2010 Annual Report - Petron

2010 Annual Report - Petron

2010 Annual Report - Petron

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

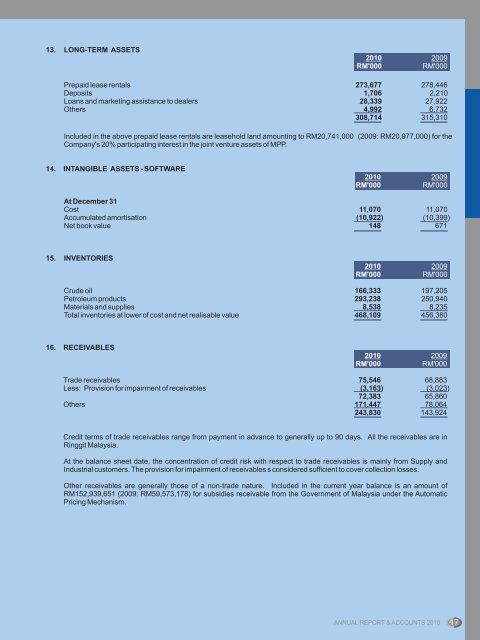

13. LONG-TERM ASSETS<br />

<strong>2010</strong> 2009<br />

RM'000<br />

RM'000<br />

Prepaid lease rentals 273,677 278,446<br />

Deposits 1,706 2,210<br />

Loans and marketing assistance to dealers 28,339 27,922<br />

Others 4,992 6,732<br />

308,714 315,310<br />

Included in the above prepaid lease rentals are leasehold land amounting to RM20,741,000 (2009: RM20,977,000) for the<br />

Company's 20% participating interest in the joint venture assets of MPP.<br />

14. INTANGIBLE ASSETS - SOFTWARE<br />

<strong>2010</strong> 2009<br />

RM'000<br />

RM'000<br />

At December 31<br />

Cost 11,070 11,070<br />

Accumulated amortisation (10,922) (10,399)<br />

Net book value 148 671<br />

15. INVENTORIES<br />

<strong>2010</strong> 2009<br />

RM'000<br />

RM'000<br />

Crude oil 166,333 197,205<br />

Petroleum products 293,238 250,940<br />

Materials and supplies 8,538 8,235<br />

Total inventories at lower of cost and net realisable value 468,109 456,380<br />

16. RECEIVABLES<br />

<strong>2010</strong> 2009<br />

RM'000<br />

RM'000<br />

Trade receivables 75,546 68,883<br />

Less: Provision for impairment of receivables (3,163) (3,023)<br />

72,383 65,860<br />

Others 171,447 78,064<br />

243,830 143,924<br />

Credit terms of trade receivables range from payment in advance to generally up to 90 days. All the receivables are in<br />

Ringgit Malaysia.<br />

At the balance sheet date, the concentration of credit risk with respect to trade receivables is mainly from Supply and<br />

Industrial customers. The provision for impairment of receivables s considered sufficient to cover collection losses.<br />

Other receivables are generally those of a non-trade nature. Included in the current year balance is an amount of<br />

RM152,939,651 (2009: RM59,573,178) for subsidies receivable from the Government of Malaysia under the Automatic<br />

Pricing Mechanism.<br />

ANNUAL REPORT & ACCOUNTS <strong>2010</strong> 47