Morning Coffee with GEPL Capital

Morning Coffee with GEPL Capital

Morning Coffee with GEPL Capital

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

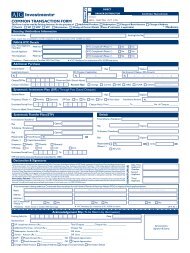

EQUITY | F&O | DP | COMMODITIES | MUTUAL FUNDS | INSURANCE | DEBT | IPOs | PMS | WMS | LAS<br />

<strong>Morning</strong> <strong>Coffee</strong> <strong>with</strong> <strong>GEPL</strong> <strong>Capital</strong><br />

Date: Dec 20, 2012<br />

Market Update<br />

Indices Close % Chg % YTD<br />

Indian Markets<br />

Sensex 19,476.00 0.57% 26.02%<br />

Nifty 5,929.60 0.56% 28.23%<br />

Global Markets<br />

DJIA 13,251.97 (0.74%) 8.47%<br />

Nasdaq 3,044.37 (0.33%) 16.86%<br />

FTSE 5,961.59 0.43% 6.99%<br />

Emerging Markets<br />

HangSeng 22,623.37 0.57% 22.72%<br />

Nikkei 10,160.40 2.39% 20.17%<br />

BSE Sectoral<br />

Indices<br />

Latest % Chg % YTD<br />

Auto 11494.88 1.84% 41.15%<br />

Banks 14374.79 0.37% 57.04%<br />

<strong>Capital</strong> Goods 10996.06 (0.62%) 36.30%<br />

Comm & Teck 3393.74 1.05% 0.40%<br />

Con. Durables 7799.71 (0.05%) 47.60%<br />

FMCG 5941.64 (0.38%) 47.24%<br />

Healthcare 8198.62 1.58% 39.66%<br />

IT 5623.19 1.33% (2.24%)<br />

Metals 11109.32 1.49% 19.54%<br />

Oil & Gas 8492.88 1.30% 12.80%<br />

Power 1992.52 0.46% 10.95%<br />

Realty 2133.13 0.59% 55.06%<br />

Midcap 7116.56 0.55% 38.59%<br />

Smallcap 7463.51 0.44% 34.47%<br />

Bulk Deals (BSE)<br />

Date Scrip Name Client Name Buy/Sell Quantity Price<br />

Corporate News<br />

• RIL plans to invest $10 bn on 4G network of its subsidiary Infotel<br />

Broadband.<br />

• Eros Worldwide, promotor group of Eros International Media Ltd<br />

will sell off 2.8% of the equity share by promoter through OFS on<br />

December 20, 2012 <strong>with</strong> floor price of Rs200/share<br />

• Hatsun Agro lines up Rs1.6 bn expansion plan to set up two new<br />

plants and other related expansion activities over the next one year<br />

• Welspun India to merge Welspun Global Brands <strong>with</strong> the company<br />

in the exchange ratio of 1:1<br />

• DLF signed an agreement to sell luxury hotel chain Aman Resorts to<br />

Adrian Zecha for about $300 mn.<br />

• Abbott launches BVS in India which to be used for the treatment of<br />

coronary artery disease<br />

• Reliance Power stake sale of 5.42% fully covered at indicative bid of<br />

Rs.95.27 a share.<br />

• Lupin gets USFDA approval for oral contraceptive tablets <strong>with</strong> current<br />

