You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Report on account of public debt of Montenegro<br />

BULLETIN OF THE MINISTRY OF FINANCE/APRIL - JUNE 2006<br />

Kombinat Aluminijuma Podgorica, was settled after successful<br />

process of privatisation of this company.<br />

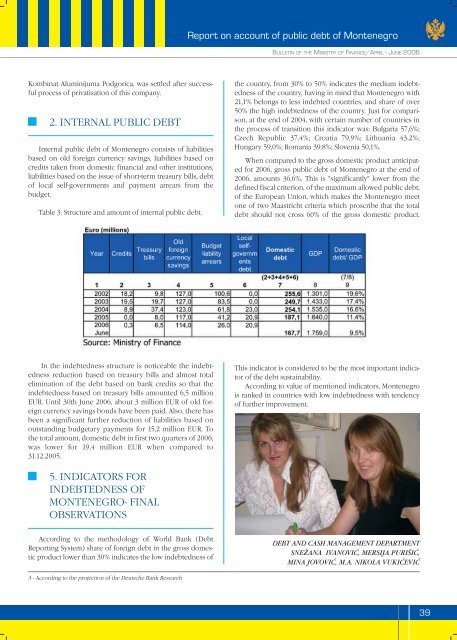

2. INTERNAL PUBLIC DEBT<br />

Internal public debt of Montenegro consists of liabilities<br />

based on old foreign currency savings, liabilities based on<br />

credits taken from domestic financial and other institutions,<br />

liabilities based on the issue of short-term treasury bills, debt<br />

of local self-governments and payment arrears from the<br />

budget.<br />

Table 3. Structure and amount of internal public debt.<br />

the country, from 30% to 50% indicates the medium indebtedness<br />

of the country, having in mind that Montenegro with<br />

21,1% belongs to less indebted countries, and share of over<br />

50% the high indebtedness of the country. Just for comparison,<br />

at the end of 2004, with certain number of countries in<br />

the process of transition this indicator was: Bulgaria 57,6%;<br />

Czech Republic 37,4%; Croatia 79,9%; Lithuania 43,2%;<br />

Hungary 59,0%; Romania 39,8%; Slovenia 50,1%.<br />

When compared to the gross domestic product anticipated<br />

for 2006, gross public debt of Montenegro at the end of<br />

2006, amounts 36,6%. This is "significantly" lower from the<br />

defined fiscal criterion, of the maximum allowed public debt,<br />

of the European Union, which makes the Montenegro meet<br />

one of two Maastricht criteria which proscribe that the total<br />

debt should not cross 60% of the gross domestic product.<br />

In the indebtedness structure is noticeable the indebtedness<br />

reduction based on treasury bills and almost total<br />

elimination of the debt based on bank credits so that the<br />

indebtedness based on treasury bills amounted 6,5 million<br />

EUR. Until 30th June 2006, about 3 million EUR of old foreign<br />

currency savings bonds have been paid. Also, there has<br />

been a significant further reduction of liabilities based on<br />

outstanding budgetary payments for 15,2 million EUR. To<br />

the total amount, domestic debt in first two quarters of 2006,<br />

was lower for 19,4 million EUR when compared to<br />

31.12.2005.<br />

This indicator is considered to be the most important indicator<br />

of the debt sustainability.<br />

According to value of mentioned indicators, Montenegro<br />

is ranked in countries with low indebtedness with tendency<br />

of further improvement.<br />

5. INDICATORS FOR<br />

INDEBTEDNESS OF<br />

MONTENEGRO- FINAL<br />

OBSERVATIONS<br />

According to the methodology of World Bank (Debt<br />

Reporting System) share of foreign debt in the gross domestic<br />

product lower than 30% indicates the low indebtedness of<br />

DEBT AND CASH MANAGEMENT DEPARTMENT<br />

SNEŽANA IVANOVIĆ, MERSIJA PURIŠIĆ,<br />

MINA JOVOVIĆ, M.A. NIKOLA VUKIĆEVIĆ<br />

3 - According to the projection of the Deutsche Bank Research<br />

39