Unlimited Duration Trusts - Minnesota CLE

Unlimited Duration Trusts - Minnesota CLE

Unlimited Duration Trusts - Minnesota CLE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

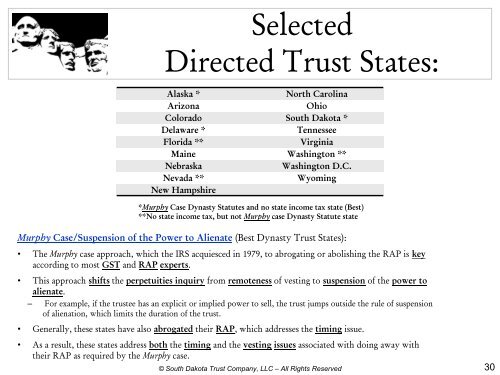

Selected<br />

Directed Trust States:<br />

Alaska *<br />

North Carolina<br />

Arizona<br />

Ohio<br />

Colorado South Dakota *<br />

Delaware *<br />

Tennessee<br />

Florida **<br />

Virginia<br />

Maine Washington **<br />

Nebraska<br />

Washington D.C.<br />

Nevada **<br />

Wyoming<br />

New Hampshire<br />

*Murphy Case Dynasty Statutes and no state income tax state (Best)<br />

**No state income tax, but not Murphy case Dynasty Statute state<br />

Murphy Case/Suspension of the Power to Alienate (Best Dynasty Trust States):<br />

• The Murphy case approach, which the IRS acquiesced in 1979, to abrogating or abolishing the RAP is key<br />

according to most GST and RAP experts.<br />

• This approach shifts the perpetuities inquiry from remoteness of vesting to suspension of the power to<br />

alienate.<br />

– For example, if the trustee has an explicit or implied power to sell, the trust jumps outside the rule of suspension<br />

of alienation, which limits the duration of the trust.<br />

• Generally, these states have also abrogated their RAP, which addresses the timing issue.<br />

• As a result, these states address both the timing and the vesting issues associated with doing away with<br />

their RAP as required by the Murphy case.<br />

© South Dakota Trust Company, LLC – All Rights Reserved<br />

30