2010 Annual Report - Petron

2010 Annual Report - Petron

2010 Annual Report - Petron

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

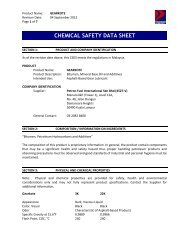

FINANCIAL HIGHLIGHTS<br />

<strong>2010</strong> 2009 %<br />

RM Million RM Million Change<br />

Revenues 8,427 8,032 5<br />

Profit after taxation 269 146 84<br />

Earnings per ordinary stock unit (sen) 99.5 53.9 85<br />

Gross dividend per ordinary stock unit (sen) 14 12 17<br />

Total assets employed 2,094 2,018 4<br />

Total shareholders’ funds 758 513 48<br />

Sales volume 79 88 (10)<br />

(thousands of barrels per calendar day)<br />

The <strong>Annual</strong> General Meeting provides<br />

shareholders the opportunity to obtain a<br />

better understanding of the Company’s<br />

operations and financial performance.<br />

EMB was recognised as one of three<br />

winners in the Energy & Natural<br />

Resources Industry category in KPMG’s<br />

annual Shareholder Value Awards<br />

Programme. The prestigious awards<br />

recognise companies that deliver the<br />

highest Economic Profit over Invested<br />

Capital and are intended to promote<br />

corporate excellence through enhancing<br />

levels of disclosure and setting<br />

explemplary industry good practice.<br />

ANNUAL REPORT & ACCOUNTS <strong>2010</strong><br />

1

ESSO MALAYSIA BERHAD<br />

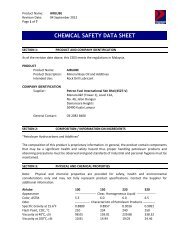

Five-Year Summary Charts<br />

REVENUES<br />

(NET OF GOVERNMENT DUTIES)<br />

RM MILLION<br />

PROFIT / (LOSS) AFTER TAX<br />

RM MILLION<br />

12,000<br />

11,735<br />

300<br />

269<br />

10,000<br />

8,000<br />

9,336<br />

9,740<br />

8,032<br />

8,427<br />

200<br />

100<br />

57<br />

146<br />

6,000<br />

0<br />

7<br />

4,000<br />

-100<br />

2,000<br />

-200<br />

0<br />

2006 2007 2008 2009 <strong>2010</strong><br />

-300<br />

(251)<br />

2006 2007 2008 2009 <strong>2010</strong><br />

SALES VOLUME<br />

THOUSANDS OF BARRELS<br />

PER CALENDAR DAY<br />

TOTAL THROUGHPUT<br />

THOUSANDS OF BARRELS<br />

PER CALENDAR DAY<br />

100<br />

93 94<br />

88 88<br />

100<br />

80<br />

60<br />

79<br />

80<br />

60<br />

71<br />

70<br />

61<br />

63<br />

45<br />

40<br />

40<br />

20<br />

20<br />

0<br />

2006<br />

2007 2008 2009 <strong>2010</strong><br />

0<br />

2006 2007 2008 2009<br />

<strong>2010</strong><br />

8 ANNUAL REPORT & ACCOUNTS <strong>2010</strong>

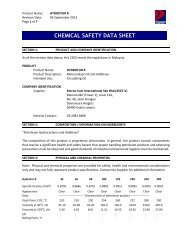

CAPITAL EXPENDITURE<br />

RM MILLION<br />

TOTAL ASSETS EMPLOYED<br />

RM MILLION<br />

Financed by:<br />

100<br />

98<br />

3,000<br />

2,700<br />

80<br />

60<br />

61<br />

57<br />

2,000<br />

2,006<br />

1,754<br />

2,018<br />

2,094<br />

40<br />

38<br />

37<br />

1,000<br />

20<br />

0<br />

2006 2007 2008 2009 <strong>2010</strong><br />

0<br />

2006 2007 2008 2009<br />

<strong>2010</strong><br />

Shareholders’ funds<br />

Trade payables<br />

Notes payable and bank borrowings<br />

Taxes payable, provisions and others<br />

SHAREHOLDERS’ INFORMATION<br />

2006 2007 2008 2009 <strong>2010</strong><br />

Earnings/(loss) per ordinary stock unit (sen) 2.6 21.2 (93.1) 53.9 99.5<br />

Gross dividend per ordinary stock unit (sen) 12 12 12 12 14<br />

Dividend yield (%)<br />

4.3 4.3 5.3 5.2<br />

5.3<br />

Share price (RM)<br />

- Highest<br />

- Lowest<br />

- Average<br />

4.06 3.30 2.81 2.86<br />

2.30 2.02 1.82 1.90<br />

2.78 2.76 2.27 2.32<br />

3.03<br />

2.42<br />

2.64<br />

Number of employees at year-end 327 326 318 299 290<br />

ANNUAL REPORT & ACCOUNTS <strong>2010</strong><br />

9

ESSO MALAYSIA BERHAD<br />

Board of Directors/ Lembaga Pengarah<br />

En. Abu Bakar Siddik Che Embi<br />

Executive Refinery Director /<br />

Pengarah Eksekutif Penapisan<br />

Absent during photo session<br />

Tidak hadir pada sessi<br />

penggambaran<br />

Allahyarhamah Puan Sri<br />

Junaidah Mohd Said<br />

Joint Secretary /<br />

Setiausaha Bersama<br />

Until / sehingga February 22,<br />

2011<br />

SEATED FROM LEFT TO RIGHT<br />

DUDUK DARI KIRI KE KANAN<br />

Y. Bhg. Tan Sri Dato’ Dr. Syed Jalaludin<br />

Syed Salim<br />

Mr. Hugh W. Thompson<br />

Chairman / Pengerusi<br />

Y. Bhg. Tan Sri Abdul Halim Ali<br />

Y. Bhg. Dato’ Zainal Abidin Putih<br />

STANDING FROM LEFT TO RIGHT<br />

BERDIRI DARI KIRI KE KANAN<br />

Puan Fatimah Merican<br />

Executive Business Services Director /<br />

Pengarah Eksekutif Urusan Perniagaan<br />

Puan Faridah Ali<br />

Executive Retail Business Director /<br />

Pengarah Eksekutif Perniagaan<br />

Jualan Runcit<br />

Mr. Manoj Devadasan<br />

Company Secretary / Setiausaha Syarikat<br />

ANNUAL REPORT & ACCOUNTS <strong>2010</strong><br />

10 11

ESSO MALAYSIA BERHAD<br />

Profile of Directors<br />

Hugh W. Thompson<br />

Chairman<br />

B. Sc. (Hons.) Geology, University of Aberdeen, Scotland<br />

M.Eng (Petroleum Engineering), Heriot-Watt University, Edinburgh, Scotland<br />

Mr. Hugh W. Thompson, aged 48, a citizen of the United Kingdom, was appointed a Director and<br />

Chairman of the Company on June 4, 2009. He joined ExxonMobil in 1988 and over the past 22 years has<br />

held positions of increasing responsibility in assignments ranging from Engineering and Operations<br />

Management, major project management and strategic business planning. He has spent the majority of<br />

his career with ExxonMobil in international assignments and has worked in Aberdeen and London in the<br />

United Kingdom as well as in Louisiana, Texas and California in the United States of America. He was the<br />

Planning Manager (Planning and Business Analysis) with ExxonMobil Production Company in Houston,<br />

Texas, United States of America before being appointed the Global Planning Manager for the<br />

ExxonMobil Production Company; a position he held until his appointment in 2009 as the Chairman of the<br />

ExxonMobil Subsidiaries in Malaysia.<br />

Fatimah Merican<br />

Executive Business Services Director<br />

Higher National Diploma, Polytechnic of Central London (now University of Westminster) (1976)<br />

Puan Fatimah Merican, aged 56, a Malaysian, was appointed Business Services Director of the<br />

Company on December 1, 2008. She joined ExxonMobil Exploration and Production Malaysia Inc.<br />

(EMEPMI) in 1977. Over her career with the Company she has held various professional and managerial<br />

positions in the local and global Information Technology organisations of ExxonMobil. Fatimah has also<br />

completed a rotational assignment in EMEPMI Public Affairs, and foreign assignments with ExxonMobil<br />

Asia Pacific Pte. Ltd., Singapore and ExxonMobil Limited, Thailand.<br />

Prior to October 1, 2008, Fatimah Merican was Manager, Downstream/Chemical Applications, Business<br />

Line Applications, Information Technology, ExxonMobil Business Support Centre Malaysia Sdn. Bhd. in<br />

Kuala Lumpur. Effective October 1, 2008, she was transferred to Upstream Business Services and<br />

thereafter appointed Business Services Director. In addition, on October 1, <strong>2010</strong>, Fatimah was also<br />

appointed the Tax Manager of ExxonMobil Subsidiaries in Malaysia; that includes Esso Malaysia<br />

