Savita Oil Technologies Ltd. - InvestmentGuruIndia

Savita Oil Technologies Ltd. - InvestmentGuruIndia

Savita Oil Technologies Ltd. - InvestmentGuruIndia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

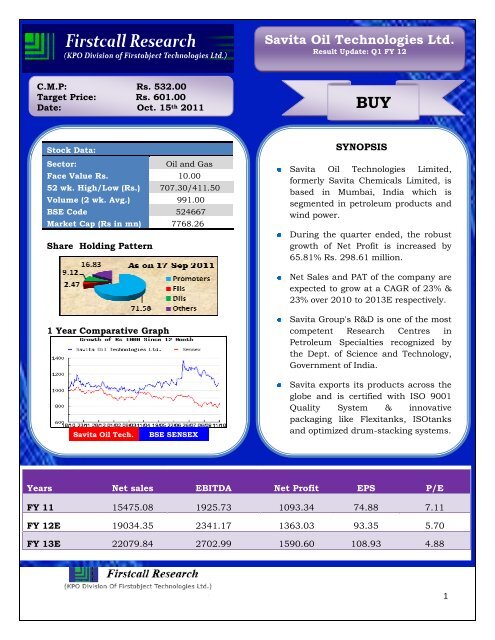

<strong>Savita</strong> <strong>Oil</strong> <strong>Technologies</strong> <strong>Ltd</strong>.<br />

Result Update: Q1 FY 12<br />

C.M.P: Rs. 532.00<br />

Target Price: Rs. 601.00<br />

Date: Oct. 15 th 2011 BUY<br />

Stock Data:<br />

Sector:<br />

<strong>Oil</strong> and Gas<br />

Face Value Rs. 10.00<br />

52 wk. High/Low (Rs.) 707.30/411.50<br />

Volume (2 wk. Avg.) 991.00<br />

BSE Code 524667<br />

Market Cap (Rs in mn) 7768.26<br />

Share Holding Pattern<br />

SYNOPSIS<br />

<strong>Savita</strong> <strong>Oil</strong> <strong>Technologies</strong> Limited,<br />

formerly <strong>Savita</strong> Chemicals Limited, is<br />

based in Mumbai, India which is<br />

segmented in petroleum products and<br />

wind power.<br />

During the quarter ended, the robust<br />

growth of Net Profit is increased by<br />

65.81% Rs. 298.61 million.<br />

Net Sales and PAT of the company are<br />

expected to grow at a CAGR of 23% &<br />

23% over 2010 to 2013E respectively.<br />

1 Year Comparative Graph<br />

<strong>Savita</strong> Group's R&D is one of the most<br />

competent Research Centres in<br />

Petroleum Specialties recognized by<br />

the Dept. of Science and Technology,<br />

Government of India.<br />

<strong>Savita</strong> <strong>Oil</strong> Tech.<br />

BSE SENSEX<br />

<strong>Savita</strong> exports its products across the<br />

globe and is certified with ISO 9001<br />

Quality System & innovative<br />

packaging like Flexitanks, ISOtanks<br />

and optimized drum-stacking systems.<br />

Years Net sales EBITDA Net Profit EPS P/E<br />

FY 11 15475.08 1925.73 1093.34 74.88 7.11<br />

FY 12E 19034.35 2341.17 1363.03 93.35 5.70<br />

FY 13E 22079.84 2702.99 1590.60 108.93 4.88<br />

1

Peer Group Comparison<br />

Name of the company<br />

CMP(Rs.)<br />

Market Cap.<br />

(Rs.mn.) EPS(Rs.) P/E(x) P/Bv(x) Dividend (%)<br />

<strong>Savita</strong> <strong>Oil</strong> <strong>Technologies</strong> 532.00 7768.26 74.88 7.11 1.97 150.00<br />

