Morning Coffee with GEPL Capital

Morning Coffee with GEPL Capital

Morning Coffee with GEPL Capital

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

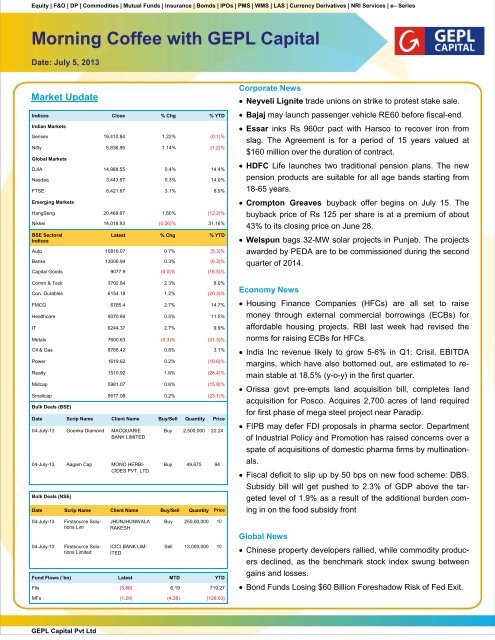

Equity | F&O | DP | Commodities | Mutual Funds | Insurance | Bomds | IPOs | PMS | WMS | LAS | Currency Derivatives | NRI Services | e– Series<br />

<strong>Morning</strong> <strong>Coffee</strong> <strong>with</strong> <strong>GEPL</strong> <strong>Capital</strong><br />

Date: July 5, 2013<br />

Market Update<br />

Indices Close % Chg % YTD<br />

Indian Markets<br />

Sensex 19,410.84 1.22% (0.1)%<br />

Nifty 5,836.95 1.14% (1.2)%<br />

Global Markets<br />

DJIA 14,988.55 0.4% 14.4%<br />

Nasdaq 3,443.67 0.3% 14.0%<br />

FTSE 6,421.67 3.1% 8.9%<br />

Emerging Markets<br />

HangSeng 20,468.67 1.60% (12.2)%<br />

Nikkei 14,018.93 (0.26)% 31.16%<br />

BSE Sectoral<br />

Indices<br />

Latest % Chg % YTD<br />

Auto 10816.07 0.7% (5.3)%<br />

Banks 13006.94 0.3% (9.3)%<br />

<strong>Capital</strong> Goods 9077.9 (0.0)% (16.5)%<br />

Comm & Teck 3702.84 2.3% 8.0%<br />

Con. Durables 6154.18 1.2% (20.3)%<br />

FMCG 6785.4 2.7% 14.7%<br />

Healthcare 9070.89 0.5% 11.5%<br />

IT 6244.37 2.7% 9.9%<br />

Metals 7600.63 (0.3)% (31.3)%<br />

Oil & Gas 8785.42 0.8% 3.1%<br />

Power 1619.62 0.2% (18.6)%<br />

Realty 1510.92 1.6% (28.4)%<br />

Midcap 5981.07 0.6% (15.9)%<br />

Smallcap 5677.08 0.2% (23.1)%<br />

Bulk Deals (BSE)<br />

Date Scrip Name Client Name Buy/Sell Quantity Price<br />

04-July-13 Goenka Diamond MACQUARIE<br />

BANK LIMITED<br />

04-July-13 Aagam Cap MONO HERBI-<br />

CIDES PVT. LTD.<br />

Bulk Deals (NSE)<br />

Buy 2,500,000 22.24<br />

Buy 49,675 94<br />

Date Scrip Name Client Name Buy/Sell Quantity Price<br />

04-July-13<br />

04-July-13<br />

Firstsource Solutions<br />

Lim<br />

Firstsource Solutions<br />

Limited<br />

JHUNJHUNWALA<br />

RAKESH<br />

ICICI BANK LIM-<br />

ITED<br />

Buy 250,00,000 10<br />

Sell 13,000,000 10<br />

Fund Flows (`bn) Latest MTD YTD<br />

Flls (5.86) 6.19 719.27<br />

MFs (1.20) (4.26) (126.03)<br />

Corporate News<br />

• Neyveli Lignite trade unions on strike to protest stake sale.<br />

• Bajaj may launch passenger vehicle RE60 before fiscal-end.<br />

• Essar inks Rs 960cr pact <strong>with</strong> Harsco to recover iron from<br />