Berhad.<br />

Abu Bakar Siddik Che Embi<br />

Executive Refinery Director<br />

B.Sc. (Hons.) Chemical Engineering, Leeds University, United Kingdom<br />

Encik Abu Bakar Siddik Che Embi, aged 58, a Malaysian, was appointed Refinery Director of the<br />

Company on September 1, 2003. He started his career with the Port Dickson Refinery in 1976 and held<br />

various technical, operational and supervisory positions in the Refinery until 1990, when he was assigned<br />

to the Baytown Refinery, Exxon U.S.A., for about three years. In this assignment, he held the position of<br />

Technical Advisor and a number of leadership roles in the Process Department. Following that, he spent<br />

six months with Exxon Company International's Refinery Department in Florham Park, New Jersey as<br />

Refinery Advisor. In 1994, he returned to Malaysia and assumed the position of Deputy Manufacturing<br />

Manager of the Port Dickson Refinery. In 1995, he was promoted to Manufacturing Manager and held this<br />

position until 2003, when he was appointed Refinery Director.<br />

Faridah Ali<br />

Executive Retail Business Director<br />

B.Sc. (Hons.) Accounting, University of East Anglia, Norwich, ACA (England & Wales)<br />

Puan Faridah Ali, aged 46, a Malaysian, was appointed Retail Business Director of the Company on June<br />

13, 2005. She began her career in ExxonMobil Malaysia Sdn. Bhd., and over the years, held supervisory<br />

roles in various functions including financial accounting, costing, planning, financial analysis, human<br />

resources and retail business. In 2000, after the merger of Exxon Corporation and Mobil Corporation in<br />

the United States of America, she assumed the position of Marketing Support Manager and subsequently<br />

Business Analysis and <strong>Report</strong>ing Manager before assuming her current position.<br />

12<br />

ANNUAL REPORT & ACCOUNTS <strong>2010</strong>

Y. Bhg. Tan Sri Dato' Dr. Syed Jalaludin Syed Salim<br />

Independent / Non-Executive Director and Member of the Board Audit Committee<br />

P.S.M., D.S.S.A., D.P.M.P., J.S.M. F.A. Sc., B.V.Sc., University of Punjab, M.Phil. and Ph.D.,<br />

University of London, D.Sc., Honoris Causa, University of Hull, U. K., D.Sc., Honoris Causa, Soka<br />

University, Japan, D.Agriculture Technology, Honoris Causa, Thaksin University, Thailand, D.Sc.,<br />

Honoris Causa, Open University Malaysia.<br />

Y. Bhg. Tan Sri Dato' Dr. Syed Jalaludin Syed Salim, aged 67, a Malaysian and a national science<br />

laureate, as well as a founder fellow of the Academy of Sciences Malaysia, was appointed Director of the<br />

Company on February 15, 2000. He had a long illustrious academic carrier in both University of Malaya<br />

and University Putra Malaysia (UPM) before retiring as Vice Chancellor of UPM in 2001. He was<br />

responsible for transforming UPM to become one of the leading centres of higher education. As an<br />

accomplished academician, he has helped found many academic societies and associations, and has<br />

published over 350 papers in journals and proceedings in the fields of animal science, university<br />

management and education. For his meritorious career and services, he has received numerous<br />

awards, decorations and honours nationally as well as internationally. He retired from UPM in April 2001.<br />

He is the Chairman of Bank Kerjasama Rakyat Malaysia Berhad, Kejuruteraan Samudra Timur Berhad,<br />

Taylor's Education Berhad and Halal Industry Development Corporation. He is a Director of TAFI<br />

Industries Berhad and is also the Chancellor of Taylor’s University.<br />

Y. Bhg. Tan Sri Abdul Halim Ali<br />

Independent / Non-Executive Director and Member of the Board Audit Committee<br />

P.M.N., P.J.N., S.P.M.S., S.I.M.P., D.G.S.M., D.H.M.S., D.S.D.K., J.S.M., K.M.N.<br />

B.A. (Hons.), University of Malaya<br />

Y. Bhg. Tan Sri Abdul Halim Ali, aged 67, a Malaysian, was appointed Director of the Company on May<br />

22, 2001. Upon graduation from University of Malaya, he joined the Ministry of Foreign Affairs in 1966.<br />

After several domestic and foreign postings, he was appointed the Malaysian Deputy Permanent<br />

Representative to the United Nations in 1979. He was appointed Ambassador to Vietnam in 1982 and<br />

returned to Malaysia in 1985 to be Deputy Secretary General in the Ministry of Foreign Affairs before<br />

being appointed Ambassador to Austria. In 1991, he again returned to Malaysia to be Deputy Secretary<br />

General I in the Ministry of Foreign Affairs and in 1996 he was promoted to Secretary General. In July<br />

1998, he was appointed Chief Secretary to the Government, the highest ranking civil service post in the<br />

country and was responsible for overseeing and coordinating the policies of the government and their<br />

implementation. He retired as Chief Secretary to the Government in March 2001. He currently is the<br />

Chairman of the Multimedia Development Corporation and Malaysia Building Society Berhad and he is<br />

also a Director of Malakoff Corporation Berhad and IJM Corporation Berhad.<br />

Y. Bhg. Dato' Zainal Abidin Putih<br />

Independent / Non-Executive Director and Chairman of the Board Audit Committee<br />

D.S.N.S., J.P., FCA (ICAEW), CA (M), CPA (M)<br />

Y. Bhg. Dato' Zainal Abidin Putih, aged 65, a Malaysian, was appointed Director of the Company on<br />

March 6, 2003. Upon qualifying from the Institute of Chartered Accountants in England and Wales, he<br />

joined the firm of Hanafiah Raslan & Mohamad, which merged with Ernst & Young in July 2002. He has<br />

extensive experience in audit having worked as a practicing accountant throughout his career<br />

covering many principal industries including banks, insurance, energy, transport, manufacturing,<br />

government agencies, plantations, properties, hotels, investment companies and unit trusts. He also<br />

has a good working knowledge of taxation matters and management consultancy, especially in the<br />

areas of acquisitions, takeovers, amalgamations, restructuring and public listing of companies. He plays<br />

an active role in the community and the corporate world being a Past President of the Malaysian Institute<br />

of Certified Public Accountants. He was also a member of the Malaysian Communication & Multimedia<br />

Commission, a body set up by the Malaysian government to oversee the orderly development of the<br />

multimedia and telecommunication industry in Malaysia. He was the Chairman of Pengurusan<br />

Danaharta Nasional Berhad as well as the Malaysian Accounting Standards Board (MASB). He is<br />

currently the Chairman of Dutch Lady Milk Industries Berhad and Land & General Berhad. He is also<br />

a Director of Tenaga Nasional Berhad and a Director of CIMB Group Holdings Berhad, including its<br />

subsidiaries CIMB Bank Berhad and CIMB Investment Bank Berhad. He is also Chairman of CIMB<br />

Group's subsidiary Southeast Asia Special Asset Management Berhad. He also acts as a Trustee of<br />

the National Heart Institute Foundation.<br />

ANNUAL REPORT & ACCOUNTS <strong>2010</strong><br />

13

ESSO MALAYSIA BERHAD<br />

Corporate Citizenship - Highlights<br />

EMB emerged as a double winner at the STARBiz-ICR<br />

Malaysia Corporate Responsibility Award <strong>2010</strong> in the<br />

‘Workplace’ and ‘Community’ categories. It was one of 21<br />

finalists selected from a shortlist of companies listed on<br />

Bursa Malaysia and was the only company among the<br />

finalists with market capitalisation below RM1 billion to win in<br />

two categories.<br />

orporate citizenship has long been an integral part of our approach as we conduct our business of<br />

providing efficient, affordable and environmentally responsible energy to Malaysia. Being a good<br />

corporate citizen is embedded in every facet of our operations; from ensuring the highest<br />

standards in safety and health, to protecting the environment, operating with the highest business<br />

integrity and contributing to the communities where we work. This section describes the corporate<br />

citizenship efforts and accomplishments of EMB and the other subsidiaries of ExxonMobil in Malaysia.<br />

Upholding Standards In Corporate Governance and Business Integrity<br />

Our efforts to be a good corporate citizen are demonstrated on many fronts, but none is more fundamental than setting<br />

and meeting the highest ethical standards for the way we do business. We support transparency, oppose corruption and<br />

are committed to honest and ethical behaviour wherever we operate.<br />

• Our philosophy on business ethics is enshrined in our Standards of Business Conduct which serves as a guide<br />

toward the highest standards of integrity in all our dealings and every aspect of our operations. These are further<br />

strengthened by each employee’s annual affirmation of their familiarity with the policies and on-going reviews to<br />

assess compliance and identify areas for improvement.<br />

• Our Operations Integrity Management System provides a disciplined framework for controlling and managing<br />

safety, health, security and environmental risks at all our facilities. It is designed to help minimise operational<br />

incidents and meets the requirements of the International Organisation for Standardisation’s standard for<br />

environmental management systems (ISO 14001).<br />

• In <strong>2010</strong>, we conducted refresher training for employees on our business practices to ensure they fully understand<br />

company expectations. Controls clinics were organised to encourage dialogue on the application of guidelines and<br />

policies. We also conducted training for employees who interact with government officials or may do so in the future<br />

to ensure they understand expectations of ethical and honest dealings with governments and obligations to comply<br />

with competition laws and anti-trust legislation of the United States.<br />

14<br />

ANNUAL REPORT & ACCOUNTS <strong>2010</strong>

Safety Excellence - The Number One Priority<br />

We are committed to maintaining the highest standards of safety and security in our day-to-day operations in order to<br />

protect the welfare of our employees, contractors, customers and the public.<br />

