Religare Morning Digest - InvestmentGuruIndia

Religare Morning Digest - InvestmentGuruIndia

Religare Morning Digest - InvestmentGuruIndia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Religare</strong> <strong>Morning</strong> <strong>Digest</strong><br />

July 19, 2013<br />

Technical Market View<br />

Recommendation<br />

SYMBOL<br />

UNIPHOS<br />

Buy/Sell<br />

Buy<br />

CMP 143.95<br />

Initiation range 141-142<br />

Stop Loss 138<br />

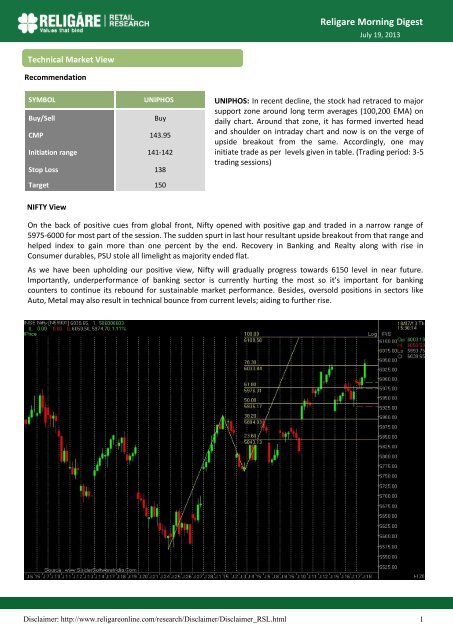

UNIPHOS: In recent decline, the stock had retraced to major<br />

support zone around long term averages (100,200 EMA) on<br />

daily chart. Around that zone, it has formed inverted head<br />

and shoulder on intraday chart and now is on the verge of<br />

upside breakout from the same. Accordingly, one may<br />

initiate trade as per levels given in table. (Trading period: 3-5<br />

trading sessions)<br />

Target 150<br />

NIFTY View<br />

On the back of positive cues from global front, Nifty opened with positive gap and traded in a narrow range of<br />

5975-6000 for most part of the session. The sudden spurt in last hour resultant upside breakout from that range and<br />

helped index to gain more than one percent by the end. Recovery in Banking and Realty along with rise in<br />

Consumer durables, PSU stole all limelight as majority ended flat.<br />

As we have been upholding our positive view, Nifty will gradually progress towards 6150 level in near future.<br />

Importantly, underperformance of banking sector is currently hurting the most so it’s important for banking<br />

counters to continue its rebound for sustainable market performance. Besides, oversold positions in sectors like<br />

Auto, Metal may also result in technical bounce from current levels; aiding to further rise.<br />

Disclaimer: http://www.religareonline.com/research/Disclaimer/Disclaimer_RSL.html<br />

1

<strong>Religare</strong> <strong>Morning</strong> <strong>Digest</strong><br />

July 19, 2013<br />

Technical Market View<br />

TRENDSHEET - INDEX TREND *<br />

INDEX SPOT Close Trend Trend changed on Trend changed at Closing Stop Loss<br />

NIFTY 6083.15 6038.05 Down Up 23-May-13 28-Jun-13 5967.05 5842.20 6200 5800<br />

BANKNIFTY 12961.55 11187.70 Down Up 31-May-13 16-Apr-13 11871.60 12475.65 12630 11620<br />

CNX-IT 6410.95 7306.35 Up 08-May-13 27-Jun-13 6380.15 6587.15 6050 6750<br />

CNXMIDCAP 7914.80 7468.30 Down Up 23-May-13 01-July-13 7802.05 8200 7230<br />

Nifty 50 - Trend Sheet *<br />

STOCKS LTP Trend Trend changed on Trend changed at at Closing Stop Loss<br />

ACC 1245.45 1275.35 Up 08-Jul-13 25-Apr-13 1256.55 1255.05 1190<br />

AMBUJACEM 211.35 185.6 Up 01-Jul-13 16-Apr-13 189.05 180.45 192 175<br />

ASIANPAINT 4826.05 5213.1 Down Up 11-Jul-13 9-Apr-13 4874.5 4531.6 4700 5000<br />

AXISBANK 1478.15 1238.2 Down Up 04-Jun-13 16-Apr-13 1395.45 1363.3 1300 1400<br />

