Fund Service Request Form - Penn Mutual Life

Fund Service Request Form - Penn Mutual Life

Fund Service Request Form - Penn Mutual Life

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

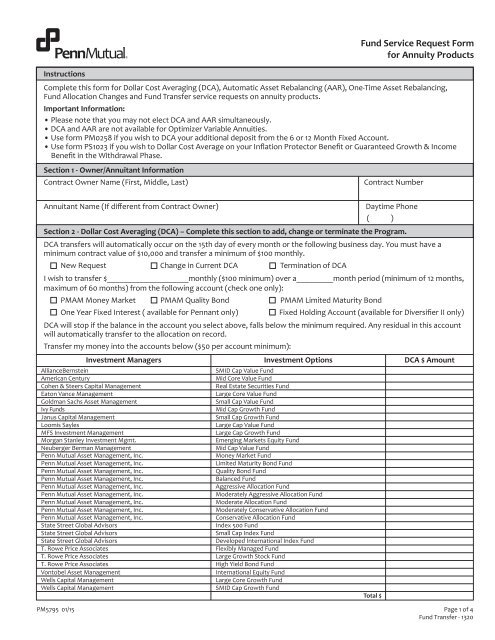

Instructions<br />

Complete this form for Dollar Cost Averaging (DCA), Automatic Asset Rebalancing (AAR), One-Time Asset Rebalancing,<br />

<strong>Fund</strong> Allocation Changes and <strong>Fund</strong> Transfer service requests on annuity products.<br />

Important Information:<br />

• Please note that you may not elect DCA and AAR simultaneously.<br />

• DCA and AAR are not available for Optimizer Variable Annuities.<br />

• Use form PM0258 if you wish to DCA your additional deposit from the 6 or 12 Month Fixed Account.<br />

• Use form PS1023 if you wish to Dollar Cost Average on your Inflation Protector Benefit or Guaranteed Growth & Income<br />

Benefit in the Withdrawal Phase.<br />

Section 1 - Owner/Annuitant Information<br />

Contract Owner Name (First, Middle, Last)<br />

<strong>Fund</strong> <strong>Service</strong> <strong>Request</strong> <strong>Form</strong><br />

for Annuity Products<br />

Contract Number<br />

Annuitant Name (If different from Contract Owner)<br />

Daytime Phone<br />

( )<br />

Section 2 - Dollar Cost Averaging (DCA) – Complete this section to add, change or terminate the Program.<br />

DCA transfers will automatically occur on the 15th day of every month or the following business day. You must have a<br />

minimum contract value of $10,000 and transfer a minimum of $100 monthly.<br />

New <strong>Request</strong> Change in Current DCA Termination of DCA<br />

I wish to transfer $____________________monthly ($100 minimum) over a_________month period (minimum of 12 months,<br />

maximum of 60 months) from the following account (check one only):<br />

PMAM Money Market PMAM Quality Bond PMAM Limited Maturity Bond<br />

One Year Fixed Interest ( available for <strong>Penn</strong>ant only)<br />

Fixed Holding Account (available for Diversifier II only)<br />

DCA will stop if the balance in the account you select above, falls below the minimum required. Any residual in this account<br />

