IPO Note | Justdial | Justdial Ltd (JDL) - InvestmentGuruIndia

IPO Note | Justdial | Justdial Ltd (JDL) - InvestmentGuruIndia

IPO Note | Justdial | Justdial Ltd (JDL) - InvestmentGuruIndia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>IPO</strong> <strong>Note</strong> | <strong>Justdial</strong> | 17 May 2013<br />

<strong>Justdial</strong> <strong>Ltd</strong> (<strong>JDL</strong>)<br />

Rating<br />

Avoid<br />

Company Background<br />

Issue Details<br />

<strong>Justdial</strong>, is a prominent “local” search engine company in India, incorporated in<br />

1993 as A&M communications by Mr. V.S.S Mani. <strong>Justdial</strong> provides search service<br />

with information & user reviews of local businesses, products & services across<br />

India through multiple platforms such as Internet, Mobile internet (App), Telephone<br />

(Voice) and text (SMS). The search service is provided free to users, whereas it<br />

generates revenue from paid advertisers who subscribe to fee-based campaign<br />

packages to list their business (predominately, SMEs) on priority basis on search<br />

results.<br />

<strong>JDL</strong> has successfully transformed itself from mere voice based local search service<br />

providers to other emerging & under penetrated platforms like internet & mobileinternet.<br />

Currently, <strong>JDL</strong>’s internet platform generates ~50% of the search requests,<br />

followed by traditional voice (~39% in 9M13 vs ~64% in FY09) and mobile internet<br />

(~10% in 9M13 vs ~2% in FY09). Increasing smart phone penetration (~7% of total<br />

mobile phone shipments in CY12, grew by 36% over CY11) & under penetrated<br />

internet market (11.4% vs Asia 27.5% & World average 34.3%) provide enormous<br />

opportunity for <strong>JDL</strong> with strong mindshare with users.<br />

Outlook and Valuation<br />

At the lower price band of `470, <strong>JDL</strong> is valued at post-<strong>IPO</strong> issue market cap of<br />

`37.9bn, which translates into an annualised FY13E P/B & P/E valuation of 8.1x and<br />

52.3x respectively. The company enjoys the first-mover advantage & strong<br />

mindshare among users in the local search space. In addition, it has shown<br />

resilience to the technological changes over the period and is planning to expand &<br />

deepen its presence into new territories & existing geographies respectively. On the<br />

financial front, <strong>JDL</strong> has a high cash conversion ratio (FCF/EBITDA - ~92% over<br />

FY10-12), due to 100% pre-payment by paid advertisers and the low capex<br />

intensive nature of the business. On the growth front, as the business model<br />

continues to move more towards non-linearity through increased penetration in the<br />

high growth internet and mobile internet platform (Mobile Internet & Internet - ~60%<br />

of the total traffic now vs ~35% in FY09), <strong>JDL</strong> should see expansion of operating<br />

margins and strong growth in earnings.<br />

The net proceeds of the <strong>IPO</strong> would not come into the company, as it is an exit<br />

opportunity for the existing investors (16% of the OFS by promoters and the<br />

remaining 84% by PE investors). We accept that the business model is efficient and<br />

has good growth prospects; however, the valuation premium <strong>JDL</strong> is demanding is<br />

very steep (P/E of 60x on upper band and 52x on lower band on FY13E),<br />

considering Google (US) trades at 27x. We believe that the steep pricing of the <strong>IPO</strong><br />

factors in the medium term growth expansion. In addition, entering into low-entry<br />

barrier business model (Google India & Nokia City lens app biggest threat) –<br />

demands rigorous monitoring and also has the risk of technological obsolescence.<br />

Moreover, ~ 16% of the issue size is an offer of sale by the existing promoters – a<br />

move not likely to inspire confidence among investors. We, thus, recommend an<br />

Avoid rating to <strong>Justdial</strong> <strong>IPO</strong> on valuation basis.<br />

