GCS ANNUAL REPORT 2014

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FOR THE FINANCIAL YEAR ENDED 30 JUNE <strong>2014</strong><br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

(CONTINUED)<br />

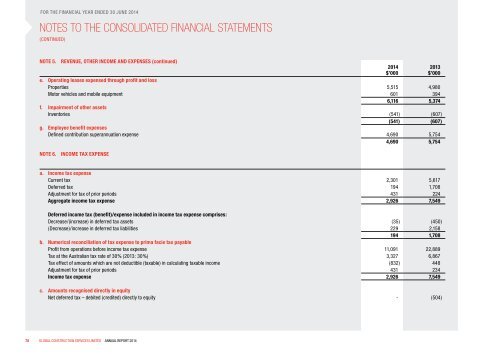

NOTE 5. REVENUE, OTHER INCOME AND EXPENSES (continued)<br />

e. Operating leases expensed through profit and loss<br />

Properties 5,515 4,980<br />

Motor vehicles and mobile equipment 601 394<br />

6,116 5,374<br />

f. Impairment of other assets<br />

Inventories (541) (607)<br />

(541) (607)<br />

g. Employee benefit expenses<br />

Defined contribution superannuation expense 4,690 5,754<br />

4,690 5,754<br />

NOTE 6. INCOME TAX EXPENSE<br />

<strong>2014</strong><br />

$’000<br />

2013<br />

$’000<br />

a. Income tax expense<br />

Current tax 2,301 5,617<br />

Deferred tax 194 1,708<br />

Adjustment for tax of prior periods 431 224<br />

Aggregate income tax expense 2,926 7,549<br />

Deferred income tax (benefit)/expense included in income tax expense comprises:<br />

Decrease/(increase) in deferred tax assets (35) (450)<br />

(Decrease)/increase in deferred tax liabilities 229 2,158<br />

194 1,708<br />

b. Numerical reconciliation of tax expense to prima facie tax payable<br />

Profit from operations before income tax expense 11,091 22,889<br />

Tax at the Australian tax rate of 30% (2013: 30%) 3,327 6,867<br />

Tax effect of amounts which are not deductible (taxable) in calculating taxable income (832) 448<br />

Adjustment for tax of prior periods 431 234<br />

Income tax expense 2,926 7,549<br />

c. Amounts recognised directly in equity<br />

Net deferred tax – debited (credited) directly to equity - (504)<br />

78 GLOBAL CONSTRUCTION SERVICES LIMITED <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2014</strong>