Penn Mutual LifeStyle Asset Allocation Funds at a Glance

Penn Mutual LifeStyle Asset Allocation Funds at a Glance

Penn Mutual LifeStyle Asset Allocation Funds at a Glance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

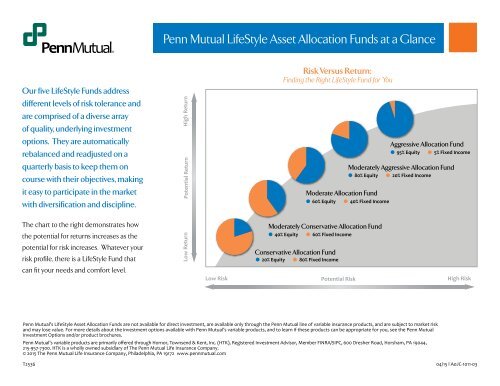

<strong>Penn</strong> <strong>Mutual</strong> <strong>LifeStyle</strong> <strong>Asset</strong> <strong>Alloc<strong>at</strong>ion</strong> <strong>Funds</strong> <strong>at</strong> a <strong>Glance</strong><br />

Our five <strong>LifeStyle</strong> <strong>Funds</strong> address<br />

different levels of risk tolerance and<br />

are comprised of a diverse array<br />

of quality, underlying investment<br />

options. They are autom<strong>at</strong>ically<br />

rebalanced and readjusted on a<br />

quarterly basis to keep them on<br />

course with their objectives, making<br />

it easy to particip<strong>at</strong>e in the market<br />

with diversific<strong>at</strong>ion and discipline.<br />

The chart to the right demonstr<strong>at</strong>es how<br />

the potential for returns increases as the<br />

potential for risk increases. Wh<strong>at</strong>ever your<br />

risk profile, there is a <strong>LifeStyle</strong> Fund th<strong>at</strong><br />

can fit your needs and comfort level.<br />

Low Return Potential Return<br />

High Return<br />

Low Risk<br />

Risk Versus Return:<br />

Finding the Right <strong>LifeStyle</strong> Fund for You<br />

Moder<strong>at</strong>e <strong>Alloc<strong>at</strong>ion</strong> Fund<br />

Moder<strong>at</strong>ely Conserv<strong>at</strong>ive <strong>Alloc<strong>at</strong>ion</strong> Fund<br />

● 40% Equity<br />

● 60% Equity<br />

● 60% Fixed Income<br />

Conserv<strong>at</strong>ive <strong>Alloc<strong>at</strong>ion</strong> Fund<br />

● 20% Equity ● 80% Fixed Income<br />

Potential Risk<br />

Aggressive <strong>Alloc<strong>at</strong>ion</strong> Fund<br />

Moder<strong>at</strong>ely Aggressive <strong>Alloc<strong>at</strong>ion</strong> Fund<br />

● 80% Equity<br />

● 40% Fixed Income<br />

● 95% Equity<br />

● 20% Fixed Income<br />

● 5% Fixed Income<br />

High Risk<br />

<strong>Penn</strong> <strong>Mutual</strong>’s <strong>LifeStyle</strong> <strong>Asset</strong> <strong>Alloc<strong>at</strong>ion</strong> <strong>Funds</strong> are not available for direct investment, are available only through the <strong>Penn</strong> <strong>Mutual</strong> line of variable insurance products, and are subject to market risk<br />

and may lose value. For more details about the investment options available with <strong>Penn</strong> <strong>Mutual</strong>’s variable products, and to learn if these products can be appropri<strong>at</strong>e for you, see the <strong>Penn</strong> <strong>Mutual</strong><br />

Investment Options and/or product brochures.<br />

<strong>Penn</strong> <strong>Mutual</strong>’s variable products are primarily offered through Hornor, Townsend & Kent, Inc. (HTK), Registered Investment Advisor, Member FINRA/SIPC, 600 Dresher Road, Horsham, PA 19044,<br />

215-957-7300. HTK is a wholly owned subsidiary of The <strong>Penn</strong> <strong>Mutual</strong> Life Insurance Company.<br />

© 2015 The <strong>Penn</strong> <strong>Mutual</strong> Life Insurance Company, Philadelphia, PA 19172 www.pennmutual.com<br />

T2536<br />

04/15 l A0JC-1011-03

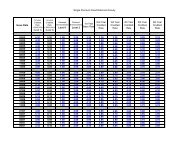

Take a Closer Look Inside the <strong>LifeStyle</strong> <strong>Asset</strong> <strong>Alloc<strong>at</strong>ion</strong> <strong>Funds</strong><br />

Each <strong>LifeStyle</strong> Fund represents a complete, diversified portfolio of funds selected from <strong>Penn</strong> <strong>Mutual</strong>’s 23 individual investment options. <strong>Penn</strong> <strong>Mutual</strong> has consulted with Ibbotson<br />

