Threadneedle UK Property Fund II - Threadneedle Investments

Threadneedle UK Property Fund II - Threadneedle Investments

Threadneedle UK Property Fund II - Threadneedle Investments

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

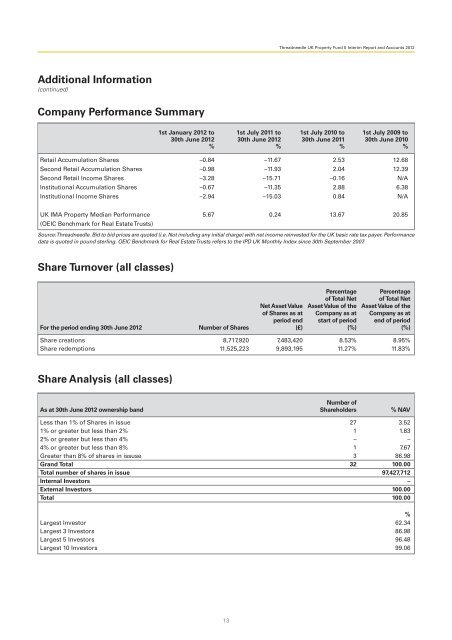

<strong>Threadneedle</strong> <strong>UK</strong> <strong>Property</strong> <strong>Fund</strong> <strong>II</strong> Interim Report and Accounts 2012<br />

Additional Information<br />

(continued)<br />

Company Performance Summary<br />

1st January 2012 to 1st July 2011 to 1st July 2010 to 1st July 2009 to<br />

30th June 2012 30th June 2012 30th June 2011 30th June 2010<br />

% % % %<br />

Retail Accumulation Shares –0.84 –11.67 2.53 12.68<br />

Second Retail Accumulation Shares –0.98 –11.93 2.04 12.39<br />

Second Retail Income Shares –3.28 –15.71 –0.16 N/A<br />

Institutional Accumulation Shares –0.67 –11.35 2.88 6.38<br />

Institutional Income Shares –2.94 –15.03 0.84 N/A<br />

<strong>UK</strong> IMA <strong>Property</strong> Median Performance 5.67 0.24 13.67 20.85<br />

(OEIC Benchmark for Real Estate Trusts)<br />

Source: <strong>Threadneedle</strong>. Bid to bid prices are quoted (i.e. Not including any initial charge) with net income reinvested for the <strong>UK</strong> basic rate tax payer. Performance<br />

data is quoted in pound sterling. OEIC Benchmark for Real Estate Trusts refers to the IPD <strong>UK</strong> Monthly Index since 30th September 2007.<br />

Share Turnover (all classes)<br />

Percentage Percentage<br />

of Total Net of Total Net<br />

Net Asset Value Asset Value of the Asset Value of the<br />

of Shares as at Company as at Company as at<br />

period end start of period end of period<br />

For the period ending 30th June 2012 Number of Shares (£) (%) (%)<br />

Share creations 8,717,920 7,483,420 8.53% 8.95%<br />

Share redemptions 11,525,223 9,893,195 11.27% 11.83%<br />

Share Analysis (all classes)<br />

Number of<br />

As at 30th June 2012 ownership band Shareholders % NAV<br />

Less than 1% of Shares in issue 27 3.52<br />

1% or greater but less than 2% 1 1.83<br />

2% or greater but less than 4% – –<br />

4% or greater but less than 8% 1 7.67<br />

Greater than 8% of shares in issuse 3 86.98<br />

Grand Total 32 100.00<br />

Total number of shares in issue 97,427,712<br />

Internal Investors –<br />

External Investors 100.00<br />

Total 100.00<br />

%<br />

Largest Investor 62.34<br />

Largest 3 Investors 86.98<br />

Largest 5 Investors 96.48<br />

Largest 10 Investors 99.06<br />

13