BPCL 652.20 23699.09 19.44 33.72 1.69 140.00<br />

Chennai Petro 201.90 3006.52 34.36 5.88 0.80 120.00<br />

Goa Carbon 80.95 74.08 12.02 6.73 1.02 40.00<br />

Investment Highlights<br />

Q1 FY12 Results Update<br />

<strong>Savita</strong> <strong>Oil</strong> <strong>Technologies</strong> <strong>Ltd</strong>. has reported net profit of Rs 298.61 million for the<br />

quarter ended on June 30, 2011 as against Rs. 180.09 million in the same quarter<br />

last year, an increase of 65.81%. It has reported net sales of Rs 4364.83 million for<br />

the quarter ended on June 30, 2011 as against Rs 3287.50 million in the same<br />

quarter last year, a rise of 32.77%. Total income grew by 32.66% to Rs 4386.88<br />

million from Rs. 3306.75 million in the same quarter last year. During the quarter,<br />

it reported earnings of Rs 20.45 a share.<br />

Quarterly Results - Standalone (Rs in mn)<br />

As At June-11 June-10 %change<br />

Net sales 4364.83 3287.50 32.77%<br />

PAT 298.61 180.09 65.81%<br />

Basic EPS 20.45 12.33 65.81%<br />

2

Break up of Expenditure<br />

Segment Revenue<br />

Segment Revenue<br />

(Rs. million)<br />

Petroleum Products 4286.31<br />

Wind Power 92.75<br />

Other Unallocated 7.81<br />

Net Sales/ Income from<br />

Operations 4386.87<br />

3

Company Profile<br />

<strong>Savita</strong> <strong>Oil</strong> <strong>Technologies</strong> Limited, formerly <strong>Savita</strong> Chemicals Limited, is an India-based<br />

company. The segments of the Company are petroleum products and wind power. Its<br />

petroleum products include Transformer <strong>Oil</strong>s, White <strong>Oil</strong>s/Liquid Paraffins and<br />

Lubricating <strong>Oil</strong>s. During the fiscal year ended March 31, 2010 (fiscal 2010), the<br />

Company's Wind Power Plants situated in the states of Maharashtra, Karnataka and<br />

Tamilnadu generated 64.0 MU against 55.4 MU.<br />

Business Area<br />

• Petroleum Energy<br />

• Wind Power<br />

• Petroleum Energy: This Sector consists of Transformer <strong>Oil</strong>s, White <strong>Oil</strong>s/Liquid<br />

Paraffins and Lubricating <strong>Oil</strong>s for Company. The main raw materials for all these<br />

products are the Base <strong>Oil</strong>s which are a refined fraction derived from Crude <strong>Oil</strong>. The<br />

demand for Transformer <strong>Oil</strong>s in India is generated and sustained by the overall<br />

development and growth of the power generation and transmission infrastructure<br />

within the country. The market for cosmetics, pharmaceuticals and personal care<br />

products decides the demand for Liquid Paraffins and White <strong>Oil</strong>s. The Automotive,<br />

Industrial and Marine Sectors primarily constitute the Indian lubricant industry.<br />

• Wind Power: The major source of power generation in India has always been coal<br />

with some share from gas and hydro based power generation. Potential for wind<br />

power in India has been increased to 48.5 GW by Ministry of New and Renewable<br />

Energy (MNRE). Apart from addressing India’s issue of climate change and global<br />

warming, renewable energy sources offer a hedge against future fossil fuel price<br />

hike and volatility. Of all the renewable sources of energy, wind energy has had an<br />

exponential growth in India. Technological maturity, a proven installed base, lower<br />

set-up and running costs are the key factors for the dominance of wind technology<br />

in the renewable energy mix.<br />

4

Research and development<br />

A team of highly competent scientists and most sophisticated equipments provide<br />

<strong>Savita</strong> the flexibility to develop and deliver tailor-made products to suit individual<br />

customer's needs. Since the seventies, <strong>Savita</strong> Group's R&D is one of the most<br />

competent Research Centres in Petroleum Specialties recognized by the Dept. of<br />

Science and Technology, Government of India. This focus on R&D has paid rich<br />

dividends in the form of 9 pioneering products ranging from Petroleum Sulphonates<br />

and White <strong>Oil</strong>s to Telecom Cable Filling Compounds.<br />

International Business<br />

The International Business Division of <strong>Savita</strong> Group was set up in 1993. The <strong>Savita</strong><br />