Associ<strong>at</strong>es, one of today’s top-ranked independent asset alloc<strong>at</strong>ion experts, in the design and monitoring of each Fund. Listed below are the underlying sub-account target alloc<strong>at</strong>ions<br />

of each <strong>LifeStyle</strong> <strong>Asset</strong> <strong>Alloc<strong>at</strong>ion</strong> Fund as of April 1, 2015. Please note, these target fund alloc<strong>at</strong>ions are subject to change and may fluctu<strong>at</strong>e as a result of quarterly monitoring and<br />

rebalancing.<br />

Fund Name<br />

Adviser/Sub-Adviser<br />

Quarterly Rebalance as of April 1, 2015<br />

Conserv<strong>at</strong>ive<br />

<strong>Alloc<strong>at</strong>ion</strong> Fund<br />

Moder<strong>at</strong>ely<br />

Conserv<strong>at</strong>ive<br />

<strong>Alloc<strong>at</strong>ion</strong> Fund<br />

Moder<strong>at</strong>e<br />

<strong>Alloc<strong>at</strong>ion</strong> Fund<br />

Moder<strong>at</strong>ely<br />

Aggressive<br />

<strong>Alloc<strong>at</strong>ion</strong> Fund<br />

Aggressive<br />

<strong>Alloc<strong>at</strong>ion</strong> Fund<br />

<strong>Penn</strong> Series Large Growth Stock Fund T. Rowe Price Associ<strong>at</strong>es 0% 1% 2% 4% 4%<br />

<strong>Penn</strong> Series Large Cap Growth MFS Investment Management 2% 2% 3% 3% 4%<br />

<strong>Penn</strong> Series Large Core Growth Fund Wells Capital Management 0% 0% 0% 1% 1%<br />

<strong>Penn</strong> Series Large Core Value Fund E<strong>at</strong>on Vance Management 1% 2% 3% 4% 5%<br />

<strong>Penn</strong> Series Large Cap Value Fund Loomis, Sayles & Company 2% 5% 6% 9% 10%<br />

<strong>Penn</strong> Series Mid Cap Growth Fund Ivy Investment Management 0% 0% 2% 3% 4%<br />

<strong>Penn</strong> Series Mid Cap Value Fund Neuberger Berman Management 2% 3% 3% 5% 5%<br />

<strong>Penn</strong> Series Mid Core Value Fund American Century Investment Management 1% 2% 3% 4% 4%<br />

<strong>Penn</strong> Series SMID Cap Growth Fund Wells Capital Management 0% 1% 1% 2% 2%<br />

<strong>Penn</strong> Series SMID Cap Value Fund AllianceBernstein 0% 2% 3% 3% 5%<br />

<strong>Penn</strong> Series Small Cap Growth Fund Janus Capital Management 0% 1% 2% 3% 4%<br />

<strong>Penn</strong> Series Small Cap Value Fund Goldman Sachs <strong>Asset</strong> Management 0% 1% 2% 3% 4%<br />

<strong>Penn</strong> Series Flexibly Managed Fund T. Rowe Price Associ<strong>at</strong>es 8% 7% 6% 4% 4%<br />

<strong>Penn</strong> Series Index 500 Fund St<strong>at</strong>e Street Global Advisors 2% 3% 5% 5% 6%<br />

<strong>Penn</strong> Series Small Cap Index Fund St<strong>at</strong>e Street Global Advisors 0% 1% 2% 2% 1%<br />

<strong>Penn</strong> Series Developed Intern<strong>at</strong>ional Index Fund St<strong>at</strong>e Street Global Advisors 3% 4% 5% 7% 8%<br />

<strong>Penn</strong> Series Intern<strong>at</strong>ional Equity Fund Vontobel <strong>Asset</strong> Management 2% 5% 9% 11% 14%<br />

<strong>Penn</strong> Series Emerging Markets Equity Fund Morgan Stanley Investment Management 0% 1% 3% 5% 7%<br />

<strong>Penn</strong> Series Real Est<strong>at</strong>e Securities Fund Cohen & Steers Capital Management 0% 2% 2% 3% 4%<br />

<strong>Penn</strong> Series Money Market Fund Independence Capital Management, Inc. 6% 2% 2% 0% 0%<br />

<strong>Penn</strong> Series Limited M<strong>at</strong>urity Bond Fund Independence Capital Management, Inc. 21% 15% 7% 4% 0%<br />

<strong>Penn</strong> Series Quality Bond Fund Independence Capital Management, Inc. 43% 34% 25% 12% 4%<br />

<strong>Penn</strong> Series High Yield Bond Fund T. Rowe Price Associ<strong>at</strong>es 7% 6% 4% 3% 0%<br />

Total Number of <strong>Funds</strong> 13 21 22 22 20<br />

To find the balance of diversific<strong>at</strong>ion and discipline in the <strong>LifeStyle</strong> Fund th<strong>at</strong>’s right for you, talk to your financial professional or visit www.pennmutual.com.