Insurance Trusts Handout - Penn Mutual Life

Insurance Trusts Handout - Penn Mutual Life

Insurance Trusts Handout - Penn Mutual Life

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Life</strong> <strong>Insurance</strong> for Estate Liquidity<br />

<strong>Insurance</strong> <strong>Trusts</strong><br />

Death creates an immediate need for cash to pay living expenses for your family and the claims<br />

against your estate: expenses of last illness, funeral & burial costs, estate settlement costs, federal<br />

& state taxes, debts & other claims against your estate, etc. <strong>Life</strong> insurance can provide the necessary<br />

cash for your estate at a cost of pennies on the dollar, and with proper planning, policy proceeds<br />

can be received tax free - no federal estate tax or state death taxes, no federal or state<br />

income taxes, no capital gains tax.<br />

<strong>Insurance</strong> policy proceeds paid at death generally are not subject to federal income tax, regardless<br />

of who is the owner and beneficiary of the policy. However, insurance proceeds will be<br />

included in the insured’s gross estate, and may be subject to federal estate tax of up to 47%, if the<br />

proceeds are paid to the insured’s estate, or if the insured is the owner of the policy or has any<br />

"incidents of ownership": the right to designate or change the policy beneficiary(s), the right to<br />

surrender or cancel the policy, the right to assign the policy or revoke an assignment, the right to<br />

receive policy loans or pledge the policy as collateral, etc. In order to avoid federal estate tax on<br />

life insurance proceeds, two effective planning techniques are irrevocable life insurance trusts and<br />

survivorship standby trusts.<br />

Irrevocable <strong>Life</strong> <strong>Insurance</strong> <strong>Trusts</strong><br />

An irrevocable life insurance trust is one created during the grantor’s lifetime, and the grantor<br />

does not have the right to terminate or modify it during lifetime. The trust is the owner and beneficiary<br />

of life insurance on the grantor, spouse, or other members of the grantor’s family. The<br />

insurance policies can be existing ones that are transferred to the trust, or they can be new policies<br />

that are purchased by the trust. In either case, policy premiums are paid by the trust with<br />

funds that are given to it by the grantor or other family members. If the trust is properly drafted<br />

and administered, federal gift taxes on the funds transferred to it to pay policy premiums can be<br />

minimized or eliminated altogether. At death, the policy proceeds are paid to the trust income<br />

tax free and estate tax free, and the trustee is given the power to make loans to the grantor’s<br />

estate or purchase non-liquid assets from the estate, thus providing the estate with the necessary<br />

cash to pay taxes and settlement costs.<br />

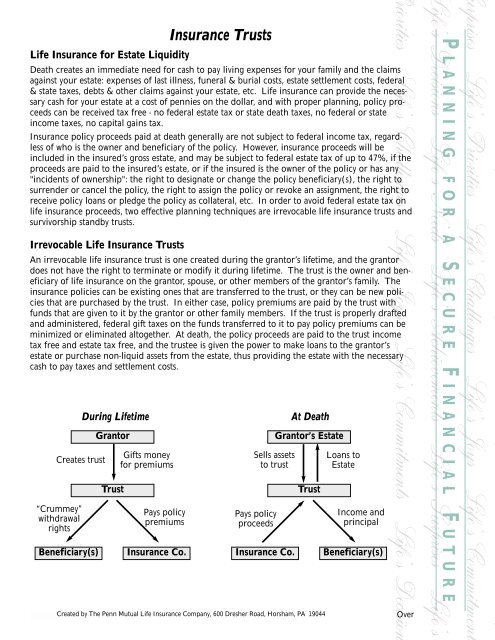

Creates trust<br />

“Crummey”<br />

withdrawal<br />

rights<br />

Beneficiary(s)<br />

During <strong>Life</strong>time<br />

Grantor<br />

Trust<br />

Gifts money<br />

for premiums<br />

Pays policy<br />

premiums<br />

<strong>Insurance</strong> Co.<br />

Sells assets<br />

to trust<br />

Pays policy<br />

proceeds<br />

<strong>Insurance</strong> Co.<br />

At Death<br />

Grantor’s Estate<br />

Trust<br />

Loans to<br />

Estate<br />

Income and<br />

principal<br />

Beneficiary(s)<br />

P LANNING FOR A S ECURE F INANCIAL F UTURE<br />

Created by The <strong>Penn</strong> <strong>Mutual</strong> <strong>Life</strong> <strong>Insurance</strong> Company, 600 Dresher Road, Horsham, PA 19044<br />