Issue Opens<br />

Issue Closes<br />

20-May-13<br />

22-May-13<br />

Equity Offerings (In mn shares) 17.5<br />

Face Value 10<br />

Price Band 470-543<br />

Issue Size (in bn) 8.22-9.50<br />

Post issue market cap (in ` bn) 32.84-37.94<br />

Maximum Application (no. of<br />

shares for retail)<br />

Issue Type<br />

Listing<br />

368<br />

100% Book<br />

Building<br />

NSE & BSE &<br />

MCX<br />

<strong>IPO</strong> Grading CRISIL – 5/5<br />

BRLMs<br />

Registrar<br />

Source: RHP<br />

Shareholding Pattern (%)<br />

Pre Issue<br />

Citigroup<br />

Global/Morgan<br />

Stanley<br />

Karvy Computer<br />

share P <strong>Ltd</strong><br />

Post Issue*<br />

Promoter 37.2% 33.1%<br />

Non Promoter 62.9% 66.9%<br />

Source: RHP<br />

Issue Structure (In mn no. shares)<br />

Issue size 17.5<br />

of which: Fresh issue by the<br />

company<br />

offer for sale 17.5<br />

Break-up of net issue to public:<br />

QIB's portion 75%<br />

Non-institutional portion 15%<br />

Retail Portion 10%<br />

Source: RHP<br />

Analyst Details<br />

Dinesh Kumar K - 022-42333531<br />

dinesh.kumar.k@adityabirla.com<br />

0<br />

Aditya Birla Money Limited<br />

2 nd Floor, Sheil Estate, Dani Corporate Park, 158 CST Road, Kalina, Santacruz (East), Mumbai 400 098 | Tel: +91 22 42333400<br />

Page No. 1

<strong>IPO</strong> <strong>Note</strong> | <strong>Justdial</strong> | 17 May 2013<br />

Business Model<br />

Having being a free service provider to users, <strong>JDL</strong> generates revenues from paid advertisers (mostly SMEs) who subscribe to feebased<br />

campaign packages or memberships in order to list their businesses on priority ranking on users’ search results. The<br />

company offers annual and long-term renewable memberships to paid advertisers. The payments are made in advance by SMEs<br />

on a monthly or annual basis (~` 1130/month), which reduces the credit risk profile for <strong>JDL</strong>. Currently, <strong>JDL</strong> converts ~2% of the<br />

total listings into paid category (in that, ~22% belongs to premium ad package and rest belongs to non-premium ad package) and<br />

rest are free business listings. Since FY09, paid advertisers base has grown exponentially from 40.5k to 195.1k in 9MFY13.<br />

Further, the total business listings (free + paid) database has increased to 9.1 mn in 9MFY13 from 7.2 mn in FY12.<br />

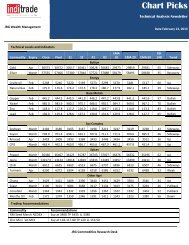

Chart 1: Traffic Mix – 9MFY13<br />

Chart 2: Business Listings categories<br />

Search Mix - 9MFY13<br />

0.3%<br />

Business Listings<br />

39.2%<br />

49.9%<br />

Premium<br />

Ad package<br />

(21.7%)<br />

Paid listings<br />

(2.1%)<br />

Non-premium<br />

Ad package<br />

(78.3%)<br />

Free listings<br />

(97.9%)<br />

10.6%<br />

Internet Mobile Voice SMS<br />

Platinum Diamond Gold<br />

Source: RHP, ABML Research<br />

Having started its search services through only phone (voice call local search in Mumbai & Delhi), <strong>JDL</strong> has expanded into emerging<br />

verticals internet, mobile net and sms in 2007 and increased their presence across the nation. Currently, <strong>JDL</strong> is witnessing bulk of<br />

the traffic from new verticals: a) Internet: attracts ~50% of the traffic (up from 34% in FY09, CAGR of ~48%), b) Mobile Net:<br />

