Venky's (India) Ltd - GEPL Capital

Venky's (India) Ltd - GEPL Capital

Venky's (India) Ltd - GEPL Capital

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Initiating<br />

Coverage<br />

Equity | <strong>India</strong> | Consumer Discretionary<br />

Venky’s (<strong>India</strong>) <strong>Ltd</strong><br />

The golden egg laying chick December 05, 2011<br />

BUY<br />

CMP (`)<br />

Target (`)<br />

440 544<br />

Potential Upside Absolute Rating<br />

24% BUY<br />

Market Info (as on 02 nd December, 2011)<br />

BSE Sensex 16,846<br />

Nifty S&P 5,050<br />

Stock Detail<br />

BSE Group<br />

B<br />

BSE Code 523261<br />

NSE Code<br />

VENKEYS<br />

Bloomberg Code<br />

WH IN<br />

Market Cap (`bn) 4.13<br />

Free Float (%) 45%<br />

52wk Hi/Lo 789 / 365<br />

Avg. Daily Volume (NSE) 39887<br />

Face Value / Div. per share (`) 10.00 / 5.00<br />

Shares Outstanding (mn) 9.39<br />

Shareholding Pattern (in %)<br />

Promoters FIIs DII Others<br />

56.12 0.22 3.68 39.98<br />

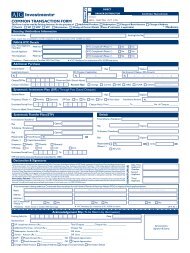

Financial Snapshot<br />

(`mn)<br />

Y/E Mar FY10 FY11 FY12E FY13E<br />

Net Sales 7,055 8,520 10,169 12,401<br />

EBITDA 916 1,135 994 1,676<br />

PAT 545 733 585 1,003<br />

EPS 57.8 77.8 62.3 106.8<br />

ROE (%) 29.9 30.4 19.5 26.9<br />

ROCE (%) 21.1 22.3 14.6 19.5<br />

P/E 5.8 8.2 7.1 4.1<br />

EV/EBITDA 4.3 6.2 5.2 3.2<br />

Share Price Performance<br />

110<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

Dec-10<br />

Jan-11<br />

Feb-11<br />

Mar-11<br />

Apr-11<br />

May-11<br />

Jun-11<br />

Jul-11<br />

Aug-11<br />

Sep-11<br />

Oct-11<br />

Nov-11<br />

Dec-11<br />

<strong>Venky's</strong> (<strong>India</strong>) BSE SENSEX<br />

Rel. Perf. 1Mth 3 Mths 6Mths 1Yr<br />

Venky’s (%) (12.9) 6.4 (29.2) (40.8)<br />

SENSEX (%) (3.5) 0.2 (8.9) (15.7)<br />

Source: Company data, <strong>GEPL</strong> <strong>Capital</strong> Research<br />

Investment Rationale<br />

<strong>India</strong>’s Poultry Industry - set to lay golden eggs in the years to come<br />

We expect the <strong>India</strong>n poultry industry to grow at +9.5% CAGR in FY11-13E considering a) we are<br />

the 6th largest poultry populated nation, b) the cheapest Country in the World in terms of cost<br />

of eggs sold, and c) amongst the cheapest Countries for day old chicks (Sri Lanka is the<br />

cheapest). Moreover, the potential to grow remains intact with the <strong>India</strong>n Egg industry having<br />

achieved a mere 29% of its true potential (per capita consumption of 53 eggs vis-a-vis NIN’s<br />

recommended 180 eggs). Similarly, the poultry meat segment has achieved a 32% of its<br />

potential (per capita consumption of 3.5 kgs as compared to NIN’s recommendation of 11kgs).<br />

With a low export share, low per capita consumption and lack of other alternatives like beef<br />

and pork due to religious reason, we believe there is plenty of scope for the Poultry industry to<br />

continue its growth trajectory.<br />

The best bird amongst the flock in <strong>India</strong>’s Poultry Industry<br />

Venky’s is amongst the best candidates to capture the growth in the <strong>India</strong>n poultry industry in<br />

FY11-13E (+9.5% CAGR) due to its healthy track record and a strong parent company backing.<br />

Venky’s is part of the VH group and with a group turnover of `35 bn offering a whole host of<br />

benefits like a) Pan-<strong>India</strong> presence (Venky’s has a strong presence in North and West <strong>India</strong> while<br />

VH group has its presence in South and East <strong>India</strong>), and b) the large scale of operations result in<br />

operating leverage with lower transportation, marketing storage cost per unit enabling higher<br />

margins. The Pan-<strong>India</strong> presence has helped Venky’s to increase its presence across the value<br />

chain as well diversified portfolio with AHP and solvent extraction insulating its risk at times of<br />

flu’s and viruses and poultry products being non-impacted by global slowdown.<br />

Venky’s XPRS – the future wings of growth<br />

Venky’s has entered the hospitality industry with the launch of ‘VENKYS XPRS’ to serve their<br />

customers with a range of healthy, hygienically cooked, and yet reasonably priced chicken<br />

delicacies. The first store was rolled out in Jan, CY10 and currently five stores in <strong>India</strong> are<br />

operational. The company plans to invest ~`2.5 bn for its research and development and set up<br />

over 100 Venky’s XPRS outlets (including London) over the next three years. Though currently<br />

the contribution from this segment is minimal, the scope for growth remains high given the<br />

changing demographics in <strong>India</strong> with a rise in disposable income, higher working population<br />

(both youth and women).<br />

Strong Financials – Fine feathers<br />

With a strong growth in the <strong>India</strong>n poultry industry we expect Venky’s to grow at 20.6% CAGR in<br />

FY11-13E to `12.4 bn driven by 23% CAGR in poultry and poultry products, 11.5% CAGR in animal<br />

health products and a 16.4% CAGR in the solvent extraction division. We expect high raw<br />

material prices to impact margins in FY12E with a strong bounce back in FY13E with retracing<br />

feed prices. Consequently, we expect the EBITDA to witness 21.5% CAGR from FY11-13E to `1.68<br />

bn. With a higher interest cost (higher capex and debt and higher interest rates), higher<br />

depreciation rate and lower other income, we believe the PAT growth would be marginally<br />

lower at 17.2% CAGR from FY11-13E to `1.0 bn.<br />

Valuation<br />

At CMP Venky’s is currently trading at 7.1x FY12E EPS and 4.1x FY13E EPS, a 34% discount to its<br />

historical one-year forward P/E band of 6.2x and a 45% discount to its average one-year forward<br />

P/E band over the last 12 months of 7.4x. We have valued the company on the four year<br />

average of its historical P/E band (5.1x) to capture the cyclicality of the industry and its profits.<br />

We believe there is good potential upside in the stock and initiate coverage with a Buy rating<br />

and target price of `544 per share (5.1x FY13E).<br />

Analyst<br />

Sunil Sewhani<br />

+91-22- 6614 2690<br />

sunilsewhani@geplcapital.com<br />

<strong>GEPL</strong> <strong>Capital</strong> Research 1

Equity | <strong>India</strong> | Consumer Discretionary<br />

Venky’s (<strong>India</strong>) <strong>Ltd</strong> December 05, 2011<br />

Investment Rationale<br />

<strong>India</strong>n Poultry Industry set to lay golden eggs in the years to come<br />

