GCS ANNUAL REPORT 2014

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

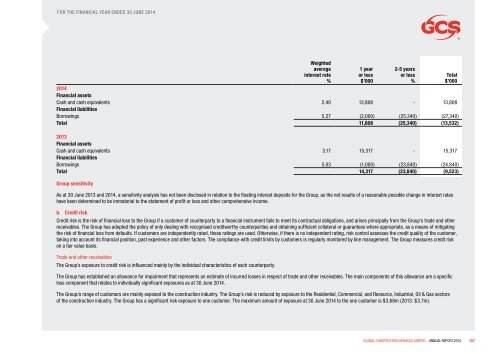

FOR THE FINANCIAL YEAR ENDED 30 JUNE <strong>2014</strong><br />

Weighted<br />

average<br />

interest rate<br />

%<br />

1 year<br />

or less<br />

$’000<br />

2-5 years<br />

or less<br />

%<br />

<strong>2014</strong><br />

Financial assets<br />

Cash and cash equivalents 2.40 13,808 - 13,808<br />

Financial liabilities<br />

Borrowings 5.27 (2,000) (25,340) (27,340)<br />

Total 11,808 (25,340) (13,532)<br />

Total<br />

$’000<br />

2013<br />

Financial assets<br />

Cash and cash equivalents 3.17 15,317 - 15,317<br />

Financial liabilities<br />

Borrowings 5.03 (1,000) (23,840) (24,840)<br />

Total 14,317 (23,840) (9,523)<br />

Group sensitivity<br />

As at 30 June 2013 and <strong>2014</strong>, a sensitivity analysis has not been disclosed in relation to the floating interest deposits for the Group, as the net results of a reasonable possible change in interest rates<br />

have been determined to be immaterial to the statement of profit or loss and other comprehensive income.<br />

b. Credit risk<br />

Credit risk is the risk of financial loss to the Group if a customer of counterparty to a financial instrument fails to meet its contractual obligations, and arises principally from the Group’s trade and other<br />

receivables. The Group has adopted the policy of only dealing with recognised creditworthy counterparties and obtaining sufficient collateral or guarantees where appropriate, as a means of mitigating<br />

the risk of financial loss from defaults. If customers are independently rated, these ratings are used. Otherwise, if there is no independent rating, risk control assesses the credit quality of the customer,<br />

taking into account its financial position, past experience and other factors. The compliance with credit limits by customers is regularly monitored by line management. The Group measures credit risk<br />

on a fair value basis.<br />

Trade and other receivables<br />

The Group’s exposure to credit risk is influenced mainly by the individual characteristics of each counterparty.<br />

The Group has established an allowance for impairment that represents an estimate of incurred losses in respect of trade and other receivables. The main components of this allowance are a specific<br />

loss component that relates to individually significant exposures as at 30 June <strong>2014</strong>.<br />

The Group/s range of customers are mainly exposed to the construction industry. The Group’s risk is reduced by exposure to the Residential, Commercial, and Resource, Industrial, Oil & Gas sectors<br />

of the construction industry. The Group has a significant risk exposure to one customer. The maximum amount of exposure at 30 June <strong>2014</strong> to the one customer is $3.68m (2013: $3.7m).<br />

GLOBAL CONSTRUCTION SERVICES LIMITED <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2014</strong><br />

107