witnessed rapid CAGR of ~94%, constitutes ~11% of total traffic (up from 2.4% in FY09) and c) Traditional voice: grew at<br />

relatively lesser pace at CAGR of 19% to ~39% (down from 63.5% in FY09). <strong>JDL</strong> is the most preferred brand in the local search<br />

engine space, primarily due to high user satisfaction experience along with a first mover advantage, which has enabled it to occupy<br />

strong brand recall and mindshare among users.<br />

Key Strengths<br />

<br />

First mover advantage in local search & strong brand recall: First, <strong>JDL</strong> started local search services in 1996 under Just<br />

Dial brand in only two cities (Delhi and Mumbai) and launched its internet and mobile internet services in 2007. By being the<br />

first in this local search market, <strong>JDL</strong> enjoys first mover advantage and strong mindshare among users largely due to high user<br />

satisfaction. Currently, <strong>JDL</strong> concentrates on 11 large cities, in order to expand its network and database further in existing and<br />

new cities appointed resellers to collect data. <strong>JDL</strong>’s database has 9.1 mn businesses listings in 9MFY13 (up from 4.5 mn in<br />

FY10), mostly SMEs.<br />

“History shows that the first brand into the brain, on an average, gets the twice the long-term market share of the No.2<br />

brand and twice again as much as the No.3 brand” – Al Ries & Jack Trout<br />

<br />

Profitable business model: <strong>JDL</strong> takes payments in advance from paid advertisers, thereby reducing credit risk and enabling<br />

a comfortable working capital management. In addition, <strong>JDL</strong> would likely benefit from non-linearity, as the business model is<br />

skewing more towards net and mobile as against the traditional voice based linear model. The company has a) higher cash<br />

generation capabilities (FCF/EBITDA - ~92% from FY10-12 and 93% OCF/EBITDA in 9MFY13), b) no long-term debt and<br />

c) cash and cash equivalents worth ` 4.76 bn (12.5% & 14.5% of higher & lower end of M-cap respectively).<br />

Aditya Birla Money Limited<br />

2 nd Floor, Sheil Estate, Dani Corporate Park, 158 CST Road, Kalina, Santacruz (East), Mumbai 400 098 | Tel: +91 22 42333400<br />

Page No. 2

<strong>IPO</strong> <strong>Note</strong> | <strong>Justdial</strong> | 17 May 2013<br />

<br />

<br />

SMEs lifeline for advertising: <strong>JDL</strong> acts as a platform for SMEs to advertise with relatively low cost (` 1130/month) compared<br />

to traditional Medias. With limited marketing budgets, SMEs can attract right target customers. SMEs can upgrade their listings<br />

from free to non-premium memberships and finally to premium memberships based upon their customer traction. Currently,<br />

<strong>JDL</strong> has conversion ratio of ~2% of total listing as paid advertisers. To achieve higher conversion of paid advertisers, it is<br />

working on a dedicated category portal to attract SMEs in a particular business.<br />

Multiple platforms: <strong>JDL</strong> provides services through several communication media i.e., Internet, Mobile Internet, Voice and<br />

SMS. Multiple platforms offer to provide reviews and ratings from users on one platform to users across all other platforms<br />

(~23 mn reviews and rating in FY13). These reviews help users for better selection of product, services and brings social<br />

quotient into the picture.<br />

Objects of the Issue<br />

The objects of the offer are to achieve the benefits of equity shares listing on stock exchanges and to carry out the sale of 17.50 mn<br />

shares by the selling shareholders. The listing would further enhance the brand name and provide liquidity to existing shareholders.<br />

The company will not receive any proceeds from the offer.<br />

Company’s Strategy going forward<br />

<br />

<br />

Widening the pan-India presence: The company has enormous scope to expand beyond its existing main concentration of<br />