The World Poultry Industry is expanding at an exceptional rate over the last decade with strong<br />

consumption demand. Factors such as a) growth in per capita income, b) population growth, c)<br />

direct price effect under the influence of productivity improvement and cost reduction, d)<br />

product innovation, and e) development of modern distribution systems have led to this growth.<br />

Hence an industry predominantly dominated by developed countries’ exporters a few years ago,<br />

is largely shared by developing countries today. With the variation in growth of per capita<br />

consumption; faster rates of increase in developing countries than in the developed world, we<br />

expect the developing Nations to gain in the growing share of the Global Poultry Industry.<br />

Rise of the <strong>India</strong>n Poultry Industry<br />

The <strong>India</strong>n Poultry Industry too is constantly on the rise with modern techniques and changing<br />

from live bird to fresh chilled and frozen product market. Several breakthroughs in poultry<br />

science and technology have led to the development of genetically superior breeds capable of<br />

higher production, even under adverse climatic conditions that offer opportunities for overseas<br />

entrepreneurs to expand export and import of poultry products on a large scale.<br />

<strong>India</strong>n poultry industry<br />

<strong>India</strong>’s Poultry industry and GDP growth<br />

Rs mn<br />

600<br />

500<br />

400<br />

300<br />

200<br />

350<br />

380<br />

400<br />

450 450<br />

550<br />

25<br />

20<br />

15<br />

10<br />

%<br />

%<br />

21<br />

19<br />

17<br />

15<br />

13<br />

11<br />

20.0 20.0<br />

19.0<br />

15.0<br />

10.0 10.0 10.0 10.0<br />

18.0<br />

20.0<br />

10.0<br />

100<br />

-<br />

CY05 CY06 CY07 CY08 CY09 CY10<br />

Poultry Industry YoY growth<br />

5<br />

0<br />

9<br />

7<br />

5<br />

8.0<br />

8.0<br />

9.0 8.7<br />

7.0 7.2<br />

8.5<br />

CY05 CY06 CY07 CY08 CY09 CY10<br />

Annual GDP (%) Poultry layer (%) Brolier (%)<br />

Source: Company data, <strong>GEPL</strong> <strong>Capital</strong> Research<br />

Source: Company data, <strong>GEPL</strong> <strong>Capital</strong> Research<br />

The <strong>India</strong>n poultry industry has grown at 9.5% CAGR in the last five years and is a major force to<br />

reckon with. The industry is worth `550 bn and provides employment to over 20 mn people.<br />

<strong>India</strong> is the second largest egg producing nation in the world with an annual production of 53 bn<br />

eggs and ranks third in the World for broiler production with an estimated 3.5 mn tons of<br />

production. <strong>India</strong>’s Poultry layer and Poultry broiler industry have seen a higher growth than our<br />

GDP over the last 10 years. The broiler industry has grown at a rate of 18-20% over the last five<br />

years while the layer industry has witnessed a steady 8-10% CAGR in the same period. We<br />

expect <strong>India</strong>’s Poultry industry to continue growing at 9.5% CAGR over FY11-13E and to be worth<br />

`659 bn by FY13E.<br />

<strong>GEPL</strong> <strong>Capital</strong> Research| Initiating Coverage 2

Equity | <strong>India</strong> | Consumer Discretionary<br />

Venky’s (<strong>India</strong>) <strong>Ltd</strong> December 05, 2011<br />

<strong>India</strong> is the 6th largest poultry populated nation in the World<br />

Chickens are physiologically comfortable in intensive conditions at temperatures between 28-32<br />

degrees Celsius. It is due to this factor that the industry remains extremely country<br />

concentrated. Currently 65% of the World Chick population is found in 10 countries with China<br />

alone accounting for 25% of the World chick population. <strong>India</strong> too is fast emerging as a strong<br />

poultry operator and currently has the 6th largest World chick population.<br />

<strong>India</strong> is the 6th largest poultry populated nation<br />

4,500<br />

4,000<br />

3,500<br />

3,860<br />

mn chicks<br />

3,000<br />

2,500<br />

2,000<br />

1,500<br />

1,970<br />

1,200 1,100<br />

540<br />

1,000<br />

500<br />

0<br />

425 340 286 280 250<br />

China<br />

USA<br />

Indonesia<br />

Brazil<br />

Mexico<br />

<strong>India</strong><br />

Russia<br />

Japan<br />

Iran<br />

Turkey<br />

Source: <strong>India</strong>agronet, <strong>GEPL</strong> <strong>Capital</strong> Research<br />

Chicken is the cheapest source of protein with limited substitutes in <strong>India</strong><br />

Poultry meat production accounts for 26% of the total meat production in the World and ranks<br />

third with pig meat (pork) leading at 40% followed by beef meat at 28%. Chicken is the dominant<br />

source of poultry meat (88%) followed by Turkey (12%).<br />

Global Meat Production<br />

28<br />

23.4<br />

26<br />

2.6<br />

40<br />

6<br />

Others Pork Beef Chicken Turkey<br />

Source: <strong>India</strong>agronet, <strong>GEPL</strong> <strong>Capital</strong> Research<br />

<strong>GEPL</strong> <strong>Capital</strong> Research| Initiating Coverage 3

Equity | <strong>India</strong> | Consumer Discretionary<br />

Venky’s (<strong>India</strong>) <strong>Ltd</strong> December 05, 2011<br />

Pig meat is not consumed by Muslims while beef meat is not consumed by Hindus, both due to<br />

their respective religious reasons. Since most of the butchers in <strong>India</strong> are Muslims they do not<br />

sell pig meat. Similarly, since a large population of <strong>India</strong> is Hindus beef meat is not sold in order<br />

to not hurt their sentiments. Even at large format retail chains like ‘Natures Basket’ etc, pig<br />

meat and beef meat are not sold. Hence chicken is best and most widely available option. This<br />

has also resulted in the taste for pig meat and beef meat not being developed in <strong>India</strong> despite<br />

the change in demographics.<br />

To add to this, poultry is the cheapest source of protein available and hence we see longer term<br />

drivers of poultry consumption in <strong>India</strong> remaining intact. We also believe with return of<br />

economic growth, poultry consumption is set to grow in <strong>India</strong> as per capita poultry consumption<br />

in <strong>India</strong> is still low. Moreover, <strong>India</strong>n meat is preferred because it is lean and contains less fat.<br />

However in <strong>India</strong>, the sporadic bird flu outbreaks in different parts of the country along with<br />

lack of storage and processing facilities and rising prices of feed stocks including soya meal and<br />

maize have severely impacted poultry exports.<br />

<strong>India</strong> is the amongst the cheapest Nations in terms of cost eggs and day old chicks<br />

Dumping of egg powder by America and other European countries, supported by heavy dose of<br />

subsidies has resulted in the decline of egg powder prices. Many countries are exporting eggs at<br />

prices lower than production costs. This has resulted in Poultry industry in these countries<br />

where investments are high coming under threat of extinction. To counter this, various Nations<br />

have implicated a ban on imports.<br />

In terms of the global prices of eggs, <strong>India</strong> is the cheapest; costing 50 US cents a kg. The prices<br />

across other Asian Countries are slightly higher (Sri Lanka 0.58 cents, Taiwan - 108 cents and<br />

Bangladesh 117 cents) while that of developed Nations (USA –80 cents, France - 102 cents, Great<br />