will automatically transfer to the allocation on record.<br />

Transfer my money into the accounts below ($50 per account minimum):<br />

Investment Managers Investment Options DCA $ Amount<br />

AllianceBernstein<br />

SMID Cap Value <strong>Fund</strong><br />

American Century<br />

Mid Core Value <strong>Fund</strong><br />

Cohen & Steers Capital Management<br />

Real Estate Securities <strong>Fund</strong><br />

Eaton Vance Management<br />

Large Core Value <strong>Fund</strong><br />

Goldman Sachs Asset Management<br />

Small Cap Value <strong>Fund</strong><br />

Ivy <strong>Fund</strong>s<br />

Mid Cap Growth <strong>Fund</strong><br />

Janus Capital Management<br />

Small Cap Growth <strong>Fund</strong><br />

Loomis Sayles<br />

Large Cap Value <strong>Fund</strong><br />

MFS Investment Management<br />

Large Cap Growth <strong>Fund</strong><br />

Morgan Stanley Investment Mgmt.<br />

Emerging Markets Equity <strong>Fund</strong><br />

Neuberger Berman Management<br />

<strong>Penn</strong> <strong>Mutual</strong> Asset Management, Inc.<br />

<strong>Penn</strong> <strong>Mutual</strong> Asset Management, Inc.<br />

<strong>Penn</strong> <strong>Mutual</strong> Asset Management, Inc.<br />

<strong>Penn</strong> <strong>Mutual</strong> Asset Management, Inc.<br />

<strong>Penn</strong> <strong>Mutual</strong> Asset Management, Inc.<br />

<strong>Penn</strong> <strong>Mutual</strong> Asset Management, Inc.<br />

<strong>Penn</strong> <strong>Mutual</strong> Asset Management, Inc.<br />

<strong>Penn</strong> <strong>Mutual</strong> Asset Management, Inc.<br />

<strong>Penn</strong> <strong>Mutual</strong> Asset Management, Inc.<br />

State Street Global Advisors<br />

State Street Global Advisors<br />

State Street Global Advisors<br />

T. Rowe Price Associates<br />

T. Rowe Price Associates<br />

T. Rowe Price Associates<br />

Vontobel Asset Management<br />

Wells Capital Management<br />

Wells Capital Management<br />

Mid Cap Value <strong>Fund</strong><br />

Money Market <strong>Fund</strong><br />

Limited Maturity Bond <strong>Fund</strong><br />

Quality Bond <strong>Fund</strong><br />

Balanced <strong>Fund</strong><br />

Aggressive Allocation <strong>Fund</strong><br />

Moderately Aggressive Allocation <strong>Fund</strong><br />

Moderate Allocation <strong>Fund</strong><br />

Moderately Conservative Allocation <strong>Fund</strong><br />

Conservative Allocation <strong>Fund</strong><br />

Index 500 <strong>Fund</strong><br />

Small Cap Index <strong>Fund</strong><br />

Developed International Index <strong>Fund</strong><br />

Flexibly Managed <strong>Fund</strong><br />

Large Growth Stock <strong>Fund</strong><br />

High Yield Bond <strong>Fund</strong><br />

International Equity <strong>Fund</strong><br />

Large Core Growth <strong>Fund</strong><br />

SMID Cap Growth <strong>Fund</strong><br />

PM5795 01/15 Page 1 of 4<br />

<strong>Fund</strong> Transfer - 1320<br />

Total $

Section 3 - Automatic Asset Rebalancing (AAR) – Complete this section to add, change or terminate the program.<br />

You must have a minimum contract value of $10,000 to participate in the AAR program. AAR will occur at the end of each<br />

calendar quarter (in March, June, September and December). AAR can only occur among the variable funds.<br />

New <strong>Request</strong> Change in Current AAR Termination of AAR<br />

I wish to rebalance the variable funds to reflect the following allocation at the end of each calendar quarter. Totals must<br />

