GCS ANNUAL REPORT 2014

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FOR THE FINANCIAL YEAR ENDED 30 JUNE <strong>2014</strong><br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

(CONTINUED)<br />

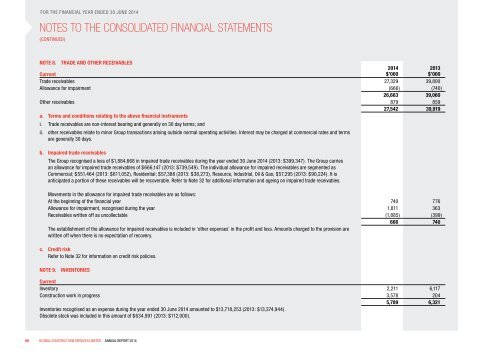

NOTE 8. TRADE AND OTHER RECEIVABLES<br />

Current<br />

<strong>2014</strong><br />

$’000<br />

2013<br />

$’000<br />

Trade receivables 27,329 39,800<br />

Allowance for impairment (666) (740)<br />

26,663 39,060<br />

Other receivables 879 859<br />

27,542 39,919<br />

a. Terms and conditions relating to the above financial instruments<br />

i. Trade receivables are non-interest bearing and generally on 30 day terms; and<br />

ii. other receivables relate to minor Group transactions arising outside normal operating activities. Interest may be charged at commercial rates and terms<br />

are generally 30 days.<br />

b. Impaired trade receivables<br />

The Group recognised a loss of $1,884,668 in impaired trade receivables during the year ended 30 June <strong>2014</strong> (2013: $399,347). The Group carries<br />

an allowance for impaired trade receivables of $666,147 (2013: $739,549). The individual allowance for impaired receivables are segmented as<br />

Commercial; $551,464 (2013: $611,052), Residential; $57,388 (2013: $38,273), Resource, Industrial, Oil & Gas; $57,295 (2013: $90,224). It is<br />

anticipated a portion of these receivables will be recoverable. Refer to Note 32 for additional information and ageing on impaired trade receivables.<br />

Movements in the allowance for impaired trade receivables are as follows:<br />

At the beginning of the financial year 740 776<br />

Allowance for impairment, recognised during the year 1,811 363<br />

Receivables written off as uncollectable (1,885) (399)<br />

666 740<br />

The establishment of the allowance for impaired receivables is included in ‘other expenses’ in the profit and loss. Amounts charged to the provision are<br />

written off when there is no expectation of recovery.<br />

c. Credit risk<br />

Refer to Note 32 for information on credit risk policies.<br />

NOTE 9. INVENTORIES<br />

Current<br />

Inventory 2,211 6,117<br />

Construction work in progress 3,578 204<br />

5,789 6,321<br />

Inventories recognised as an expense during the year ended 30 June <strong>2014</strong> amounted to $13,718,253 (2013: $13,374,944).<br />

Obsolete stock was included in this amount of $634,991 (2013: $112,000).<br />

80 GLOBAL CONSTRUCTION SERVICES LIMITED <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2014</strong>