Transfer of Assets at Death Handout - Penn Mutual Life

Transfer of Assets at Death Handout - Penn Mutual Life

Transfer of Assets at Death Handout - Penn Mutual Life

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Transfer</strong> <strong>of</strong> <strong>Assets</strong> <strong>at</strong> De<strong>at</strong>h<br />

One <strong>of</strong> the basic goals <strong>of</strong> est<strong>at</strong>e planning is making sure your assets are transferred to your heirs<br />

according to your wishes after de<strong>at</strong>h. Without proper est<strong>at</strong>e planning, the people whom you most<br />

want to benefit could be left out in the cold – even if you’ve made your wishes clear during your<br />

lifetime.<br />

How do you make sure your assets are passed on according to your wishes?<br />

• You have to understand how st<strong>at</strong>e and federal law will tre<strong>at</strong> your assets <strong>at</strong> the time <strong>of</strong> your<br />

de<strong>at</strong>h.<br />

• Based on th<strong>at</strong> understanding, you have to develop a plan.<br />

There are several ways th<strong>at</strong> property is transferred <strong>at</strong> the time <strong>of</strong> de<strong>at</strong>h.<br />

<strong>Transfer</strong> By Oper<strong>at</strong>ion <strong>of</strong> Law<br />

The most common example <strong>of</strong> oper<strong>at</strong>ion <strong>of</strong> law is when two or more people share ownership <strong>of</strong><br />

an asset. When one <strong>of</strong> them dies, ownership rights pass to the survivor(s).<br />

Advantages<br />

• No Prob<strong>at</strong>e Administr<strong>at</strong>ion: as long as there is <strong>at</strong> least one surviving owner, there is no need for<br />

a lengthy and potentially costly prob<strong>at</strong>e process.<br />

Disadvantages<br />

• The potential for increased federal and st<strong>at</strong>e de<strong>at</strong>h taxes as well as capital gains taxes.<br />

• Lack <strong>of</strong> individual control <strong>of</strong> the asset during lifetime.<br />

• Inflexibility. When one owner dies, the surviving owner(s) autom<strong>at</strong>ically own the property<br />

outright, regardless <strong>of</strong> any provisions which may have been made in wills, trusts, or other<br />

documents.<br />

Because jointly owned assets are passed on to survivors under oper<strong>at</strong>ion <strong>of</strong> law – regardless <strong>of</strong> any<br />

other wishes you may have – make sure you resolve any ownership issues during your lifetime.<br />

<strong>Transfer</strong> By Oper<strong>at</strong>ion <strong>of</strong> Contract<br />

Owners <strong>of</strong> property can make a contract or agreement during their lifetime to ensure th<strong>at</strong> assets<br />

are transferred to someone else <strong>at</strong> the time <strong>of</strong> their de<strong>at</strong>h. The most common examples <strong>of</strong><br />

oper<strong>at</strong>ion <strong>of</strong> contract include:<br />

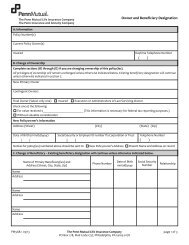

• Beneficiary Design<strong>at</strong>ions: <strong>Life</strong> insurance and annuity policies, employee benefit and retirement<br />

plans, certain U.S. Savings Bonds, and some other types <strong>of</strong> financial accounts permit an<br />

individual to design<strong>at</strong>e who will receive funds in the event <strong>of</strong> de<strong>at</strong>h.<br />

• Inter Vivos (Living) Trusts: A contractual arrangement where property is transferred to a<br />

trustee who manages and distributes it for the beneficiary(s) <strong>of</strong> the trust. If property is<br />

transferred to the trust during the owner’s lifetime, the trust agreement can specify who will<br />

receive the property <strong>at</strong> de<strong>at</strong>h.<br />

But remember: <strong>at</strong> de<strong>at</strong>h, jointly owned property will still pass to the surviving owner, regardless <strong>of</strong><br />

any contract or agreement.<br />

<strong>Transfer</strong> By Prob<strong>at</strong>e Administr<strong>at</strong>ion<br />

When a property owner dies and his/her property is not transferred under oper<strong>at</strong>ion <strong>of</strong> law or<br />

oper<strong>at</strong>ion <strong>of</strong> contract, it must be transferred by the process <strong>of</strong> prob<strong>at</strong>e administr<strong>at</strong>ion. Generally,<br />

prob<strong>at</strong>e proceedings are conducted in the st<strong>at</strong>e where the property owner resided <strong>at</strong> the time <strong>of</strong><br />

de<strong>at</strong>h, as well as in all other st<strong>at</strong>es in which he/she owned real est<strong>at</strong>e.<br />

P LANNING FOR A S ECURE F INANCIAL F UTURE<br />

Cre<strong>at</strong>ed by The <strong>Penn</strong> <strong>Mutual</strong> <strong>Life</strong> Insurance Company, 600 Dresher Road, Horsham, PA 19044<br />

