to download the latest Annual Report in PDF (2.2 MB) - Batelco Group

to download the latest Annual Report in PDF (2.2 MB) - Batelco Group

to download the latest Annual Report in PDF (2.2 MB) - Batelco Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes To The Consolidated F<strong>in</strong>ancial Statements<br />

Notes To The Consolidated F<strong>in</strong>ancial Statements<br />

for <strong>the</strong> year ended 31 December 2012<br />

BD’000<br />

for <strong>the</strong> year ended 31 December 2012<br />

BD’000<br />

4 FINANCIAL INSTRUMENTS AND RISK MANAGEMENT (cont<strong>in</strong>ued)<br />

4 FINANCIAL INSTRUMENTS AND RISK MANAGEMENT (cont<strong>in</strong>ued)<br />

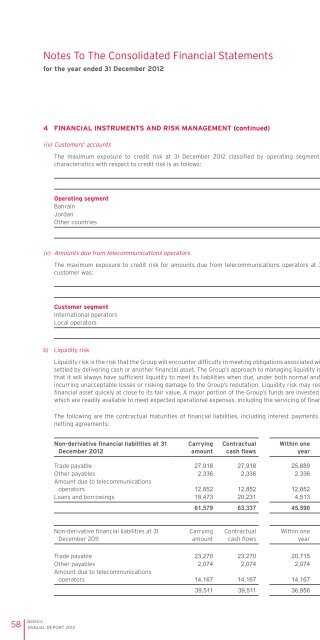

(iv) Cus<strong>to</strong>mers’ accounts<br />

c) Market risk<br />

The maximum exposure <strong>to</strong> credit risk at 31 December 2012 classified by operat<strong>in</strong>g segment shar<strong>in</strong>g common economic<br />

characteristics with respect <strong>to</strong> credit risk is as follows:<br />

2012 2011<br />

Operat<strong>in</strong>g segment<br />

Bahra<strong>in</strong> 30,651 26,330<br />

Jordan 1,973 1,557<br />

O<strong>the</strong>r countries 5,882 8,613<br />

38,506 36,500<br />

(v) Amounts due from telecommunications opera<strong>to</strong>rs<br />

The maximum exposure <strong>to</strong> credit risk for amounts due from telecommunications opera<strong>to</strong>rs at 31 December 2012 by type of<br />

cus<strong>to</strong>mer was:<br />

2012 2011<br />

Cus<strong>to</strong>mer segment<br />

International opera<strong>to</strong>rs 2,438 3,606<br />

Local opera<strong>to</strong>rs 10,865 9,881<br />

13,303 13,487<br />

b) Liquidity risk<br />

Liquidity risk is <strong>the</strong> risk that <strong>the</strong> <strong>Group</strong> will encounter difficulty <strong>in</strong> meet<strong>in</strong>g obligations associated with f<strong>in</strong>ancial liabilities that are<br />

settled by deliver<strong>in</strong>g cash or ano<strong>the</strong>r f<strong>in</strong>ancial asset. The <strong>Group</strong>’s approach <strong>to</strong> manag<strong>in</strong>g liquidity is <strong>to</strong> ensure, as far as possible,<br />

that it will always have sufficient liquidity <strong>to</strong> meet its liabilities when due, under both normal and stressed conditions, without<br />

<strong>in</strong>curr<strong>in</strong>g unacceptable losses or risk<strong>in</strong>g damage <strong>to</strong> <strong>the</strong> <strong>Group</strong>’s reputation. Liquidity risk may result from an <strong>in</strong>ability <strong>to</strong> sell a<br />

f<strong>in</strong>ancial asset quickly at close <strong>to</strong> its fair value. A major portion of <strong>the</strong> <strong>Group</strong>’s funds are <strong>in</strong>vested <strong>in</strong> cash and cash equivalents<br />

which are readily available <strong>to</strong> meet expected operational expenses, <strong>in</strong>clud<strong>in</strong>g <strong>the</strong> servic<strong>in</strong>g of f<strong>in</strong>ancial obligations.<br />

