Vodafone Group Plc Annual Report for the year ended 31 March 2012

Vodafone Group Plc Annual Report for the year ended 31 March 2012

Vodafone Group Plc Annual Report for the year ended 31 March 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Vodafone</strong> <strong>Group</strong> <strong>Plc</strong><br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

101<br />

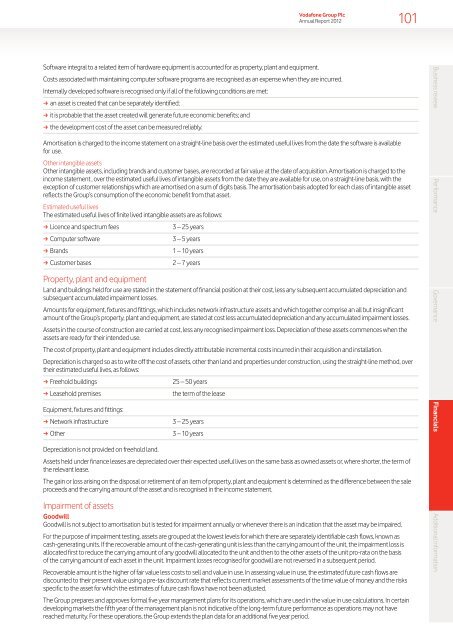

Software integral to a related item of hardware equipment is accounted <strong>for</strong> as property, plant and equipment.<br />

Costs associated with maintaining computer software programs are recognised as an expense when <strong>the</strong>y are incurred.<br />

Internally developed software is recognised only if all of <strong>the</strong> following conditions are met:<br />

aa<br />

an asset is created that can be separately identified;<br />

aa<br />

it is probable that <strong>the</strong> asset created will generate future economic benefits; and<br />

aa<br />

<strong>the</strong> development cost of <strong>the</strong> asset can be measured reliably.<br />

Amortisation is charged to <strong>the</strong> income statement on a straight-line basis over <strong>the</strong> estimated useful lives from <strong>the</strong> date <strong>the</strong> software is available<br />

<strong>for</strong> use.<br />

O<strong>the</strong>r intangible assets<br />

O<strong>the</strong>r intangible assets, including brands and customer bases, are recorded at fair value at <strong>the</strong> date of acquisition. Amortisation is charged to <strong>the</strong><br />

income statement , over <strong>the</strong> estimated useful lives of intangible assets from <strong>the</strong> date <strong>the</strong>y are available <strong>for</strong> use, on a straight-line basis, with <strong>the</strong><br />

exception of customer relationships which are amortised on a sum of digits basis. The amortisation basis adopted <strong>for</strong> each class of intangible asset<br />

reflects <strong>the</strong> <strong>Group</strong>’s consumption of <strong>the</strong> economic benefit from that asset.<br />

Estimated useful lives<br />

The estimated useful lives of finite lived intangible assets are as follows:<br />

aa<br />

Licence and spectrum fees<br />

3 – 25 <strong>year</strong>s<br />

aa<br />

Computer software<br />

3 – 5 <strong>year</strong>s<br />

aa<br />

Brands<br />

1 – 10 <strong>year</strong>s<br />

aa<br />

Customer bases<br />

2 – 7 <strong>year</strong>s<br />

Property, plant and equipment<br />

Land and buildings held <strong>for</strong> use are stated in <strong>the</strong> statement of financial position at <strong>the</strong>ir cost, less any subsequent accumulated depreciation and<br />

subsequent accumulated impairment losses.<br />

Amounts <strong>for</strong> equipment, fixtures and fittings, which includes network infrastructure assets and which toge<strong>the</strong>r comprise an all but insignificant<br />

amount of <strong>the</strong> <strong>Group</strong>’s property, plant and equipment, are stated at cost less accumulated depreciation and any accumulated impairment losses.<br />