approval it's the 7 th for Lupin in the oral contraceptive space.<br />

• Jayashree Chemicals is on verge of shutdown due to serious financial<br />

crisis weighed on by escalating input costs & hike in power tariff<br />

• L&T Construction has secured new orders worth Rs10.09 mn. in the<br />

month of November and December so far.<br />

• Oil Ministry may seek opinion of Solicitor General of India, whether<br />

RIL and Cairn India can be permitted to drill exploration wells in<br />

already producing oil and gas fields.<br />

• Indiabulls Real Estate bought back 5mn equity shares from the<br />

shareholders through the open market for about Rs2.73 bn.<br />

• Natco Pharma received USFDA approval to market anti-ulcer drug,<br />

Lansoprazole delayed release capsules, in the American market.<br />

Economy News<br />

19-Dec-12<br />

Vakrangee Software<br />

Newtree Trading<br />

Company Pvt. Ltd.<br />

Sell 2,600,000 60.25<br />

• Telcos to install around 30,000 more 3G base station in 2 years to<br />

610 districts to be covered by 3G services in the country.<br />

19-Dec-12<br />

Birla Pacific<br />

Medspa<br />

Credo India Thematic<br />

Fund<br />

Sell 1,172,732 2.86<br />

• Internet’s contribution to India’s GDP could treble to $100 bn by 2015<br />

versus $30 bn in 2011.<br />

Bulk Deals (NSE)<br />

Date Scrip Name Client Name Buy/Sell Quantity Price<br />

19-Dec-12 Bajaj Finance El Dorado Holdings II<br />

Ltd.<br />

19-Dec-12<br />

Persistent Systems<br />

Ltd.<br />

Norwest Venture<br />

Partners FVCI<br />

Mauritius<br />

Sell 500,000 1,300<br />

Sell 1,120,000 490.00<br />

Fund Flows (`bn) Latest MTD YTD<br />

Flls 11.68 160.93 1,541.55<br />

MFs 17.47 318.25 4,247.29<br />

• Kaushik Basu has warned of inflation shadow on direct cash transfer.<br />

Global News<br />

• S&P upgrades Greece's rating from selective default; raises sovereign<br />

credit rating to B-minus <strong>with</strong> a stable outlook.<br />

• New Zealand’s GDP rose 0.2% in Q3CY12 versus consensus estimates<br />

of a 0.4% growth.<br />

• The ECB re-opened the path to cheap financing for Greek banks,<br />

allowing the country's sovereign debt to be used as collateral in<br />

ECB funding operations in a big confidence boost for markets.<br />

<strong>GEPL</strong> <strong>Capital</strong> Pvt Ltd

EQUITY | F&O | DP | COMMODITIES | MUTUAL FUNDS | INSURANCE | DEBT | IPOs | PMS | WMS | LAS<br />

<strong>Morning</strong> <strong>Coffee</strong> <strong>with</strong> <strong>GEPL</strong> <strong>Capital</strong><br />

Date: December 20, 2012<br />

Debt Market Snapshot<br />

Market Turnover ` bn % Chg<br />

BSE 25.19 (17.84)<br />

NSE 141.25 1.07<br />

Derivatives (NSE) 1222.08 (36.56)<br />

Market Breadth Adv Dec A/D<br />

BSE 1651 1310 1.26<br />

NSE 869 645 1.35<br />

Forex Rates Latest % Chg % YTD<br />

Rs / US$ 54.47 (0.70) 2.13<br />

Euro / US $ 0.76 0.17 (2.22)<br />

Yen / US$ 84.21 (0.09) 8.63<br />

Particulars Latest Previous Chg(bps)<br />

5 Year GOI Bond 8.11% 8.10% (0.01)<br />

10 Year GOI Bond 8.15% 8.15% -<br />

15-Year GOI Bond 8.33% 8.32% (0.01)<br />

Government Security Market:<br />

• The Inter-bank call money rate traded in the range of 7.95% - 8.15% on Wednesday,<br />

ended at 8.13%.<br />

• Total Borrowings From RBI's Repo <strong>with</strong> banks Taking Rs.164615 mn on Wednesday<br />

Vs. Rs.151770 mn on Tuesday.<br />

• The benchmark 8.15% GOI 2022 Closed at 8.1540% on Wednesday Vs 8.1476% on<br />

Tuesday.<br />

• Global Debt Market:<br />

US.Treasury rose for the first time in three days before a report tomorrow forecast to show<br />

the world’s largest economy isn’t growing fast enough to stop the Federal Reserve from<br />

boosting monetary stimulus.<br />

10 Year Benchmark Technical View:<br />

10 year yield likely to move in the range of 8.13% - 8.15% level on Thursday.<br />