Group is today India's largest exporter of Petroleum Specialties Products.<br />

<strong>Savita</strong> exports its products across the globe and is known for its customization, ISO<br />

9001 Quality System and innovative packaging like Flexitanks, ISOtanks and<br />

optimized drum-stacking systems. Today, <strong>Savita</strong>'s global reputation is that of an<br />

ethical & reliable company with an efficient distribution channels.<br />

Product range of the company includes:<br />

• Savonol: Liquid paraffin for pharmaceutical and cosmetic products.<br />

• Transol: Transformer oil<br />

• Savsol: Lubricants<br />

• Savowax: Waxes<br />

• Idemitsu: Automotive & Industrial lubricants<br />

• Specialty wax emulsion: For leather finishings, Water based paints & printings.<br />

• Vitagel: Optic Fibre Cable Filling Compound<br />

• Technol: White oil<br />

• Savogel: Petroleum Jellies<br />

• Savofil/Savoflod: Cable Filling Compound<br />

• Savox BW300: Emulsifiable (Oxidized) Polyethylene Wax<br />

5

Financial Results<br />

12 Months Ended Profit & Loss Account (Standalone)<br />

Value(Rs.in.mn) FY10 FY11 FY12E FY13E<br />

Description 12m 12m 12m 12m<br />

Net Sales 11780.14 15475.08 19034.35 22079.84<br />

Other Income 89.18 112.67 116.05 121.85<br />

Total Income 11869.32 15587.75 19150.40 22201.70<br />

Expenditure -10334.53 -13662.02 -16809.23 -19498.71<br />

Operating Profit 1534.79 1925.73 2341.17 2702.99<br />

Interest -46.74 -68.93 -74.44 -81.14<br />

Gross profit 1488.05 1856.80 2266.72 2621.84<br />

Depreciation -203.09 -252.96 -268.14 -289.59<br />

Profit Before Tax 1284.96 1603.84 1998.58 2332.25<br />

Tax -421.12 -510.50 -635.55 -741.66<br />

Profit After Tax 863.84 1093.34 1363.03 1590.60<br />

Equity capital 146.02 146.02 146.02 146.02<br />

Reserves 3051.62 3805.53 5168.56 6759.16<br />

Face value 10.00 10.00 10.00 10.00<br />

EPS 59.16 74.88 93.35 108.93<br />

6

Quarterly Ended Profit & Loss Account (Standalone)<br />

Value(Rs.in.mn) 31-Dec-10 31-Mar-11 30-Jun-11 30-Sep-11E<br />

Description 3m 3m 3m 3m<br />

Net sales 4128.68 4327.87 4364.83 4844.96<br />

Other income 28.86 29.97 22.05 24.26<br />

Total Income 4157.54 4357.84 4386.88 4869.22<br />

Expenditure -3658.59 -3807.82 -3866.51 -4265.99<br />

Operating profit 498.95 550.02 520.37 603.23<br />

Interest -15.21 -14.88 -17.60 -18.48<br />

Gross profit 483.74 535.14 502.77 584.75<br />

Depreciation -64.62 -64.62 -56.88 -59.16<br />

Profit Before Tax 419.12 470.52 445.89 525.59<br />

Tax -132.65 -143.85 -147.28 -167.93<br />

Profit After Tax 286.47 326.67 298.61 357.67<br />

Equity capital 146.02 146.02 146.02 146.02<br />

Face value 10.00 10.00 10.00 10.00<br />

EPS 19.62 22.37 20.45 24.49<br />

7

Key Ratios<br />

Particulars FY10 FY11 FY12E FY13E<br />

No. of Shares (in mn) 14.60 14.60 14.60 14.60<br />

EBITDA Margin (%) 13.03% 12.44% 12.30% 12.24%<br />

PBT Margin (%) 10.91% 10.36% 10.50% 10.56%<br />

PAT Margin (%) 7.33% 7.07% 7.16% 7.20%<br />

P/E Ratio (x) 8.99 7.11 5.70 4.88<br />

ROE (%) 27.01% 27.67% 25.65% 23.03%<br />

ROCE (%) 45.07% 46.92% 43.20% 39.03%<br />

Debt Equity Ratio 0.21 0.17 0.14 0.11<br />

EV/EBITDA (x) 5.06 4.03 3.32 2.87<br />

Book Value (Rs.) 218.99 270.62 363.96 472.89<br />

P/BV 2.43 1.97 1.46 1.12<br />

Charts:<br />

Net sales & PAT<br />

8

P/E Ratio (x)<br />

Debt Equity Ratio<br />

9

EV/EBITDA(x)<br />

P/BV<br />

10

Outlook and Conclusion<br />