Britain – 102 cents, New Zealand – 136 cents, ) also remain high with Argentina being the<br />

costliest in at 145 cents per kg.<br />

Even in terms of day-old chicks, <strong>India</strong> is one of the cheapest Nations with day old chicks costing<br />

39 US cents a chick. Though the price is slightly higher than Sri Lanka’s 29 cents (cheapest<br />

Nation), prices are still competitive when compared to other developed Nations like USA (47<br />

cents), UK (70 cents) or Japan (132 cents).<br />

Cost of Eggs sold across Countries<br />

Cost of Day-old chicks across Countries<br />

cents per kg<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

50<br />

58<br />

80<br />

86<br />

102 102<br />

117<br />

127<br />

136<br />

145<br />

cents per chick<br />

200<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

29<br />

39<br />

47<br />

70<br />

76<br />

132<br />

172<br />

<strong>India</strong><br />

Sri Lanka<br />

USA<br />

Holland<br />

France<br />

UK<br />

Bangladesh<br />

Japan<br />

New Zealand<br />

Argentina<br />

Sri Lanka<br />

<strong>India</strong><br />

USA<br />

UK<br />

Canada<br />

Japan<br />

New Zealand<br />

Source: <strong>India</strong>agronet, <strong>GEPL</strong> <strong>Capital</strong> Research<br />

Source: <strong>India</strong>agronet, <strong>GEPL</strong> <strong>Capital</strong> Research<br />

<strong>GEPL</strong> <strong>Capital</strong> Research| Initiating Coverage 4

Equity | <strong>India</strong> | Consumer Discretionary<br />

Venky’s (<strong>India</strong>) <strong>Ltd</strong> December 05, 2011<br />

As per media reports, the egg price are selling at a flat rate of `2.9 per piece after witnessing a<br />

marginal increase in November due with onset of winter. The prices remained flat due to<br />

resistance of buyers; need to perk up demand and high competitive scenario.<br />

Broiler chicken meanwhile continues its slide and the prices have been reduced to as low as `46<br />

per kg on account of the Sabarimala season. The prices may remain under pressure due to the<br />

festive season is South <strong>India</strong> which is a main consumer market. However, we do not expect this<br />

to impact sales of Venky’s significantly as the company is strongly present in the Western and<br />

Northern regions on <strong>India</strong>. The National Egg Coordination Committee (NECC) has also slashed the<br />

price of layer birds to `43 per kg as compared to `46 per kg earlier.<br />

Higher raw material prices could impact margins<br />

The poultry industry is highly dependent on the feed industry as feed alone constitutes 65% of<br />

the cost of broiler and egg production. Therefore, any price movement in the feed sector<br />

(maize, soya, rice, and other cereals) has a direct impact on the prices of eggs and broilers. As<br />

per Mckinsey’s report, the <strong>India</strong>n poultry can compete at an international level if it is able to<br />

successfully reduce feed cost. As maize costs are key for the growth of the <strong>India</strong>n poultry<br />

market, the report has suggested that the poultry players may integrate into feed and maize<br />

seed production.<br />

The nature of the poultry industry is such that product pricing is a major weapon in companies’<br />

competitive pricing. The cost of production comparison favor countries with ample low cost raw<br />

material feedstuff supplies and low labour cost. Hence the drive becomes to minimize the cost<br />

added per unit sold in process between the base input costs and the overall cost. Poultry<br />

industry with high investments in these countries is under threat of extinction. Many countries<br />

have saved their poultry industry with a ban on imports. In the global poultry market, <strong>India</strong>n<br />

eggs are cheapest while that in Argentina are the costliest.<br />

Maize prices<br />

Feed cost for eggs across Countries<br />

3,000<br />

2,500<br />

2,298<br />

2,437<br />

60<br />

50<br />

44 45<br />

50<br />

Rs per Kg<br />

2,000<br />

1,500<br />

1,000<br />

1,490<br />

1,442<br />

1,730<br />

1,621<br />

1,836<br />

1,937 2,205<br />

cents per kg<br />

40<br />

30<br />

20<br />

10<br />

18<br />

24 25 25<br />

27<br />

0<br />

500<br />

Nov-10<br />

Dec-10<br />

Jan-11<br />

Feb-11<br />

Mar-11<br />

Apr-11<br />

May-11<br />

Jun-11<br />

Jul-11<br />

Aug-11<br />

Sep-11<br />

Oct-11<br />

Zimbawe<br />

Sri Lanka<br />

Pakistan<br />

France<br />

UK<br />

<strong>India</strong><br />

Phillipines<br />

USA<br />

Source: Bloomberg, <strong>GEPL</strong> <strong>Capital</strong> Research<br />

Source: <strong>India</strong>agronet, <strong>GEPL</strong> <strong>Capital</strong> Research<br />

<strong>GEPL</strong> <strong>Capital</strong> Research| Initiating Coverage 5

Equity | <strong>India</strong> | Consumer Discretionary<br />

Venky’s (<strong>India</strong>) <strong>Ltd</strong> December 05, 2011<br />

Strong potential to grow<br />

Fast urbanisation, changes in life style and food habits of consumers, improvement in standards<br />

of living etc. have resulted into increase in per capita consumption of egg and poultry meats but<br />

per capita consumption of these commodities in <strong>India</strong> is still far below that of developed<br />

countries showing enormous potential/scope for poultry development<br />

The industry has grown at a 9.5% CAGR over the last 5 years aided by a 3.3% CAGR in egg<br />

production and an 11.8% CAGR in broiler production. Despite this the <strong>India</strong>n Egg industry has<br />

achieved a mere 29% of its true potential with a vast gap between per capita consumption (53<br />

eggs) and National Institute of Nutrition’s recommended level (180 eggs). Similarly, the poultry<br />

meat segment has achieved a 32% of its potential with per capita consumption of 3.5 kgs as<br />

compared to the National Institute of Nutrition’s recommendation of 11kgs of poultry meat.<br />

Here, again, there is considerable variation in per capita consumption between rural and urban<br />

areas and also across the region.<br />

Egg consumption per capita and potential of achieved<br />

Poultry meat consumption in <strong>India</strong> and potential achieved<br />

per capita consumption<br />

54.0<br />

52.0<br />

50.0<br />

48.0<br />

46.0<br />

44.0<br />

42.0<br />

25.0<br />

27.8<br />

28.9 28.9<br />

29.4<br />

29.4<br />

30.0<br />

29.0<br />

28.0<br />

27.0<br />

26.0<br />

25.0<br />

24.0<br />

23.0<br />

%<br />

per capita consumption<br />

4.0<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

18.2<br />

20.0<br />

28.2<br />

28.2<br />

29.1<br />

31.8<br />

35.0<br />

30.0<br />

25.0<br />

20.0<br />

15.0<br />

10.0<br />

5.0<br />

%<br />

40.0<br />

22.0<br />

-<br />

-<br />

CY05 CY06 CY07 CY08 CY09 CY10<br />

CY05 CY06 CY07 CY08 CY09 CY10<br />

Egg consumption (nos per capita)<br />

Potential achieved<br />

Poultry meat consumption (kgs per capita)<br />

Potential achieved<br />

Source: Company data, <strong>GEPL</strong> <strong>Capital</strong> Research<br />

Source: Company data, <strong>GEPL</strong> <strong>Capital</strong> Research<br />