Our goal is Hurt-Free, Every Site, Every Day. We enforce strict compliance with safety procedures and management<br />

systems to achieve this vision. While these systems provide a valuable framework for achieving safety excellence,<br />

active employee involvement is crucial to maintaining this performance. Safety programmes such as U-See U-Act, Job<br />

Safety Analysis and a Loss Prevention System reinforce the message of personal accountability towards mitigating risks<br />

in our operations. These programmes are extended to our contractors and third-party workers to ensure a common<br />

approach to safety.<br />

• Port Dickson Refinery continued its outstanding safety performance, achieving eight years Lost Time Incident (LTI)<br />

free as at April <strong>2010</strong> and six years Total Recordable Incident (TRI) free as at September <strong>2010</strong>. The Refinery was<br />

awarded the ExxonMobil Refining & Supply Safety Excellence Award (Platinum) for the former and ExxonMobil<br />

Refining & Supply “Nobody Gets Hurt” Special Recognition Award for the latter. The Refinery also received a Gold<br />

Merit Award from the Malaysian Society for Occupational Safety & Health (MSOSH) for its <strong>2010</strong> occupational safety<br />

and health performance.<br />

• Our Distribution terminals achieved flawless operations throughout <strong>2010</strong>, recording zero LTI. Our terminals<br />

business also logged 13.8 years straight without LTI, representing 16.78 million hours worked without incident. Port<br />

Dickson and Bagan Luar Terminals obtained Gold Awards from MSOSH for their exemplary safety performance<br />

during the previous 12 months.<br />

• EMB’s construction services provider, which services ExxonMobil’s Asia Pacific retail business, celebrated eight<br />

years and five million manhours without LTI. In addition, EMB together with ExxonMobil’s retail businesses in the<br />

Asia Pacific region, received the ExxonMobil Fuels Marketing President’s Safety Award, which recognised them for<br />

exceptional overall security, safety, health and environmental performance as well as continuous improvement over<br />

time. For a number of years, ExxonMobil’s Asia Pacific retail sales group has consistently achieved the lowest total<br />

recordable incident rate for a retail business. Showing relentless attention to SSH&E, the team posted best-in-class<br />

employee and contractor recordable rates, a nearly 70% improvement in employee incident rates since 2008, and<br />

zero environmental incidents in the past two years.<br />

ANNUAL REPORT & ACCOUNTS <strong>2010</strong> 15

ESSO MALAYSIA BERHAD<br />

Environmental Performance - Protect Tomorrow. Today.<br />

Protect Tomorrow<br />

Today<br />

We are committed to operating our business in an environmentally responsible manner that<br />

balances the environmental and economic needs of the communities in which we operate.<br />

In addition to strict compliance with applicable environmental legislation and regulations,<br />

we continuously seek ways to understand and mitigate the impact of our business on the<br />

environment. As part of our Protect Tomorrow. Today. initiative, we take active measures at<br />

all our facilities to reduce emissions, improve energy efficiency, prevent environmental<br />

incidents and minimise our environmental footprint.<br />

Port Dickson Refinery achieved exemplary performance in flare reduction with 55<br />

percent improvement compared to 2009. The site also sustained zero reportable spills<br />

in <strong>2010</strong> for the second year running.<br />

<br />

<br />

Port Dickson Refinery is also a pace setter in energy conservation through its energy<br />

efficiency measures, resulting in some RM5 million in cost savings. The Refinery ranks<br />

in second place among all ExxonMobil refineries throughout Asia Pacific for energy<br />

efficiency.<br />

All our distribution terminal storage tanks for gasoline products are equipped with an<br />

internal floating roof to reduce the release of Volatile Organic Compounds (VOCs) into<br />

the atmosphere. At the same time, we operate a robust Preventive Maintenance<br />

Programme for all storage tanks and pipelines to ensure their integrity is maintained, all<br />

with the goal of zero leaks or spills to the environment.<br />

Product Safety & Stewardship<br />

We are dedicated to minimising the risks and impacts associated with the manufacture and<br />

use of our products, from development through to their end use and ultimate disposal. We<br />

have processes in place to ensure the quality and high standards of our products. We<br />

ensure our products are safely delivered to our customers in all sectors and conduct regular<br />

safety checks of all our equipment. We provide up-to-date product specifications and safe<br />

handling procedures of the products we sell.<br />

Our service station dealers are trained in preventive and responsive safety and<br />

environmental procedures to ensure safety at all our sites and to minimise the impact of any<br />

security or environmental incident that may occur.<br />

Supporting Sustainability<br />

We are committed to supporting our customers’ sustainability efforts by developing<br />

innovative, high-performance products and services that deliver both business and<br />

sustainability related benefits.<br />

<br />

In <strong>2010</strong>, our Lubricants & Specialties business ran a communications campaign with its<br />

distributors to highlight the measures we are taking on sustainability in our business.<br />

Specific initiatives include:<br />

<br />

<br />

<br />

<br />

<br />

<br />

A focus on helping to extend equipment life, and increase efficiencies and<br />

productivity in order to benefit equipment manufacturers and users alike.<br />

Working with engine manufacturers to boost fuel economy and lower emissions.<br />

This also enables marine/truck fleet operators to reduce oil consumption and thus<br />

resulting in cost savings. Our formulations are also designed with increased fuel<br />

economy as a primary goal.<br />

Extending the performance and protection of vehicle engines by developing longer<br />

lasting lubricants. Our longer lasting synthetic motor oils also cut down on used oil<br />

volumes.<br />

Reducing the use of materials through package design enhancements.<br />

Using fully recyclable road bitumen to conserve building materials.<br />

Reducing marine fleet oil consumption with a feed rate optimisation programme.<br />

16<br />

ANNUAL REPORT & ACCOUNTS <strong>2010</strong>

A Healthy Workplace, A Healthy Business<br />

We know that the success of our business lies fundamentally in the personal well-being and<br />

professional growth of our employees. During the year, we ran a number of occupational<br />

health programmes and initiatives to reduce the risk of occupational injury or illness and to<br />

raise awareness of the importance of health among employees, contractors and others<br />

involved in our operations.<br />

The Ergo Lead / Ergo Contact Network continued its stewardship of the Office Ergonomics<br />

programme with regular assessment and reviews to ensure that potential injury and<br />

illness among employees related to ergonomic factors were minimised. An Ergo<br />

Resource Centre was also opened during the year to help employees learn more about<br />

preventing illness and injury in the workplace and at home. A Health Week was<br />

organised for employees featuring a series of talks on health topics with<br />

demonstrations and presentations on maintaining a healthy lifestyle.<br />

Nurturing Talent - We recognised the importance of attracting and retaining top performers<br />

from the broadest possible talent pool to meet our business requirements. We put in place<br />

fair and responsive succession plans and opportunities for advancement, keeping pace<br />

with our employees’ progress and achievements in order to identify areas in which they can<br />

contribute and grow. We encourage a healthy work-life balance, and instill respect for this<br />

philosophy among our employees and management.<br />

Equal Treatment - Employees are treated equally regardless of race, religion, gender,<br />

sexual orientation or impairment due to health conditions. We adopt policies that<br />

encourage diversity in the work place and practice zero tolerance of all forms of harassment<br />

in the workplace.<br />

Developing Potential - We strive to provide our employees with the best career<br />

opportunities in our industry, including assignments abroad to help foster individual growth<br />

and achievement. During <strong>2010</strong>, a number of EMB employees were among the 100<br />

Malaysians on international assignments within ExxonMobil.<br />

Active In The Community<br />

ExxonMobil has a long tradition of community involvement via employee volunteerism and<br />

financial contributions. We work with government and non-government bodies and<br />

community leaders to identify areas of need and make positive contributions through<br />

projects that bring sustainable, long-term benefits in the areas of human capital<br />

development, health and safety, energy literacy and corporate governance.<br />

In <strong>2010</strong>, about RM1.3 million was contributed by EMB and other ExxonMobil subsidiaries to<br />

some 35 organisations to support a number of human capital development, environment,<br />

safety and health projects. Some of our contributions include:<br />

ExxonMobil Education & Scholarship Fund for deserving students in Negeri<br />

<br />

Sembilan.<br />

Sports award to recognise outstanding young athletes under the Majlis Sukan<br />