11 large cities and deepen its presence in existing cities. Apart from brand recall, <strong>JDL</strong>’s database updating capability would<br />

keep them ahead of competitors and attract niche users and customers. Currently, it has 9.1 mn listings across various cities<br />

and towns in India and is planning to convert more non-premium customers to premium by offering specialised packages<br />

(2.2% of total listing is paid).<br />

Develop new products and services:<br />

<br />

<br />

<br />

<br />

<br />

Mobile apps: <strong>JDL</strong> created a Master App for Android & iPhones and is expected to launch for Blackberry and Windows<br />

enabled phones. In addition, users can use WAP to search the <strong>JDL</strong>’s database.<br />

Enabling transactions: <strong>JDL</strong> is in the process of offering additional services under its existing platform by enabling<br />

purchases and bookings that are integrated in the search results from across the platforms in collaboration with service<br />

providers and vendors. For example, reservations at restaurants, taxi bookings, doctors’ appointment fixing, ordering<br />

groceries, etc.,<br />

Car listings: <strong>JDL</strong> is exploring various areas for users to offer to sell, as well as buy, goods and services through its<br />

website. On this process, it is developing a car listings website in which users can research and rate car models being<br />

offered for sale, list their cars for sale and receive price quotes from vendors of both new and used cars.<br />

Quick Quotes: This product will provide a price quote from multiple vendors for the prospective buyers on 24/7 basis.<br />

Prospective buyers will also receive real-time updates of revised quotes by vendors through SMS and email.<br />

Structured data for business: <strong>JDL</strong> plans to use data analytics to leverage its existing search & user data to provide<br />

structured data to various businesses, product and services.<br />

Key Risks<br />

<br />

<br />

<br />

Low entry barriers: Local search industry has a low entry barrier as any player can establish a database and offer services.<br />

As it requires more initial investment, players with strong balance sheets can enter and offer competitive pricing (Google India<br />

and Nokia’s city lens app would be the biggest threat).<br />

Once lost is lost forever: The business model depends on the user traffic, - the higher the traffic, the more the SME’s<br />

advertising. Any dissatisfaction on user’s experience on data updation (availability), technological glitches in mobile & website<br />

would be difficult to win back the customer’s trust.<br />

Technological obsolescence: As the technological cycles are getting shorter and shorter, any failure to adapt to the latest<br />

and next generation of technology might affect them quite adversely.<br />

Aditya Birla Money Limited<br />

2 nd Floor, Sheil Estate, Dani Corporate Park, 158 CST Road, Kalina, Santacruz (East), Mumbai 400 098 | Tel: +91 22 42333400<br />

Page No. 3

<strong>IPO</strong> <strong>Note</strong> | <strong>Justdial</strong> | 17 May 2013<br />

