Unlimited Duration Trusts - Minnesota CLE

Unlimited Duration Trusts - Minnesota CLE

Unlimited Duration Trusts - Minnesota CLE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

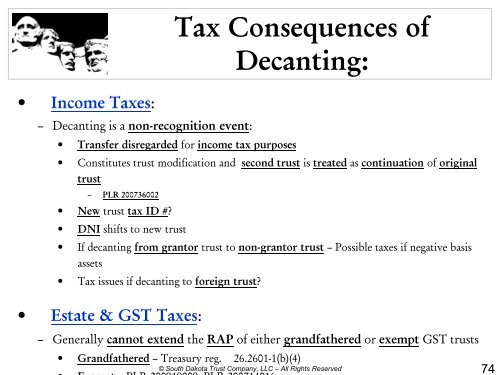

Tax Consequences of<br />

Decanting:<br />

• Income Taxes:<br />

– Decanting is a non-recognition event:<br />

• Transfer disregarded for income tax purposes<br />

• Constitutes trust modification and second trust is treated as continuation of original<br />

trust<br />

– PLR 200736002<br />

• New trust tax ID #?<br />

• DNI shifts to new trust<br />

• If decanting from grantor trust to non-grantor trust – Possible taxes if negative basis<br />

assets<br />

• Tax issues if decanting to foreign trust?<br />

• Estate & GST Taxes:<br />

– Generally cannot extend the RAP of either grandfathered or exempt GST trusts<br />

• Grandfathered – Treasury reg. 26.2601-1(b)(4)<br />

© South Dakota Trust Company, LLC – All Rights Reserved<br />

74