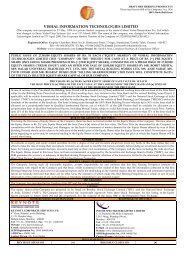

SUMMARY STATEMENT OF FINANCIAL INFORMATION You should read the following information together with the information contained in the Auditors’ report included in the section titled “Financial Statements” beginning on page 111 of the Draft Letter of Offer. Summary Statement of Assets and Liabilities, as Restated Sr. No Particulars As at Rupees in lacs 31-Mar-08 31-Mar-07 31-Mar-06 31-Mar-05 31-Mar-04 1 FIXED ASSETS Gross Block 59,885.68 43,437.40 41,637.34 40,134.39 39,530.90 Less: Depreciation 25,997.55 23,776.81 21,438.63 19,071.16 16,698.29 Net Block 33,888.13 19,660.59 20,198.71 21,063.23 22,832.61 Add: <strong>Capital</strong> Work - in - Progress 2,581.05 976.24 674.50 463.03 127.69 Less: Revaluation Reserve 14,293.43 1,087.64 1,995.37 2,905.50 3,833.36 Net Block after adjustment for Revaluation Reserve 22,175.75 19,549.19 18,877.84 18,620.76 19,126.94 2 INVESTMENTS 2,621.11 2,381.22 2,378.91 2,578.91 2,583.67 3 DEFERRED TAX ASSETS (NET) 74.57 541.19 975.13 1,115.87 1,486.20 4 CURRENT ASSETS, LOANS AND ADVANCES Inventories 11,825.74 8,320.37 9,484.56 7,568.29 5,188.71 Sundry Debtors 3,742.01 3,647.75 2,464.08 4,230.74 2,534.73 Cash and Bank Balances 1,824.15 1,734.06 1,947.84 1,514.78 4,364.45 Loans and Advances 2,651.44 2,760.63 2,525.71 1,767.76 2,225.11 20,043.34 16,462.81 16,422.19 15,081.57 14,313.00 LIABILITIES AND PROVISIONS: 5 SECURED LOANS 11,585.42 10,604.11 10,474.00 9,734.59 10,541.62 6 UNSECURED LOANS 4,327.35 4,437.61 4,662.89 5,452.95 4,507.62 7 CURRENT LIABILITIES AND PROVISIONS Current Liabilities 14,971.69 11,096.21 11,902.68 10,900.22 13,186.00 Provisions 877.99 775.36 709.31 638.27 625.50 15,849.68 11,871.57 12,611.99 11,538.49 13,811.50 NET WORTH (1+2+3+4-5-6-7) 13,152.32 12,021.12 10,905.19 10,671.08 8,649.07 NET WORTH REPRESENTED BY 8 SHARE CAPITAL 5,242.17 5,242.17 5,242.17 4,835.59 3,347.71 9 RESERVE AND SURPLUS 22,213.93 7,880.36 7,725.56 8,962.07 9,529.49 Less: Revaluation Reserve 14,293.43 1,087.64 1,995.37 2,905.50 3,833.36 Less: Miscellaneous Expenditure 10.35 13.77 67.17 221.08 394.77 Reserves (Net of Revaluation Reserves) 7,910.15 6,778.95 5,663.02 5,835.49 5,301.36 NET WORTH (8+9) 13,152.32 12,021.12 10,905.19 10,671.08 8,649.07 5