At the current market price of Rs.532.00, the stock is trading at 5.70x FY12E<br />

and 4.88 x FY13E respectively.<br />

Earning per share (EPS) of the company for the earnings for FY12E and FY13E<br />

is seen at Rs.93.35 and Rs.108.93 respectively.<br />

Net Sales and PAT of the company are expected to grow at a CAGR of 23% and<br />

23% over 2010 to 2013E respectively.<br />

On the basis of EV/EBITDA, the stock trades at 3.32 x for FY12E and 2.87 x for<br />

FY13E.<br />

Price to Book Value of the stock is expected to be at 1.46 x and 1.12 x<br />

respectively for FY12E and FY13E.<br />

We expect that the company will keep its growth story in the coming quarters<br />

also. We recommend ‘BUY’ in this particular scrip with a target price of<br />

Rs.601.00 for Medium to Long term investment.<br />

Industry Overview<br />

India’s oil and gas sector holds strategic importance in the economy as it meets<br />

around 42 per cent of the country’s primary energy demand and contributes over 15<br />

per cent to the gross domestic product (GDP). With an interesting mix of private and<br />

government companies, the industry is scaling new heights in domestic and<br />

international markets.<br />

With a strong resource position, India ranks second (behind Australia and ahead of<br />

Vietnam), in BMI’s upstream Business Environment ratings while the country shares<br />

first place with China in BMI’s downstream Business Environment ratings. The<br />

recently released BMI forecasts state that India will account for 12.4 per cent of Asia<br />

Pacific regional oil demand by 2015, while satisfying 11.2 per cent of the supply.<br />

11

Due to increasing refining capacities, India is set to be a top exporter of petro-products<br />

in Asia, surpassing South Korea. India’s exports of refined products stood at 0.95<br />

million barrels per day (b/d) as of June 2011 and US$ 4.6 billion worth of petroleum<br />

products were exported during July 2011.<br />

<strong>Oil</strong> & Gas- Market Dynamics<br />

Production and Consumption<br />

According to the provisional production data released by the Ministry of Petroleum and<br />

Natural Gas, dated August 2011,<br />

• Crude <strong>Oil</strong> production for April-July 2011 was 12.858 million metric tonne<br />

(MMT), as compared to the 11.985 MMT in April-July 2010.<br />

• Natural Gas production during April-July 2011 was 16356.3 million cubic<br />

metres (MCM).<br />

• During April-July 2011, 57.01 MMT of crude oil was refined, compared to 54.33<br />

MMT refined during corresponding period in 2010.<br />

State oil firm <strong>Oil</strong> & Natural Gas Corporation (ONGC) has the onus to maximise<br />

domestic oil production, which in 2010 stood at 909,000 b/d of estimated average.<br />

Due to incredible efforts made by ONGC and UK-based Cairn Energy, BMI predicts oil<br />

production at around 1.2 million b/d by 2013 in its report for the third quarter of<br />

(Q3)_ 2011.<br />

<strong>Oil</strong> consumption in India is projected to enhance by 4-5 per cent per annum to 2015,<br />

indicating a demand of 4.01 million b/d by 2015.<br />

Diesel & Petrol<br />

International Energy Agency (IEA) forecasts an increment of 3.8 per cent in India’s fuel<br />

demand led by diesel and petrol (gasoline). Diesel satisfies about 40 per cent of fuel<br />

consumption in India. Its demand is expected to increase to 1.37 million b/d in 2011<br />