equal 100%. Use whole percentages only:<br />

Investment Managers Investment Options AAR %<br />

AllianceBernstein<br />

SMID Cap Value <strong>Fund</strong><br />

American Century<br />

Mid Core Value <strong>Fund</strong><br />

Cohen & Steers Capital Management<br />

Real Estate Securities <strong>Fund</strong><br />

Eaton Vance Management<br />

Large Core Value <strong>Fund</strong><br />

Goldman Sachs Asset Management<br />

Small Cap Value <strong>Fund</strong><br />

Ivy <strong>Fund</strong>s<br />

Mid Cap Growth <strong>Fund</strong><br />

Janus Capital Management<br />

Small Cap Growth <strong>Fund</strong><br />

Loomis Sayles<br />

Large Cap Value <strong>Fund</strong><br />

MFS Investment Management<br />

Large Cap Growth <strong>Fund</strong><br />

Morgan Stanley Investment Mgmt.<br />

Emerging Markets Equity <strong>Fund</strong><br />

Neuberger Berman Management<br />

Mid Cap Value <strong>Fund</strong><br />

<strong>Penn</strong> <strong>Mutual</strong> Asset Management, Inc.<br />

Money Market <strong>Fund</strong><br />

<strong>Penn</strong> <strong>Mutual</strong> Asset Management, Inc.<br />

Limited Maturity Bond <strong>Fund</strong><br />

<strong>Penn</strong> <strong>Mutual</strong> Asset Management, Inc.<br />

Quality Bond <strong>Fund</strong><br />

<strong>Penn</strong> <strong>Mutual</strong> Asset Management, Inc.<br />

Balanced <strong>Fund</strong><br />

<strong>Penn</strong> <strong>Mutual</strong> Asset Management, Inc.<br />

Aggressive Allocation <strong>Fund</strong><br />

<strong>Penn</strong> <strong>Mutual</strong> Asset Management, Inc.<br />

Moderately Aggressive Allocation <strong>Fund</strong><br />

<strong>Penn</strong> <strong>Mutual</strong> Asset Management, Inc.<br />

Moderate Allocation <strong>Fund</strong><br />

<strong>Penn</strong> <strong>Mutual</strong> Asset Management, Inc.<br />

Moderately Conservative Allocation <strong>Fund</strong><br />

<strong>Penn</strong> <strong>Mutual</strong> Asset Management, Inc.<br />

Conservative Allocation <strong>Fund</strong><br />

State Street Global Advisors<br />

Index 500 <strong>Fund</strong><br />

State Street Global Advisors<br />

Small Cap Index <strong>Fund</strong><br />

State Street Global Advisors<br />

Developed International Index <strong>Fund</strong><br />

T. Rowe Price Associates<br />

Flexibly Managed <strong>Fund</strong><br />

T. Rowe Price Associates<br />

Large Growth Stock <strong>Fund</strong><br />

T. Rowe Price Associates<br />

High Yield Bond <strong>Fund</strong><br />

Vontobel Asset Management<br />

International Equity <strong>Fund</strong><br />

Wells Capital Management<br />

Large Core Growth <strong>Fund</strong><br />

Wells Capital Management<br />

SMID Cap Growth <strong>Fund</strong><br />

Total $<br />

Section 4 - One-time Asset Rebalancing, Future Allocation Changes & <strong>Fund</strong> Transfer <strong>Request</strong>s<br />

One-time Asset Rebalancing (This will change current & future allocations)<br />

I wish to rebalance the total assets of my annuity contract to the percentages shown under the Future Allocations<br />

column.<br />

Future Allocation Changes & <strong>Fund</strong> Transfer<br />

I wish to make the following future allocation changes and/or fund transfers in my annuity contract.<br />

Transfer Note: Please review the transfer provisions in your contract. To transfer existing funds or change the allocation of<br />

your future payments, complete the sections below. The minimum transfer amount is $250.00. For partial transfers, the<br />

amount remaining must be at least $250.00. Transfers may only be made from the Fixed Interest Options up to 25 days after<br />

the expiration of the interest period. Option C funds transferred prior to the end of any thirty-six month period will be<br />

reduced by a premature transaction penalty equal to 2 ½% of amount transferred. <strong>Fund</strong> options vary by product and are<br />

subject to change at any time.<br />

PM5795 01/15 Page 2 of 4<br />

<strong>Fund</strong> Transfer - 1320

Section 4 - One-time Asset Rebalancing, Future Allocation Changes & <strong>Fund</strong> Transfer <strong>Request</strong>s (continued)<br />

Totals must equal 100% - Use whole percentages only<br />

Investment Managers<br />

Investment Options<br />

Future<br />

Investment Options<br />

Allocations<br />

From<br />

To<br />

AllianceBernstein<br />

SMID Cap Value <strong>Fund</strong> % $ or % $ or %<br />

American Century<br />

Mid Core Value <strong>Fund</strong><br />

% $ or % $ or %<br />

Cohen & Steers Capital Management Real Estate Securities <strong>Fund</strong><br />

