to download the latest Annual Report in PDF (2.2 MB) - Batelco Group

to download the latest Annual Report in PDF (2.2 MB) - Batelco Group

to download the latest Annual Report in PDF (2.2 MB) - Batelco Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes To The Consolidated F<strong>in</strong>ancial Statements<br />

Notes To The Consolidated F<strong>in</strong>ancial Statements<br />

for <strong>the</strong> year ended 31 December 2012<br />

BD’000<br />

for <strong>the</strong> year ended 31 December 2012<br />

BD’000<br />

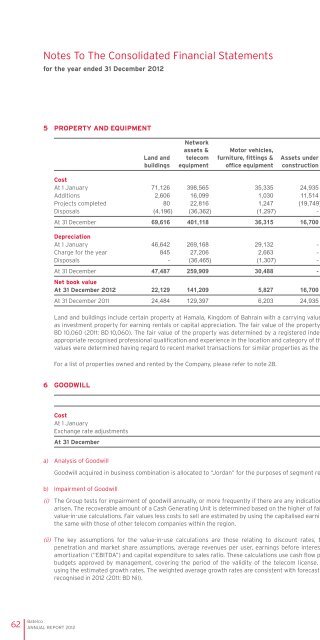

5 PROPERTY AND EQUIPMENT<br />

6 GOODWILL (cont<strong>in</strong>ued)<br />

Land and<br />

build<strong>in</strong>gs<br />

Network<br />

assets &<br />

telecom<br />

equipment<br />

Mo<strong>to</strong>r vehicles,<br />

furniture, fitt<strong>in</strong>gs &<br />

office equipment<br />

Assets under<br />

construction<br />

Total<br />

2012<br />

Cost<br />

At 1 January 71,126 398,565 35,335 24,935 529,961 522,636<br />

Additions 2,606 16,099 1,030 11,514 31,249 26,634<br />

Projects completed 80 22,816 1,247 (19,749) 4,394 3,574<br />

Disposals (4,196) (36,362) (1,297) - (41,855) (22,883)<br />

At 31 December 69,616 401,118 36,315 16,700 523,749 529,961<br />

Depreciation<br />

At 1 January 46,642 269,168 29,132 - 344,942 331,162<br />

Charge for <strong>the</strong> year 845 27,206 2,663 - 30,714 33,462<br />

Disposals - (36,465) (1,307) - (37,772) (19,682)<br />

At 31 December 47,487 259,909 30,488 - 337,884 344,942<br />

Net book value<br />

At 31 December 2012 22,129 141,209 5,827 16,700 185,865 185,019<br />

At 31 December 2011 24,484 129,397 6,203 24,935 185,019<br />

Land and build<strong>in</strong>gs <strong>in</strong>clude certa<strong>in</strong> property at Hamala, K<strong>in</strong>gdom of Bahra<strong>in</strong> with a carry<strong>in</strong>g value of BD 56 (2011: BD 56) held<br />

as <strong>in</strong>vestment property for earn<strong>in</strong>g rentals or capital appreciation. The fair value of <strong>the</strong> property as at 31 December 2012 was<br />

BD 10,060 (2011: BD 10,060). The fair value of <strong>the</strong> property was determ<strong>in</strong>ed by a registered <strong>in</strong>dependent appraiser hav<strong>in</strong>g an<br />

appropriate recognised professional qualification and experience <strong>in</strong> <strong>the</strong> location and category of <strong>the</strong> property be<strong>in</strong>g valued. Fair<br />

values were determ<strong>in</strong>ed hav<strong>in</strong>g regard <strong>to</strong> recent market transactions for similar properties as <strong>the</strong> Company’s property.<br />

For a list of properties owned and rented by <strong>the</strong> Company, please refer <strong>to</strong> note 28.<br />

Total<br />

2011<br />

(iii) The above estimates were tested by <strong>the</strong> <strong>Group</strong> for sensitivity <strong>in</strong> <strong>the</strong> follow<strong>in</strong>g areas:<br />

• An <strong>in</strong>crease / decrease <strong>in</strong> <strong>the</strong> discount rate and <strong>the</strong> long term growth rates used<br />

• A change <strong>in</strong> market share<br />

• A decrease <strong>in</strong> future planned revenues and EBITDA marg<strong>in</strong>s<br />

• An <strong>in</strong>crease <strong>in</strong> capex <strong>to</strong> sales ratio forecasts<br />

