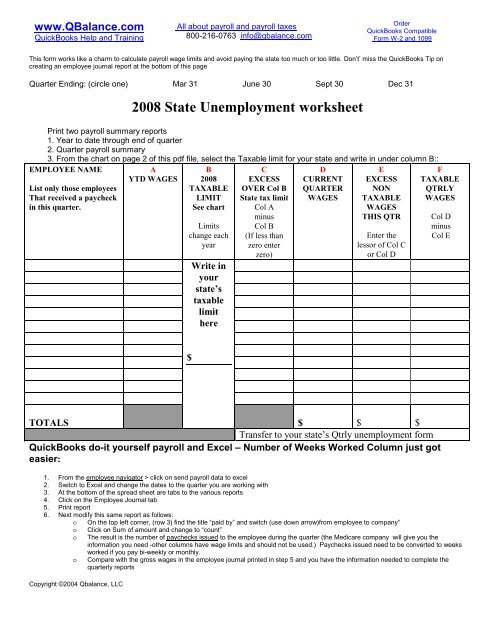

2008 State Unemployment worksheet - QBalance.com

2008 State Unemployment worksheet - QBalance.com

2008 State Unemployment worksheet - QBalance.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

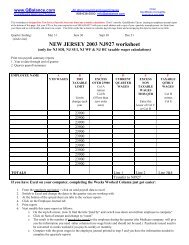

Year <strong>2008</strong> <strong>State</strong> <strong>Unemployment</strong> Taxable wage LimitsTax limits subject to change annually January 1 st . The rate of tax is also subject to change so keep a watchful eye out for correspondence from the<strong>State</strong> Department of labor notifying you of the change.STATEEmployerrate<strong>2008</strong>Confirm the limits in this table with the <strong>Unemployment</strong> Tax return formmailed to you by your <strong>State</strong> or consult with your tax advisor.Alabama 8,000Alaska 31,300Arizona 7,000Arkansas 10,000California 7,000Colorado 10,000Connecticut 15,000Delaware 10,500District of Col. 9,000Florida 7,000Georgia 8,500Hawaii 13,000Idaho 32,200Illinois 12,000Indiana 7,000Iowa 22,800Kansas 8,000Kentucky 8,000Louisiana 7,000Maine 12,000Maryland 8,500Massachusett 14,000s Michigan 9,000Minnesota 25,000Mississippi 7,000Missouri 12,000Montana 23,800Nebraska 9,000Nevada 25,400New8,000HahaHampshiNew Jersey 27,700New Mexico 19,900New York 8,500North Carolina 18,600North Dakota 22,100Ohio 9,000Oklahoma 13,600Oregon 30,200Pennsylvania 8,000(employee) UnlimitedPuerto Rico 7,000Rhode Island 14,000South 7,000South Dakota 9,000Tennessee 7,000Texas 9,000Utah 26,700Vermont 8,000Virginia 8,000Washington 34,000West Virginia 8,000Wisconsin 10,500Wyoming 20,100While we have made every effort to confirm the accuracy of these wage limits,we cannot be held responsible for typographical errors.These taxable wage limit are included as part of the QuickBooks tax tablesbutthe the rate of tax (% due) is a function of state law and your <strong>com</strong>pany’s experience with former employee’s collectingunemployment and therefore must be manually entered into QuickBooks. Tax rates can change annually. But the anniversarydate of the change varies based upon the state. You will be informed of changes by your state so be sure to read allcorrespondence that <strong>com</strong>es in the mail.When the tax rates change you should make the change to the Payroll item(s) as of the effective date. Payroll items are foundunder the list menu in QuickBooks. If you fail to set-up your rate in QuickBooks under Payroll items as of the effective date,QuickBooks will not calculate the right liability for the first Quarter the change applies to. You can be sure you always pay thecorrect amount of tax, <strong>com</strong>plete the <strong>worksheet</strong> on the previous page before filing your return.An adjustment for any discrepancy between the tax form and QuickBooks balance in the liability can easily be made right onthe payroll tax liability check:.From the payroll menu > Select the date range for the quarter > Pay the amount currently registered as a payable for thestate unemployment item > Edit this check and use the expense tab to record the difference (positive or negative) in theamount due. Be sure to select the payroll tax expense account as the adjustment account (QuickBooks sets up a defaultaccount called “payroll expenses” which may be the account you are using to record your payroll tax expenses.)Be sure to edit the payroll item so QuickBooks can calculate the correct amount of tax for future quartersFrom the List menu > Payroll item list > Locate the item type “state unemployment tax”, right click and click on edit > Clickthrough to the 3 rd window and enter the tax rate as a percentage(example: 3.3%) for each quarter.Copyright ©2006 Qbalance, LLC

<strong>QBalance</strong>.<strong>com</strong>We make QuickBooks work for youCPACall Toll-Free: (800) 216-0763Congratulations!You are using the best accounting software available!But: you may be one of the 75% of all QuickBooks installations that have hiddendeficiencies that cost your business time, and money. Can you honestly answer thesefollowing questions:Do you have an ideal set-up in QuickBooks?Are you using the most efficient activities to enter transactions?Is there a quicker way to obtain information?Are your reports accurate? Do you trust them to make business decisions? Areyou using the right reports to make decisions?Are you using the right version of QuickBooks?For over 7 years, <strong>QBalance</strong> Certified QuickBooks ProAdvisors who are also CPAshave been helping businesses like yours to save real time and money by makingQuickBooks work for you. We have the answers to these questions and any others youmight have.Remember our toll-free telephone number: (800) 216-0763. Please jot it down forready reference. Call us when you have any of the following:You have a problem using QuickBooks and need an answer.You are overdue for the re<strong>com</strong>mended QuickBooks Tune-up.You need training for either existing or new users.Our help is provided by telephone, e-mail and through the Internet directly toyour personal <strong>com</strong>puter via remote control while you watch – call for a freedemonstration!QuickBooks Training www.qbalance.<strong>com</strong>/QuickBooksTrainingUSA.htmwww.qbalance.<strong>com</strong>/QuickBooks_supplies.htmQuickBooks Checks W2s 1099s Deposit Slips Shipping Labels Check Envelopes