Unlimited Duration Trusts - Minnesota CLE

Unlimited Duration Trusts - Minnesota CLE

Unlimited Duration Trusts - Minnesota CLE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

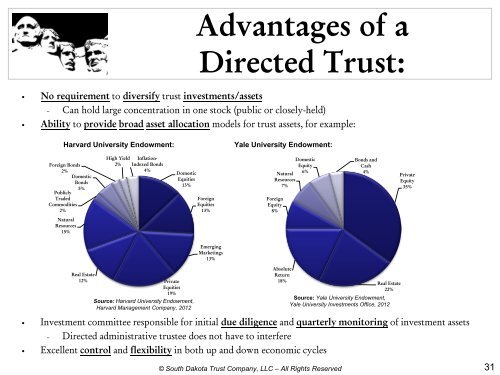

Advantages of a<br />

Directed Trust:<br />

• No requirement to diversify trust investments/assets<br />

– Can hold large concentration in one stock (public or closely-held)<br />

• Ability to provide broad asset allocation models for trust assets, for example:<br />

Harvard University Endowment:<br />

Yale University Endowment:<br />

Foreign Bonds<br />

2%<br />

Domestic<br />

Bonds<br />

5%<br />

Publicly<br />

Traded<br />

Commodities<br />

2%<br />

High Yield<br />

2%<br />

Inflation-<br />

Indexed Bonds<br />

4%<br />

Domestic<br />

Equities<br />

13%<br />

Foreign<br />

Equities<br />

13%<br />

Domestic<br />

Equity<br />

Natural<br />

6%<br />

Resources<br />

7%<br />

Foreign<br />

Equity<br />

8%<br />

Bonds and<br />

Cash<br />

4%<br />

Private<br />

Equity<br />

35%<br />

Natural<br />

Resources<br />

15%<br />

Emerging<br />

Marketings<br />

13%<br />

Real Estate<br />

12%<br />

Private<br />

Equities<br />

19%<br />

Source: Harvard University Endowment,<br />

Harvard Management Company, 2012<br />

• Investment committee responsible for initial due diligence and quarterly monitoring of investment assets<br />

Absolute<br />

Return<br />

18%<br />

– Directed administrative trustee does not have to interfere<br />

• Excellent control and flexibility in both up and down economic cycles<br />

Source: Yale University Endowment,<br />

Yale University Investments Office, 2012<br />

© South Dakota Trust Company, LLC – All Rights Reserved<br />

Real Estate<br />

22%<br />

31