Sekolah-Sekolah Negeri Sembilan (MSSNS) programme.<br />

In addition to financial contributions, EMB employees are very much involved in community<br />

service. Our employees have once again been the driving force behind the success of our<br />

various employee volunteer programmes during the year which aim to make a difference in<br />

the lives of the underprivileged.<br />

ExxonMobil Community Projects Programme: In <strong>2010</strong>, EMB employees were part<br />

of about 650 employees and family members who carried out a total of 14<br />

community projects at various locations. These included arranging a shopping<br />

expedition for children from a local orphanage to help them prepare for the new<br />

school year; and working with children from poor urban communities to help<br />

generate an understanding of what makes strong families and to build their self<br />

worth. At Rumah Alam Darul Aminan Orphanage in Senawang, Port Dickson<br />

Refinery employees and their families carried out a project to upgrade the<br />

orphanage buildings and gardens and organised a day of activities with the<br />

resident children. In total, RM220,000 was spent for the year’s programme.<br />

ANNUAL REPORT & ACCOUNTS <strong>2010</strong> 17

CORPORATE GOVERNANCE<br />

The Board of Directors of Esso Malaysia Berhad is committed to ensuring that the highest standards of corporate<br />

governance are practised throughout the Company. The Board views this as a fundamental part of its responsibilities to<br />

protect and enhance shareholder value. Accordingly, the Board fully supports the principles laid out in the Malaysian<br />

Code on Corporate Governance.<br />

Exxon Mobil Corporation, as the Company's ultimate holding company, has developed a series of policies and<br />

management systems that are designed to create and support a strong system of corporate governance. The policies<br />

and management systems have been adopted by the Board and are communicated to the Company's employees,<br />

contractors and vendors, so that each has a clear understanding of the Company's expectations.<br />

The policies, which are set out in a Standards of Business Conduct booklet, and the management systems are strictly<br />

enforced. The Foundation Policies include Business Ethics, Conflicts of Interest, Antitrust, Alcohol and Drug Use, Gifts<br />

and Entertainment, Harassment in the Workplace and Outside Directorships. The management systems are designed to<br />

achieve high standards of performance in the areas of safety, operations integrity, internal control and legal and<br />

environmental compliance.<br />

The Board and the Board Audit Committee ensure that the policies and the management systems are fully implemented<br />

and consistently enforced. They are supported by an internal Management Committee and an Audit and Controls<br />

Committee, both led by the Chairman.<br />

The Board<br />

The Board leads and controls the Company. The Board meets at least four times a year, with additional matters resolved<br />

by way of Circular Resolutions as and when necessary. Each Non-Executive Director is independent and brings<br />

invaluable judgment to bear on issues of strategy, performance, resource allocation, risk management and standards of<br />

conduct.<br />

For the year ended December 31, <strong>2010</strong>, four Board and four Board Audit Committee meetings were held. Details of the<br />

Directors' attendance at these meetings are summarised below:<br />

Directors Number of Board Number of Board Audit<br />

Meetings<br />

Committee Meetings<br />

Held Attended Held Attended<br />

Mr. Hugh W. Thompson 4 4 Non-member Non-member<br />

Y. Bhg. Tan Sri Dato' Dr. Syed Jalaludin Syed Salim 4 4 4 4<br />

Y. Bhg. Tan Sri Abdul Halim Ali 4 4 4 4<br />

Y. Bhg. Dato' Zainal Abidin Putih 4 4 4 4<br />

Puan Fatimah Merican 4 4 Non-member Non-member<br />

Encik Abu Bakar Siddik Che Embi 4 3 Non-member Non-member<br />

Puan Faridah Ali 4 4 Non-member Non-member<br />

ANNUAL REPORT & ACCOUNTS <strong>2010</strong> 19

ESSO MALAYSIA BERHAD<br />

CORPORATE GOVERNANCE (Continued)<br />

Board Membership<br />

The Board had 7 members as at the end of <strong>2010</strong>, with 3 Independent Non-Executive Directors and 4 Executive Directors<br />

(including the Chairman). Together, the Directors form the mind and management of the Company.<br />

The functional organisation of the Company provides a system and structure of checks and balances in the decision<br />

making process. There is a clear division of responsibilities between the Chairman and each of the other Executive<br />

Directors.<br />

Balance in the Board is achieved and maintained with the composition of both Executive and Independent Non-Executive<br />

Directors. In recognition that the Independent Non-Executive Directors have a primary role in providing unbiased and<br />

independent views, the Company has selectively appointed highly qualified individuals of integrity and character, with<br />

broad experience and proven business and management expertise.<br />

Y. Bhg. Tan Sri Dato' Dr. Syed Jalaludin Syed Salim is the longest serving Independent Non-Executive Director of the<br />

Company. Shareholders are at liberty to approach Y. Bhg. Tan Sri Dato' Dr. Syed Jalaludin Syed Salim, or any of the other<br />

Independent Non-Executive Directors, should there be any concerns relating to the Company and its Management.<br />

Supply of Information<br />

Information regarding the Company's business and affairs is normally provided to the Board by the Company's<br />

management and staff and by the Company's independent auditors. Towards meeting this objective, Board meetings are<br />

structured with a pre-determined agenda. Board papers covering the Company's operational and financial performance,<br />

strategic plans on any significant matters and developments, together with the minutes of the previous Board and Board<br />

Audit Committee meetings, are circulated to the Directors (or Members of the Board Audit Committee, as the case may be)<br />

in advance of each meeting. This allows the Directors time to deliberate on the issues to be raised and discussed at each<br />

meeting. The Board, in addition to having full access to the advice and services of the Company Secretary, has the<br />

authority to retain such outside advisors, including accountants, legal counsels, and other experts, as it deems<br />

appropriate. The fees and expenses of any such advisors will be paid by the Company.<br />

Appointment and Re-election of Directors<br />

In accordance with the Company's Articles of Association, the Board can appoint any person to be a Director as and when it<br />

is deemed necessary. However, consistent with the best practices of the Malaysian Code on Corporate Governance, the<br />

Nominating Committee makes recommendations to the Board prior to such appointments. Any person so appointed shall<br />

hold office until the next <strong>Annual</strong> General Meeting at which time the candidate will be subject to election by the<br />

shareholders. An election of Directors takes place every year, with each Director retiring from office at least once every<br />

three years. Directors retiring by rotation are eligible for re-election by the shareholders at the <strong>Annual</strong> General Meeting.<br />

Remuneration Committee<br />

The Remuneration Committee is responsible for the recommendation of the remuneration of the Executive and the<br />

Independent Non-Executive Directors, for the Board's consideration and decision.<br />

The current members of the Remuneration Committee are as follows:<br />

1. Mr. Hugh W. Thompson (Executive Director) - Chairman<br />

Puan Fatimah Merican (Executive Director) - Alternate Chairman<br />

2. Y. Bhg. Tan Sri Dato' Dr. Syed Jalaludin Syed Salim (Independent Non-Executive Director)<br />

3. Y. Bhg. Dato' Zainal Abidin Putih (Independent Non-Executive Director)<br />

Directors' Remuneration<br />

The remuneration received by the Independent Non-Executive Directors in <strong>2010</strong> was recommended by the Board as a<br />

whole (with the Independent Non-Executive Directors abstaining from participation in the discussions and voting on the<br />

matter) and approved by the shareholders at the <strong>Annual</strong> General Meeting on May 25, <strong>2010</strong>.<br />

With the recommendation of the Remuneration Committee, the Board has adopted Exxon Mobil Corporation's<br />

compensation system to set the remuneration of Executive Directors. The compensation system took into account the<br />

performance of each Executive Director and the competitive environment in which the Company operates. The Executive<br />

Directors took no part in deciding their own remuneration.<br />

20<br />

ANNUAL REPORT & ACCOUNTS <strong>2010</strong>

CORPORATE GOVERNANCE (Continued)<br />

An analysis of the aggregate Directors' remuneration incurred by the Company for the year ended December 31, <strong>2010</strong> as<br />

prescribed under Appendix 9C Part A Item 11(a) of the Main Market Listing Requirements of the Bursa Malaysia Securities<br />

Berhad (BMSB) is set out below :<br />

FEES VALUE OF REMUNERATION<br />

TOTAL<br />

(RM) AND OTHERS (RM)<br />

(RM)<br />

EXECUTIVE DIRECTORS - 1,359,779 1,359,779<br />

INDEPENDENT NON-EXECUTIVE 126,000 33,000 159,000<br />

DIRECTORS<br />

An analysis of the number of Directors whose remuneration, incurred by the Company, falls in successive bands of<br />