The results of <strong>the</strong> sensitivity test<strong>in</strong>g revealed that <strong>the</strong> value <strong>in</strong> use calculations is sensitive <strong>to</strong> <strong>the</strong> above changes, although <strong>the</strong>se<br />

did not result <strong>in</strong> a materially significant change <strong>in</strong> <strong>the</strong> carry<strong>in</strong>g value of <strong>the</strong> goodwill and related assets.<br />

7 INTANGIBLE ASSETS<br />

2012 2011<br />

Cost<br />

At 1 January 67,969 68,305<br />

Additions dur<strong>in</strong>g <strong>the</strong> year 32,368 464<br />

Disposals dur<strong>in</strong>g <strong>the</strong> year (249) (800)<br />

At 31 December 100,088 67,969<br />

Amortisation<br />

At 1 January 43,661 39,901<br />

Charge for <strong>the</strong> year 5,659 4,523<br />

Disposals dur<strong>in</strong>g <strong>the</strong> year (112) (763)<br />

At 31 December 49,208 43,661<br />

Net book value at 31 December 50,880 24,308<br />

6 GOODWILL<br />

2012 2011<br />

Cost<br />

At 1 January 124,682 125,129<br />

Exchange rate adjustments (305) (447)<br />

At 31 December 124,377 124,682<br />

a) Analysis of Goodwill<br />

Goodwill acquired <strong>in</strong> bus<strong>in</strong>ess comb<strong>in</strong>ation is allocated <strong>to</strong> “Jordan” for <strong>the</strong> purposes of segment report<strong>in</strong>g.<br />

b) Impairment of Goodwill<br />

(i) The <strong>Group</strong> tests for impairment of goodwill annually, or more frequently if <strong>the</strong>re are any <strong>in</strong>dications that impairment may have<br />

arisen. The recoverable amount of a Cash Generat<strong>in</strong>g Unit is determ<strong>in</strong>ed based on <strong>the</strong> higher of fair values less costs <strong>to</strong> sell and<br />

value-<strong>in</strong>-use calculations. Fair values less costs <strong>to</strong> sell are estimated by us<strong>in</strong>g <strong>the</strong> capitalised earn<strong>in</strong>gs approach and compar<strong>in</strong>g<br />

<strong>the</strong> same with those of o<strong>the</strong>r telecom companies with<strong>in</strong> <strong>the</strong> region.<br />

(ii) The key assumptions for <strong>the</strong> value-<strong>in</strong>-use calculations are those relat<strong>in</strong>g <strong>to</strong> discount rates, <strong>the</strong> long term growth rates,<br />

penetration and market share assumptions, average revenues per user, earn<strong>in</strong>gs before <strong>in</strong>terest, taxation, depreciation and<br />

amortization (“EBITDA”) and capital expenditure <strong>to</strong> sales ratio. These calculations use cash flow projections based on f<strong>in</strong>ancial<br />

budgets approved by management, cover<strong>in</strong>g <strong>the</strong> period of <strong>the</strong> validity of <strong>the</strong> telecom license. Cash flows are extrapolated<br />

us<strong>in</strong>g <strong>the</strong> estimated growth rates. The weighted average growth rates are consistent with forecasts. No impairment losses were<br />

recognised <strong>in</strong> 2012 (2011: BD Nil).<br />

8 INVESTMENT IN ASSOCIATES<br />

2012 2011<br />

At 1 January 78,580 130,124<br />

Receipts from associates (2,762) (1,930)<br />

Share of profit/(loss) (net) 1,599 (3,124)<br />

Share of currency translation (loss)/ga<strong>in</strong> - (17)<br />

Investment classified as held for sale <strong>in</strong>vestment (Note 9) - (46,473)<br />

At 31 December 77,417 78,580<br />

The summarized aggregate f<strong>in</strong>ancial <strong>in</strong>formation of <strong>the</strong> associates is as follows:<br />

2012* 2011<br />

Assets 150,747 132,814<br />

Liabilities 126,349 115,915<br />

Revenues 82,610 70,663<br />

Profit/(loss) 7,499 (9,123)<br />

* Unaudited and as of 30 November 2012.<br />

62<br />

<strong>Batelco</strong><br />

ANNUAL REPORT 2012<br />

<strong>Batelco</strong><br />

ANNUAL REPORT 2012<br />

63