Construction Industry - Audit Technique Guide - Uncle Fed's Tax ...

Construction Industry - Audit Technique Guide - Uncle Fed's Tax ...

Construction Industry - Audit Technique Guide - Uncle Fed's Tax ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

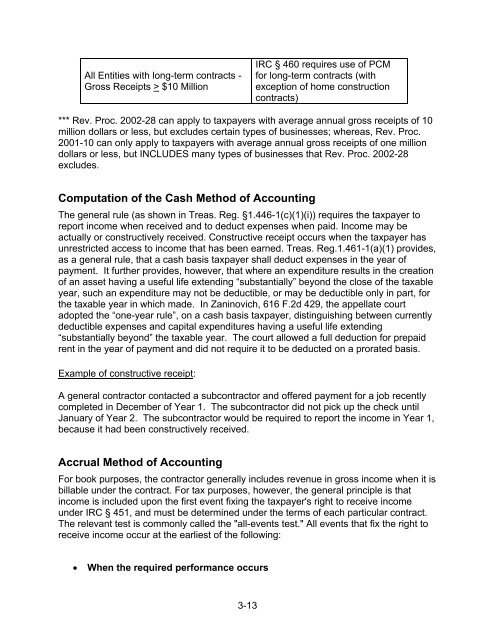

All Entities with long-term contracts -Gross Receipts > $10 MillionIRC § 460 requires use of PCMfor long-term contracts (withexception of home constructioncontracts)*** Rev. Proc. 2002-28 can apply to taxpayers with average annual gross receipts of 10million dollars or less, but excludes certain types of businesses; whereas, Rev. Proc.2001-10 can only apply to taxpayers with average annual gross receipts of one milliondollars or less, but INCLUDES many types of businesses that Rev. Proc. 2002-28excludes.Computation of the Cash Method of AccountingThe general rule (as shown in Treas. Reg. §1.446-1(c)(1)(i)) requires the taxpayer toreport income when received and to deduct expenses when paid. Income may beactually or constructively received. Constructive receipt occurs when the taxpayer hasunrestricted access to income that has been earned. Treas. Reg.1.461-1(a)(1) provides,as a general rule, that a cash basis taxpayer shall deduct expenses in the year ofpayment. It further provides, however, that where an expenditure results in the creationof an asset having a useful life extending “substantially” beyond the close of the taxableyear, such an expenditure may not be deductible, or may be deductible only in part, forthe taxable year in which made. In Zaninovich, 616 F.2d 429, the appellate courtadopted the “one-year rule”, on a cash basis taxpayer, distinguishing between currentlydeductible expenses and capital expenditures having a useful life extending“substantially beyond” the taxable year. The court allowed a full deduction for prepaidrent in the year of payment and did not require it to be deducted on a prorated basis.Example of constructive receipt:A general contractor contacted a subcontractor and offered payment for a job recentlycompleted in December of Year 1. The subcontractor did not pick up the check untilJanuary of Year 2. The subcontractor would be required to report the income in Year 1,because it had been constructively received.Accrual Method of AccountingFor book purposes, the contractor generally includes revenue in gross income when it isbillable under the contract. For tax purposes, however, the general principle is thatincome is included upon the first event fixing the taxpayer's right to receive incomeunder IRC § 451, and must be determined under the terms of each particular contract.The relevant test is commonly called the "all-events test." All events that fix the right toreceive income occur at the earliest of the following:• When the required performance occurs3-13