The growth potential for the <strong>India</strong>n poultry industry is further evident if our per capita<br />

consumption is compared with that of USA (300 eggs and 49.8 kgs of poultry meat). Realising<br />

the massive untapped potential of this industry, the Central Government has reiterated its<br />

commitment to create an enabling environment for steady growth in agricultural and agrobased<br />

industries production and diversification from traditional crops to ancillaries, including<br />

animal husbandry. The allocation for Mid-Day Meal program has been stepped up significantly<br />

by Central and State Governments.<br />

Fuelled by burgeoning demand for broiler meat and eggs, the poultry industry in the country,<br />

the Business chamber, Assocham, has pegged the market size for the poultry products at `1.32<br />

tn by CY15E. They believe there is a huge opportunity for foreign direct investment (FDI) in<br />

the poultry sector in areas like breeding, medication, feed production, vertical integration<br />

and processing.<br />

<strong>GEPL</strong> <strong>Capital</strong> Research| Initiating Coverage 6

Equity | <strong>India</strong> | Consumer Discretionary<br />

Venky’s (<strong>India</strong>) <strong>Ltd</strong> December 05, 2011<br />

The best bird amongst the flock in <strong>India</strong>’s Poultry Industry<br />

Venky’s has a witnessed a revenue CAGR of 17.3% in FY06-11 to `8.52 bn driven by a 21.6% CAGR<br />

in poultry and poultry products. We expect the company to grow steadily with operational<br />

leverages due to a) strong parent lineage in the form of VH group which offers it a Pan-<strong>India</strong><br />

presence, b) presence across the geographies, and value chain, and c) large scale operation<br />

leverages like lower transportation and storage cost.<br />

Strong parent lineage<br />

Venky’s is part of the (VH) group which was established in 1971 in Pune, <strong>India</strong>, by founder<br />

Chairman Late Padmashree Dr. B.V.Rao, referred to as “The Father of the <strong>India</strong>n Poultry<br />

Industry”. With a unique combination of expertise and experience and supported by strategic<br />

collaborations, the company diversified its activities to include SPF eggs, chicken and eggs<br />

processing, broiler and layer breeding, genetic research and Poultry diseases diagnostic, Poultry<br />

vaccines and feed supplements, vaccine production, bio-security products, Poultry feed &<br />

equipments, nutritional health products, soya bean extract and many more.<br />

With a focus on technology and return on investments, the company embarked upon new<br />

ventures, and has grown to over 30 units spread across <strong>India</strong>. The strategic collaborations has<br />

helped combine expertise and experience, and diversify into Specific Pathogen Free (SPF) eggs,<br />

processed chicken products, solvent oil extraction, chicken and eggs processing. The company’s<br />

SPF Egg unit, in technical collaboration with SPAFAS Inc is among four such units in the world.<br />

The company has also added to its credit, manufacturing facilities for nutritional health<br />

products for humans, and pet food and health care products. With a product mix of more than<br />

40 unique poultry health products, Venky’s offers complete solutions to all concerns in poultry<br />

farming right from ‘field to fork’.<br />

Geographical presence<br />

Source: Company data, <strong>GEPL</strong> <strong>Capital</strong> Research<br />

<strong>GEPL</strong> <strong>Capital</strong> Research| Initiating Coverage 7

Equity | <strong>India</strong> | Consumer Discretionary<br />

Venky’s (<strong>India</strong>) <strong>Ltd</strong> December 05, 2011<br />

Presence across geographies, and value-chain<br />

Currently, the group is the largest fully integrated poultry group in Asia. The VH group has an<br />

annual turnover of over `50 bn (Venky’s contributes 17% to the top line). Moreover, while<br />

Venky’s has a strong presence in the Northern and Western regions of <strong>India</strong>, the VH group has a<br />

remarkable presence down South and in East <strong>India</strong>. Also the brand recall for the ‘Venky’s<br />

chicken’ is one of the highest in the country. This has helped Venky’s expand its product<br />

portfolio as well as increase sales over the last few years.<br />

The company is also present across segments (branded and unbranded) as well across markets<br />

(organised and unorganised). In the organised market the company markets its presence through<br />

processed chicken where the brand recall remains high for Venky’s chicken. The company has<br />

also started its new retail store formats- VENKYS XPRS on a small scale to cater to the organised<br />

market and earn higher margins though the revenue pie remains miniscule as compared to the<br />

group turnover. In the unorganised market as well the VH group has a strong presence and<br />

supplies grown-up chicks, grown up commercial broilers and grow-up commercial layers to other<br />

players and operators in the industry. Such innovative steps has made it possible for the VH<br />

group to command a 85% market share in the commercial layer industry and a 60% market share<br />

in the commercial broiler industry.<br />

Large scale benefits<br />

According to a study by the Food and Agriculture Organization (FAO) of the United Nations,<br />

small producers of poultry enjoy fewer advantages when compared with large producers in<br />

terms of obtaining information, marketing, and transportation and storage facilities (transaction<br />

costs). At the same time, small producers are observed to spend more effort per unit of poultry<br />

output than large producers on collecting; drying and transporting poultry manure (pollution<br />

abatement costs).<br />

Speculatively, this could be due to the lower opportunity cost of their labor, or perhaps due to<br />

the greater incentive to keep the surrounding household and neighborhood environment clean in<br />

a close-settled smallholder setting. In addition to transaction costs and pollution abatement<br />

costs, differences in the amount of implicit policy subsidies received by farms across<br />

regions/states are also found to affect the relative profit efficiency of small and large<br />

producers.<br />

Due a strong parent company backing, Venky’s is able to enjoy the benefits of economies of<br />

scale, a larger distribution network, lower transportation cost and lower effort per unit with a<br />

strong management in place.<br />

Benefits of large scale production<br />

Parameters Large scale production Smaller scale production<br />

Information gathering<br />

Transportation<br />

Lesser time to gather<br />

information<br />

Lower transportation cost due<br />

to economies of scale<br />

More time and effort to gather<br />

information<br />

Higher transportation cost per egg<br />

Storage Storage cost per unit lower Higher storage cost per unit<br />

Transaction<br />

Marketing<br />

Lower transaction costs per<br />

unit<br />

Lower marketing effort due to<br />

strong presence<br />

Transaction cost per unit is higher<br />

Higher marketing efforts<br />

Labour Lower labour cost per unit Higher labour cost per unit<br />

Effort per unit<br />

Source: <strong>GEPL</strong> <strong>Capital</strong> Research<br />

Lower effort to production<br />

ratio<br />

Higher effort to production ratio<br />

<strong>GEPL</strong> <strong>Capital</strong> Research| Initiating Coverage 8

Equity | <strong>India</strong> | Consumer Discretionary<br />

Venky’s (<strong>India</strong>) <strong>Ltd</strong> December 05, 2011<br />

VENKYS XPRS- the future wings of growth<br />

Besides being a prominent supplier of chicken products to various International Quick Service<br />

Restaurant chains in <strong>India</strong> like Kentucky Fried Chicken, Pizza Hut, Domino’s, TGIF and Vista<br />

Foods etc., Venky’s have also developed a whole range of Ready-to-eat, Freezer-to Fryer and<br />