BAJAJ-AUTO 1818.1 1896.7 Up 19-Jun-13 23-Apr-13 1835.65 1805 1755 1730<br />

BANKBARODA 682.25 566.85 Down Up 29-May-13 25-Apr-13 679.45 708.55 600 680<br />

BHARTIARTL 309.15 323.65 Down Up 24-May-13 02-Jul-13 302.85 298.5 297 332<br />

BHEL 196.95 189.5 Up 02-Jul-13 25-Apr-13 183.6 192.55 175 187<br />

BPCL 377.45 343.55 Down 23-May-13 379.9 365 415<br />

CAIRN 286.15 303.65 Down 23-May-13 277.55 305<br />

CIPLA 401.5 413.3 Up 28-Jun-13 08-Mar-13 391.95 391.8 372 390<br />

COALINDIA 313.8 291.1 Down 13-Jun-13 24-Jan-13 298.9 343.65 314 320<br />

DLF 171.25 215.3 Down Up 22-May-13 01-Jul-13 189.1 227.15 164 235<br />

DRREDDY 2090.95 2339.5 Up 4-Apr-13 1889.75 2150 1960<br />

GAIL 324.5 Down Up 23-May-13 01-Jul-13 324.9 324.3 295 345<br />

GRASIM 2991.8 2804.9 Down Up 29-May-13 25-Apr-13 2892.95 2983.2 3000 2900<br />

HCLTECH 858.85 741.7 Up 9-May-13 770.15 790 695<br />

HDFC 829.05 929.5 Up 28-Jun-13 11-Mar-13 879.05 831.65 809 840<br />

HDFCBANK 715.05 684.1 Up 12-Jul-13 16-Apr-13 695.75 663.35 645 675<br />

HEROMOTOCO 1654.35 1731.75 Up 15-Jul-13 23-Apr-13 1573.6 1725 1560 1550<br />

HINDALCO 110.6 104.4 Up 15-Jul-13 23-Apr-13 105.4 96.3 94 100<br />

*Refer Annexure to understand this table<br />

Disclaimer: http://www.religareonline.com/research/Disclaimer/Disclaimer_RSL.html<br />

2

<strong>Religare</strong> <strong>Morning</strong> <strong>Digest</strong><br />

July 19, 2013<br />

Technical Market View<br />

STOCKS LTP Trend Trend when changed Rate when trend changed Closing Stop loss<br />

HINDUNILVR 688.05 Up 12-Apr-13 479.05 617<br />

ICICIBANK 984.45 Down 10-Jun-13 1117.8 1060<br />

IDFC 127.9 Up 15-Jul-13 137.85 120<br />

INDUSINDBK 465 Down 17-Jul-13 453.9 500<br />

INFY 2800.75 Up 03-Jun-13 2514.1 2600<br />

ITC 368.65 Up 11-Jul-13 353.4 345<br />

JINDALSTEL 216.25 Down 23-May-13 291.1 225<br />

JPASSOCIAT 50.6 Down 22-May-13 73.4 55<br />

KOTAKBANK 711.7 Up 11-Jul-13 745.8 700<br />

LT 985.3 Down 23-May-13 1418.2 1025<br />

LUPIN 890.4 Up 03-Jul-13 830.45 825<br />

M&M 874.75 Down 26-Jun-13 911.15 950<br />

MARUTI 1445.55 Down 16-Jul-13 1411.25 1580<br />

NMDC 105.45 Up 15-Jul-13 108.35 98<br />

NTPC 146.5 Down 23-May-13 148.5 150<br />

ONGC 314.65 Up 28-Jun-13 331.10 296<br />

PNB 636.9 Down 31-May-13 760.05 675<br />

POWERGRID 111 Down 25-Jun-13 103.10 113<br />

RANBAXY 336.5 Down 23-May-13 394.3 355<br />

RELIANCE 917.25 Up 28-Jun-13 862.6 835<br />

RELINFRA 385.5 Up 01-Jul-13 366.5 355<br />

SBIN 1824.25 Down 23-May-13 2177.6 1930<br />

SESAGOA 149.6 Up 02-Jul-13 151 142<br />

SUNPHARMA 1118.4 Up 28-Jun-13 1011.55 1025<br />

TATAMOTORS 286.9 Up 04-Jul-13 292.3 265<br />

TATAPOWER 93.1 Up 28-Jun-13 86.3 85<br />

TATASTEEL 244.7 Down 08-Jul-13 259.9 268<br />

TCS 1660.4 Up 28-Jun-13 1518.15 1520<br />

ULTRACEMCO 1924.35 Up 10-Jul-13 1841.1 1810<br />

*Refer Annexure to understand this table<br />

Disclaimer: http://www.religareonline.com/research/Disclaimer/Disclaimer_RSL.html<br />

3

<strong>Religare</strong> <strong>Morning</strong> <strong>Digest</strong><br />

July 19, 2013<br />

Derivative Market View<br />

Nifty futures opened flat trading in a narrow range of 5980 to 6000 levels, post the results of Axis Bank it<br />

sparked a huge short covering in banking stocks and other sectors. Nifty futures ended up by 81.6 points<br />

at 6052.4 with a premium of 14.0 point to the spot closing of 6038.05.<br />

All sectors ended positive with highest gains in beaten sectors like banking, infrastructure and realty by<br />

3%. The advance decline was good with 124 advances and 20 declines in the derivatives segment.<br />