12

ising by 5.8 per cent and further to 1.44 million b/d in 2012, increasing by 5.5 per<br />

cent.<br />

Demand for petrol is expected to expand by 7.6 per cent (363,000 b/d) in 2011 and<br />

eventually by 6.7 per cent (388,000 b/d) in 2012. For FY12, the ministry of petroleum<br />

anticipates a growth of 4.6 per cent in the sale of oil products.<br />

Gas<br />

Global consultancy firm McKinsey anticipates that natural gas demand in India is<br />

expected to increase from current 166 million standard cubic meters per day to 320<br />

million standard cubic meters per day by 2015.<br />

Moreover, BMI’s report for Q3 2011 states that India’s share (in the Asian pacific<br />

region) of gas consumption in 2010 was an estimated 10.9 per cent, while its share of<br />

production is estimated at 11.1 per cent. BMI expects that the country’s share of gas<br />

consumption would reach to 11.7 per cent by 2015 while that of supply would stand<br />

at 13.1 per cent.<br />

Gas consumption is expected to increase from an estimated 55 billion cubic metres<br />

(BCM) in 2010 to 76 BCM in 2015, while domestic production is anticipated to<br />

increase from around 45 BCM in 2010 to at least 73 BCM in 2015.<br />

<strong>Oil</strong> & Gas - Key Developments and Investments<br />

Indian oil companies are present in around 20 countries worldwide. According to the<br />

Petroleum Ministry, India's public sector enterprises have invested around Rs 64,832<br />

crore (US$ 14.5 billion) for acquiring oil and natural gas exploration and production<br />

assets abroad.<br />

In a deal entailing largest ever foreign direct investment (FDI) in India, Reliance<br />

Industries Limited has sold 30 per cent stake in its 21 oil & gas blocks, including the<br />

showcase Andhra offshore gas field, to BP (formerly British Petroleum) for over US$ 7<br />

billion.<br />

13

State run Navratna explorer <strong>Oil</strong> India is planning over expansion and diversification<br />

and is also contemplating to enter city gas distribution. The company has set aside<br />

about 52 per cent of surplus funds for exploration activities in future.<br />

<strong>Oil</strong> India <strong>Ltd</strong> (OIL) along with its partner GeoGlobal Resources from Barbados has<br />

decided to drill 3 wells in financial year 2012-13 as a part of its commitment to drill 12<br />

wells in the east coastline of the 549 sq km Krishna Godavari block on the eastern<br />

coast of India. GeoGlobal holds 10 per cent stake in the block.<br />

In order to solidify its position in southern India, GAIL India has entered joint venture<br />

(JV) agreements with the state entities of Kerala and Karnataka.<br />

Its agreement signed with Kerala State Industrial Development Corp (KSIDC) states<br />

that GAIL would be providing compressed natural gas (CNG) to automobiles and piped<br />

cooking gas to households, commercial establishments and industries in Kerala. GAIL<br />

Gas <strong>Ltd</strong> would hold 26 per cent stake while KSIDC will be holding 24 percent. The<br />

remaining 50 per cent shares will be kept reserved for strategic partners, financial<br />

institutions (Indian or international) and non-Government companies.<br />

<strong>Oil</strong> & Gas - Government Initiatives<br />

• New Exploration Licensing Policy (NELP), implemented by government, permits<br />

100 per cent FDI for small and medium sized oil fields via competitive bidding.<br />

• Public-private partnerships as well as only private investments can foray into<br />

the refining sector. In case of an Indian private company, 100 per cent FDI is<br />

allowed.<br />

• 100 per cent FDI is allowed for petroleum products and pipeline sector as well<br />

as natural gas/LNG pipeline, for infrastructure related to marketing of<br />

petroleum products, market study of formulation and investment financing.<br />

• Minimum 26 per cent equity is covered over five years, in case of trading and<br />

marketing.<br />

• S Jaipal Reddy, Minister of Petroleum and Natural Gas has asserted in a recent<br />

meeting that the government is determined to protect the interest of common<br />