Easy-to-Cook products based on three types of cooking, i.e. flash fried, kettle cooked and oven<br />

cooked products.<br />

The food services industry in <strong>India</strong> is expected to witness a 5% CAGR in the next four years<br />

driven by the changing demographics in <strong>India</strong>, rising urbanization, concept of nuclear families,<br />

rising income levels, growth of middle class, higher percentage of youth population and growth<br />

in working women ratio. Among the various formats, Quick Service Restaurants (QSR) and cafes<br />

have had the maximum growth over the last few years.<br />

Venky’s has hence entered the hospitality industry with the launch of ‘VENKYS XPRS’ to serve<br />

their customers with a range of healthy, hygienically cooked, and yet reasonably priced chicken<br />

delicacies. This will help them cater the increasingly popular QSR segment. ‘VENKYS XPRS’<br />

brand sell various delicacies like garlic & pepper roast chicken, tender grilled chicken, tandoori<br />

chicken roast, grilled chicken burger, chicken hot dog, Kathi roll, etc.<br />

The first store was rolled out in Jan, CY10 and currently five stores in <strong>India</strong> are operational. The<br />

company plans to invest ~`2.5 bn for its research and development and set up over 100 Venky’s<br />

XPRS outlets (including London) over the next three years. It expects a break-even for the new<br />

initiative within 15 months. The company also has a technical agreement with Campden BRI of<br />

the United Kingdom to get food technologies.<br />

<strong>India</strong>’s answer to foreign QSR’s<br />

Venky’s XPRS seems to be <strong>India</strong>’s answer to international QSR’s due to:<br />

Healthier Products: Venky’s XPRS is set up with the intention to cater to the niche health<br />

conscious consumers who want quick food but do not want to compromise on quality. With a<br />

focus on health, the UK stores are expected to gain immediate traction. Moreover, the concept<br />

of healthy food is gaining momentum in Tier I cities in <strong>India</strong> and should lead to a stronger<br />

growth in the years to come. Even as the current menu is limited, Venky’s XPRS serves their<br />

frozen products fried n hot right in front of the customer. This ensures that the products are<br />

fresh and healthy<br />

Effective Pricing: The pricing remains extremely competitive when compared to other QSR’s<br />

like KFC and McDonalds. Given the price sensitivity of <strong>India</strong>ns, we believe this should help them<br />

gain market share in the time to come.<br />

Lower pricing than competitors<br />

Menu Venky’s XPRS McDonalds KFC<br />

Chicken Burger 50 69 99<br />

Chicken Roll 40 129 110<br />

Roast Chicken (2 pieces) 60 NA 120<br />

Source: various companies, <strong>GEPL</strong> <strong>Capital</strong> Research<br />

Though currently the contribution from this segment is minimal, the scope for growth remains<br />

high given the changing demographics in <strong>India</strong> with a rise in disposable income, higher working<br />

population (both youth and women). The management is focused towards the growth of its<br />

brand and plans to expand the XPRS network and open restaurants all over <strong>India</strong> and overseas,<br />

in the near future.<br />

<strong>GEPL</strong> <strong>Capital</strong> Research| Initiating Coverage 9

Equity | <strong>India</strong> | Consumer Discretionary<br />

Venky’s (<strong>India</strong>) <strong>Ltd</strong> December 05, 2011<br />

Financials<br />

Revenues to record 20.6% CAGR in FY11-FY13E<br />

Venky’s has a witnessed a revenue CAGR of 17.3% in FY06-11 to `8.5 bn driven by a 21.7% CAGR<br />

in poultry and poultry products and a 15.4% CAGR in the solvent extraction business.<br />

Consequently, the poultry and poultry products segment contributed 65% to the consolidated<br />

revenues in FY11 as compared to 55% in FY06. While the revenue contribution of the solvent<br />

extract division declined marginally over the same period to 20% from 21%, the contribution<br />

from the animal health product segment declined to 10% from 16%.<br />

Revenue mix in FY11<br />

Revenue mix in FY13E<br />

20%<br />

5%<br />

18%<br />

5%<br />

10%<br />

65%<br />

8%<br />

69%<br />

Poultry and poultry products<br />

Animal health products<br />

Poultry and poultry products<br />

Animal health products<br />

Solvent extraction<br />

Others<br />

Solvent extraction<br />

Others<br />

Source: Company data, <strong>GEPL</strong> <strong>Capital</strong> Research<br />

Source: Various Companies, <strong>GEPL</strong> <strong>Capital</strong> Research<br />

With the a) strong growth in the <strong>India</strong>n poultry segment, b) vast gap between the present per<br />

capita consumption and NIN’s recommended level, and c) strong market position of Venky’s, we<br />

expect it to be the biggest beneficiary and capture a larger pie of the growth. We expect the<br />

company to witness a 20.6% CAGR in FY11-13E to `12.4 bn driven by a 23% CAGR in poultry and<br />

poultry related products. We expect the AHP segment to grow at 11.5% CAGR and the solvent<br />

extraction business with witness a 16.4% CAGR in the same period.<br />

Net revenues<br />

14.00<br />

12.40<br />

12.00<br />

10.00<br />

8.52<br />

10.17<br />

Rs bn<br />

8.00<br />

6.00<br />

5.69<br />

7.05<br />

4.00<br />

2.00<br />

0.00<br />

FY09 FY10 FY11 FY12E FY13E<br />

Source: Company data, <strong>GEPL</strong> <strong>Capital</strong> Research<br />

<strong>GEPL</strong> <strong>Capital</strong> Research| Initiating Coverage 10

Equity | <strong>India</strong> | Consumer Discretionary<br />

Venky’s (<strong>India</strong>) <strong>Ltd</strong> December 05, 2011<br />

Operational efficiencies has helped EBITDA grow four fold in FY06-FY11<br />

The company has witnessed a four-fold increase in EBITDA in FY06-FY11 while the EBITDA<br />

margin has doubled to 13.3% in FY11 from 6.6% in FY06. The poultry and poultry related<br />

segment contributed ~73.5% of the company’s EBIT in FY11 and going forward we expect this<br />

segment to drive revenue and profitability growth for the other segments as well.<br />

The growth trend is clearly visible in the poultry segment (contributed ~73.5% of EBIT in FY11)<br />

of where EBIT margins have doubled from 7.2% in FY08 to 14.4% in FY11. The company has also<br />

been able to maintain its animal health product margins at 17-19% over the last five years.<br />

Given the interlinked business activities with promoters and the Pan-<strong>India</strong> presence we expect<br />

the margins to remain in this range. While the animal health product segment has seen a<br />

constant margin, the picture is very different for solvent extracts with EBIT margins ranging<br />

from 5-11.8% in FY07-FY11. The high volatility in margins is due to higher commodity prices.<br />

EBIT mix in FY11<br />

Segmental margins<br />

13.1%<br />

25.0<br />

13.3%<br />

20.0<br />

15.0<br />

17.5<br />

18.5 17.9<br />

14.4<br />

17.7<br />

15.4<br />

19.1<br />

73.6%<br />

%<br />

10.0<br />

5.0<br />

2.2<br />

9.5<br />

11.8<br />

9.6<br />

7.2<br />

5.0<br />

5.0<br />

6.9<br />

Poultry and poultry products<br />

Animal health products<br />

Solvent extraction<br />

0.0<br />

FY07 FY08 FY09 FY10 FY11<br />

Poultry and poultry products Animal health products Solvent extraction<br />

Source: Company data, <strong>GEPL</strong> <strong>Capital</strong> Research<br />

Source: Company data, <strong>GEPL</strong> <strong>Capital</strong> Research<br />