Assets in <strong>the</strong> course of construction are carried at cost, less any recognised impairment loss. Depreciation of <strong>the</strong>se assets commences when <strong>the</strong><br />

assets are ready <strong>for</strong> <strong>the</strong>ir int<strong>ended</strong> use.<br />

The cost of property, plant and equipment includes directly attributable incremental costs incurred in <strong>the</strong>ir acquisition and installation.<br />

Depreciation is charged so as to write off <strong>the</strong> cost of assets, o<strong>the</strong>r than land and properties under construction, using <strong>the</strong> straight-line method, over<br />

<strong>the</strong>ir estimated useful lives, as follows:<br />

aa<br />

Freehold buildings<br />

25 – 50 <strong>year</strong>s<br />

aa<br />

Leasehold premises<br />

<strong>the</strong> term of <strong>the</strong> lease<br />

Equipment, fixtures and fittings:<br />

aa<br />

Network infrastructure<br />

aa<br />

O<strong>the</strong>r<br />

3 – 25 <strong>year</strong>s<br />

3 – 10 <strong>year</strong>s<br />

Depreciation is not provided on freehold land.<br />

Assets held under finance leases are depreciated over <strong>the</strong>ir expected useful lives on <strong>the</strong> same basis as owned assets or, where shorter, <strong>the</strong> term of<br />

<strong>the</strong> relevant lease.<br />

The gain or loss arising on <strong>the</strong> disposal or retirement of an item of property, plant and equipment is determined as <strong>the</strong> difference between <strong>the</strong> sale<br />

proceeds and <strong>the</strong> carrying amount of <strong>the</strong> asset and is recognised in <strong>the</strong> income statement.<br />

Impairment of assets<br />

Goodwill<br />

Goodwill is not subject to amortisation but is tested <strong>for</strong> impairment annually or whenever <strong>the</strong>re is an indication that <strong>the</strong> asset may be impaired.<br />

For <strong>the</strong> purpose of impairment testing, assets are grouped at <strong>the</strong> lowest levels <strong>for</strong> which <strong>the</strong>re are separately identifiable cash flows, known as<br />

cash-generating units. If <strong>the</strong> recoverable amount of <strong>the</strong> cash-generating unit is less than <strong>the</strong> carrying amount of <strong>the</strong> unit, <strong>the</strong> impairment loss is<br />

allocated first to reduce <strong>the</strong> carrying amount of any goodwill allocated to <strong>the</strong> unit and <strong>the</strong>n to <strong>the</strong> o<strong>the</strong>r assets of <strong>the</strong> unit pro-rata on <strong>the</strong> basis<br />

of <strong>the</strong> carrying amount of each asset in <strong>the</strong> unit. Impairment losses recognised <strong>for</strong> goodwill are not reversed in a subsequent period.<br />

Recoverable amount is <strong>the</strong> higher of fair value less costs to sell and value in use. In assessing value in use, <strong>the</strong> estimated future cash flows are<br />

discounted to <strong>the</strong>ir present value using a pre-tax discount rate that reflects current market assessments of <strong>the</strong> time value of money and <strong>the</strong> risks<br />

specific to <strong>the</strong> asset <strong>for</strong> which <strong>the</strong> estimates of future cash flows have not been adjusted.<br />

The <strong>Group</strong> prepares and approves <strong>for</strong>mal five <strong>year</strong> management plans <strong>for</strong> its operations, which are used in <strong>the</strong> value in use calculations. In certain<br />

developing markets <strong>the</strong> fifth <strong>year</strong> of <strong>the</strong> management plan is not indicative of <strong>the</strong> long-term future per<strong>for</strong>mance as operations may not have<br />

reached maturity. For <strong>the</strong>se operations, <strong>the</strong> <strong>Group</strong> extends <strong>the</strong> plan data <strong>for</strong> an additional five <strong>year</strong> period.<br />

Business review Per<strong>for</strong>mance Governance Financials Additional in<strong>for</strong>mation