% $ or % $ or %<br />

Eaton Vance Management<br />

Large Core Value <strong>Fund</strong><br />

% $ or % $ or %<br />

Goldman Sachs Asset Management Small Cap Value <strong>Fund</strong><br />

% $ or % $ or %<br />

Ivy <strong>Fund</strong>s<br />

Mid Cap Growth <strong>Fund</strong><br />

% $ or % $ or %<br />

Janus Capital Management<br />

Small Cap Growth <strong>Fund</strong><br />

% $ or % $ or %<br />

Loomis Sayles Large Cap Value <strong>Fund</strong> 1<br />

% $ or % $ or %<br />

MFS Investment Management<br />

Large Cap Growth <strong>Fund</strong><br />

% $ or % $ or %<br />

Morgan Stanley Investment Mgmt. Emerging Markets Equity <strong>Fund</strong><br />

% $ or % $ or %<br />

Neuberger Berman Management<br />

Mid Cap Value <strong>Fund</strong><br />

% $ or % $ or %<br />

<strong>Penn</strong> <strong>Mutual</strong> Asset Management, Inc. Money Market <strong>Fund</strong> 1<br />

% $ or % $ or %<br />

<strong>Penn</strong> <strong>Mutual</strong> Asset Management, Inc. Limited Maturity Bond <strong>Fund</strong><br />

% $ or % $ or %<br />

<strong>Penn</strong> <strong>Mutual</strong> Asset Management, Inc. Quality Bond <strong>Fund</strong> 1<br />

% $ or % $ or %<br />

<strong>Penn</strong> <strong>Mutual</strong> Asset Management, Inc. Balanced <strong>Fund</strong><br />

% $ or % $ or %<br />

<strong>Penn</strong> <strong>Mutual</strong> Asset Management, Inc. Aggressive Allocation <strong>Fund</strong><br />

% $ or % $ or %<br />

<strong>Penn</strong> <strong>Mutual</strong> Asset Management, Inc. Moderately Aggressive Allocation <strong>Fund</strong><br />

% $ or % $ or %<br />

<strong>Penn</strong> <strong>Mutual</strong> Asset Management, Inc. Moderate Allocation <strong>Fund</strong><br />

% $ or % $ or %<br />

<strong>Penn</strong> <strong>Mutual</strong> Asset Management, Inc. Moderately Conservative Allocation <strong>Fund</strong><br />

% $ or % $ or %<br />

<strong>Penn</strong> <strong>Mutual</strong> Asset Management, Inc. Conservative Allocation <strong>Fund</strong><br />