EBIDTA to witness 21.5% CAGR as margins improve by 20bps in FY11-13E<br />

The company has been able to constantly scale up its operations. This coupled with a strong<br />

bargaining power due to its track record and parent company backing has resulted in<br />

operational efficiencies with employee expenses as a percentage of sales improving by 100bps in<br />

FY06-FY11 while other expenses have improved by 440bps in the same period. However, the<br />

poultry margins depend highly on the raw material cost (75-80% of which consist of feed<br />

ingredients like maize and soya).<br />

Despite the fact that there has been an improvement of 280bps in raw material expenses as a<br />

percentage of sales due to better operations by the company, the pressure on margins due to<br />

increase in prices of soya and wheat is visible. Moreover, a strong demand all through put the<br />

entry of newer players who are ready to sell products below the cost of production has resulted<br />

in lower realizations for the company and the industry, these two factors have resulted in<br />

margin erosion in FY12 so far.<br />

We expect the company to maintain a double digit margin in FY12E and witness a strong<br />

recovery in FY13E due to the historical cyclical nature of the business with cycles lasting for 3-4<br />

years and a typical downtrend lasting for 6-9 months. We expect the margins to improve by<br />

20bps over the next two years despite the current scenario of higher competition, lower<br />

realization and higher raw material prices. Consequently, we expect the EBITDA to witness<br />

21.5% CAGR from FY11-13E to `1.68 bn.<br />

<strong>GEPL</strong> <strong>Capital</strong> Research| Initiating Coverage 11

Equity | <strong>India</strong> | Consumer Discretionary<br />

Venky’s (<strong>India</strong>) <strong>Ltd</strong> December 05, 2011<br />

Cost break up<br />

EBITDA and EBITDA margin<br />

%<br />

100.0<br />

80.0<br />

60.0<br />

40.0<br />

14.8<br />

13.5 14.1<br />

16.0<br />

14.7<br />

7.2<br />

6.2 6.6 7.0<br />

6.4<br />

70.7 67.4 65.9 67.3 65.3<br />

Rs mn<br />

1,800<br />

1,600<br />

1,400<br />

1,200<br />

1,000<br />

800<br />

600<br />

7.3<br />

13.0 13.3<br />

9.8<br />

13.5<br />

16.0<br />

14.0<br />

12.0<br />

10.0<br />

8.0<br />

6.0<br />

%<br />

20.0<br />

400<br />

4.0<br />

200<br />

2.0<br />

0.0<br />

FY09 FY10 FY11 FY12E FY13E<br />

0<br />

FY09 FY10 FY11 FY12E FY13E<br />

0.0<br />

RMC Employee expenses Other expenses<br />

EBITDA<br />

EBITDA margin(%)<br />

Source: Bloomberg, <strong>GEPL</strong> <strong>Capital</strong> Research<br />

Source: Company data, <strong>GEPL</strong> <strong>Capital</strong> Research<br />

Net profit to record 17.2% CAGR in FY11-13E<br />

The company has capex of `1.10 which would spill over till FY13E owing to which the interest<br />

cost is expected to increase. We expect the PAT CAGR to be marginally lower led by the a)<br />

higher interest costs owing to the rise in interest rates, b) higher depreciation, c) a flattish<br />

other income component, and d) marginal rise in tax rates. Hence, we expect the PAT to<br />

witness a 17.2% CAGR in FY11-FY13E despite a 20% de-growth in FY12E owing to a sharp bounce<br />

in FY13E.<br />

Net profit<br />

1,200<br />

1,000<br />

1,003<br />

200.0<br />

150.0<br />

Rs mn<br />

800<br />

600<br />

400<br />

543<br />

730<br />

585<br />

100.0<br />

50.0<br />

%<br />

200<br />

206<br />

0.0<br />

0<br />

(50.0)<br />

FY09 FY10 FY11 FY12E FY13E<br />

Profit after tax<br />

YoY growth<br />

Source: Company data, <strong>GEPL</strong> <strong>Capital</strong> Research<br />

<strong>GEPL</strong> <strong>Capital</strong> Research| Initiating Coverage 12

Equity | <strong>India</strong> | Consumer Discretionary<br />

Venky’s (<strong>India</strong>) <strong>Ltd</strong> December 05, 2011<br />

Key Risks<br />

Strong input cost could hurt margins<br />

The poultry industry faces the threat of relentless increase in prices of fee ingredients like<br />

maize and soya which account for 80% of the cost of production. A sharp surge in prices has<br />

impacted margins in the past and can do so in the future.<br />

However, the overall demand scenarios are favourable for continued growth of the industry.<br />

Moreover, the poultry industry has pleaded with the Government to ban forward trading in<br />

maize and soya and channelises the export of maize and soya meal through a designated<br />

government agency and to put a ceiling on the volume of export.<br />

Virus and diseases<br />

In the last quarter of the FY06, poultry industry suffered a major set back due to reports of bird<br />

flu in Maharashtra. The panic caused a steep fall in consumption of both eggs and chicken.<br />

Similarly, bird flu in February, 2006 had affected the performance of the company during the<br />

first half of the FY07. Any further such virus and diseases can impact the financial performance<br />

of the industry and the company going forward.<br />

However, the fact is that <strong>India</strong> is second to none as far as poultry technology is concerned and<br />

has the most advanced technology outside USA. With the increasing awareness amongst<br />

consumer led by the company and various government initiatives we believe the company is<br />

prepared to tackle such a situation in a much better way if the need arises.<br />

Competition<br />

The poultry business due to its constant growth has become extremely competitive. The<br />

expenses are increasing even as customers want quality products at cheaper rates. Due to this<br />

fact newer players are offering products even at below cost prices which have impacted<br />

realizations. Continuation of such a scenario can be harmful to the industry.<br />

However, <strong>India</strong> with abundant land, technical people, and irrigation systems can offer the best<br />

place for world’s poultry industry. Being a large Pan-<strong>India</strong> player with a strong backing and<br />

strong brand recall, we expect the company to be able to absorb the marginal pain.<br />

Lower Global slowdown<br />

The global economic slowdown witnessed in 2008 had adversely impacted all the major<br />

economies of the world including that of <strong>India</strong>. The global slowdown impacted the poultry<br />

industry at large as well as Venky’s. A threat of global slowdown persists.<br />

However, while most of the industries showed a severe decline, the poultry industry managed to<br />

withstand the impact to a certain extent as the industry in <strong>India</strong> is primarily domestic demand<br />

driven.<br />

<strong>GEPL</strong> <strong>Capital</strong> Research| Initiating Coverage 13

Equity | <strong>India</strong> | Consumer Discretionary<br />

Venky’s (<strong>India</strong>) <strong>Ltd</strong> December 05, 2011<br />

Valuations<br />

Currently, Venky’s is trading at 7.1x FY12E EPS and 4.1x FY13E EPS, a 34% discount to its<br />

historical one-year forward P/E band of 6.2x. The discount is wider (45%) when compared to its<br />

average one-year forward P/E band over the last 12 months of 7.4x.<br />

However, the stocks has traded within a wide band over the last few years with it commanding<br />

a one-year forward P/E of 12.5x in its best year (FY06) and 2.8x during FY10. A volatile earning<br />

scenario with a drop in profits after every two-three years due to the cyclical nature of the<br />

business coupled with the systemic risks (break-out of diseases and virus like Bird flu) have led<br />

to this erratic movements in the one-year forward P/E bands.<br />

We have hence taken a four year average of its historical P/E band (5.1x) to capture the<br />