slag. The Agreement is for a period of 15 years valued at<br />

$160 million over the duration of contract.<br />

• HDFC Life launches two traditional pension plans. The new<br />

pension products are suitable for all age bands starting from<br />

18-65 years.<br />

• Crompton Greaves buyback offer begins on July 15. The<br />

buyback price of Rs 125 per share is at a premium of about<br />

43% to its closing price on June 28.<br />

• Welspun bags 32-MW solar projects in Punjab. The projects<br />

awarded by PEDA are to be commissioned during the second<br />

quarter of 2014.<br />

Economy News<br />

• Housing Finance Companies (HFCs) are all set to raise<br />

money through external commercial borrowings (ECBs) for<br />

affordable housing projects. RBI last week had revised the<br />

norms for raising ECBs for HFCs.<br />

• India Inc revenue likely to grow 5-6% in Q1: Crisil. EBITDA<br />

margins, which have also bottomed out, are estimated to remain<br />

stable at 18.5% (y-o-y) in the first quarter.<br />

• Orissa govt pre-empts land acquisition bill, completes land<br />

acquisition for Posco. Acquires 2,700 acres of land required<br />

for first phase of mega steel project near Paradip.<br />

• FIPB may defer FDI proposals in pharma sector. Department<br />

of Industrial Policy and Promotion has raised concerns over a<br />

spate of acquisitions of domestic pharma firms by multinationals.<br />

• Fiscal deficit to slip up by 50 bps on new food scheme: DBS.<br />

Subsidy bill will get pushed to 2.3% of GDP above the targeted<br />

level of 1.9% as a result of the additional burden coming<br />

in on the food subsidy front<br />

Global News<br />

• Chinese property developers rallied, while commodity producers<br />

declined, as the benchmark stock index swung between<br />

gains and losses.<br />

• Bond Funds Losing $60 Billion Foreshadow Risk of Fed Exit.<br />

<strong>GEPL</strong> <strong>Capital</strong> Pvt Ltd

Equity | F&O | DP | Commodities | Mutual Funds | Insurance | Bomds | IPOs | PMS | WMS | LAS | Currency Derivatives | NRI Services | e– Series<br />

<strong>Morning</strong> <strong>Coffee</strong> <strong>with</strong> <strong>GEPL</strong> <strong>Capital</strong><br />

Date: July 5, 2013<br />

Debt Market Snapshot<br />

Market Turnover ` bn % Chg<br />

Market Breadth Adv Dec A/D<br />

Forex Rates Latest % Chg % YTD<br />

Rs / US$ 60.18 (0.07) 11.42<br />

Euro / US $ 0.78 0.98 0.32<br />

Yen / US$ 100.25 0.44 23.25<br />

Particulars Latest Previous Chg(bps)<br />

5 Year GOI Bond 7.66% 7.77% 0.11<br />

10 Year GOI Bond 7.42% 7.50% 0.08<br />

Government Security Market:<br />

• The Inter-bank call money rate traded in the range of 6.25% to 7.00% on Thursday,<br />

ended at 6.35%.<br />

• Total Borrowings From RBI's Repo <strong>with</strong> banks Taking Rs.116900 mn on Thursday Vs<br />

Rs.172150 mn on Wednesday.<br />

• The benchmark 7.16% GOI 2023 Closed at 7.4186% on Thursday Vs 7.5022% on<br />

Wednesday.<br />

• Global Debt Market:<br />

U.S.Treasury fell for the first time in three days as traders speculated the June employment<br />

report may be strong enough for the Federal Reserve to pull back on its asset-buying<br />

program.<br />

10 Year Benchmark Technical View:<br />

10 year (7.16% GOI 2023 ) yield likely to move in the range of 7.37% - 7.43% level on<br />

Friday.<br />

Bonds in Primary Market :<br />

Bonds Coupon Maturity Min Quantum (in Rs.)<br />

15-Year GOI Bond 7.78% 7.91% 0.13<br />

Call Money (WAR) 6.83% 7.22% 0.39<br />

CBLO (WAR) 6.59% 6.79% 0.20<br />

US 10 Year 2.50% 2.65% 0.15<br />

Crude Oil (in $/bl) 101.24 99.60 (1.64)<br />

REC/NHAI <strong>Capital</strong><br />

Gain Bond<br />

6% 3 Year Lock in Period Rs.10000/-<br />

Inflation (Monthly) 4.70% 4.70% -<br />

For Further Bond Details Please Contact <strong>GEPL</strong> Debt Desk<br />

Derivatives Snapshot<br />

Nifty Spot<br />

Nifty Futures<br />

Nifty Futures<br />

Prem. / Disc<br />

Nifty Futures<br />

Basis<br />

Nifty Futures<br />

OI<br />

Nifty Futures<br />

Change in OI<br />

Nifty Futures<br />

Volume (` in<br />

cr.)<br />

Highest Total OI<br />

Call Stirke<br />

Highest Total<br />

OI Put Strike<br />

Nifty OI<br />

PCR<br />

NSE VIX<br />

Current 5836.95 5840.1 3.15 23.15 14965450 212650 1.38<br />

6000<br />

5600 1.30 18.58<br />

Previous 5770.90 5767.85 (3.05) 23.65 14752800 (338200) 1.27<br />

6000<br />

5600 1.21 18.91<br />

Change 66.05 72.25 6.2 - -<br />

- -<br />

-<br />

- - (0.33)<br />

% Chg 1.14 1.25 - - -<br />

- -<br />

-<br />

- - (1.75)<br />

Snapshot<br />

1. Nifty July Futures ended @ 5840.1 up by 72.25 points <strong>with</strong> the premium of 3.15 points.<br />

2. Nifty futures Open interest increased by 2.12 lakh shares <strong>with</strong> July series total open interest stands at 1.48 crores.<br />

3. Nifty 6000 call holds the highest OI, whereas 5600 put holds the highest OI indicating 5550 to 5950 range for today.<br />

