FUTURA POLYESTERS LIMITED - IDBI Capital

FUTURA POLYESTERS LIMITED - IDBI Capital

FUTURA POLYESTERS LIMITED - IDBI Capital

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

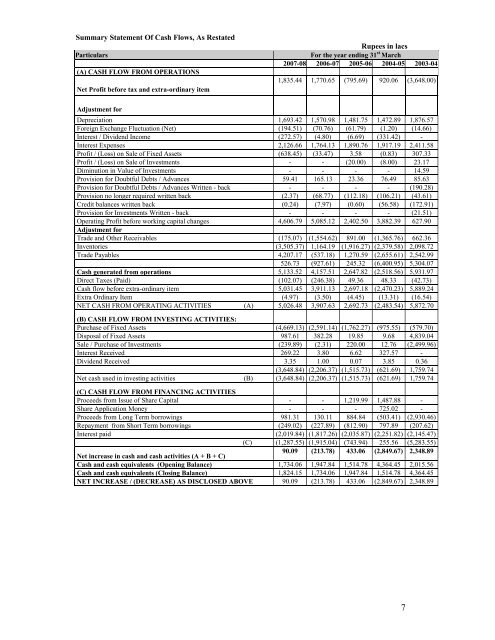

Summary Statement Of Cash Flows, As Restated<br />

Particulars<br />

(A) CASH FLOW FROM OPERATIONS<br />

Net Profit before tax and extra-ordinary item<br />

Rupees in lacs<br />

For the year ending 31 st March<br />

2007-08 2006-07 2005-06 2004-05 2003-04<br />

1,835.44 1,770.65 (795.69) 920.06 (3,648.00)<br />

Adjustment for<br />

Depreciation 1,693.42 1,570.98 1,481.75 1,472.89 1,876.57<br />

Foreign Exchange Fluctuation (Net) (194.51) (70.76) (61.79) (1.20) (14.66)<br />

Interest / Dividend Income (272.57) (4.80) (6.69) (331.42) -<br />

Interest Expenses 2,126.66 1,764.13 1,890.76 1,917.19 2,411.58<br />

Profit / (Loss) on Sale of Fixed Assets (638.45) (33.47) 3.58 (0.83) 307.33<br />

Profit / (Loss) on Sale of Investments - - (20.00) (8.00) 23.17<br />

Diminution in Value of Investments - - - - 14.59<br />

Provision for Doubtful Debts / Advances 59.41 165.13 23.36 76.49 85.63<br />

Provision for Doubtful Debts / Advances Written - back - - - - (190.28)<br />

Provision no longer required written back (2.37) (68.77) (112.18) (106.21) (43.61)<br />

Credit balances written back (0.24) (7.97) (0.60) (56.58) (172.91)<br />

Provision for Investments Written - back - - - - (21.51)<br />

Operating Profit before working capital changes 4,606.79 5,085.12 2,402.50 3,882.39 627.90<br />

Adjustment for<br />

Trade and Other Receivables (175.07) (1,554.62) 891.00 (1,365.76) 662.36<br />

Inventories (3,505.37) 1,164.19 (1,916.27) (2,379.58) 2,098.72<br />

Trade Payables 4,207.17 (537.18) 1,270.59 (2,655.61) 2,542.99<br />

526.73 (927.61) 245.32 (6,400.95) 5,304.07<br />

Cash generated from operations 5,133.52 4,157.51 2,647.82 (2,518.56) 5,931.97<br />

Direct Taxes (Paid) (102.07) (246.38) 49.36 48.33 (42.73)<br />

Cash flow before extra-ordinary item 5,031.45 3,911.13 2,697.18 (2,470.23) 5,889.24<br />

Extra Ordinary Item (4.97) (3.50) (4.45) (13.31) (16.54)<br />

NET CASH FROM OPERATING ACTIVITIES (A) 5,026.48 3,907.63 2,692.73 (2,483.54) 5,872.70<br />

(B) CASH FLOW FROM INVESTING ACTIVITIES:<br />

Purchase of Fixed Assets (4,669.13) (2,591.14) (1,762.27) (975.55) (579.70)<br />

Disposal of Fixed Assets 987.61 382.28 19.85 9.68 4,839.04<br />

Sale / Purchase of Investments (239.89) (2.31) 220.00 12.76 (2,499.96)<br />

Interest Received 269.22 3.80 6.62 327.57 -<br />

Dividend Received 3.35 1.00 0.07 3.85 0.36<br />

(3,648.84) (2,206.37) (1,515.73) (621.69) 1,759.74<br />

Net cash used in investing activities (B) (3,648.84) (2,206.37) (1,515.73) (621.69) 1,759.74<br />

(C) CASH FLOW FROM FINANCING ACTIVITIES<br />

Proceeds from Issue of Share <strong>Capital</strong> - - 1,219.99 1,487.88 -<br />

Share Application Money - - - 725.02 -<br />

Proceeds from Long Term borrowings 981.31 130.11 884.84 (503.41) (2,930.46)<br />

Repayment from Short Term borrowings (249.02) (227.89) (812.90) 797.89 (207.62)<br />

Interest paid (2,019.84) (1,817.26) (2,035.87) (2,251.82) (2,145.47)<br />

(C) (1,287.55) (1,915.04) (743.94) 255.56 (5,283.55)<br />

Net increase in cash and cash activities (A + B + C)<br />

90.09 (213.78) 433.06 (2,849.67) 2,348.89<br />

Cash and cash equivalents (Opening Balance) 1,734.06 1,947.84 1,514.78 4,364.45 2,015.56<br />

Cash and cash equivalents (Closing Balance) 1,824.15 1,734.06 1,947.84 1,514.78 4,364.45<br />

NET INCREASE / (DECREASE) AS DISCLOSED ABOVE 90.09 (213.78) 433.06 (2,849.67) 2,348.89<br />

7