laTeST - Music & Sound Retailer

laTeST - Music & Sound Retailer

laTeST - Music & Sound Retailer

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

It’s in the cards<br />

(continued from cover)<br />

tion. However, there are so many<br />

retailers in the United States that<br />

it would be difficult—although<br />

certainly not impossible—to be<br />

fined for a failure to be PCI compliant<br />

unless you had a security<br />

breach.<br />

The payment card industry<br />

was formed jointly by Visa,<br />

MasterCard, American Express<br />

and Discover to reduce dramatically<br />

the possibility of security<br />

breaches. To get the entire scoop,<br />

we spoke to Jason Wagner, senior<br />

national account manager for<br />

Omaha, Neb.-based First National<br />

Merchant Solutions, NAMM’s<br />

recommended vendor. One of<br />

the processor’s roles has been to<br />

work with vendors to make sure<br />

they are PCI compliant before the<br />

July 1 deadline.<br />

Let’s start with the most<br />

important question. What is PCI<br />

compliance and why should you<br />

care about it? “The goal is to<br />

make sure merchants are not improperly<br />

storing any data so that,<br />

if there were a security breach,<br />

nobody’s card numbers would be<br />

compromised,” said Wagner.<br />

First National Merchant<br />

Solutions currently is making<br />

sure merchants are in tune with<br />

the 12 PCI requirements. “The<br />

validation has to be completed<br />

by a qualified security assessor<br />

(QSA), though,” said Wagner.<br />

“So, at First National Merchant<br />

Solutions, we combined forces<br />

with a company named Trustwave,<br />

which is a certified QSA.<br />

First National Merchant Solutions<br />

makes sure merchants<br />

comply with PCI standards, but<br />

also provides ongoing training as<br />

requirements may change.”<br />

For more on First National<br />

Merchant Solutions, visit www.<br />

fnms.com.<br />

Wagner added there are four<br />

levels of PCI compliance: Levels<br />

1 through 4. Level 1 merchants<br />

have more than 6 million credit<br />

card transactions per year. Level<br />

2 merchants have between 1<br />

million and 6 million credit card<br />

transactions per year. Level 3<br />

refers to those with 20,000 to 1<br />

million transactions, and Level<br />

4 refers to those processing less<br />

than 1 million transactions or less<br />

than 20,000 e-commerce transactions<br />

per year.<br />

Being PCI compliant is intended<br />

to ensure breaches cannot<br />

occur from either the outside<br />

and internally—meaning your<br />

employees.<br />

All four levels must become<br />

PCI compliant. To become PCI<br />

compliant, you must follow all of<br />

these 12 steps:<br />

1. Install and maintain a firewall<br />

configuration to protect data.<br />

2. Do not use vendor-supplied<br />

defaults for system passwords and<br />

other security parameters.<br />

3. Protect stored data.<br />

4. Encrypt transmission of<br />

cardholder data and sensitive information<br />

across public networks.<br />

5. Use and regularly update<br />

anti-virus software.<br />

6. Develop and maintain<br />

secure systems and applications.<br />

7. Restrict access to data by<br />

business need-to-know.<br />

8. Assign a unique ID to each<br />

person with computer access.<br />

9. Restrict physical access to<br />

cardholder data.<br />

10. Track and monitor all<br />

access to network resources and<br />

cardholder data.<br />

11. Regularly test security<br />

systems and processes.<br />

12. Maintain a policy that addresses<br />

information security.<br />

For more on this topic, visit<br />

www.visa.com/cisp.<br />

We also looked into another<br />

aspect of PCI compliance. Merchant<br />

Link, which is involved in<br />

credit card tokenization. What is<br />

tokenization? Merchant Link’s<br />

Dan Lane and Tim Kinsella<br />

will fill us in. “Merchants have<br />

to trust vendors like Visa and<br />

MasterCard to make sure money<br />

gets into their accounts,” said<br />

Kinsella. “Many times, that<br />

works. But sometimes, it doesn’t.<br />

What do you do then? Merchant<br />

Link provides an answer. We<br />

offer a gateway between a store’s<br />

credit system and the banks to<br />

make sure transactions go to the<br />

right place and are tracked. It’s<br />

become much easier for bad guys<br />

to steal credit card data and turn<br />

it into money for themselves.<br />

As that risk accelerated, card<br />

associations created Payment<br />

Card Industry (PCI) compliance,<br />

which is a requirement to protect<br />

personal data. We saw an opportunity<br />

to create a technology to<br />

help merchants.”<br />

“Credit card companies expect<br />

you, the merchant, to protect that<br />

data,” added Lane. “Our product<br />

is called tokenization. It does that<br />

for merchants. You know how difficult<br />

it is just to protect information<br />

on your home computer. It<br />

gets much more complex on the<br />

merchant level. It can be very<br />

challenging. Even for small merchants.<br />

Since broadband [Internet<br />

service] became widely avail-<br />

CD-ROM Book & DVD<br />

able, bad guys immediately took<br />

advantage of that and hacked into<br />

merchant security systems more<br />

easily.”<br />

Merchant Link said the average<br />

cost of using its service is<br />

two to three cents per transaction.<br />

For more, visit www.<br />

merchantlink.com.<br />

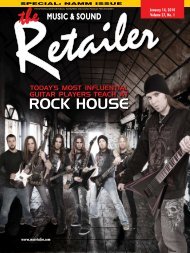

THE ULTIMATE<br />

MULTIMEDIA INSTRUCTOR<br />

Over 30 titles available in three formats for Guitar, Bass, & Keyboard!<br />

Contact your sales rep for exclusive buy-in opportunities!<br />

USA/Canada<br />

Phone: (800) 292-6122<br />

Fax: (800) 632-1928<br />

International<br />

Phone: +1 (818) 891-5999<br />

Fax: +1 (818) 893-5560<br />

DVD<br />

Online<br />

Web: alfred.com/dealer<br />

E-mail: sales@alfred.com<br />

Coming in the May Issue of<br />

the <strong>Music</strong> & <strong>Sound</strong> <strong>Retailer</strong>:<br />

• Pro Audio Update<br />

• Summer NAMM Preview<br />

• Five Minutes With: Ron Manus, CEO Alfred Publishing<br />

• Formidable Females: Mary Ann Giorgio,<br />

MXL Microphones<br />

• MI Spy Visits Sin City: Las Vegas<br />

• The second edition of Appraisal Scene Investigation<br />

And Much, Much More!