Bonds in Primary Market :<br />

Coupon Maturity Min Quantum (in Rs.)<br />

Call Money (WAR) 8.11% 8.10% (0.01)<br />

CBLO (WAR) 8.12% 8.08% (0.04)<br />

PFCTax Free<br />

Bonds<br />

7.69% & 7.86%<br />

(For Retail)<br />

10 & 15 Year 5 bond( Face Value 1000)<br />

(Issue Opens on 14th December)<br />

US 10 Year 1.80% 1.77% (0.03)<br />

Crude Oil (in $/bl) 87.93 87.20 (0.73)<br />

IIfcl Tax Free 7.69%,7.86% & 7.90<br />

(For Retail)<br />

10,15 & 20 Year 5 bond( Face Value 1000)<br />

(Issue Opens on 26th December<br />

Inflation (Monthly) 7.24% 7.24% -<br />

For Further Bond Details Please Contact <strong>GEPL</strong> Debt Desk<br />

Derivatives Snapshot<br />

Nifty Spot<br />

Nifty Futures<br />

Nifty Futures<br />

Prem. / Disc<br />

Nifty Futures<br />

Basis<br />

Nifty Futures<br />

Change in OI<br />

Nifty Futures<br />

Volume (` in<br />

cr.)<br />

Total Market F&O Open<br />

Interest (` in bn)<br />

Nifty Open Interest<br />

(OI) PCR<br />

Nifty Volume<br />

PCR<br />

NSE VIX<br />

Current 5929.60<br />

5946.90 17.30 39.50 23309700 4242.90<br />

1.20 0.98 14.17<br />

Previous 5896.80<br />

5928.90 32.10 37.60 23227900 8788.62<br />

1.19 0.86 14.44<br />

change 32.80<br />

18.00 (14.80) 1.90 81800 (4545.72)<br />

0.01 0.12 (0.27)<br />

% Change 0.56 0.30 0.35 (51.72)<br />

(1.87)<br />

Snapshot<br />

• From the options data, 5900 put has added more than 2lakh shares suggesting that level of 5850 is likely to act as positional support for Nifty futures.<br />

• The open interest put call ratio for Nifty futures stood at 1.20 vs. 1.19 levels.<br />

• The IV’s stood in between 12% to 18% <strong>with</strong> NSE VIX index ending 1.87% lower at 14.17 levels.<br />

• Long positions were witnessed in stocks like GSPL, MARUTI, SUNPHARMA, BAJAJ-AUTO.<br />

• Short positions were witnessed in stocks like HDIL, ITC, HDFC, AXISBANK.<br />

FII Derivatives Statistics<br />

Buy (` in Cr.) Sell (` in Cr.) Open Interest at the end of the<br />

day (` in Cr.)<br />

Open Interest as on 10-fEB-<br />

2011 (` in Cr.)<br />

Change in open<br />

Interest (` in Cr.)<br />

Net Buy / Sell (`in Cr.)<br />

INDEX FUTURES 724.71 891.18 12914.90 12711.43 203.47 (166.47)<br />

INDEX OPTIONS 12355.27 11910.22 47616.73 47281.79 334.94 445.05<br />

STOCK FUTURES 3153.68 3105.91 35921.53 34895.30 1026.23 47.77<br />

STOCK OPTIONS 1508.81 1548.18 2245.09 2145.20 99.89 (39.37)<br />

<strong>GEPL</strong> <strong>Capital</strong> Pvt Ltd

EQUITY | F&O | DP | COMMODITIES | MUTUAL FUNDS | INSURANCE | DEBT | IPOs | PMS | WMS | LAS<br />

<strong>Morning</strong> <strong>Coffee</strong> <strong>with</strong> <strong>GEPL</strong> <strong>Capital</strong><br />

Date: Dec 20, 2012<br />

Technical Snapshot<br />

Immediate Support for Nifty Futures at 5900<br />

Key Highlights<br />

• Nifty Futures closed at 5947 which is 18 points higher than its previous<br />

close of 5929.<br />

• Nifty Futures moved in just 25 points range testing 5960 keeping the<br />

hope of uptrend continuation.<br />

• Above 5960, the next target for Nifty Futures is placed at 6000.<br />

• If any corrective trend is seen, then the immediate support is placed at<br />

5900 from where uptrend is likely to resume again.<br />

• Nifty Futures can be bought in the range of 5920 – 5900 <strong>with</strong> the stop<br />

loss of 5840 and initial target of 6000 levels.<br />

• The level of 5840 is a crucial support and can be treated as stop loss<br />

for all trading long positions.<br />

• As long as Nifty Futures trades above 5600, the current intermediate<br />

trend will be positive.<br />

• The intraday resistance levels for Nifty are placed at 5960 & 6000<br />

whereas the intraday support levels are placed at 5910 & 5870 respectively.<br />

Trading Calls for the day<br />

Stock Buy / Sell Segment Lot Size<br />

Type of Call Reco. Price Stop Loss Target 1 Target 2<br />

GSPL Buy Futures 4000<br />

One day 78 76 80 -<br />

ITC Sell Futures 1000<br />

One day 292 300 286 -<br />

Technical Calls for Retail Desk<br />

Sr. No Date Action Company Reco. Price Stop Loss Target 1 Target 2 CMP Remarks<br />