cyclicality of the industry in terms of pricing, downtrend in the industry, lower realisations and<br />

lower profits once in every four years. We believe Venky’s should be viewed as a turnaround<br />

story in FY13E despite the below expected performance seen in HiFY12.<br />

We believe there is good potential upside in the stock and initiate coverage with a Buy rating<br />

and target price of `544 per share (5.1x FY13E EPS).<br />

1 year forward P/E<br />

1,200<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

Apr-05<br />

Aug-05<br />

Dec-05<br />

Apr-06<br />

Aug-06<br />

Dec-06<br />

Apr-07<br />

Aug-07<br />

Dec-07<br />

Apr-08<br />

Aug-08<br />

Dec-08<br />

Apr-09<br />

Aug-09<br />

Dec-09<br />

Apr-10<br />

Aug-10<br />

Dec-10<br />

Apr-11<br />

Aug-11<br />

Dec-11<br />

Price 2.0x 5.0x 8.0x 11.0x<br />

Source: Bloomberg, <strong>GEPL</strong> <strong>Capital</strong> Research<br />

1 year forward EV/EBITDA<br />

1,400<br />

1,200<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

-200<br />

Apr-05<br />

Aug-05<br />

Dec-05<br />

Apr-06<br />

Aug-06<br />

Dec-06<br />

Apr-07<br />

Aug-07<br />

Dec-07<br />

Apr-08<br />

Aug-08<br />

Dec-08<br />

Apr-09<br />

Aug-09<br />

Dec-09<br />

Apr-10<br />

Aug-10<br />

Dec-10<br />

Apr-11<br />

Aug-11<br />

Dec-11<br />

Price 3.0x 5.0x 7.0x 9.0x<br />

Source: Bloomberg, <strong>GEPL</strong> <strong>Capital</strong> Research<br />

<strong>GEPL</strong> <strong>Capital</strong> Research| Initiating Coverage 14

Equity | <strong>India</strong> | Consumer Discretionary<br />

Venky’s (<strong>India</strong>) <strong>Ltd</strong> December 05, 2011<br />

Company background: A Chick laying golden eggs<br />

Venky’s <strong>India</strong> Limited (Venky’s) formerly known as Western Hatcheries Limited was established<br />

in 1976, mainly to produce day-old layer and broiler chicks for the dense poultry markets of<br />

North <strong>India</strong>. It is part of the Venkateshwara Hatcheries (VH) group established in 1971, by<br />

Late Padmashree Dr. B.V.Rao, “The Father of the <strong>India</strong>n Poultry Industry” in Pune, <strong>India</strong>.<br />

Its main products can be broadly classified into<br />

1. Poultry and poultry products<br />

2. Animal health products<br />

3. Solvent extraction<br />

Company Structure<br />

Venky’s<br />

Poultry & Poultry<br />

Products (65%)<br />

Animal Health<br />

Products (10%)<br />

Solvent Extraction<br />

(20%)<br />

Chicks<br />

Animal Health<br />

Products- Powder<br />

Refined Oil<br />

SPF Eggs<br />

Animal Health<br />

Products- Liquid<br />

De oiled cake for<br />

poultry<br />

Grown up<br />

Commercial broiler<br />

Grown up<br />

commercial layers<br />

Grown up broiler<br />

parents<br />

Poultry Feed<br />

Processed Chicken<br />

Source: Company data, <strong>GEPL</strong> <strong>Capital</strong> Research<br />

1. Poultry and Poultry Products<br />

The Company’s major business segment is poultry and poultry products which consisted of 65%<br />

of the total revenues in FY11. The business involves production and sale of day old broiler and<br />

layer chicks, specific pathogen free eggs, processed chicken products and poultry feed.<br />

a) Chicks: The Company produces over 55 mn chicks a year for both their meat and their eggs.<br />

Chickens raised for meat are called broilers, whilst those raised for eggs are called laying<br />

hens.<br />

<strong>GEPL</strong> <strong>Capital</strong> Research| Initiating Coverage 15

Equity | <strong>India</strong> | Consumer Discretionary<br />

Venky’s (<strong>India</strong>) <strong>Ltd</strong> December 05, 2011<br />

b) SPF Eggs: SPF Eggs are fertile chicken eggs produced from known SPF parent flocks and are<br />

free from the vertically transmitted agents and laterally transmitted infections. Venky’s is<br />

the only company in Asia and one of the 6 companies in the world to produce SPF eggs.<br />

c) Grown up commercial broilers: Broiler grown up birds are slaughtered for production of<br />

whole chicken, portions in fresh and frozen form and sold in retail and institutional market<br />

under “Venky’s” brand. The products are also sold to institutional buyers, major hotels and<br />

leading Quick Service Restaurant chains like KFC, Pizza Hut, Dominos, Vista Foods who<br />

supply to McDonalds, etc. Venky’s are also in further processing, value added Chicken-inminutes<br />

products like freezer to fryer, completely cooked, ready-to-eat products sold under<br />

“Venky’s” brand. Venky’s chicken products are sold through distributors and retail outlets<br />

and are available in all leading super markets / food malls.<br />

d) Grown up broiler parents: Venky’s sources one day old broiler breeder parents who are<br />

grown in farms and females are artificially inseminated to obtain the hatching eggs which<br />

are hatched in incubators. Chicks coming out of the eggs are called commercial chicks<br />

which are sold to various commercial poultry farmers and integrators who grow the<br />

commercial chicks in their own/contract farms and when the commercial chicks are grown<br />

to an age of 40 to 45 days they are sold as grown up broiler birds for meat purpose meant<br />

for human consumption.<br />

e) Grown up commercial layers: Venky’s sells commercial layer chicks to various poultry<br />

farmers who, in turn, grow them for obtaining “table eggs” – meant for human<br />

consumption.<br />

f) Poultry Feeds: Venky’s manufactures and sells poultry feed under the Venky’s brand name<br />

for captive consumption to the VH Group as well as to the major poultry markets of<br />

Western and Northern states of <strong>India</strong>.<br />

g) Processed Chicken: Venky’s is the first national brand in the processed chicken segment<br />

and sells its processed and further processed chicken under the Venky’s brand name. It is a<br />

preferred supplier to the <strong>India</strong>n outlets of McDonalds, KFC, Pizza Hut, and Domino’s.<br />

2. Animal Health Products (AHP)<br />

The Company has its animal health products manufacturing facility at Pune which constituted<br />

9% of the company’s revenues in FY11. AHPs are manufactured in powder as well as liquid forms<br />

in the manufacturing plant. It has more than 35 unique products ensuring better health and<br />

better performance in breeders as well as commercial broilers and layers.<br />

Nutritional supplements: Venky’s offers a unique range of Nutritional supplements to poultry<br />

farmers as profit enhancers to the business. The blend of vitamins and minerals is standardized<br />

after research of more than 2 decades depending upon the needs of various kinds of birds.<br />

3. Solvent Extraction<br />

The solvent extraction segment contributed 26% to the revenues of Venky’s in FY11. However,<br />

lower realisation in oil prices was the main reason for the fall in profit. The solvent extraction<br />

business can be further classified into<br />

a) Refined oil: The Company’s soya processing plant is located near Solapur, Maharashtra.<br />

