GCS ANNUAL REPORT 2014

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FOR THE FINANCIAL YEAR ENDED 30 JUNE <strong>2014</strong><br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

(CONTINUED)<br />

NOTE 32. FINANCIAL RISK MANAGEMENT (continued)<br />

The Board of Directors review the written principles for overall risk management, including the following specific areas:<br />

a. Market risk<br />

The Group’s activities expose it primarily to the financial risk of changes in foreign currency exchange rates and interest rates. There has been no material change to the Group’s exposure to market<br />

risk and how it manages those risks from 2013.<br />

i. Foreign exchange risk<br />

The Group undertakes certain transactions denominated in foreign currencies and is exposed to foreign exchange risk through foreign exchange rate fluctuations. Foreign exchange risk arises from<br />

future commercial transactions and recognised financial asset and financial liabilities denominated in a currency that is not the entity’s functional currency. A formal risk management policy has been<br />

implemented in order to manage this risk.<br />

The Group deems an individual foreign currency exposure greater than AUD $250,000 of which the quantum and timing is know with certainty, to be a material exposure and required to be assessed<br />

for full or partial hedging. Individual transactions up to AUD $500,000 can be authorised by the Chief Financial Officer, individual foreign currency exposures in the range of AUD $500,000 and up to<br />

AUD $1,000,000 and transactions which aggregate up to AUD $5,000,000 are to be referred to the Executive members of the Audit and Risk Management Committee, Individual foreign currency<br />

exposures above AUD $1,000,000 and in aggregate above AUD $5,000,000 are to be referred to the full Board of Directors for assessment. No sensitivity analysis has been undertaken as exposure<br />

to foreign currency risk is immaterial to the statement of profit or loss and other comprehensive income.<br />

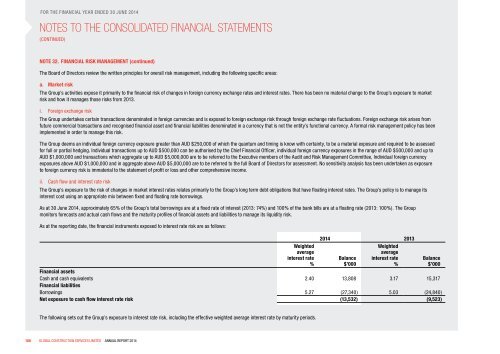

ii. Cash flow and interest rate risk<br />

The Group’s exposure to the risk of changes in market interest rates relates primarily to the Group’s long term debt obligations that have floating interest rates. The Group’s policy is to manage its<br />

interest cost using an appropriate mix between fixed and floating rate borrowings.<br />

As at 30 June <strong>2014</strong>, approximately 65% of the Group’s total borrowings are at a fixed rate of interest (2013: 74%) and 100% of the bank bills are at a floating rate (2013: 100%). The Group<br />

monitors forecasts and actual cash flows and the maturity profiles of financial assets and liabilities to manage its liquidity risk.<br />

As at the reporting date, the financial instruments exposed to interest rate risk are as follows:<br />

Weighted<br />

average<br />

interest rate<br />

%<br />

<strong>2014</strong> 2013<br />

Balance<br />

$’000<br />

Weighted<br />

average<br />

interest rate<br />

%<br />

Financial assets<br />

Cash and cash equivalents 2.40 13,808 3.17 15,317<br />

Financial liabilities<br />

Borrowings 5.27 (27,340) 5.03 (24,840)<br />

Net exposure to cash flow interest rate risk (13,532) (9,523)<br />

Balance<br />

$’000<br />

The following sets out the Group’s exposure to interest rate risk, including the effective weighted average interest rate by maturity periods.<br />

106 GLOBAL CONSTRUCTION SERVICES LIMITED <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2014</strong>