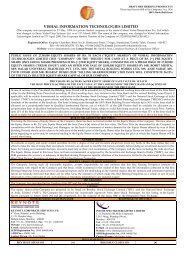

- Page 1 and 2: DRAFT LETTER OF OFFER Dated: July 1

- Page 3 and 4: SECTION I - DEFINITIONS AND ABBREVI

- Page 5 and 6: Renouncees Rights Entitlement Right

- Page 7 and 8: NO OFFER IN OTHER JURISDICTIONS The

- Page 9 and 10: SECTION II - RISK FACTORS FORWARD L

- Page 11 and 12: **The amount involved in the income

- Page 13 and 14: Company may need additional financi

- Page 15 and 16: a. Cost of Raw Materials Purified T

- Page 17 and 18: expenditures or incur additional op

- Page 19 and 20: 2. Any downgrading of India’s deb

- Page 21 and 22: 4 Net Asset Value as per the Restat

- Page 23 and 24: PET PET is eco-friendly and inert w

- Page 25 and 26: THE ISSUE Equity Shares proposed to

- Page 27 and 28: Summary statement of Profit & Losse

- Page 29 and 30: GENERAL INFORMATION Our Company was

- Page 31 and 32: UNION BANK OF INDIA Union Bank Bhav

- Page 33 and 34: CAPITAL STRUCTURE PARTICULARS AS ON

- Page 35 and 36: September 09, 2005 2005 issue Septe

- Page 37 and 38: Bloomingdale Investment & Finance 5

- Page 39 and 40: Other than as stated hereinbelow, t

- Page 42 and 43: OBJECTS OF THE ISSUE Our Company in

- Page 46 and 47: Financial year 2007 8.84 2 Financia

- Page 48 and 49: ii. If long term capital gain is co

- Page 50 and 51: SECTION IV - ABOUT US INDUSTRY OVER

- Page 52 and 53: Kilo Tons 3000 2500 2000 1500 1000

- Page 54 and 55: 2 Inhouse Research and Development

- Page 56 and 57: The major raw materials used in the

- Page 58 and 59: 1. Polyester Staple Fibre/Chips M.T

- Page 60 and 61: 3 PET Preforms PET Preforms are sol

- Page 62 and 63: 6. December 22, 2006 November 21, 2

- Page 64 and 65: We have obtained insurance policies

- Page 66 and 67: Paragon Textile Mills Private Limit

- Page 68 and 69: 2 Implementation of any scheme of e

- Page 70 and 71: KEY INDUSTRY REGULATIONS Our Compan

- Page 72 and 73: 9. Hazardous Wastes (Management and

- Page 74 and 75: after satisfactory adjudications of

- Page 76 and 77: (70% through Transmere and 30% dire

- Page 78 and 79: twenty years. April 03, 2007 Grant

- Page 80 and 81: The shareholding pattern of this co

- Page 82 and 83: OUR MANAGEMENT BOARD OF DIRECTORS A

- Page 84 and 85: Developers Private Limited. 36. Kun

- Page 86 and 87: Nationality: Indian Tenure: Balance

- Page 88 and 89: For further details of the provisio

- Page 90 and 91: CHANGES IN OUR BOARD OF DIRECTORS D

- Page 92 and 93: Names of the Directors Designation

- Page 94 and 95:

Mr. Gopalan Venkatesh 46 October 6,

- Page 96 and 97:

OUR PROMOTERS Our Company has two P

- Page 98 and 99:

OUR PROMOTER GROUP ENTITIES Note: A

- Page 100 and 101:

Category No. of Shares held Percent

- Page 102 and 103:

The financial performance of this c

- Page 104 and 105:

Nature of Activities The company wa

- Page 106 and 107:

Financial Performance The financial

- Page 108 and 109:

Nature of Activities The company wa

- Page 110 and 111:

Limited Kuntiputra Properties Priva

- Page 112 and 113:

The company was incorporated with t

- Page 114 and 115:

Shareholding Pattern The shareholdi

- Page 116 and 117:

Shareholding Pattern The shareholdi

- Page 118 and 119:

Brief History Bay Side Exports Priv

- Page 120 and 121:

The company was incorporated with t

- Page 122 and 123:

Nature of Activities The company wa

- Page 124 and 125:

Shareholding Pattern The shareholdi

- Page 126 and 127:

Net Worth 216.29 4132.02 EPS per sh

- Page 128 and 129:

Particulars For the year ending on

- Page 130 and 131:

1. Brahmasonic Sound Production Pri

- Page 132 and 133:

DIVIDEND POLICY Dividends, other th

- Page 134 and 135:

1. Balance Sheet as per Annexure XV

- Page 136 and 137:

STATEMENT OF PROFIT & LOSSES Annexu

- Page 138 and 139:

Investments are classified into cur

- Page 140 and 141:

DIVIDEND DECLARED BY THE COMPANY IV

- Page 142 and 143:

ACCOUNTING RATIOS Annexure - VI Det

- Page 144 and 145:

SECURED LOANS - TERM LOANS AS ON 31

- Page 146 and 147:

SECURED LOANS OTHERS ON 31ST MARCH,

- Page 148 and 149:

UNSECURED LOANS AS ON 31ST MARCH, 2

- Page 150 and 151:

SUNDRY DEBTORS Annexure - XII (Rupe

- Page 152 and 153:

STATEMENT OF CAPITAL COMMITMENT AND

- Page 154 and 155:

1. Mr. S. B. Ghia Chairman & Managi

- Page 156 and 157:

NOTE ON CONSOLIDATION OF ACCOUNTS O

- Page 158 and 159:

Significant accounting policies: -

- Page 160 and 161:

MANAGEMENT DISCUSSION AND ANALYSIS

- Page 162 and 163:

High Speed blow moulding, Hot Fill

- Page 164 and 165:

Our Company’s manufacturing facil

- Page 166 and 167:

Company’s contributions paid /pay

- Page 168 and 169:

Administration, selling and distrib

- Page 170 and 171:

Less: Provision for Fringe Benefit

- Page 172 and 173:

Profit / (Loss) after tax As a resu

- Page 174 and 175:

Net cash from/used in Financing Act

- Page 176 and 177:

SECTION VI - LEGAL AND OTHER INFORM

- Page 178 and 179:

7. Indian Organic Chemicals Limited

- Page 180 and 181:

Raheja (the “Defendants”) 6. Ms

- Page 182 and 183:

C. Sales Tax Cases filed by our Com

- Page 184 and 185:

E. Income Tax Cases filed by our Co

- Page 186 and 187:

Deputy Commissioner of Income Tax,

- Page 188 and 189:

15. Disallowance in respect of purc

- Page 190 and 191:

1. Indian Organic Chemicals Limited

- Page 192 and 193:

Appellate Tribunal [now Customs, Ex

- Page 194 and 195:

Notice issued by Supreintendent of

- Page 196 and 197:

15. Show Cause Notice issued by the

- Page 198 and 199:

PART II - OUTSTANDING LITIGATIONS I

- Page 200 and 201:

2. Hathway Investment Private Limit

- Page 202 and 203:

Sr. No. Parties 1. Kapesh R. Shah (

- Page 204 and 205:

“Defendants”) 6. T.V. Today Net

- Page 206 and 207:

v/s Gautam Kashinath Rokde (the “

- Page 208 and 209:

2. The Respondent has failed to con

- Page 210 and 211:

8. Asianet Satellite Communications

- Page 212 and 213:

Village (the “Complainant”) v/s

- Page 214 and 215:

Managing Director, Asianet Satellit

- Page 216 and 217:

esidential township on the factory

- Page 218 and 219:

Defendant from proceeding further w

- Page 220 and 221:

Material Developments after date of

- Page 222 and 223:

Shops and Establishment Act 1. Cert

- Page 224 and 225:

1. Letter of renewal of license for

- Page 226 and 227:

1. License bearing no. 809/05, date

- Page 228 and 229:

4. Report of Examination dated June

- Page 230 and 231:

enewal of the same can be applied f

- Page 232 and 233:

B. ALL THE LEGAL REQUIREMENTS CONNE

- Page 234 and 235:

legal requirements applicable in su

- Page 236 and 237:

Promise vs. performance The objecti

- Page 238 and 239:

2007- 08 2006- 07 2005- 06 2004- 05

- Page 240 and 241:

In case our Company issues letters

- Page 242 and 243:

TERMS OF THE ISSUE The Equity Share

- Page 244 and 245:

) They can renounce their right sha

- Page 246 and 247:

duplicate CAF, by furnishing the re

- Page 248 and 249:

trust/society is authorised under i

- Page 250 and 251:

Renouncee(s) The person(s) in whose

- Page 252 and 253:

SUBMISSION OF APPLICATION & MODE OF

- Page 254 and 255:

General Applications should be made

- Page 256 and 257:

Listing and Trading of the Equity S

- Page 258 and 259:

III. Direct Credit Applicants apply

- Page 260 and 261:

Renouncees will also have to provid

- Page 262 and 263:

(e) PAN Number: Whenever the applic

- Page 264 and 265:

3 Multiple applications Disposal of

- Page 266 and 267:

SECTION VIII: ARTICLES OF ASSOCIATI

- Page 268 and 269:

Shares. 9.3% Cumulative Redeemable

- Page 270 and 271:

subject, however, to Section 81 (3)

- Page 272 and 273:

The first name of jointholders deem

- Page 274 and 275:

Commission may be paid. 25. Subject

- Page 276 and 277:

Application of proceeds of sale 41.

- Page 278 and 279:

and transferor or the person giving

- Page 280 and 281:

debentureholder concerned or deceas

- Page 282 and 283:

Extraordinary Meeting General shall

- Page 284 and 285:

Poll to be taken if demanded. 90. I

- Page 286 and 287:

proxy notwithstanding death of Memb

- Page 288 and 289:

Special Remuneration for Director p

- Page 290 and 291:

Company shall disclose the nature o

- Page 292 and 293:

Notice of candidate for office of D

- Page 294 and 295:

and otherwise regulate their meetin

- Page 296 and 297:

(c) is detrimental to the interest

- Page 298 and 299:

Director, officer or other person e

- Page 300 and 301:

custody of the Seal for the time be

- Page 302 and 303:

Capitalisation 172. (a) The Company

- Page 304 and 305:

or notice shall be deemed to be eff

- Page 306 and 307:

SECTION IX - OTHER INFORMATION MATE