4. 6100 call added around 8.6 lakh shares in OI, whereas, 5800 put added 12 lakh shares in OI.<br />

5. India VIX ended 1.75% down @ 18.58 against the previous close of 18.91 levels.<br />

FII Derivatives Statistics<br />

Buy (Rs. in Cr.) Sell (Rs. in Cr.) Net Buy / Sell (Rs. in Cr.)<br />

INDEX FUTURES 1361.95 1343.90 18.06<br />

INDEX OPTIONS 15607.90 14448.34 1159.56<br />

STOCK FUTURES 2127.00 1825.40 301.60<br />

STOCK OPTIONS 1111.22 1080.71 30.51<br />

<strong>GEPL</strong> <strong>Capital</strong> Pvt Ltd

Equity | F&O | DP | Commodities | Mutual Funds | Insurance | Bonds | IPOs | PMS | WMS | LAS | Currency Derivatives | NRI Services | e-Series<br />

<strong>Morning</strong> <strong>Coffee</strong> <strong>with</strong> <strong>GEPL</strong> <strong>Capital</strong><br />

Date: July 5, 2013<br />

Technical Snapshot<br />

Market Activity<br />

4-Jul Close Points %<br />

BSE 19411 233 1.22<br />

NSE 5837 66 1.14<br />

BSE FMCG 6785 178 2.69<br />

BSE Teck 3703 85 2.35<br />

BSE CG 9078 0 0<br />

BSE Metal 7601 -22 -0.29<br />

Nifty Short Term Levels Nifty Intraday Supports Nifty Intraday Resistance<br />

6000(UP) 5800 5875<br />

5500 (DOWN) 5750 5910<br />

Sensex Support Resistance<br />

Key Highlights<br />

19411 19170 19570<br />

Nifty Futures needs to close above 5850 for positive weekly close<br />

• Nifty Futures closed at 5840 which is just 72 points higher than its previous close of 5768.<br />

• Nifty Futures opened <strong>with</strong> 26 points upward price gap and moved upwards to form intraday high at 5854.<br />

• Nifty Futures has filled the price gap on the daily chart but a follow up of bullish candle is necessary for concluding the end of the current corrective trend.<br />

• If Nifty Futures breaches 5800 level then there is still possibility of testing of 5700 in the coming days.<br />

• On the other hand, close of Nifty Futures above 5900 will trigger a strong uptrend for surpassing 6100 mark.<br />

• Nifty Futures needs close above 5850 to show 2nd consecutive positive week for maintaining the upward momentum.<br />

• Currently the important levels for Nifty Futures to watch on closing basis are placed at 5900 (Breakout) and 5800 (Breakdown).<br />

• As long as Nifty trades below 6000 on weekly closing basis, the current intermediate trend will be in downward direction.<br />

• The intraday resistance levels for Nifty are placed at 5875 & 5910 where as the intraday support levels are placed 5800 & 5750 respectively.<br />

• The breadth of the market was negative as out of 1442 stocks traded on NSE, 342 stocks advanced, 1011 stocks declined and 89 stocks remained unchanged.<br />

• Amongst the sectoral indices, the BSE FMCG and Teck indices closed in green where as the BSE Metal index closed in red.<br />

Trading Calls for the day<br />

Stock Buy / Sell Segment Lot Size Type of call Reco. Price Stop Loss Target 1 Target 2<br />

Reliance <strong>Capital</strong> Buy Futures 1000 One Day 360 352 368 -<br />

Axis Bank Sell Futures 250 One Day 1260 1290 1230 -<br />

Current Calls<br />

Sr. No Date Action Company Reco. Price Stop Loss Target 1 CMP Remarks<br />

1 2-Jul-13 Buy (P) Crompton 93.75 79 125 88.35<br />

2 4-Jul-13 Sell (I) Dr Reddy 2215 2235 2180 2222.8 Exit at 2220.0. Call Closed.<br />

3 4-Jul-13 Sell (I) Sesa Goa 141 144 137 142.05 Exit at 142.0. Call Closed.<br />

4 4-Jul-13 Buy (ST) HCL Tech Cash 789.5 755 860 799.75<br />

5 4-Jul-13 Buy (ST) Indus Ind Bank 479.5 465 500 472.3<br />

6 3-Jul-13 Sell(ST) Titan Fut 227.5 238.5 210 229<br />

7 3-Jul-13 Sell(ST) DLF Fut 176.5 189 159 180.45<br />

8 3-Jul-13 Sell(ST) Tech Mahindra Fut 1012.5 1047 940 1021 Exit at 1018. Call Closed.<br />

Options Recommendations<br />

Sr. No Date Action Company Reco. Price Stop Loss Target 1 Target 2 CMP Remarks<br />

1 3-Jul-13 Buy Nifty 5700 PE 75.5 52 110 120 71 SL triggered at 52.0. Call Closed.<br />

Derivatives Open Positions: Buy1 & Sell 0 | Technical Open Position: Buy 3 & Sell 2 | *Denotes Revised Stop Loss<br />

<strong>GEPL</strong> <strong>Capital</strong> Pvt Ltd