Unlimited Duration Trusts - Minnesota CLE

Unlimited Duration Trusts - Minnesota CLE

Unlimited Duration Trusts - Minnesota CLE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

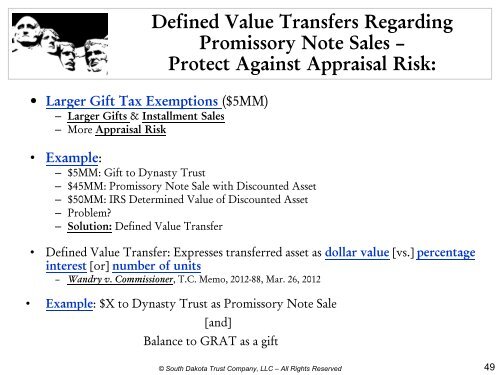

• Larger Gift Tax Exemptions ($5MM)<br />

– Larger Gifts & Installment Sales<br />

– More Appraisal Risk<br />

Defined Value Transfers Regarding<br />

Promissory Note Sales –<br />

Protect Against Appraisal Risk:<br />

• Example:<br />

– $5MM: Gift to Dynasty Trust<br />

– $45MM: Promissory Note Sale with Discounted Asset<br />

– $50MM: IRS Determined Value of Discounted Asset<br />

– Problem?<br />

– Solution: Defined Value Transfer<br />

• Defined Value Transfer: Expresses transferred asset as dollar value [vs.] percentage<br />

interest [or] number of units<br />

– Wandry v. Commissioner, T.C. Memo, 2012-88, Mar. 26, 2012<br />

• Example: $X to Dynasty Trust as Promissory Note Sale<br />

[and]<br />

Balance to GRAT as a gift<br />

© South Dakota Trust Company, LLC – All Rights Reserved<br />

49