14

man while providing quality petroleum products at reasonable prices. He<br />

indicated that with a view to reduce burden on consumers as well as oil<br />

marketing companies (OMCs), the government has eradicated the Customs<br />

Duty on Crude <strong>Oil</strong> and trimmed Customs Duty on petroleum products by 5 per<br />

cent. Excise Duty on diesel was also reduced by Rs 2.60 (US$ 0.056) per litre.<br />

<strong>Oil</strong> & Gas - Road Ahead<br />

India will be adding refining capacity of close to 800,000 b/d till 2013.<br />

The boost in refining capacity will be initiated by BPCL and its partner with a 120,000<br />

b/d refinery coming up at Bina in Madhya Pradesh. Later in 2011, HPCL and Mittal<br />

will commission an 180,000 b/d plant at Bathinda in Punjab.<br />

Essar <strong>Oil</strong> will be expanding its capacity of Vadinar refinery from 300,000 b/d to<br />

375,000 b/d in 2012, while Nagarjuna <strong>Oil</strong> and Indian <strong>Oil</strong> will be adding capacities of<br />

120,000 b/d and 300,000 b/d, respectively, by 2012-13.<br />

______________ ____ _________________________<br />

Disclaimer:<br />

This document prepared by our research analysts does not constitute an offer or solicitation<br />

for the purchase or sale of any financial instrument or as an official confirmation of any<br />

transaction. The information contained herein is from publicly available data or other<br />

sources believed to be reliable but do not represent that it is accurate or complete and it<br />

should not be relied on as such. Firstcall India Equity Advisors Pvt. <strong>Ltd</strong>. or any of it’s<br />

affiliates shall not be in any way responsible for any loss or damage that may arise to any<br />

person from any inadvertent error in the information contained in this report. This document<br />

is provide for assistance only and is not intended to be and must not alone be taken as the<br />

basis for an investment decision.<br />

15

Firstcall India Equity Research: Email – info@firstcallindia.com<br />

C.V.S.L.Kameswari<br />

Pharma<br />

U. Janaki Rao Capital Goods<br />

D. Ashakirankumar Automobile<br />

A. Rajesh Babu FMCG<br />

H.Lavanya<br />

<strong>Oil</strong> & Gas<br />

Dheeraj Bhatia<br />

Diversified<br />

Manoj kotian<br />

Diversified<br />

Nimesh Gada<br />

Diversified<br />

Firstcall India also provides<br />

Firstcall India Equity Advisors Pvt.<strong>Ltd</strong> focuses on, IPO’s, QIP’s, F.P.O’s,Takeover<br />

Offers, Offer for Sale and Buy Back Offerings.<br />

Corporate Finance Offerings include Foreign Currency Loan Syndications,<br />

Placement of Equity / Debt with multilateral organizations, Short Term Funds<br />

Management Debt & Equity, Working Capital Limits, Equity & Debt<br />

Syndications and Structured Deals.<br />

Corporate Advisory Offerings include Mergers & Acquisitions(domestic and<br />

cross-border), divestitures, spin-offs, valuation of business, corporate<br />

restructuring-Capital and Debt, Turnkey Corporate Revival – Planning &<br />

Execution, Project Financing, Venture capital, Private Equity and Financial<br />

Joint Ventures<br />

Firstcall India also provides Financial Advisory services with respect to raising<br />

of capital through FCCBs, GDRs, ADRs and listing of the same on International<br />

Stock Exchanges namely AIMs, Luxembourg, Singapore Stock Exchanges and<br />

other international stock exchanges.<br />

For Further Details Contact:<br />

3rd Floor,Sankalp,The Bureau,Dr.R.C.Marg,Chembur,Mumbai 400 071<br />

Tel. : 022-2527 2510/2527 6077/25276089 Telefax : 022-25276089<br />

E-mail: info@firstcallindiaequity.com<br />

www.firstcallindiaequity.com<br />

16