Summary statement of Profit & Losses, as Restated Rupees in lacs Particulars For the year ending 31 st March 2007-08 2006-07 2005-06 2004-05 2003-04 INCOME Sales and Services (Gross) Manufacture 44,814.30 56,146.50 52,138.73 52,175.54 45,090.96 Traded - - - - 114.27 Less: - Excise Duty 4,464.34 4,621.98 5,023.54 4,956.42 4,341.82 Services 1,012.80 181.90 - 174.72 124.81 41,362.76 51,706.42 47,115.19 47,393.84 40,988.22 Other Income 1,295.89 520.17 487.99 587.72 610.98 (Less)/Add: (Increase)/Decrease in Inventories (1,078.40) 829.70 (1,420.22) (1,482.90) 1,660.85 43,737.05 51,396.89 49,023.40 49,464.46 39,938.35 EXPENDITURE Raw Material Consumed 23,590.41 29,400.62 29,802.01 28,881.78 23,200.74 Staff Costs 1,690.89 2,009.97 1,990.54 1,833.13 1,982.94 Other Manufacturing Expenses 10,055.20 11,822.37 11,372.38 11,001.91 10,325.83 Administration Expenses 1,265.81 1,111.74 1,083.47 1,092.17 1,247.95 Selling and Distribution Expenses 1,479.22 1,946.43 2,198.18 2,345.33 2,370.26 Purchase of Traded Items - - - - 170.48 Interest 2,126.66 1,764.13 1,890.76 1,917.19 2,411.58 Depreciation 2,577.57 2,478.71 2,391.90 2,410.31 2,188.33 Less:- Transfer from Revaluation Reserve (884.15) (907.73) (910.15) (937.42) (311.76) 41,901.61 49,626.24 49,819.09 48,544.40 43,586.35 Net Profit /(Loss) before Tax and Extraordinary items 1,835.44 1,770.65 (795.69) 920.06 (3,648.00) Add: Profit on sale of Chemical Business Less: Voluntary Retirement Scheme - - - - 1,626.97 8.39 25.39 57.75 86.39 264.62 Less: Deferred VRS Gratuity Payment - 31.51 100.61 100.61 100.61 Profit / (Loss) after extra ordinary items but before tax 1,827.05 1,713.75 (954.05) 733.06 (2,386.26) Less: Provision for Tax 203.83 192.28 - - - Less: Provision for Wealth Tax 2.00 2.00 2.00 2.29 2.50 Less: Provision for Fringe Benefit Tax Add: Deferred Tax adjustment 28.00 23.00 43.00 - - (466.61) (433.94) (140.74) (370.33) 2,188.15 Less: Excess Provision of Earlier Years (1.17) - - - - Net Profit /(Loss) after Tax 1,127.78 1,062.53 (1,139.79) 360.44 (200.61) Balance brought forward 1,064.57 2.04 1,141.83 781.39 982.00 BALANCE CARRIED TO BALANCE SHEET 2,192.35 1,064.57 2.04 1,141.83 781.39 6

- Page 1 and 2: DRAFT LETTER OF OFFER Dated: July 1

- Page 3 and 4: SECTION I - DEFINITIONS AND ABBREVI

- Page 5 and 6: Renouncees Rights Entitlement Right

- Page 7 and 8: NO OFFER IN OTHER JURISDICTIONS The

- Page 9 and 10: SECTION II - RISK FACTORS FORWARD L

- Page 11 and 12: **The amount involved in the income

- Page 13 and 14: Company may need additional financi

- Page 15 and 16: a. Cost of Raw Materials Purified T

- Page 17 and 18: expenditures or incur additional op

- Page 19 and 20: 2. Any downgrading of India’s deb

- Page 21 and 22: 4 Net Asset Value as per the Restat

- Page 23 and 24: PET PET is eco-friendly and inert w

- Page 25: THE ISSUE Equity Shares proposed to

- Page 29 and 30: GENERAL INFORMATION Our Company was

- Page 31 and 32: UNION BANK OF INDIA Union Bank Bhav

- Page 33 and 34: CAPITAL STRUCTURE PARTICULARS AS ON

- Page 35 and 36: September 09, 2005 2005 issue Septe

- Page 37 and 38: Bloomingdale Investment & Finance 5

- Page 39 and 40: Other than as stated hereinbelow, t

- Page 42 and 43: OBJECTS OF THE ISSUE Our Company in

- Page 44 and 45: 3 Printing, stationery, distributio

- Page 46 and 47: Financial year 2007 8.84 2 Financia

- Page 48 and 49: ii. If long term capital gain is co

- Page 50 and 51: SECTION IV - ABOUT US INDUSTRY OVER

- Page 52 and 53: Kilo Tons 3000 2500 2000 1500 1000

- Page 54 and 55: 2 Inhouse Research and Development

- Page 56 and 57: The major raw materials used in the

- Page 58 and 59: 1. Polyester Staple Fibre/Chips M.T

- Page 60 and 61: 3 PET Preforms PET Preforms are sol

- Page 62 and 63: 6. December 22, 2006 November 21, 2

- Page 64 and 65: We have obtained insurance policies

- Page 66 and 67: Paragon Textile Mills Private Limit

- Page 68 and 69: 2 Implementation of any scheme of e

- Page 70 and 71: KEY INDUSTRY REGULATIONS Our Compan

- Page 72 and 73: 9. Hazardous Wastes (Management and

- Page 74 and 75: after satisfactory adjudications of

- Page 76 and 77:

(70% through Transmere and 30% dire

- Page 78 and 79:

twenty years. April 03, 2007 Grant

- Page 80 and 81:

The shareholding pattern of this co

- Page 82 and 83:

OUR MANAGEMENT BOARD OF DIRECTORS A

- Page 84 and 85:

Developers Private Limited. 36. Kun

- Page 86 and 87:

Nationality: Indian Tenure: Balance

- Page 88 and 89:

For further details of the provisio

- Page 90 and 91:

CHANGES IN OUR BOARD OF DIRECTORS D

- Page 92 and 93:

Names of the Directors Designation

- Page 94 and 95:

Mr. Gopalan Venkatesh 46 October 6,

- Page 96 and 97:

OUR PROMOTERS Our Company has two P

- Page 98 and 99:

OUR PROMOTER GROUP ENTITIES Note: A

- Page 100 and 101:

Category No. of Shares held Percent

- Page 102 and 103:

The financial performance of this c

- Page 104 and 105:

Nature of Activities The company wa

- Page 106 and 107:

Financial Performance The financial

- Page 108 and 109:

Nature of Activities The company wa

- Page 110 and 111:

Limited Kuntiputra Properties Priva

- Page 112 and 113:

The company was incorporated with t

- Page 114 and 115:

Shareholding Pattern The shareholdi

- Page 116 and 117:

Shareholding Pattern The shareholdi

- Page 118 and 119:

Brief History Bay Side Exports Priv

- Page 120 and 121:

The company was incorporated with t

- Page 122 and 123:

Nature of Activities The company wa

- Page 124 and 125:

Shareholding Pattern The shareholdi

- Page 126 and 127:

Net Worth 216.29 4132.02 EPS per sh

- Page 128 and 129:

Particulars For the year ending on

- Page 130 and 131:

1. Brahmasonic Sound Production Pri

- Page 132 and 133:

DIVIDEND POLICY Dividends, other th

- Page 134 and 135:

1. Balance Sheet as per Annexure XV

- Page 136 and 137:

STATEMENT OF PROFIT & LOSSES Annexu

- Page 138 and 139:

Investments are classified into cur

- Page 140 and 141:

DIVIDEND DECLARED BY THE COMPANY IV

- Page 142 and 143:

ACCOUNTING RATIOS Annexure - VI Det

- Page 144 and 145:

SECURED LOANS - TERM LOANS AS ON 31

- Page 146 and 147:

SECURED LOANS OTHERS ON 31ST MARCH,

- Page 148 and 149:

UNSECURED LOANS AS ON 31ST MARCH, 2

- Page 150 and 151:

SUNDRY DEBTORS Annexure - XII (Rupe

- Page 152 and 153:

STATEMENT OF CAPITAL COMMITMENT AND

- Page 154 and 155:

1. Mr. S. B. Ghia Chairman & Managi

- Page 156 and 157:

NOTE ON CONSOLIDATION OF ACCOUNTS O

- Page 158 and 159:

Significant accounting policies: -

- Page 160 and 161:

MANAGEMENT DISCUSSION AND ANALYSIS

- Page 162 and 163:

High Speed blow moulding, Hot Fill

- Page 164 and 165:

Our Company’s manufacturing facil

- Page 166 and 167:

Company’s contributions paid /pay

- Page 168 and 169:

Administration, selling and distrib

- Page 170 and 171:

Less: Provision for Fringe Benefit

- Page 172 and 173:

Profit / (Loss) after tax As a resu

- Page 174 and 175:

Net cash from/used in Financing Act

- Page 176 and 177:

SECTION VI - LEGAL AND OTHER INFORM

- Page 178 and 179:

7. Indian Organic Chemicals Limited

- Page 180 and 181:

Raheja (the “Defendants”) 6. Ms

- Page 182 and 183:

C. Sales Tax Cases filed by our Com

- Page 184 and 185:

E. Income Tax Cases filed by our Co

- Page 186 and 187:

Deputy Commissioner of Income Tax,

- Page 188 and 189:

15. Disallowance in respect of purc

- Page 190 and 191:

1. Indian Organic Chemicals Limited

- Page 192 and 193:

Appellate Tribunal [now Customs, Ex

- Page 194 and 195:

Notice issued by Supreintendent of

- Page 196 and 197:

15. Show Cause Notice issued by the

- Page 198 and 199:

PART II - OUTSTANDING LITIGATIONS I

- Page 200 and 201:

2. Hathway Investment Private Limit

- Page 202 and 203:

Sr. No. Parties 1. Kapesh R. Shah (

- Page 204 and 205:

“Defendants”) 6. T.V. Today Net

- Page 206 and 207:

v/s Gautam Kashinath Rokde (the “

- Page 208 and 209:

2. The Respondent has failed to con

- Page 210 and 211:

8. Asianet Satellite Communications

- Page 212 and 213:

Village (the “Complainant”) v/s

- Page 214 and 215:

Managing Director, Asianet Satellit

- Page 216 and 217:

esidential township on the factory

- Page 218 and 219:

Defendant from proceeding further w

- Page 220 and 221:

Material Developments after date of

- Page 222 and 223:

Shops and Establishment Act 1. Cert

- Page 224 and 225:

1. Letter of renewal of license for

- Page 226 and 227:

1. License bearing no. 809/05, date

- Page 228 and 229:

4. Report of Examination dated June

- Page 230 and 231:

enewal of the same can be applied f

- Page 232 and 233:

B. ALL THE LEGAL REQUIREMENTS CONNE

- Page 234 and 235:

legal requirements applicable in su

- Page 236 and 237:

Promise vs. performance The objecti

- Page 238 and 239:

2007- 08 2006- 07 2005- 06 2004- 05

- Page 240 and 241:

In case our Company issues letters

- Page 242 and 243:

TERMS OF THE ISSUE The Equity Share

- Page 244 and 245:

) They can renounce their right sha

- Page 246 and 247:

duplicate CAF, by furnishing the re

- Page 248 and 249:

trust/society is authorised under i

- Page 250 and 251:

Renouncee(s) The person(s) in whose

- Page 252 and 253:

SUBMISSION OF APPLICATION & MODE OF

- Page 254 and 255:

General Applications should be made

- Page 256 and 257:

Listing and Trading of the Equity S

- Page 258 and 259:

III. Direct Credit Applicants apply

- Page 260 and 261:

Renouncees will also have to provid

- Page 262 and 263:

(e) PAN Number: Whenever the applic

- Page 264 and 265:

3 Multiple applications Disposal of

- Page 266 and 267:

SECTION VIII: ARTICLES OF ASSOCIATI

- Page 268 and 269:

Shares. 9.3% Cumulative Redeemable

- Page 270 and 271:

subject, however, to Section 81 (3)

- Page 272 and 273:

The first name of jointholders deem

- Page 274 and 275:

Commission may be paid. 25. Subject

- Page 276 and 277:

Application of proceeds of sale 41.

- Page 278 and 279:

and transferor or the person giving

- Page 280 and 281:

debentureholder concerned or deceas

- Page 282 and 283:

Extraordinary Meeting General shall

- Page 284 and 285:

Poll to be taken if demanded. 90. I

- Page 286 and 287:

proxy notwithstanding death of Memb

- Page 288 and 289:

Special Remuneration for Director p

- Page 290 and 291:

Company shall disclose the nature o

- Page 292 and 293:

Notice of candidate for office of D

- Page 294 and 295:

and otherwise regulate their meetin

- Page 296 and 297:

(c) is detrimental to the interest

- Page 298 and 299:

Director, officer or other person e

- Page 300 and 301:

custody of the Seal for the time be

- Page 302 and 303:

Capitalisation 172. (a) The Company

- Page 304 and 305:

or notice shall be deemed to be eff

- Page 306 and 307:

SECTION IX - OTHER INFORMATION MATE