RM50,000 as prescribed under Appendix 9C Part A Item 11(b) of the Main Market Listing Requirements of the BMSB is set<br />

out below:<br />

Remuneration (RM) Number of Executive Number of Non-Executive<br />

Directors<br />

Directors<br />

Less than 50,000<br />

50,001 - 100,000 3<br />

100,001 - 150,000 1<br />

150,001 - 200,000<br />

200,001 - 250,000 1<br />

250,001- 300,000<br />

300,001 - 350,000 1<br />

350,001 - 400,000<br />

400,001 - 450,000<br />

450,000 - 500,000<br />

500,001 - 550,000<br />

550,001 - 600,000<br />

600,001 - 650,000<br />

650,001 - 700,000 1<br />

The Company has opted not to disclose each Director's remuneration as the Board considers the information to be<br />

sensitive and proprietary.<br />

Nominating Committee<br />

The Nominating Committee is responsible for the recommendation of candidates for Independent Non-Executive<br />

Directors and Executive Directors and the recommendation of Directors for Committees, for the Board's consideration and<br />

decision.<br />

The Nominating Committee is also responsible for the assessment of the effectiveness of individual Directors, Board<br />

Committees and the overall Board on an ongoing basis. These assessments, based on a combination of qualitative and<br />

quantitative factors, were carried out by the Nominating Committee in <strong>2010</strong>. The findings and results of these<br />

assessments by the Nominating Committee were reported to the Board.<br />

The current members of the Nominating Committee are as follows:<br />

1. Mr. Hugh W. Thompson (Executive Director) - Chairman<br />

Puan Fatimah Merican (Executive Director) - Alternate Chairman<br />

2. Y. Bhg. Tan Sri Dato' Dr. Syed Jalaludin Syed Salim (Independent Non-Executive Director)<br />

3. Y. Bhg. Tan Sri Abdul Halim Ali (Independent Non-Executive Director)<br />

The Board when setting up the Nominating Committee in 2003 formed the view, which it still holds today, that the Chairman<br />

of the Company, being an Executive Director, should be a member and Chairman of the Nominating Committee. While the<br />

composition of the Nominating Committee departs from the Best Practices as outlined in the Malaysian Code on Corporate<br />

Governance, compliance with which is not compulsory, the Board is of the view that the inclusion of the Chairman of the<br />

Company provides the Nominating Committee with invaluable perspective on the business and operational needs of the<br />

Company. Such input is needed in the selection and recommendation of suitable candidates for appointment by the Board,<br />

as well as in assessing the performance of the Board, Directors and Committees.<br />

Apart from the Chairman, the Nominating Committee members are all Independent Non-Executive Directors.<br />

ANNUAL REPORT & ACCOUNTS <strong>2010</strong> 21

Directors' Training<br />

The Board places great emphasis on continuous education for Directors. In this regard, the status of each Director's<br />

continuous education was regularly monitored and reviewed by the Board. The Board had in 2006, adopted the 'Principles<br />

for Training of Directors of the Company' that sets out the philosophies on and the types and modes of training, that the<br />

Directors will undertake in each year, to help them serve the Board more effectively. These same Principles were applied<br />

by the Board in determining the relevant training for Directors of the Company in <strong>2010</strong>.<br />

All Directors on the Board had received or undergone relevant training in <strong>2010</strong>. Further details of the training programmes<br />

attended by the Directors in <strong>2010</strong> are as set out in pages 24 to 26.<br />

The Company reimburses Directors for costs incurred in attending continuous education programmes.<br />

The Directors are also briefed at quarterly Board meetings on any significant changes in laws and regulations that are<br />

relevant to the Company's operations.<br />

Dialogue between the Company and Investors<br />

The Board values and encourages dialogue with the shareholders to establish better understanding of the Company's<br />

objectives and performance. The <strong>Annual</strong> General Meeting provides an appropriate forum for the shareholders to dialogue<br />

with the Board. Additionally, queries from investors and potential investors are dealt with by our Investor Relations. The<br />

Company also has its own website with contact details of a dedicated officer for such purpose. The Company holds open<br />

discussions with investors and analysts upon request. In this regard, the Company disseminates information in strict<br />

adherence to the disclosure requirements of the Main Market Listing Requirements of the BMSB. Material information<br />

relating to the Company is disclosed to the public by way of announcements to the BMSB, as required by the Main Market<br />

Listing Requirements of the BMSB.<br />

<strong>Annual</strong> General Meeting<br />

At the <strong>Annual</strong> General Meeting, the Chairman of the Board reviews the progress and performance of the Company with<br />

the shareholders. A question and answer session is also conducted to allow shareholders the opportunity to question<br />

Management on the Company's business and the proposed resolutions. The Chairman, the Board members and the<br />

external auditors are available at the <strong>Annual</strong> General Meeting to respond to questions.<br />

Accountability and Audit<br />

In announcing the quarterly, semi-annual and annual financial statements to the shareholders and the public, the Board<br />

endeavours to present a balanced and understandable assessment of the Company's financial position and prospects.<br />

The Board Audit Committee assists the Board by ensuring the accuracy and adequacy of the information announced.<br />

Internal Control<br />

ESSO MALAYSIA BERHAD<br />

CORPORATE GOVERNANCE (Continued)<br />

The Directors are responsible for the Company's system of internal controls. The system applies to all financial and<br />

operating activities with the objective of safeguarding the shareholders' investment and the Company's assets. The<br />

internal control system has clear management support, including the involvement of the Board, and is designed to meet<br />

the risks to which the Company is exposed. The Board is satisfied with the design of the control system and believes that<br />

there is compliance with all of the requirements.<br />

Key elements of the Company's internal control system include:<br />

1. a comprehensive and clearly documented System of Management Control Standards Manual that establishes the<br />

core requirements for good controls within the Company. The Manual not only identifies the principal risks faced by<br />

the Company, but also prescribes the appropriate systems to manage these risks. The Manual also specifies the<br />

overall control framework, the required control checks and the required checks on the system's effectiveness,<br />

2. a clearly defined organisational structure with clear lines of accountability and delegation of authority for each level,<br />

3. annual reviews of the control system, including internal and external audits. The results are reviewed with various<br />

levels of management and any major concerns are raised to senior management and the Board Audit Committee,<br />

22<br />

ANNUAL REPORT & ACCOUNTS <strong>2010</strong>

CORPORATE GOVERNANCE (Continued)<br />

Internal Control (Continued)<br />

4. key policies covering, among others, Business Ethics, Conflicts of Interest, Antitrust, Alcohol and Drug Use, Gifts<br />

and Entertainment, Harassment in the Workplace and Outside Directorships. They include requirements to comply<br />

with all applicable laws and regulations. These policies are communicated to and acknowledged by employees on<br />

an annual basis,<br />

5. a Controls Integrity Management System to assess and sustain the effectiveness of the organisation's system of<br />

controls; and<br />

6. a yearly representation of compliance to the internal control system and key policies by the managers of each<br />

business unit in the Company. Managers are required to document any outstanding control concerns and the<br />

planned corrective action steps.<br />

It should be noted that systems of internal controls and risk management are designed to manage rather than eliminate<br />

the risk of failure to achieve business objectives, and any system can only provide reasonable and not absolute<br />

assurance against material misstatement or loss.<br />

Statement of Directors' Responsibility for Preparing the Financial Statements<br />

The Directors are required by the Companies Act, 1965 and the Main Market Listing Requirements of the BMSB to<br />

confirm that the financial statements for each financial year have been made out in accordance with the applicable<br />

approved accounting standards and that they give a true and fair view of the results of the business and state of affairs of<br />

the Company for the financial year.<br />

The Directors have carried out their responsibilities by:<br />

selecting suitable accounting policies and applying them consistently;<br />

making judgments and estimates that are reasonable and prudent;<br />

ensuring that all applicable accounting standards have been adhered to; and<br />

basing the financial statements on a going-concern basis, as the Directors have a reasonable expectation, after<br />

having made due enquiries, that the Company has adequate resources to continue in operational existence for the<br />

foreseeable future.<br />

The Directors are responsible for ensuring that the Company keeps accounting records which disclose with reasonable<br />

accuracy, the financial position of the Company, enabling the Directors to ensure that the financial statements comply<br />

with the Companies Act, 1965 and to safeguard the assets of the Company.<br />

Relationship with Auditors<br />

The Board has established a formal and transparent relationship with the auditors of the Company. The role of the Board<br />

Audit Committee in relation to the internal and external auditors is described on pages 27 and 28.<br />

Material Contracts<br />

The Company is not and was not a party to any material contracts involving the Directors' interests during the year.<br />

Further the Company is not and was not a party to any material contracts that are not in its ordinary course of business<br />

involving its major shareholders' interests during the year.<br />

Non-Audit Fees<br />

No non-audit fees were paid or are payable to the external auditors, PricewaterhouseCoopers, by the Company for the<br />

financial year ended December 31, <strong>2010</strong>.<br />

Other Information<br />

i) Family Relationship<br />

None of the Directors have any family relationship with any other Director and/or major shareholder(s) of the<br />