Edible oil obtained from the processing activity is sold in bulk to traders while the de-oiled<br />

cake is used in poultry feed.<br />

b) De-oiled soya cake (DOC) for poultry: is an important ingredient of poultry feed. To meet<br />

the growing demand for the DOC of feed mills of VH Group, Venky’s set up a solvent<br />

extraction plant in 1954.<br />

<strong>GEPL</strong> <strong>Capital</strong> Research| Initiating Coverage 16

Equity | <strong>India</strong> | Consumer Discretionary<br />

Venky’s (<strong>India</strong>) <strong>Ltd</strong> December 05, 2011<br />

Income Statement<br />

Y/E march (`mn) FY09(A) FY10(A) FY11(A) FY12(E) FY13(E)<br />

Total net revenues 5,693 7,055 8,520 10,169 12,401<br />

COGS 4,024 4,752 5,616 6,844 8,102<br />

Gross Profit 1,668 2,302 2,904 3,325 4,299<br />

Employee Cost 410 437 566 707 796<br />

Selling & Admin Exp. 427 493 617 0 0<br />

Other Expenditure 415 456 586 1,624 1,827<br />

EBITDA 416 916 1,135 994 1,676<br />

EBITDA Margin (%) 25 39.8 39.1 29.9 39<br />

Depreciation 86 90 96 124 162<br />

Other Income 60 49 87 80 80<br />

Interest (Net) 79 50 46 77 97<br />

PBT 311 825 1,080 873 1,496<br />

PBT Margin (%) 5.5 11.7 12.7 8.6 12.1<br />

Tax 105 280 347 288 494<br />

Minority Interest 0 0 0 0 0<br />

Adjusted PAT 207 545 733 585 1,003<br />

Extraordinary items 0 0 0 0 0<br />

Reported PAT 207 545 733 585 1,003<br />

Key Ratio<br />

Y/E (`mn) FY09 FY10 FY11P FY12E FY13E<br />

Per Share Ratios<br />

Fully diluted E P S 22 58 78 62 107<br />

Book Value 167 220 292 347 446<br />

Dividend per share 4 4 5 6 7<br />

per share FCFO 4 5 5 11 11<br />

Valuation Ratio<br />

P/E 3 6 8 7 4<br />

P/BV 0 2 2 1 1<br />

EV/EBITDA 4 4 6 5 3<br />

EV/Sales 0 1 1 1 0<br />

Price/ FCFO per share 19 62 133 42 40<br />

Growth Ratios<br />

Sales Growth 9 24 21 19 22<br />

EBITDA Growth (23) 120 24 (12) 69<br />

Net Profit Growth 4 8 9 6 8<br />

EPS Growth (23) 164 35 (20) 71<br />

Common size Ratios<br />

Gross Margin 29 33 34 33 35<br />

EBITDA Margin 7 13 13 10 14<br />

PAT Margin 4 8 9 6 8<br />

Employee Cost 7 6 7 7 6<br />

S&G Expenses 8 7 7 0 0<br />

Return ratios<br />

RoAE 14 30 30 20 27<br />

RoACE 10 21 22 15 20<br />

Turnover ratios (days)<br />

Debtors ( Days) 32 27 24 22 21<br />

Creditors ( Days) 37 33 31 29 27<br />

Inventory (Days) 49 41 45 44 41<br />

Net working capital 56 47 50 51 50<br />

Solvency Ratios<br />

Total Debt/Equity 1 0 0 1 1<br />

Interest coverage 3 12 17 8 11<br />

Balance Sheet<br />

Y/E March (`mn) FY09 FY10 FY11P FY12E FY13E<br />

Equity capital 94 94 94 94 94<br />

Reserves & Surplus 1,477 1,973 2,648 3,167 4,093<br />

Preference <strong>Capital</strong> 0 0 0 0 0<br />

Net worth 1,571 2,067 2,742 3,261 4,187<br />

Minority interest 0 0 0 0 0<br />

Deffered tax liability 134 146 153 153 153<br />

Total debt 939 899 1,145 1,545 1,945<br />

Total Liab. & Equity 2,510 2,966 3,887 4,806 6,132<br />

Net block 1,175 1,238 1,515 2,191 3,029<br />

<strong>Capital</strong> WIP 87 97 245 345 445<br />

Total fixed assets 1,262 1,335 1,760 2,536 3,474<br />

Investments 521 813 928 928 928<br />

Goodwill 0 0 0 0 0<br />

Current Assets 1,471 1,595 2,108 2,631 3,373<br />

Inventories 710 866 1,223 1,254 1,563<br />

Debtors 523 514 599 655 781<br />

Cash & bank 108 85 135 569 842<br />

Loans & advances 130 130 151 153 187<br />

Other Current Assets 0 0 0 0 0<br />

Current Liab. & Prov. 609 632 756 1,136 1,489<br />

Creditors 409 444 523 563 644<br />

Other liabilities 78 89 129 149 190<br />

Provisions 123 98 104 424 656<br />

Net Working capital (134) (146) (153) (153) (153)<br />

Miscellaneous Exp 0 0 0 0 0<br />

Total Assets 2,510 2,966 3,887 4,806 6,132<br />

Cash Flow<br />

Y/E March, (`mn) FY09 FY10 FY11P FY12E FY13E<br />

PBT 311 825 1,080 873 1,496<br />

Add: Depreciation 86 90 96 124 162<br />

Add: Interest expense 79 50 46 77 97<br />

Less: Other Income (60) (49) (87) (80) (80)<br />

Other Adjustments 0 0 0 0 0<br />

Change in working cap. 50 (125) (339) 291 (116)<br />

Taxes paid 105 280 347 288 494<br />

CF from operations 362 511 449 997 1067<br />

Change in fixed assets (121) (163) (521) (900) (1100)<br />

Changes in Int. Asset 0 0 0 0 0<br />

Change in investments 5 (292) (115) 0 0<br />

Other income 60 49 87 80 80<br />

CF from investing acti. (56) (406) (549) (820) (1020)<br />

Change in debt (165) (40) 246 400 400<br />

Change in Equity cap. 0 0 0 0 0<br />

Changes in Pref. capital 0 0 0 0 0<br />

Dividend & dividend tax (38) (44) (55) (66) (77)<br />

Interest paid (79) (50) (46) (77) (97)<br />

Other Adjustments (5) 8 7 0 0<br />

CF from financing acti. (287) (126) 153 257 226<br />

Change in cash 18 (24) 50 434 272<br />

Opening cash 91 108 85 135 569<br />

Closing cash 108 85 135 569 842<br />

Du-Pont Analysis<br />

(%) FY09A FY10A FY11E FY12E FY13E<br />

Net Profit Margin 3.6 7.7 8.6 5.8 8.1<br />

Asset Turnover 2.3 2.4 2.2 2.1 2<br />

Leverage 1.6 1.4 1.4 1.5 1.5<br />

ROE 13.8 29.9 30.4 19.5 26.9<br />

Source: Company data, <strong>GEPL</strong> <strong>Capital</strong> Research<br />

<strong>GEPL</strong> <strong>Capital</strong> Research| Initiating Coverage 17

Equity | <strong>India</strong> | Consumer Discretionary<br />

Venky’s (<strong>India</strong>) <strong>Ltd</strong> December 05, 2011<br />

NOTES<br />

Recommendation Rationale<br />

Recommendation<br />

Expected Absolute Return (%) over 12 months<br />

BUY >20%<br />

ACCUMULATE 10%<br />

NEUTRAL