The follow<strong>in</strong>g are <strong>the</strong> contractual maturities of f<strong>in</strong>ancial liabilities, <strong>in</strong>clud<strong>in</strong>g <strong>in</strong>terest payments and exclud<strong>in</strong>g <strong>the</strong> impact of<br />

nett<strong>in</strong>g agreements:<br />

Market risk is <strong>the</strong> risk that changes <strong>in</strong> market prices, such as foreign exchange rates, <strong>in</strong>terest rates and equity prices will affect<br />

<strong>the</strong> <strong>Group</strong>’s <strong>in</strong>come or <strong>the</strong> value of its hold<strong>in</strong>gs of f<strong>in</strong>ancial <strong>in</strong>struments. The objective of market risk management is <strong>to</strong> manage<br />

and control market risk exposures with<strong>in</strong> acceptable parameters, while optimis<strong>in</strong>g <strong>the</strong> return on risk. The <strong>Group</strong> <strong>in</strong>curs f<strong>in</strong>ancial<br />

liabilities, <strong>in</strong> order <strong>to</strong> manage market risks. All such transactions are carried out with<strong>in</strong> <strong>the</strong> guidel<strong>in</strong>es set by <strong>the</strong> <strong>Group</strong> Treasury<br />

Function.<br />

(i) Currency risk<br />

Currency risk is <strong>the</strong> risk that <strong>the</strong> value of a f<strong>in</strong>ancial <strong>in</strong>strument will fluctuate due <strong>to</strong> changes <strong>in</strong> foreign exchange rates. The <strong>Group</strong><br />

is exposed <strong>to</strong> currency risk on sales and purchases that are denom<strong>in</strong>ated <strong>in</strong> a currency o<strong>the</strong>r than <strong>the</strong> respective functional<br />

currencies of <strong>Group</strong> entities, primarily <strong>the</strong> Bahra<strong>in</strong>i D<strong>in</strong>ar and Jordanian D<strong>in</strong>ar, (which are pegged <strong>to</strong> <strong>the</strong> US Dollar) and Kuwaiti<br />

D<strong>in</strong>ar. The <strong>Group</strong>’s exposure <strong>to</strong> currency risk is limited as <strong>the</strong> majority of its <strong>in</strong>vestments, due <strong>to</strong> and from <strong>in</strong>ternational opera<strong>to</strong>rs<br />

are denom<strong>in</strong>ated <strong>in</strong> US Dollar or denom<strong>in</strong>ated <strong>in</strong> currencies which are pegged <strong>to</strong> US Dollar. Consequently, <strong>the</strong> currency risk of<br />

<strong>the</strong> <strong>Group</strong> is limited.<br />

The <strong>Group</strong> seeks <strong>to</strong> manage currency risk by cont<strong>in</strong>ually moni<strong>to</strong>r<strong>in</strong>g exchange rates and by ma<strong>in</strong>ta<strong>in</strong><strong>in</strong>g an adequate level of<br />

foreign currencies <strong>to</strong> cover its expected commitment <strong>to</strong> <strong>in</strong>ternational telecommunication opera<strong>to</strong>rs. These amounts are placed<br />

significantly <strong>in</strong> short-term fixed deposit accounts. In respect of o<strong>the</strong>r monetary assets and liabilities denom<strong>in</strong>ated <strong>in</strong> foreign<br />

currencies, <strong>the</strong> <strong>Group</strong> ensures that its net exposure is kept <strong>to</strong> an acceptable level by buy<strong>in</strong>g or sell<strong>in</strong>g foreign currencies at spot<br />

rates when necessary <strong>to</strong> address short-term imbalances.<br />

The <strong>Group</strong>’s <strong>in</strong>vestment <strong>in</strong> its subsidiaries is not hedged as those currency positions are considered <strong>to</strong> be long-term <strong>in</strong> nature.<br />

In respect of o<strong>the</strong>r monetary assets and liabilities denom<strong>in</strong>ated <strong>in</strong> foreign currencies, consider<strong>in</strong>g <strong>the</strong> nature of its f<strong>in</strong>ancial<br />

<strong>in</strong>struments, <strong>the</strong> <strong>Group</strong> currently is not engaged <strong>in</strong> hedg<strong>in</strong>g of foreign currency risk.<br />