Company.<br />

ii)<br />

Conflicts of Interest<br />

None of the Directors have any conflicts of interest with the Company.<br />

ANNUAL REPORT & ACCOUNTS <strong>2010</strong> 23

ESSO MALAYSIA BERHAD<br />

CORPORATE GOVERNANCE (Continued)<br />

Other Information(Continued)<br />

iii)<br />

Conviction for offences (excluding traffic offences)<br />

None of the Directors have been convicted for any offences within the past 10 years.<br />

iv) Sanctions and/or penalties<br />

No sanction or penalty has been imposed on the Company, or the Directors or the Management, by<br />

the relevant regulatory bodies.<br />

This Statement is made in accordance with the Board of Directors' resolution dated February 25, 2011.<br />

Training Attended by Directors in <strong>2010</strong><br />

Directors / Training Date in <strong>2010</strong> Organiser<br />

Hugh W. Thompson<br />

Upstream Working Group Feb 22 PETRONAS<br />

Offsite Strategy Planning Mar 2 ExxonMobil<br />

Operations - ALT Effectiveness Workshop Mar 16 ExxonMobil<br />

ESG Drill Apr 1 ExxonMobil<br />

Production Leadership Team Conference Apr 12-15 ExxonMobil -<br />

Houston, USA<br />

<strong>Annual</strong> Safety Forum Apr 19 ExxonMobil<br />

Data Privacy Laws May 20 ExxonMobil<br />

Offsite Strategy Meeting May 26 ExxonMobil<br />

- PUL Alignment Workshop<br />

Asia Oil & Gas Conference Jun 7-8 PETRONAS<br />

- Panel Chairman “ The Roundtable Carbon Agenda”<br />

Upstream Working Group Jun 21 PETRONAS<br />

Visiting Senior Executive Programme Jun 30 Thunderbirds<br />

Offsite External Engagement Strategy Conference - 1 Jul 6 ExxonMobil<br />

Advanced ESG Training Jul 19-21 ExxonMobil<br />

Offsite External Engagement Strategy Conference - 2 Jul 28 ExxonMobil<br />

Upstream Oil & Gas Business in Malaysia Aug 27 ExxonMobil<br />

Upstream Working Group Oct 4 PETRONAS<br />

Economic Transformation Programme Roadmap Oct 24 Govt of Malaysia<br />

Leadership Offsite - Safety Nov 25 ExxonMobil<br />

Tan Sri Dato' Dr. Syed Jalaludin Syed Salim<br />

Data Privacy Laws May 20 ExxonMobil<br />

Banking Insight Programme - Prof. Nabil Jun 8-9 Bank Negara Malaysia<br />

Upstream Oil & Gas Business in Malaysia Aug 27 ExxonMobil<br />

24<br />

ANNUAL REPORT & ACCOUNTS <strong>2010</strong>

CORPORATE GOVERNANCE (Continued)<br />

Training Attended by Directors in <strong>2010</strong> (Continued)<br />

Directors / Training Date in <strong>2010</strong> Organiser<br />

Tan Sri Abdul Halim Ali<br />

Enhancing Protection for Directors and Officers Jan 26 IJM Corporation Bhd<br />

in an Escalating Risk Environment<br />

Financial Instruments Seminar Mar 16-17 Malaysia Building<br />

- FRS 101, 139, 132, 7 and IFRIC 15 Society Berhad<br />

Data Privacy Laws May 20 ExxonMobil<br />

Corporate Governance Seminar Mar 25 MSWG<br />

Leaders building Leaders Jul 13 Ministry of Higher Education<br />

Seminar of Competition Bill <strong>2010</strong> Aug 5 Rahmat Lim & Partners<br />

A Contrarian View of Corporate Governance by John Zinkin Sep 30 IJM Corporation Bhd<br />

Upstream Oil & Gas Business in Malaysia Aug 27 ExxonMobil<br />

Dato' Zainal Abidin Putih<br />

Talk on Managing Risks in Mortgage Financing Jan 13 Bank Negara Malaysia<br />

& Cagamas Berhad<br />

Forum on “The Challenges of Implementing FRS 139” Jan 21 Bursa Malaysia<br />

Building Organisational Capability for Strategic May 4 Bank Negara Malaysia<br />

Transformation - Prof. Dave Ulrich<br />

Data Privacy Laws May 20 ExxonMobil<br />

Building Audit Committees for Tomorrow May 20-21 Bank Negara Malaysia<br />

- David Brown (Brown Governance)<br />

Banking Insight Programme - Prof. Nabil Jun 8-9 Bank Negara Malaysia<br />

Advance Risk Management Programme - David Bobker Jun 21-22 Bank Negara Malaysia<br />

Capitalize Investment Opportunity Aug 2-5 IBC Asia - Singapore<br />

- Nuclear Energy Sector in Asia<br />

Khazanah Megatrend Forum <strong>2010</strong> Oct 4-5 Khazanah Nasional<br />

Upstream Oil & Gas Business in Malaysia Aug 27 ExxonMobil<br />

BNM Financial Industry Conference <strong>2010</strong> Nov 3 Bank Negara Malaysia<br />

<strong>Annual</strong> Management Dialogue Nov 26-27 CIMB<br />

Faridah Ali<br />

Data Privacy Laws May 20 ExxonMobil<br />

Work-Life Balance Seminar Jul 8 ExxonMobil<br />

Antitrust Briefing Jul 23 ExxonMobil<br />

Upstream Oil & Gas Business in Malaysia Aug 27 ExxonMobil<br />

Professional Development - Supervisors’ Training Sep 22-23 ExxonMobil<br />

Defensive Driving Oct 6 ExxonMobil/SAMP<br />

Retail Investments Basis Seminar Oct 14 ExxonMobil<br />

Project Management Workshop Oct 20-21 ExxonMobil<br />

Business Practices Review Oct 29 ExxonMobil<br />

DOSS NTI Workshop Dec 2 ExxonMobil<br />

ANNUAL REPORT & ACCOUNTS <strong>2010</strong> 25

ESSO MALAYSIA BERHAD<br />

CORPORATE GOVERNANCE (Continued)<br />

Training Attended by Directors in <strong>2010</strong> (Continued)<br />

Directors / Training Date in <strong>2010</strong> Organiser<br />

Fatimah Merican<br />

SH+E Leadership Workshop by John Gelland Feb 4 ExxonMobil<br />

Speakers Coalition Media Training by Ray Thompson Mar 18 ExxonMobil<br />

ESG Drill Apr 1 ExxonMobil<br />

NIEW Gender Series: Women and New Economic Model Apr 9 Ministry of Women,<br />

Family and Community<br />

Development<br />

Data Privacy Laws May 20 ExxonMobil<br />

Offsite Strategy Meeting May 26 ExxonMobil<br />

- PUL Alignment Workshop<br />

Asia Oil & Gas Conference Jun 7-8 PETRONAS<br />

Offsite External Engagement Strategy Conference - 1 Jul 6 ExxonMobil<br />

Offsite External Engagement Strategy Conference - 2 Jul 28 ExxonMobil<br />

Upstream Oil & Gas Business in Malaysia Aug 27 ExxonMobil<br />

First Ladies Summit <strong>2010</strong> Oct 1 Govt of Malaysia<br />

US Security Briefing Oct 14 US Embassy<br />

Energy Outlook Nov 22 David S Reed<br />

& ExxonMobil<br />

Leadership Offsite - Safety Nov 25 ExxonMobil<br />

Abu Bakar Siddik Che Embi<br />

Data Privacy Laws May 20 ExxonMobil<br />

Upstream Oil & Gas Business in Malaysia Aug 27 ExxonMobil<br />

26<br />

ANNUAL REPORT & ACCOUNTS <strong>2010</strong>

Meetings and Minutes (Continued)<br />

The Secretary to the Committee shall be appointed by the Committee. The Secretary shall be responsible for the timely<br />

issuance of meeting notices together with meeting agenda and any supporting documents in advance of such meeting, for<br />

recording, keeping and distributing the minutes of meetings and any other duties ordinarily discharged by a secretary of<br />

such Committee.<br />

Authority<br />

The Committee is authorised by the Board:<br />

<br />

<br />

<br />

<br />

<br />

ESSO MALAYSIA BERHAD<br />

Board Audit Committee <strong>Report</strong> (Continued)<br />

to investigate any matter within its terms of reference;<br />

to have the resources which are required to perform its duties;<br />

to have full and unrestricted access to any information pertaining to the Company;<br />

to have unrestricted access to and communication with the external auditors of the Company and internal auditors;<br />

to obtain external legal or other independent professional advice as necessary; and<br />

to convene meetings with the external auditors of the Company, without the attendance of the executive members of<br />

the Committee, whenever deemed necessary.<br />

Duties<br />

The Committee is charged with the following duties:<br />

to review with the external auditors of the Company and internal auditors, the audit plan of the Company, the<br />

respective auditors' evaluation of the Company's system of internal accounting controls and the audit report, the<br />

external auditors' management letter and management's response to such letter, and report the same to the Board;<br />

to review and report to the Board the assistance given by the Company's employees to the external auditors of the<br />