Over

Advantages of Irrevocable <strong>Life</strong> <strong>Insurance</strong> Trust<br />

• Policy proceeds received by the trust income tax free and estate tax free.<br />

• Provide cash for estate settlement costs.<br />

• Provide income to family members.<br />

• Professional management of policy proceeds and other trust assets.<br />

• Avoid probate administration and maintain confidentiality regarding trust assets.<br />

• Protect policy proceeds and trust assets from creditors.<br />

• Minimize gift tax consequences with "Crummey" withdrawal rights in trust beneficiary(s).<br />

Survivorship Standby Trust<br />

A survivorship standby trust is a variation of the traditional irrevocable life insurance trust that is<br />

funded with a survivorship ("second-to-die") life insurance policy. Survivorship life is a type of policy<br />

that insures two people, generally spouses, under a single policy, and the death benefit is not<br />

paid until the death of both insureds or the last survivor between them. In a typical estate plan<br />

for a married couple, no federal estate tax will be payable until the death of the surviving spouse.<br />

Survivorship life was designed to be "synchronized" with the federal estate tax because the death<br />

proceeds are not paid until the death of the surviving spouse. If the survivorship policy is owned<br />

by an irrevocable trust, the policy proceeds generally will not be subject to federal estate tax, but<br />

there are some disadvantages:<br />

• Loss of control over policy - insureds can’t be trustees.<br />

• Insureds can’t access policy cash values during lifetime.<br />

• Trust can’t be changed or terminated if circumstances or goals change.<br />

• Funds transferred for premiums may be subject to gift taxes.<br />

• "Crummey" beneficiary(s) might withdraw funds against insureds’ wishes.<br />

A survivorship standby trust (SST) is designed to accomplish two objectives: permit the insureds to<br />

retain lifetime control over a survivorship life policy and have access to policy cash values, and<br />

avoid federal estate tax on policy proceeds paid at death. Here’s how it works: the spouse with the<br />

shorter life expectancy due to age, sex, health, etc. (generally the husband) applies for and owns a<br />

survivorship policy on both spouses. The policyowner-spouse creates a survivorship stand-by trust<br />

under the terms of his/her Will, and the SST is designated as the contingent owner and beneficiary<br />

of the policy. Basically, an SST is an irrevocable life insurance trust that doesn't begin to operate<br />

until the policyowner’s death. During the joint lifetime of the insureds, the policyowner pays<br />

all premiums, and because the policy is owned outright, the policyowner-spouse has unrestricted<br />

access to policy cash values. At the policyowner's death, the policy is transferred to the SST, which<br />

begins to function as a conventional irrevocable life insurance trust. If the non-policyowner<br />

spouse dies first, the policyowner-spouse can continue to own the policy outright, or transfer it to<br />

an irrevocable trust or other third party (children, etc.) during lifetime to avoid inclusion of the<br />

proceeds in his/her gross estate.<br />

Advantages of Survivorship Standby Trust<br />

• Income-tax-free & estate-tax-free proceeds for estate liquidity.<br />

• Elimination of gift tax on premiums paid during policyowner’s lifetime.<br />

• Income tax deferral on growth of policy cash values.<br />

• Policy cash values may be received during policyowner’s lifetime for for retirement, college<br />

funding, or other lifetime needs.<br />

P LANNING FOR A S ECURE F INANCIAL F UTURE