FUTURA POLYESTERS LIMITED - IDBI Capital

FUTURA POLYESTERS LIMITED - IDBI Capital

FUTURA POLYESTERS LIMITED - IDBI Capital

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

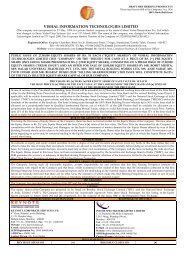

STATEMENT OF TAX BENEFITS<br />

The Board of Directors,<br />

Futura Polyesters Limited,<br />

Paragon Condominium, 3 rd Floor,<br />

Pandurang Budhkar Marg,<br />

Mumbai 400 013<br />

Dear Sirs,<br />

BENEFITS UNDER THE INCOME TAX ACT, 1961 (hereinafter referred to as the ‘Act’)<br />

TO THE COMPANY<br />

1) In accordance with the provisions of section 10(38) of the ‘Act” the long-term capital gains arising<br />

from the transfer of securities / units in a transaction entered into in a recognized stock exchange in<br />

India (such transaction is chargeable to Securities Transaction Tax under Chapter VII of the Finance<br />

(No.2) Act, 2004), shall be exempt from income tax. However, the said exemption will not be<br />

allowable as deduction from Book Profits under Section 115 JB of the Act.<br />

2) The long-term capital gains accruing to the Company otherwise than as mentioned in A. 1) above, shall<br />

be chargeable to tax in accordance with and subject to the provisions of section 112 of the Act as<br />

follows:<br />

i. If long-term capital gain is computed after indexation @ 20% (plus applicable Surcharge and<br />

Education Cess).<br />

ii. If long-term capital gain is computed without indexation @ 10% (plus applicable Surcharge and<br />

Education Cess).<br />

3) The short-term capital gains accruing to the Company, from the transfer of a short-term capital asset,<br />

being securities, in a transaction entered into in a recognized stock exchange in India (such transaction<br />

is chargeable to Securities Transaction Tax under Chapter VII of the Finance (No.2) Act, 2004) shall be<br />

chargeable to tax at the rate of 15% [plus applicable Surcharge and Education Cess] as per the<br />

provisions of section 111A of the Act.<br />

4) The Company is eligible to claim exemption in respect of tax on long term capital gains under sections<br />

54EC of the Act, if the amount of capital gains is invested in certain specified bonds/securities subject<br />

to the fulfillment of the conditions specified in those sections upto a ceiling of fifty lakh rupees.<br />

5) The Company is eligible to exemption under section 10(34) of the Act in respect of income by way of<br />

dividend received from other Domestic Companies.<br />

6) The Company is eligible to exemption under section 10(35) of the Act in respect of income by way of<br />

dividend received from mutual fund specified under Section 10(23D) of the Act and other specified<br />

undertakings/companies.<br />

TO THE MEMBERS OF THE COMPANY<br />

B I – RESIDENTS<br />

1) Members will be entitled to exemption, under section 10(34) of the Act in respect of the income by<br />

way of dividend received from the Company.<br />

2) The long-term <strong>Capital</strong> gains accruing to the members of the Company on sale of the Company’s shares<br />

in a transaction entered into in a recognized stock exchange in India (such transaction is chargeable to<br />

Securities Transaction Tax under Chapter VII of the Finance (No.2) Act, 2004) shall be exempt from<br />

tax as per the provisions of section 10(38) of the Act.<br />

3) The long term capital gains otherwise than as mentioned in (2) above, shall be chargeable to tax in<br />

accordance with and subject to the provisions of Section 112 of the Act as follows:<br />

i. If long term capital gain is computed after indexation @ 20% (plus applicable surcharge and<br />

education cess).<br />

26