Company and internal auditors;<br />

to review and report to the Board the adequacy of the scope, functions, competency and resources of the internal<br />

<br />

audit function and that it has the necessary authority to carry out its work;<br />

to review and report to the Board the internal audit programme, processes, the results of the internal audit<br />

programme, processes, or investigation undertaken, and whether or not appropriate action has been taken on the<br />

recommendations of the internal audit;<br />

to review and report to the Board the quarterly results and year end financial statements, including the balance sheet<br />

and profit and loss statement, prior to submission of the statements to the Board for approval, focusing particularly on:<br />

- changes in existing accounting policies or implementation of new accounting policies;<br />

- significant and unusual events;<br />

- compliance with accounting standards and other legal requirements; and<br />

- the going concern assumption;<br />

to review and report to the Board any related party transaction and conflict of interest situation that may arise within<br />

the Company;<br />

to review and report to the Board any removal, resignation, appointment and audit fee of the Company's external<br />

<br />

auditors;<br />

to review and report to the Board whether there is reason (supported by grounds) to believe that the Company's<br />

<br />

external auditors are not suitable for reappointment;<br />

<br />

to recommend the nomination of a person or persons as external auditors of the Company;<br />

to report promptly to Bursa Malaysia Securities Berhad (BMSB) matters reported by the Committee to the Board<br />

which have not been satisfactorily resolved resulting in a breach of the Main Market Listing Requirements of BMSB ;<br />

<br />

and<br />

to perform such other functions as may be agreed to by the Committee and the Board.<br />

This Statement is made in accordance with the Board of Directors' resolution dated February 25, 2011.<br />

28<br />

ANNUAL REPORT & ACCOUNTS <strong>2010</strong>

REPORT OF THE DIRECTORS<br />

The Directors are pleased to submit the annual report together with the audited financial statements of the Company for the year<br />

ended December 31, <strong>2010</strong>.<br />

PRINCIPAL ACTIVITIES<br />

The Company is a public company incorporated in Malaysia under the Companies Act, 1965 and is listed on the Bursa Malaysia<br />

Securities Berhad. The Company's principal activities are the manufacturing and marketing of petroleum products in Peninsular<br />

Malaysia. There has been no significant change in the nature of the Company's activities during the year.<br />

FINANCIAL RESULTS<br />

RM'000<br />

Net profit attributable to shareholders 268,579<br />

Retained profits brought forward 370,243<br />

Profits available for appropriation 638,822<br />

Dividends paid less income tax at 25% (24,300)<br />

Retained profits carried forward 614,522<br />

DIVIDENDS<br />

The amount of dividends paid since December 31, 2009 are as follows:<br />

RM'000<br />

In respect of the year ended December 31, 2009:<br />

Final dividend per stock unit, paid on June 21, <strong>2010</strong>:<br />

Ordinary – 12 sen gross less income tax at 25% 24,300<br />

The Directors propose that a final dividend of 14 sen less income tax at 25% per ordinary stock unit, amounting to RM28,350,000<br />

be paid for the year ended December 31, <strong>2010</strong>.<br />

RESERVES AND PROVISIONS<br />

All material transfers to or from reserves and provisions during the year are shown in the financial statements.<br />

STATUTORY INFORMATION ON THE FINANCIAL STATEMENTS<br />

Before the statement of comprehensive income and statement of financial position were completed, the Directors took<br />

reasonable steps:<br />

1. to satisfy themselves that all receivables had been properly analysed, that bad debts had been written off where<br />

appropriate and that adequate provision for impairment of receivables had been established; and<br />

2. to ensure that any current assets, which were unlikely to be realised in the ordinary course of business, were written<br />

down to the expected realisable amount.<br />

At the date of this report, the Directors are not aware of any circumstances:<br />

1. which would make the amounts written off for bad debts or the provision for impairment of receivables in the financial<br />

statements of the Company inadequate to any substantial extent; or<br />

2. which would make the values attributed to current assets in the financial statements of the Company misleading; or<br />

3. which would make adherence to the existing method of valuation of assets or liabilities of the Company misleading or<br />

inappropriate.<br />

No contingent or other liability has become enforceable or is likely to become enforceable within the period of twelve months after<br />

the end of the year which, in the opinion of the Directors, will or may affect the ability of the Company to meet its obligations when<br />

they fall due.<br />

ANNUAL REPORT & ACCOUNTS <strong>2010</strong> 29

ESSO MALAYSIA BERHAD<br />

STATUTORY INFORMATION ON THE FINANCIAL STATEMENTS (Continued)<br />

At the date of this report, there does not exist:<br />

1. any charge on the assets of the Company which has arisen since the end of the year which secures the liability of any<br />

other person; or<br />

2. any contingent liability of the Company which has arisen since the end of the year.<br />

At the date of this report, the Directors are not aware of any circumstances not otherwise dealt with in this report or the financial<br />

statements which would make any amount stated in the financial statements misleading.<br />

In their opinion:<br />

1. the results of the Company's operations during the year were not substantially affected by any item, transaction or event<br />

of a material and unusual nature; and<br />

2. there has not arisen in the interval between the end of the year and the date of this report any item, transaction or event of<br />

a material and unusual nature likely to affect substantially the results of the operations of the Company for the year in<br />

which this report is made.<br />

DIRECTORS<br />

The Directors who have held office during the period since the date of the last report are as follows:<br />

Mr. Hugh W. Thompson<br />

Y. Bhg. Tan Sri Dato' Dr. Syed Jalaludin Syed Salim<br />

Y. Bhg. Tan Sri Abdul Halim Ali<br />

Y. Bhg. Dato' Zainal Abidin Putih<br />

Puan Fatimah Merican<br />

Encik Abu Bakar Siddik Che Embi<br />

Puan Faridah Ali<br />

DIRECTORS' BENEFITS<br />

Since the end of the previous year, no Director has entered into or received or become entitled to receive a benefit (other than<br />

benefits disclosed in notes 8 and 9 to the financial statements) by reason of a contract made by the Company or a related<br />

corporation with the Director or with a firm of which he is a member, or with a company in which he has a substantial financial<br />

interest. All transactions between the Company or a related corporation and companies in which Directors have interests are<br />

conducted on an arms-length, commercial basis in the ordinary course of business.<br />

The Company was not a party to any contract or arrangement during the year and at the end of the year, as envisaged by section<br />

169(6)(f) of the Companies Act, 1965, which would have enabled any of the Directors to acquire benefits through the acquisition of<br />

shares in or debentures of the Company or any other body corporate.<br />

30<br />

ANNUAL REPORT & ACCOUNTS <strong>2010</strong>

DIRECTORS' INTERESTS IN SHARES<br />

According to the register of Directors' shareholdings, the interests of Directors who held office at the end of the year in the share<br />

capital of the Company and its related corporations are as follows:<br />

Exxon Mobil Corporation<br />

(Ultimate holding company)<br />

- Number of common stock without par value<br />

held by the following Directors:<br />

As at<br />

As at<br />

01.01.10 Acquired Sold 31.12.10<br />

Mr. Hugh W. Thompson 5,041 6,018 - 11,059<br />

Puan Fatimah Merican 9,852 6,550 (3,308) 13,094<br />

Puan Faridah Ali 437 570 (400) 607<br />

No other Director in office at the end of the year held any interest in the share capital of the Company or its related corporations<br />

during the year.<br />

ULTIMATE HOLDING COMPANY<br />

The Directors regard Exxon Mobil Corporation, a corporation incorporated in the state of New Jersey, United States of America,<br />

as the ultimate holding company of the Company.<br />

AUDITORS<br />

The auditors, PricewaterhouseCoopers, have expressed their willingness to continue in office.<br />

In accordance with a resolution of the Board of Directors dated February 25, 2011.<br />

