Unlimited Duration Trusts - Minnesota CLE

Unlimited Duration Trusts - Minnesota CLE

Unlimited Duration Trusts - Minnesota CLE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

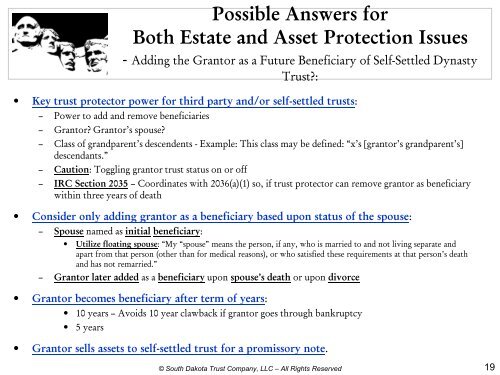

Possible Answers for<br />

Both Estate and Asset Protection Issues<br />

- Adding the Grantor as a Future Beneficiary of Self-Settled Dynasty<br />

Trust?:<br />

• Key trust protector power for third party and/or self-settled trusts:<br />

– Power to add and remove beneficiaries<br />

– Grantor? Grantor’s spouse?<br />

– Class of grandparent’s descendents - Example: This class may be defined: “x’s [grantor’s grandparent’s]<br />

descendants.”<br />

– Caution: Toggling grantor trust status on or off<br />

– IRC Section 2035 – Coordinates with 2036(a)(1) so, if trust protector can remove grantor as beneficiary<br />

within three years of death<br />

• Consider only adding grantor as a beneficiary based upon status of the spouse:<br />

– Spouse named as initial beneficiary:<br />

• Utilize floating spouse: “My “spouse” means the person, if any, who is married to and not living separate and<br />

apart from that person (other than for medical reasons), or who satisfied these requirements at that person’s death<br />

and has not remarried.”<br />

– Grantor later added as a beneficiary upon spouse’s death or upon divorce<br />

• Grantor becomes beneficiary after term of years:<br />

• 10 years – Avoids 10 year clawback if grantor goes through bankruptcy<br />

• 5 years<br />

• Grantor sells assets to self-settled trust for a promissory note.<br />

© South Dakota Trust Company, LLC – All Rights Reserved<br />

19