Banking, Media and Telecom sectors gained the maximum open interest.<br />

Nifty futures have ended near the current expiry high and the trend reversal level will be 5930 on closing<br />

basis. The immediate resistances are placed at 6095 and 6120 while on the downside supports are at 5980<br />

and 5930.<br />

Stocks Futures with Upward Potential<br />

Stocks Futures with Downward Potential<br />

Stocks Price % Change OI<br />

Change<br />

In OI<br />

Stocks Price % Change OI<br />

Change<br />

In OI<br />

SYNDIBANK 112.0 3.7 955 18.6 FINANTECH 681.3 -3.5 2396 12.5<br />

ZEEL 248.1 1.6 4592 19.9 SIEMENS 575.2 -1.3 1490 10.6<br />

GODREJIND 300.8 1.1 565 11.9 STER 85.6 -1.3 7027 7.5<br />

F & O Trade / Strategy Recommendation for today<br />

Stock View CMP Strategy<br />

Recommended<br />

Price/ Initiation<br />

Range<br />

Target Price<br />

Stop loss<br />

SRTRANSFIN BULLISH 656.7 BUY JUL FUTS 650-653 682 633<br />

Today’s Derivatives Summary<br />

Disclaimer: http://www.religareonline.com/research/Disclaimer/Disclaimer_RSL.html<br />

4

26-Jun<br />

27-Jun<br />

28-Jun<br />

2-Jul<br />

3-Jul<br />

4-Jul<br />

5-Jul<br />

8-Jul<br />

9-Jul<br />

10-Jul<br />

11-Jul<br />

12-Jul<br />

15-Jul<br />

16-Jul<br />

17-Jul<br />

Fundamental Market view<br />

<strong>Religare</strong> <strong>Morning</strong> <strong>Digest</strong><br />

July 19, 2013<br />

Key benchmark indices surged in late trade with higher European markets boosting sentiment. BSE Sensex<br />

scaled its highest level in almost seven weeks above the psychological 20,000 level, after having<br />

alternately moved above and below that mark in intraday trade. The CNX Nifty also hit almost seven week<br />

high above the psychological 6,000 level. Bank stocks rose across the board on bargain hunting. The<br />

market breadth turned positive from negative in late trade.<br />

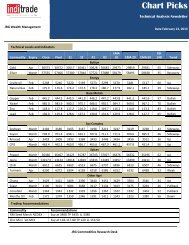

Daily Trends In FIIs Investments (Rs Crore)<br />

2000<br />

1000<br />

0<br />

-1000<br />

-2000<br />

-1320.5<br />

-561.6 -842.8<br />

1211.4<br />

-585.5<br />

421<br />

-240.2<br />

167.2<br />

73.4<br />

-1313.3<br />

-176.9<br />

-309.8<br />

-3000<br />

-4000<br />

-5000<br />

-6000<br />

-5110.4<br />

Corporate News<br />

BPCL will invest Rs 900 crore to set up a new LPG pipeline from Kochi to Coimbatore and enhance the<br />

storage capacity at its Irumpanam installation.<br />

Axis Bank posted a 23% growth in net profit to Rs 1,409 crore in the first quarter ended June 30, 2013.<br />

bank had reported a net profit of Rs 1,154 crore in the year-ago period.<br />

IDBI Bank has reported 28.1% decline in net profit at Rs 306.95 crore for the first quarter ended June 30,<br />

2014.The net profit stood at Rs 427.34 crore.<br />

Kotak Mahindra Bank has posted a 43% jump in net profit at Rs 403 crore during April-June quarter of this<br />

fiscal against Rs 282 crore in the year-ago quarter. The profit was driven by a spike in interest income and<br />

robust loan growth.<br />

Results on 19 July 2013: Reliance Industries, HDFC Ltd, Federal Bank, NIIT Ltd, JK Paper, Hindustan Zinc,<br />

Hexaware Technologies, Bajaj Auto, UCO Bank.<br />

Disclaimer: http://www.religareonline.com/research/Disclaimer/Disclaimer_RSL.html<br />

5

<strong>Religare</strong> <strong>Morning</strong> <strong>Digest</strong><br />

July 19, 2013<br />

Annexure<br />

How to Understand the Trend Sheet table<br />

When trend changes to up, one can buy & when trend changes to down one can sell.<br />

Resistance is mentioned for stocks which are in downtrend where one can go short with closing stop loss<br />

as mentioned. Support is mentioned for stocks which are in uptrend where one can go long with closing<br />

stop loss as mentioned.<br />

Closing stop loss has to be seen at closing at 3:30pm. All stocks prices refer to spot price.<br />

In this table of trends, it has been observed that if someone tries to take all levels of a stock or index continuously,<br />

the losses are small but once the market catches a strong trend in either direction, one makes<br />

a huge profit that time.<br />

In our trend sheet,<br />

If we underline only the stock name and closing stop loss then it means we have trailed our closing stop<br />

loss.<br />

If we underline the complete line including all fields Stock’s name, LTP, Trend, Trend changed on, Trend<br />

changed at & closing stop loss, it signifies fresh reversal of the trend.<br />

Note – For our running recommendations and past performance, please click here<br />

Disclaimer: http://www.religareonline.com/research/Disclaimer/Disclaimer_RSL.html<br />

6