Income Statement<br />

Profit & Loss Account (` In Mns) FY09 FY10 FY11 FY12 9MFY13<br />

INCOME:<br />

Sale of search related services 735.39 1160.62 1796.03 2593.98 2643.63<br />

Yellow pages pub services 123.83 148.45 0 0 0<br />

Revenue from operations 859.22 1309.07 1796.03 2593.98 2643.63<br />

Other Op. Income 0 0 43.3 26.63 1.34<br />

Total Income 859.22 1309.07 1839.33 2620.61 2644.97<br />

23.5% 52.4% 40.5% 42.5%<br />

EXPENDITURE:<br />

Employee cost 522.77 668.82 947.17 1308.37 1290.28<br />

Other Exps 260.7 343.17 438.29 639.47 619.47<br />

Total Expenditure 783.47 1011.99 1385.46 1947.84 1909.75<br />

EBITDA 75.75 297.08 453.87 672.77 735.22<br />

EBITDA Margin (%) 8.8% 22.7% 24.7% 25.7% 27.8%<br />

Depreciation 40.81 52.53 67.88 90.23 101.98<br />

Finance Cost 0.05 0.04 0.29 0.17 0.05<br />

Other Income 58.92 38.56 37.26 149.63 71.17<br />

PBT 93.81 283.07 422.96 732.00 704.36<br />

Tax 24.41 98.82 134.73 209.22 218.33<br />

Tax on PBT (%) 26.0% 34.9% 31.9% 28.6% 31.0%<br />

PAT 69.4 184.25 288.23 522.78 486.03<br />

PAT Margin (%) 8.1% 14.1% 16.0% 20.2% 18.4%<br />

Discounting operation/Share of loss 0 0.09 -2.08 5.37 -15.25<br />

PAT - Restated 69.4 184.34 286.15 528.15 470.78<br />

EPS (Pre-issue) 0.99 2.64 4.10 7.56 6.74<br />

EPS (Post-issue) 0.99 2.64 4.10 7.56 6.74<br />

Source: RHP, ABML Research<br />

Aditya Birla Money Limited<br />

2 nd Floor, Sheil Estate, Dani Corporate Park, 158 CST Road, Kalina, Santacruz (East), Mumbai 400 098 | Tel: +91 22 42333400<br />

Page No. 4

<strong>IPO</strong> <strong>Note</strong> | <strong>Justdial</strong> | 17 May 2013<br />

Balance Sheet<br />

Particulars (` In Mns) FY09 FY10 FY11 FY12 9MFY13<br />

a) Current Assets 647.40 936.15 1462.50 1904.83 4912.62<br />

b) Non-Current Assets 307.63 298.50 431.51 572.92 820.93<br />

Total Assets (a) 955.03 1234.65 1894.01 2477.75 5733.55<br />

c) Current liabilities 485.90 578.49 945.34 1382.37 1644.32<br />

d) Non-current Liabilities 30.16 19.37 17.10 22.95 40.49<br />

Total Liabilities (b) 516.06 597.86 962.44 1405.32 1684.81<br />

Share issue expenses (c) 38.76<br />

Net worth (a-b-c) 438.97 636.79 931.57 1033.67 4048.74<br />

Share Capital - Equity 8.56 8.56 519.05 519.08 694.44<br />

Preference SC 2.52 2.52 1.96 11.64 0.00<br />

Reserves & Surplus 427.89 625.71 410.56 541.71 3354.30<br />

Share issue expenses 0.00 0.00 0.00 38.76 0.00<br />

Net worth 438.97 636.79 931.57 1033.67 4048.74<br />

Source: RHP, ABML Research<br />

Cash flow<br />

Particulars (` In Mns) FY09 FY10 FY11 FY12 9MFY13<br />

Restated PBT 93.81 283.07 422.96 732.00 689.11<br />

Cash flow from operating activities 61.41 349.83 604.67 902.02 684.54<br />

Cash flow from Investing activities -98.49 -297.55 -527.82 -1144.34 -3185.15<br />

Cash flow from financing activities -3.55 5.89 -1.09 291.33 2521.20<br />

Net inc/dec in cash and cash equivalent (A+B+C) -40.63 58.17 75.76 49.01 20.59<br />

Opening cash balance 93.52 52.89 111.06 180.08 214.54<br />

Cash pertaining to de-merged sub -6.74 -14.55<br />

Closing cash balance 52.89 111.06 180.08 214.54 235.13<br />

Aditya Birla Money Limited<br />

2 nd Floor, Sheil Estate, Dani Corporate Park, 158 CST Road, Kalina, Santacruz (East), Mumbai 400 098 | Tel: +91 22 42333400<br />

Page No. 5

<strong>IPO</strong> <strong>Note</strong> | <strong>Justdial</strong> | 17 May 2013<br />

