Threadneedle UK Property Fund II - Threadneedle Investments

Threadneedle UK Property Fund II - Threadneedle Investments

Threadneedle UK Property Fund II - Threadneedle Investments

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Threadneedle</strong> <strong>UK</strong> <strong>Property</strong> <strong>Fund</strong> <strong>II</strong> Interim Report and Accounts 2012<br />

Manager’s Report<br />

(continued)<br />

As displayed in the table above, it was the office sector that<br />

generated the strongest total returns over the period,<br />

registering 6.4% and being the only sector with positive rental<br />

value movement. This was however very much a product of the<br />

relatively strong performance of the Central London submarket<br />

which produced total returns of 10.4%. The retail and industrial<br />

sectors both suffered negative rental value growth of –1.1%<br />

and –0.8% respectively, although the industrial sector’s higher<br />

income return resulted in it generating a total return of 5.9%<br />

compared to that of the retail sector of 3.0%.<br />

Market Outlook<br />

With GDP growth of 0.3% forecast, output levels in 2012 are<br />

predicted to be low. Such low growth and output will<br />

undoubtedly hold back expansion in the occupier markets,<br />

which, coupled with a lack of available debt, will also act to<br />

limit activity levels in the investment markets. The issue of<br />

forced disposals through legacy debt issues will also be<br />

prominent, as the <strong>UK</strong> banks look to further deleverage balance<br />

sheet exposure. Banks still have more than £210bn exposure to<br />

<strong>UK</strong> commercial property, with nearly a quarter of loans in<br />

breach of terms or default. More than half the debt has to be<br />

repaid by 2016 with approximately £50bn due to mature this<br />

year.<br />

With only modest inflows into <strong>UK</strong> pooled property funds and a<br />

dearth of debt finance to take its place, it has been no surprise<br />

that recent months have seen small incremental falls in<br />

property capital values across the market. Perceived volatility<br />

in the financial and economic environment, particularly centred<br />

around the Euro crisis, has not helped risk aversion amongst<br />

investors. We expect these dynamics to be an on-going feature<br />

of 2012, with investors in property benefiting from the sector’s<br />

solid income return but seeing this eaten into by modest<br />

negative capital value movements. Beyond this immediate<br />

outlook we remain of the view that prevailing property pricing<br />

does look logical and supportable over the longer term<br />

perspective, a time horizon that property investment, by its<br />

nature, demands.<br />

An eventual return to trend economic growth in the <strong>UK</strong> does<br />

present real upside for <strong>UK</strong> property markets, the majority of<br />

which have experienced a de minimus level of fresh<br />

construction activity for nearly half a decade. The Company is<br />

now experiencing a period of stability following a pronounced<br />

expansionary phase.<br />

Although <strong>UK</strong> property fund inflows are currently at negligible<br />

levels, it is reported that, after record inflows in the period<br />

3Q09-4Q10, institutional investors still hold significant<br />

un-invested cash balances, but remain wedded to a cautious<br />

investment approach. Institutional investors seeking to exploit<br />

the property sector’s income yield advantage, relative to<br />

competing investment media, remain focussed upon the<br />

acquisition of core/core+ property assets, long-let to<br />

undoubted tenant covenants. Institutional investors currently<br />

have little appetite for entrepreneurial property risk.<br />

The Portfolio<br />

The average weighted lease length across the entire portfolio<br />

of 12 properties and 14 tenancies is approximately 5 years,<br />

assuming all lease break options within the existing portfolio<br />

are exercised. The Company’s directly held property generates<br />

a combined net initial income yield of 6.4% a 10 basis point<br />

income yield advantage above the comparable (IPD Monthly<br />

Index) market yield.<br />

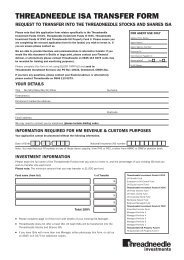

We have shown a sector breakdown of the portfolio below, which<br />

shows the Company’s position versus the IPD <strong>UK</strong> Monthly Index.<br />

Sector breakdown – as at 30th June 2012<br />

Company Index Active<br />

Retail Warehouses 18% 24% –6%<br />

Shops 47% 23% 24%<br />

Industrials 21% 17% 4%<br />

Offices 14% 31% –17%<br />

Other – 5% –5%<br />

<strong>Property</strong> Type Overview<br />

47%<br />

Source: <strong>Threadneedle</strong><br />

We have shown a sector breakdown of the portfolio below,<br />

illustrating the Company’s position versus the IPD <strong>UK</strong> Monthly<br />

Index.<br />

Sector Breakdown as at 30th June 2012<br />

50%<br />

45%<br />

40%<br />

35%<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

Company<br />

Index<br />

Offices Shops Industrials Retail Other<br />

Warehouses<br />

Source: <strong>Threadneedle</strong>/IPD<br />

14%<br />

18%<br />

21%<br />

Offices<br />

Industrials<br />

Retail Warehouses<br />

Shops<br />

Other<br />

Income returns will form the core component of total returns<br />

over the next 5 years and capital value gain will have to be<br />

4