GCS ANNUAL REPORT 2014

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FOR THE FINANCIAL YEAR ENDED 30 JUNE <strong>2014</strong><br />

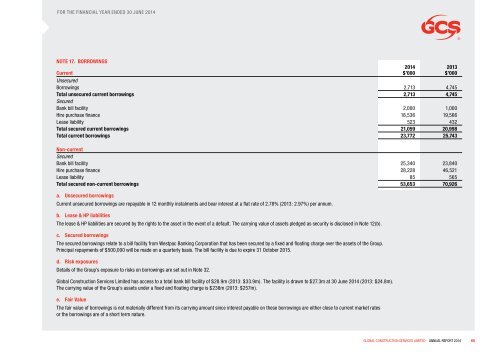

NOTE 17. BORROWINGS<br />

Current<br />

Unsecured<br />

Borrowings 2,713 4,745<br />

Total unsecured current borrowings 2,713 4,745<br />

Secured<br />

Bank bill facility 2,000 1,000<br />

Hire purchase finance 18,536 19,566<br />

Lease liability 523 432<br />

Total secured current borrowings 21,059 20,998<br />

Total current borrowings 23,772 25,743<br />

<strong>2014</strong><br />

$’000<br />

2013<br />

$’000<br />

Non-current<br />

Secured<br />

Bank bill facility 25,340 23,840<br />

Hire purchase finance 28,228 46,521<br />

Lease liability 85 565<br />

Total secured non-current borrowings 53,653 70,926<br />

a. Unsecured borrowings<br />

Current unsecured borrowings are repayable in 12 monthly instalments and bear interest at a flat rate of 2.78% (2013: 2.97%) per annum.<br />

b. Lease & HP liabilities<br />

The lease & HP liabilities are secured by the rights to the asset in the event of a default. The carrying value of assets pledged as security is disclosed in Note 12(b).<br />

c. Secured borrowings<br />

The secured borrowings relate to a bill facility from Westpac Banking Corporation that has been secured by a fixed and floating charge over the assets of the Group.<br />

Principal repayments of $500,000 will be made on a quarterly basis. The bill facility is due to expire 31 October 2015.<br />

d. Risk exposures<br />

Details of the Group’s exposure to risks on borrowings are set out in Note 32.<br />

Global Construction Services Limited has access to a total bank bill facility of $28.9m (2013: $33.9m). The facility is drawn to $27.3m at 30 June <strong>2014</strong> (2013: $24.8m).<br />

The carrying value of the Group’s assets under a fixed and floating charge is $238m (2013: $257m).<br />

e. Fair Value<br />

The fair value of borrowings is not materially different from its carrying amount since interest payable on these borrowings are either close to current market rates<br />

or the borrowings are of a short term nature.<br />

GLOBAL CONSTRUCTION SERVICES LIMITED <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2014</strong><br />

89