractors, amounting to ¥2,472 million<br />

($20,430 thousand) as at March 31, 1999.<br />

The Company and its consolidated subsidiaries had cancellable<br />

and non-cancellable long-term lease agreements, principally for<br />

office space and computer equipment. Annual rental expenses for<br />

the year ended March 31, 1999, were ¥18,249 million ($150,818<br />

thousand).<br />

9. Segment Information<br />

The Company conducts various printing activities classified as the<br />

“printing” segment and non-printing activities classified as the<br />

“other” segment.<br />

A summary of net sales, costs and expenses and operating<br />

income by segment of business activities for the years ended March<br />

31, 1997, 1998 and 1999, is shown on the next page.<br />

As described in Note 1 (Depreciation), effective April 1, 1998,<br />

the Company changed its depreciation method for buildings,<br />

excluding building fixtures, from the declining-balance method to<br />

the straight-line method. As a result of this change, operating<br />

income and assets of the Printing segment for the year ended<br />

March 31, 1999, increased by ¥2,651 million ($21,909 thousand)<br />

and ¥3,233 million ($26,719 thousand), respectively.<br />

Also, as described in Note 1 (Depreciation), effective April 1,<br />

1998, the Company shortened the estimated useful lives of buildings,<br />

excluding building fixtures. As a result of this change, operating<br />

income and assets of the Printing segment decreased by ¥701<br />

million ($5,793 thousand) and ¥833 million ($6,884 thousand),<br />

respectively.<br />

Also, as described in Note 1 (Allowance for doubtful receivables),<br />

effective from the year ended March 31, 1999, the<br />

Company changed the policy for providing the allowance for<br />

doubtful receivables from using the formula provided by the<br />

Corporation Tax Law to applying a percentage based on collection<br />

experience to the remaining account. As a result of this change,<br />

operating income and assets of the Printing segment increased by<br />

¥434 million ($3,587 thousand) and ¥1,868 million ($15,438<br />

thousand), respectively. Also, operating income and assets of the<br />

Other segment increased by ¥28 million ($231 thousand) and<br />

¥136 million ($1,124 thousand), respectively.<br />

Geographical segment information was not presented as the<br />

sales and assets of consolidated domestic subsidiaries for the years<br />

ended March 31, 1997, 1998 and 1999 exceed 90% of consolidated<br />

net sales and assets.<br />

The overseas sales of the Company and its consolidated<br />

subsidiaries for the years ended March 31, 1997, 1998 and<br />

1999, were less than 10% of consolidated net sales.<br />

34