...............................<br />

Hugh W. Thompson<br />

Chairman<br />

...............................<br />

Fatimah Merican<br />

Director<br />

Kuala Lumpur,<br />

February 25, 2011<br />

ANNUAL REPORT & ACCOUNTS <strong>2010</strong> 31

ESSO MALAYSIA BERHAD<br />

STATEMENT OF COMPREHENSIVE INCOME<br />

FOR THE YEAR ENDED DECEMBER 31, <strong>2010</strong><br />

Note <strong>2010</strong> 2009<br />

RM'000<br />

RM'000<br />

REVENUES 5 8,427,445 8,032,440<br />

COST OF SALES (7,650,829) (7,429,880)<br />

GROSS PROFIT 776,616 602,560<br />

OTHER INCOME 22,229 22,946<br />

OPERATING EXPENSES (344,645) (334,522)<br />

ADMINISTRATIVE AND OTHER EXPENSES (65,311) (67,793)<br />

FINANCE COST 6 (20,432) (22,195)<br />

PROFIT/(LOSS) BEFORE TAX 7 368,457 200,996<br />

TAX (EXPENSE)/BENEFIT 10 (99,878) (55,478)<br />

NET PROFIT/(LOSS) ATTRIBUTABLE TO 268,579 145,518<br />

SHAREHOLDERS<br />

OTHER COMPREHENSIVE INCOME - -<br />

TOTAL COMPREHENSIVE INCOME<br />

ATTRIBUTABLE TO SHAREHOLDERS 268,579 145,518<br />

Earnings/(Loss) per ordinary stock unit (sen) 11 99.5 53.9<br />

Proposed final gross dividend less income tax at 25%<br />

(2009: 25%) per ordinary stock unit (sen) 14.0 12.0<br />

The accompanying notes 1 to 28 form part of these financial statements.<br />

32<br />

ANNUAL REPORT & ACCOUNTS <strong>2010</strong>

STATEMENT OF FINANCIAL POSITION<br />

AS AT DECEMBER 31, <strong>2010</strong><br />

Note <strong>2010</strong> 2009<br />

RM'000<br />

RM'000<br />

NON-CURRENT ASSETS<br />

Property, plant and equipment 12 830,244 806,203<br />

Long-term assets 13 308,714 315,310<br />

Intangible assets - software 14 148 671<br />

TOTAL NON-CURRENT ASSETS 1,139,106 1,122,184<br />

CURRENT ASSETS<br />

Inventories 15 468,109 456,380<br />

Assets held for sale – leasehold land - 2,552<br />

Receivables 16 243,830 143,924<br />

Amounts due from related corporations 19 140,417 181,699<br />

Deposit, cash and bank balances 102,261 75,869<br />

Taxation - 35,234<br />

TOTAL CURRENT ASSETS 954,617 895,658<br />

CURRENT LIABILITIES<br />

Payables 17 142,327 135,467<br />

Retirement benefits obligations 18 1,006 2,721<br />

Amounts due to related corporations 19 396,907 443,040<br />

Borrowings (unsecured) 20 616,307 807,950<br />

Taxation 54,257 -<br />

TOTAL CURRENT LIABILITIES 1,210,804 1,389,178<br />

NET CURRENT LIABILITIES (256,187) (493,520)<br />

LESS: NON-CURRENT LIABILITIES<br />

Retirement benefits obligations 18 50,383 48,449<br />

Deferred taxation 21 75,014 66,972<br />

125,397 115,421<br />

TOTAL NET ASSETS EMPLOYED 757,522 513,243<br />

FINANCED BY:<br />

SHARE CAPITAL 22 135,000 135,000<br />

RESERVES 23 8,000 8,000<br />

RETAINED PROFITS 23 614,522 370,243<br />

SHAREHOLDERS' EQUITY 757,522 513,243<br />

The accompanying notes 1 to 28 form part of these financial statements.<br />

ANNUAL REPORT & ACCOUNTS <strong>2010</strong> 33

ESSO MALAYSIA BERHAD<br />

STATEMENT OF CHANGES IN EQUITY<br />

FOR THE YEAR ENDED DECEMBER 31, <strong>2010</strong><br />

Issued and fully paid<br />

ordinary stock of<br />

RM0.50 each Non-distributable<br />

Number of capital Distributable<br />

ordinary Nominal redemption retained<br />

stock unit value reserves profits Total<br />

'000 RM'000 RM'000 RM'000 RM'000<br />

At January 1, 2009 270,000 135,000 8,000 249,025 392,025<br />

Net profit - - - 145,518 145,518<br />

Dividends for the year ended<br />

December 31, 2008 (final) - - - (24,300) (24,300)<br />

At December 31, 2009 270,000 135,000 8,000 370,243 513,243<br />

At January 1, <strong>2010</strong> 270,000 135,000 8,000 370,243 513,243<br />

Net profit - - - 268,579 268,579<br />

Dividends for the year ended<br />

December 31, 2009 (final) - - - (24,300) (24,300)<br />

At December 31, <strong>2010</strong> 270,000 135,000 8,000 614,522 757,522<br />

The accompanying notes 1 to 28 form part of these financial statements.<br />

34<br />

ANNUAL REPORT & ACCOUNTS <strong>2010</strong>

STATEMENT OF CASH FLOWS<br />

FOR THE YEAR ENDED DECEMBER 31, <strong>2010</strong><br />

Note <strong>2010</strong> 2009<br />

RM’000<br />

RM’000<br />

CASH FLOWS FROM OPERATING ACTIVITIES<br />

Net profit / (loss) attributable to shareholders 268,579 145,518<br />

Adjustments for:<br />

Depreciation on property, plant and equipment 58,767 60,505<br />

Amortisation of intangible assets 523 845<br />

Tax expense / (benefit) 99,878 55,478<br />

Interest income (2,691) (581)<br />

Interest expense / commercial papers profit elements incurred 20,432 22,195<br />

Retirement / separation benefits cost 3,995 4,848<br />

(Gain) / loss on disposal of assets held for sale (659) (769)<br />

(Gain) / loss on disposal of property, plant and equipment 109 (294)<br />

Write-off of property, plant and equipment 3,976 2,763<br />

Unrealised foreign exchange (gain) / loss (7,813) 10,997<br />

Changes in:<br />

(Increase) / decrease in inventories (11,729) (158,336)<br />

(Increase) / decrease in assets held for sale - (2,552)<br />

(Increase) / decrease in receivables (99,843) (88,800)<br />

(Increase) / decrease in amounts due from related corporations 41,282 (7,960)<br />

Increase / (decrease) in amounts due to related corporations (38,430) 199,698<br />

Increase / (decrease) in payables and provisions 6,682 (106,254)<br />

Cash generated from operations 343,058 137,301<br />

Interest / commercial papers profit elements paid (20,495) (23,596)<br />

Interest received 2,691 581<br />

Income taxes paid (37,580) -<br />

Income taxes refunded 35,235 -<br />

Retirement / separation benefits paid (3,666) (3,943)<br />

Net cash from operating activities 319,243 110,343<br />

CASH FLOWS FROM INVESTING ACTIVITIES<br />

Purchase of property, plant and equipment (87,853) (47,096)<br />

(Increase) / decrease in long-term assets 6,596 30,982<br />

Proceeds from disposal of property, plant and equipment 960 992<br />

Proceeds from disposal of assets held for sale 3,211 5,874<br />

Net cash used in investing activities (77,086) (9,248)<br />

CASH FLOWS FROM FINANCING ACTIVITIES<br />

Repayment of borrowings – net (191,643) (17,058)<br />

Dividends paid to shareholders (24,300) (24,300)<br />

Net cash used in financing activities (215,943) (41,358)<br />

NET INCREASE / (DECREASE) IN CASH AND CASH EQUIVALENTS 26,214 59,737<br />

CASH AND CASH EQUIVALENTS AT BEGINNING OF YEAR 68,358 8,621<br />

CASH AND CASH EQUIVALENTS AT END OF YEAR 24 94,572 68,358<br />

The accompanying notes 1 to 28 form part of these financial statements.<br />

ANNUAL REPORT & ACCOUNTS <strong>2010</strong> 35

ESSO MALAYSIA BERHAD<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

1. BASIS OF PREPARATION<br />

The financial statements of the Company are prepared under the historical cost convention except as disclosed in the<br />

summary of significant accounting policies in Note 2. The financial statements comply with the Financial <strong>Report</strong>ing<br />

Standards (FRS) in Malaysia and the provisions of the Companies Act, 1965.<br />

The preparation of financial statements in conformity with the FRS requires the use of certain critical accounting estimates<br />

and assumptions that affect the reported amounts of assets and liabilities, revenues and expenses and the disclosure of<br />

contingent assets and liabilities. It also requires the Directors to make judgements that affect the application of the<br />

Company's accounting policies. Although these estimates and judgements are based on the Directors' best knowledge of<br />

current events and actions, actual results may differ.<br />

The financial statements have been approved for issues in accordance with a resolution of the Board of Directors dated<br />

February 25, 2011.<br />

a) Standards, amendments to published standards and interpretations that are applicable to the<br />

Company and are effective<br />

The new accounting standards, amendments to published standards and interpretations to existing<br />

standards effective for the financial period beginning January 1, <strong>2010</strong> and applicable to the Company are as<br />

follows:<br />

• Amendment to FRS 1 First Time Adoption of Financial <strong>Report</strong>ing Standards<br />

• Amendments to FRS 2 Share-Based Payment Vesting Conditions and Cancellations<br />

• FRS 8 Operating Segments and Amendment to FRS 8 Operating Segments<br />

• FRS 101 (Revised) Presentation of Financial Statements<br />

• FRS 123 (Revised) Borrowing Costs<br />