1 10-Feb-12 Buy (P) Dredging Corp Cash 317.5 287.5 347.5 377.5 230.7<br />

2 14-Dec-12 Buy (ST) Tech Mahindra Cash 939.5 895 1035 944.45 Exit called at 952, call closed<br />

3 17-Dec-12 Buy (ST) Sterlite Cash 115.9 112 123 119.9 Profit booked at 120.60<br />

4 19-Dec-12 Buy (ST) Hindalco Cash 129.75 115 149 129.65<br />

5 3-Dec-12 Buy (ST) Jain Irrigation cash 71.7 64.5 83 77.2 Profit booked at 77<br />

6 16-Nov-12 Buy(ST) IGL Cash 265.5 248 300 258.85<br />

7 21-Nov-12 Buy (ST) TV18 Broadcast 31.8 27 39 34<br />

8 5-Dec-12 Buy (ST) Moser Baer 6.95 5.25 11 6.75<br />

9 7-Dec-12 Buy (P) Educomp 158.5 145 180 148.7<br />

10 12-Dec-12 Buy (ST) Timbor 41.7 35 51 39.15<br />

11 13-Dec-12 Buy (ST) Pantaloon Cash 240.5 220 270 240.45<br />

12 18-Dec-12 Buy (OD) NMDC Fut. 164.5 161.5 172 163 Exit called at 163.70<br />

13 17-Dec-12 Sell (P) Cairn India Fut.(Jan) 327.75 338 310 329<br />

14 19-Dec-12 Buy (OD) Reliance Fut. 843 829 860 842.05<br />

15 14-Dec-12 Buy Tata Mot. Bull Spread 4.1 0 12 15 3.2 Profit booked at 9<br />

16 10-Dec-12 Buy DLF Bull Spread 2.5 0 7 9 1.7<br />

17 12-Dec-12 Buy Wipro 360 PE 2.75 0 8 0.9<br />

18 18-Dec-12 Buy Nifty 6000 CE 22 0 50 4.4<br />

19 18-Dec-12 Buy Sesa Goa 200 CE 3.35 1 6 21.8<br />

20 19-Dec-12 Buy ONGC 260 CE 2.9 1 6 3.45<br />

Open Positions Buy 17 & Sell 0<br />

*- Revised Stop Loss<br />

<strong>GEPL</strong> <strong>Capital</strong> Pvt Ltd

EQUITY | F&O | DP | COMMODITIES | MUTUAL FUNDS | INSURANCE | DEBT | IPOs | PMS | WMS | LAS<br />

<strong>Morning</strong> <strong>Coffee</strong> <strong>with</strong> <strong>GEPL</strong> <strong>Capital</strong><br />

Date: Dec 20, 2012<br />

Commodities Snapshot<br />

Commodity Month Trend Support 1 Support 2 Resistance 1 Resistance 2 Trading calls for the day<br />

Gold Feb Bearish 30800 30700 31000 31100 -<br />

Silver Mar Bearish 59500 59000 60250 60800 -<br />

Crude Oil JAN Bullish 4905 4880 4960 4985 -<br />

Natural Gas Dec SIDEWAYS 181 179 185 187 -<br />

Copper Feb BEARISH 437 435 441 443.50<br />

Nickel Jan SIDEWAYS 960 950 990 1010 -<br />

Aluminium Dec SIDEWAYS 112.50 111 114 115 -<br />

Lead Dec Bullish 125.60 124 127 128 -<br />

Zinc Dec Bullish 111.90 110 113.50 115 -<br />

Gold $ Spot bearish 1660 1630 1682 1695 -<br />

Silver $ Spot bearish 31.55 31 32 32.25 -<br />

*Figures in INR unless indicated otherwise<br />

Disclaimer: This document has been prepared by the Research Desk of M/s <strong>GEPL</strong> <strong>Capital</strong> Pvt. Ltd. and is meant for use of the recipient only and is not for circulation. This document is not to be reported<br />

or copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to support any security. The information contained herein is obtained and collated<br />

from sources believed reliable and we do not represent it as accurate or complete and it should not be relied upon as such. The opinion expressed or estimates made are as per the best judgment as<br />

applicable at that point of time and are subject to change <strong>with</strong>out any notice. <strong>GEPL</strong> <strong>Capital</strong> Pvt. Ltd. along <strong>with</strong> its associated companies/ officers/employees may or may not, have positions in, or support<br />

and sell securities referred to herein.<br />

<strong>GEPL</strong> <strong>Capital</strong> Pvt Ltd