Research Team<br />

Vivek Mahajan<br />

Hemant Thukral<br />

Head of Research<br />

Head – Derivatives Desk<br />

022-42333522 022-42333483<br />

vivek.mahajan@adityabirla.com<br />

hemant.thukral@adityabirla.com<br />

Fundamental Team<br />

Akhil Jain Metals & Mining 022-42333540 akhil.jain@adityabirla.com<br />

Sunny Agrawal FMCG/Cement 022-42333458 sunny.agrawal@adityabirla.com<br />

Sumit Jatia Banking & Finance 022-42333460 sumit.jatia@adityabirla.com<br />

Shreyans Mehta Construction/Real Estate 022-42333544 shreyans.m@adityabirla.com<br />

Dinesh Kumar Information Technology/Auto 022-42333531 dinesh.kumar.k@adityabirla.com<br />

Pradeep Parkar Database Analyst 022-42333597 pradeep.parkar@adityabirla.com<br />

Quantitative Team<br />

Jyoti Nangrani Sr. Technical Analyst 022-42333454 jyoti.nangrani@adityabirla.com<br />

Advisory Support<br />

Indranil Dutta Advisory Desk – HNI 022-42333494 indranil.dutta@adityabirla.com<br />

Suresh Gardas Advisory Desk 022-42333535 suresh.gardas@adityabirla.com<br />

Sandeep Pandey Advisory Desk 022-30442104 sandeep.pandey@adityabirla.com<br />

ABML research is also accessible in Bloomberg at ABMR<br />

Aditya Birla Money Limited<br />

2 nd Floor, Sheil Estate, Dani Corporate Park, 158 CST Road, Kalina, Santacruz (East), Mumbai 400 098 | Tel: +91 22 42333400<br />

Page No. 6

<strong>IPO</strong> <strong>Note</strong> | <strong>Justdial</strong> | 17 May 2013<br />

Disclaimer:<br />

This document is not for public distribution and is meant solely for the personal information of the authorised recipient.<br />

No part of the information must be altered, transmitted, copied, distributed or reproduced in any form to any other<br />

person. Persons into whose possession this document may come are required to observe these restrictions. This<br />

document is for general information purposes only and does not constitute an investment advice or an offer to sell or<br />

solicitation of an offer to buy / sell any security and is not intended for distribution in countries where distribution of<br />

such material is subject to any licensing, registration or other legal requirements.<br />

The information , opinion, views contained in this document are as per prevailing conditions and are of the date of<br />

appearing on this material only and are subject to change. No reliance may be placed for any purpose whatsoever on<br />

the information contained in this document or on its completeness. Neither Aditya Birla Money Limited (ABML) nor any<br />

person connected with it accepts any liability or loss arising from the use of this document. The views and opinions<br />

expressed herein by the author in the document are his own and do not reflect the views of Aditya Birla Money Limited<br />

or any of its associate or group companies. The information set out herein may be subject to updating, completion,<br />

revision, verification and amendment and such information may change materially. Past performance is no guarantee<br />

and does not indicate or guide to future performance.<br />

Nothing in this document is intended to constitute legal, tax or investment advice, or an opinion regarding the<br />

appropriateness of any investment, or a solicitation of any type. The contents in this document are intended for<br />

general information purposes only. This document or information mentioned therefore should not form the basis of<br />

and should not be relied upon in connection with making any investment. The investment may not be suited to all the<br />

categories of investors. The recipients should therefore obtain your own professional, legal, tax and financial advice<br />

and assessment of their risk profile and financial condition before considering any decision.<br />

Aditya Birla Money Limited, its associate and group companies, its directors, associates, employees from time to time<br />

may have various interests/ positions in any of the securities of the Company(ies) mentioned therein or be engaged in<br />

any other transactions involving such securities or otherwise in other securities of the companies / organisation<br />

mentioned in the document or may have other potential conflict of interest with respect of any recommendation and /<br />

related information and opinions.<br />

Analyst holding in the stock: NIL<br />

Aditya Birla Money Limited<br />

2 nd Floor, Sheil Estate, Dani Corporate Park, 158 CST Road, Kalina, Santacruz (East), Mumbai 400 098 | Tel: +91 22 42333400<br />

Page No. 7