Vodafone Group Plc Annual Report for the year ended 31 March 2012

Vodafone Group Plc Annual Report for the year ended 31 March 2012

Vodafone Group Plc Annual Report for the year ended 31 March 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

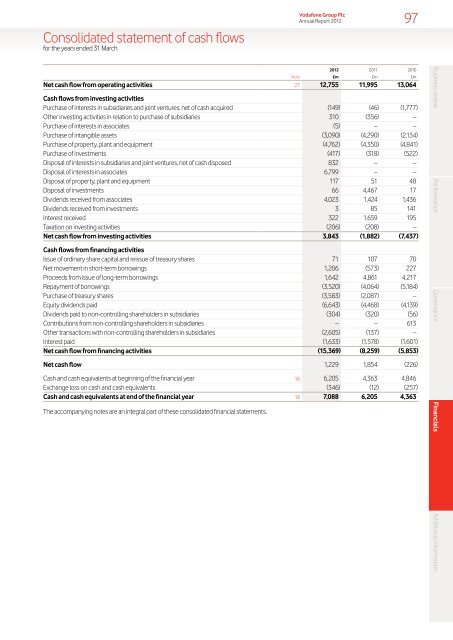

Consolidated statement of cash flows<br />

<strong>for</strong> <strong>the</strong> <strong>year</strong>s <strong>ended</strong> <strong>31</strong> <strong>March</strong><br />

<strong>Vodafone</strong> <strong>Group</strong> <strong>Plc</strong><br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

97<br />

<strong>2012</strong> 2011 2010<br />

Note £m £m £m<br />

Net cash flow from operating activities 27 12,755 11,995 13,064<br />

Cash flows from investing activities<br />

Purchase of interests in subsidiaries and joint ventures, net of cash acquired (149) (46) (1,777)<br />

O<strong>the</strong>r investing activities in relation to purchase of subsidiaries <strong>31</strong>0 (356) –<br />

Purchase of interests in associates (5) – –<br />

Purchase of intangible assets (3,090) (4,290) (2,134)<br />

Purchase of property, plant and equipment (4,762) (4,350) (4,841)<br />

Purchase of investments (417) (<strong>31</strong>8) (522)<br />

Disposal of interests in subsidiaries and joint ventures, net of cash disposed 832 – –<br />

Disposal of interests in associates 6,799 – –<br />

Disposal of property, plant and equipment 117 51 48<br />

Disposal of investments 66 4,467 17<br />

Dividends received from associates 4,023 1,424 1,436<br />

Dividends received from investments 3 85 141<br />

Interest received 322 1,659 195<br />

Taxation on investing activities (206) (208) –<br />

Net cash flow from investing activities 3,843 (1,882) (7,437)<br />

Cash flows from financing activities<br />

Issue of ordinary share capital and reissue of treasury shares 71 107 70<br />

Net movement in short-term borrowings 1,206 (573) 227<br />

Proceeds from issue of long-term borrowings 1,642 4,861 4,217<br />

Repayment of borrowings (3,520) (4,064) (5,184)<br />

Purchase of treasury shares (3,583) (2,087) –<br />

Equity dividends paid (6,643) (4,468) (4,139)<br />

Dividends paid to non-controlling shareholders in subsidiaries (304) (320) (56)<br />

Contributions from non-controlling shareholders in subsidiaries – – 613<br />

O<strong>the</strong>r transactions with non-controlling shareholders in subsidiaries (2,605) (137) –<br />

Interest paid (1,633) (1,578) (1,601)<br />

Net cash flow from financing activities (15,369) (8,259) (5,853)<br />

Net cash flow 1,229 1,854 (226)<br />

Cash and cash equivalents at beginning of <strong>the</strong> financial <strong>year</strong> 18 6,205 4,363 4,846<br />

Exchange loss on cash and cash equivalents (346) (12) (257)<br />

Cash and cash equivalents at end of <strong>the</strong> financial <strong>year</strong> 18 7,088 6,205 4,363<br />

The accompanying notes are an integral part of <strong>the</strong>se consolidated financial statements.<br />

Business review Per<strong>for</strong>mance Governance Financials Additional in<strong>for</strong>mation