Over

Purposes <strong>of</strong> Prob<strong>at</strong>e Administr<strong>at</strong>ion<br />

• To prove th<strong>at</strong> a Will is authentic, valid, and effective under st<strong>at</strong>e law.<br />

• To assure th<strong>at</strong> all debts, expenses, and other liabilities are paid.<br />

• To transfer property to those entitled to it under the terms <strong>of</strong> a Will, or if there is no Will, to<br />

those entitled to it under st<strong>at</strong>e law.<br />

Advantages <strong>of</strong> Prob<strong>at</strong>e Administr<strong>at</strong>ion<br />

• Est<strong>at</strong>e administr<strong>at</strong>ion is handled by a court, ensuring th<strong>at</strong> any problems, disputes, or other<br />

m<strong>at</strong>ters th<strong>at</strong> might arise are resolved impartially.<br />

• Any rights th<strong>at</strong> creditors may have to est<strong>at</strong>e assets are termin<strong>at</strong>ed by prob<strong>at</strong>e proceedings,<br />

preventing them from asserting claims against the property <strong>at</strong> a l<strong>at</strong>er d<strong>at</strong>e.<br />

• Inherited property receives a "stepped up" cost basis for tax purposes so th<strong>at</strong> if it is l<strong>at</strong>er sold,<br />

capital gains taxes will be reduced or elimin<strong>at</strong>ed. Also, with a properly drafted Will, federal and<br />

st<strong>at</strong>e de<strong>at</strong>h taxes can be minimized.<br />

• An <strong>of</strong>ficial record documenting the ownership <strong>of</strong> property is cre<strong>at</strong>ed, elimin<strong>at</strong>ing the need to<br />

prove ownership in the future.<br />

Disadvantages <strong>of</strong> Prob<strong>at</strong>e Administr<strong>at</strong>ion<br />

• Prob<strong>at</strong>e administr<strong>at</strong>ion can be complic<strong>at</strong>ed, costly and confusing.<br />

• Legal fees, court costs, executor’s fees, and other expenses <strong>of</strong> est<strong>at</strong>e settlement may be<br />

substantial.<br />

• The final distribution <strong>of</strong> est<strong>at</strong>e assets can be delayed for months or even years.<br />

• Dealing with money and family issues in this way can be very stressful.<br />

• Prob<strong>at</strong>e is generally a m<strong>at</strong>ter <strong>of</strong> public record resulting in a lack <strong>of</strong> privacy. Others may have<br />

access to your personal and financial m<strong>at</strong>ters.<br />

Each <strong>of</strong> the above methods <strong>of</strong> transferring property <strong>at</strong> de<strong>at</strong>h has its advantages and disadvantages. But remember,<br />

the various methods are mutually exclusive - if property is transferred under one method, then the other<br />

methods do not oper<strong>at</strong>e. For example, property th<strong>at</strong> is jointly owned will autom<strong>at</strong>ically pass to the surviving<br />

owner(s) regardless <strong>of</strong> any provisions in a will or trust agreement. Similarly, the design<strong>at</strong>ed beneficiary <strong>of</strong> a life<br />

insurance policy will receive the proceeds when the insured dies, regardless <strong>of</strong> the terms <strong>of</strong> the insured’s will.<br />

Th<strong>at</strong>’s why it is extremely important to examine the ownership <strong>of</strong> assets, beneficiary design<strong>at</strong>ions, and the terms<br />

<strong>of</strong> any Wills or Trusts Agreements, to assure th<strong>at</strong> all elements <strong>of</strong> an est<strong>at</strong>e plan are properly coordin<strong>at</strong>ed with<br />

one another and th<strong>at</strong> property and assets will be transferred <strong>at</strong> de<strong>at</strong>h as intended.<br />

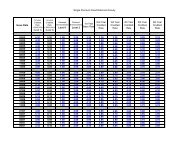

Will<br />

Property<br />

<strong>Transfer</strong>red<br />

Based on<br />

Terms <strong>of</strong> Will<br />

Prob<strong>at</strong>e <strong>Assets</strong><br />

No Will<br />

Property<br />

<strong>Transfer</strong>red<br />

Under St<strong>at</strong>e<br />

Intestacy Law<br />

<strong>Transfer</strong> <strong>at</strong> De<strong>at</strong>h<br />

Non-Prob<strong>at</strong>e <strong>Assets</strong><br />

Contract<br />

<strong>Assets</strong><br />

Property<br />

<strong>Transfer</strong>red<br />

to Design<strong>at</strong>ed<br />

Beneficiary(s)<br />

Joint<br />

Ownership<br />

Property<br />

<strong>Transfer</strong>red<br />

to Surviving<br />

Owner(s)<br />

P LANNING FOR A S ECURE F INANCIAL F UTURE