% $ or % $ or %<br />

State Street Global Advisors<br />

Index 500 <strong>Fund</strong><br />

% $ or % $ or %<br />

State Street Global Advisors<br />

Small Cap Index <strong>Fund</strong><br />

% $ or % $ or %<br />

State Street Global Advisors<br />

Developed International Index <strong>Fund</strong><br />

% $ or % $ or %<br />

T. Rowe Price Associates<br />

Flexibly Managed <strong>Fund</strong> 1<br />

% $ or % $ or %<br />

T. Rowe Price Associates<br />

Large Growth Stock <strong>Fund</strong> 1<br />

% $ or % $ or %<br />

T. Rowe Price Associates<br />

High Yield Bond <strong>Fund</strong> 1<br />

% $ or % $ or %<br />

Vontobel Asset Management<br />

International Equity <strong>Fund</strong> 1<br />

% $ or % $ or %<br />

Wells Capital Management<br />

Large Core Growth <strong>Fund</strong><br />

% $ or % $ or %<br />

Wells Capital Management<br />

SMID Cap Growth <strong>Fund</strong><br />

% $ or % $ or %<br />

Fixed Interest Option<br />

Fixed Holding Account 2<br />

% $ or % $ or %<br />

Fixed Interest Option<br />

1 Year Fixed Interest 3<br />

% $ or % $ or %<br />

Fixed Interest Option<br />

3 Year Fixed Interest 4<br />

% $ or % $ or %<br />

Fixed Interest Option<br />

5 Year Fixed Interest 4<br />

% $ or % $ or %<br />

Fixed Interest Option<br />

7 Year Fixed Interest 5<br />

% $ or % $ or %<br />

Fixed Interest Option<br />

Interest Option B (One Month) 1<br />

% $ or % $ or %<br />

Fixed Interest Option<br />

Interest Option A (One Year) 1<br />

% $ or % $ or %<br />

Fixed Interest Option<br />

Interest Option C (Three Year) 1<br />

% $ or % $ or %<br />

Fixed Interest Option<br />

6 Month Fixed Interest 6<br />

% $ or % $ or %<br />

Fixed Interest Option<br />

12 Month Fixed Interest 6<br />

% $ or % $ N/A or N/A %<br />

Total Must Equal 100 %<br />

% $ or % $ N/A or N/A %<br />

1. Optimizer is limited to these funds only: Money Market <strong>Fund</strong>, Quality Bond <strong>Fund</strong>, Large Cap Value <strong>Fund</strong>, Flexibly Managed<br />

<strong>Fund</strong>, Large Growth Stock <strong>Fund</strong>, High Yield Bond <strong>Fund</strong>, International Equity <strong>Fund</strong>, Interest Option B (One Month), Interest<br />

Option A (One Year) and Interest Option C (Three Year).<br />

2. The Fixed Holding Account is only available for Diversifier II annuity contracts.<br />

3. One Year Fixed Interest Option is unavailable for contracts issued on or after 08/11/03, except for Diversifier II and<br />

Retirement Planner Variable Annuity contracts.<br />

4. Three and Five Year Fixed Interest Options are not available for Commander, Olympia XT, Enhanced Credit, <strong>Penn</strong>ant<br />

Select and Inflation Protector Variable Annuities. These options are also unavailable for <strong>Penn</strong> Freedom Variable Annuities<br />

issued after 08/22/2011.<br />

PM5795 01/15 Page 3 of 4<br />

<strong>Fund</strong> Transfer - 1320

Section 4 - One-time Asset Rebalancing, Future Allocation Changes & <strong>Fund</strong> Transfer <strong>Request</strong>s (continued)<br />

5. The Seven Year Fixed Interest Option is not available for Commander, Olympia XT, Enhanced Credit, <strong>Penn</strong>ant Select and<br />

Inflation Protector Variable Annuities.<br />

6. Six and Twelve Month Fixed Interest Options are available for Dollar Cost Average for the following products: <strong>Penn</strong>ant<br />

Select, Olympia XT, Enhanced Credit VA, <strong>Penn</strong>Freedom, Smart Foundation VA and Inflation Protector VA contracts not in<br />

the Withdrawal Phase. The Twelve Month Fixed Interest Options is not available for Retirement Planner VA.<br />

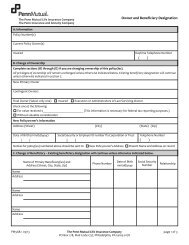

Section 5 - Signatures<br />

Contract Owner's Signature<br />

/ /<br />

Date (mm/dd/yyyy)<br />

Joint Owner's Signature<br />

/ /<br />

Date (mm/dd/yyyy)<br />

If Submitted by a Producer: By signing below, I signify that I have reviewed this transaction with the contract owner and<br />

the contract owner is in agreement.<br />

Producer's Signature<br />

/ /<br />

Date (mm/dd/yyyy)<br />

Please return form to The <strong>Penn</strong> <strong>Mutual</strong> <strong>Life</strong> Insurance Company or The <strong>Penn</strong> Insurance & Annuity Company,<br />

Mail Code C3R, P.O. Box 178, Philadelphia, PA 19105-0178.<br />

PM5795 01/15 Page 4 of 4<br />

<strong>Fund</strong> Transfer - 1320