(ii) Interest rate risk<br />

Interest rate risk is <strong>the</strong> risk that <strong>the</strong> value of a f<strong>in</strong>ancial <strong>in</strong>strument will fluctuate due <strong>to</strong> changes <strong>in</strong> market <strong>in</strong>terest rates. Under<br />

<strong>the</strong> <strong>Group</strong>’s <strong>in</strong>terest rate management policy, <strong>in</strong>terest rates on monetary assets and liabilities denom<strong>in</strong>ated <strong>in</strong> Bahra<strong>in</strong>i D<strong>in</strong>ars,<br />

Jordanian D<strong>in</strong>ars, and Kuwaiti D<strong>in</strong>ars are ma<strong>in</strong>ta<strong>in</strong>ed on a float<strong>in</strong>g rate basis. The average <strong>in</strong>terest rate yield from bank deposits<br />

and available-for-sale <strong>in</strong>vestments dur<strong>in</strong>g 2012 was 0.94 % (2011: 0.8 %).<br />

At <strong>the</strong> report<strong>in</strong>g date, <strong>the</strong> <strong>in</strong>terest rate profile of <strong>the</strong> <strong>Group</strong>’s <strong>in</strong>terest-bear<strong>in</strong>g f<strong>in</strong>ancial <strong>in</strong>struments was:<br />

2012 2011<br />

Non-derivative f<strong>in</strong>ancial liabilities at 31<br />

December 2012<br />

Carry<strong>in</strong>g<br />

amount<br />

Contractual<br />

cash flows<br />

With<strong>in</strong> one<br />

year<br />

1 - 2<br />

Years<br />

More than<br />

two years<br />

Fixed rate <strong>in</strong>struments<br />

F<strong>in</strong>ancial liabilities - 41<br />

Trade payable 27,918 27,918 25,889 1,353 676<br />

O<strong>the</strong>r payables 2,336 2,336 2,336 - -<br />

Amount due <strong>to</strong> telecommunications<br />

opera<strong>to</strong>rs 12,852 12,852 12,852 - -<br />

Loans and borrow<strong>in</strong>gs 18,473 20,231 4,513 2,585 13,133<br />

61,579 63,337 45,590 3,938 13,809<br />

Non-derivative f<strong>in</strong>ancial liabilities at 31<br />

December 2011<br />

Carry<strong>in</strong>g<br />

amount<br />

Contractual<br />

cash flows<br />

With<strong>in</strong> one<br />

year<br />

1 - 2<br />

years<br />

More than<br />

two years<br />

Trade payable 23,270 23,270 20,715 582 1,973<br />

O<strong>the</strong>r payables 2,074 2,074 2,074 - -<br />

Amount due <strong>to</strong> telecommunications<br />

opera<strong>to</strong>rs 14,167 14,167 14,167 - -<br />

Variable rate <strong>in</strong>struments<br />

F<strong>in</strong>ancial assets 81,377 87,982<br />

F<strong>in</strong>ancial liabilities 18,473 -<br />

Fair value sensitivity analysis for fixed rate <strong>in</strong>struments<br />

The <strong>Group</strong> does not account for any fixed rate f<strong>in</strong>ancial assets and liabilities at fair value through <strong>the</strong> profit or loss. Therefore a<br />

change <strong>in</strong> <strong>in</strong>terest rates at <strong>the</strong> report<strong>in</strong>g date would not affect <strong>the</strong> profit or loss. Increase or decrease <strong>in</strong> equity result<strong>in</strong>g from<br />

variation <strong>in</strong> <strong>in</strong>terest rates will be <strong>in</strong>significant.<br />

Cash flow sensitivity analysis for variable rate <strong>in</strong>struments<br />

A change of 100 basis po<strong>in</strong>ts <strong>in</strong> <strong>in</strong>terest rates at <strong>the</strong> report<strong>in</strong>g date would have <strong>in</strong>creased (decreased) equity and profit or loss<br />

by BD 629 (2011: BD 880). This analysis assumes that all o<strong>the</strong>r variables, <strong>in</strong> particular foreign currency rates, rema<strong>in</strong> constant.<br />

39,511 39,511 36,956 582 1,973<br />

58<br />

<strong>Batelco</strong><br />

ANNUAL REPORT 2012<br />

<strong>Batelco</strong><br />

ANNUAL REPORT 2012<br />

59