996 - Banca Antonveneta

996 - Banca Antonveneta

996 - Banca Antonveneta

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

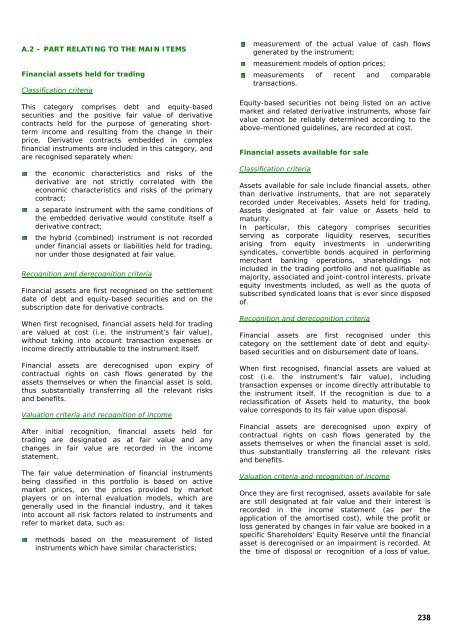

A.2 – PART RELATING TO THE MAIN ITEMSFinancial assets held for tradingClassification criteriaThis category comprises debt and equity-basedsecurities and the positive fair value of derivativecontracts held for the purpose of generating shorttermincome and resulting from the change in theirprice. Derivative contracts embedded in complexfinancial instruments are included in this category, andare recognised separately when:the economic characteristics and risks of thederivative are not strictly correlated with theeconomic characteristics and risks of the primarycontract;a separate instrument with the same conditions ofthe embedded derivative would constitute itself aderivative contract;the hybrid (combined) instrument is not recordedunder financial assets or liabilities held for trading,nor under those designated at fair value.Recognition and derecognition criteriaFinancial assets are first recognised on the settlementdate of debt and equity-based securities and on thesubscription date for derivative contracts.When first recognised, financial assets held for tradingare valued at cost (i.e. the instrument’s fair value),without taking into account transaction expenses orincome directly attributable to the instrument itself.Financial assets are derecognised upon expiry ofcontractual rights on cash flows generated by theassets themselves or when the financial asset is sold,thus substantially transferring all the relevant risksand benefits.Valuation criteria and recognition of incomeAfter initial recognition, financial assets held fortrading are designated as at fair value and anychanges in fair value are recorded in the incomestatement.The fair value determination of financial instrumentsbeing classified in this portfolio is based on activemarket prices, on the prices provided by marketplayers or on internal evaluation models, which aregenerally used in the financial industry, and it takesinto account all risk factors related to instruments andrefer to market data, such as:methods based on the measurement of listedinstruments which have similar characteristics;measurement of the actual value of cash flowsgenerated by the instrument;measurement models of option prices;measurements of recent and comparabletransactions.Equity-based securities not being listed on an activemarket and related derivative instruments, whose fairvalue cannot be reliably determined according to theabove-mentioned guidelines, are recorded at cost.Financial assets available for saleClassification criteriaAssets available for sale include financial assets, otherthan derivative instruments, that are not separatelyrecorded under Receivables, Assets held for trading,Assets designated at fair value or Assets held tomaturity.In particular, this category comprises securitiesserving as corporate liquidity reserves, securitiesarising from equity investments in underwritingsyndicates, convertible bonds acquired in performingmerchant banking operations, shareholdings notincluded in the trading portfolio and not qualifiable asmajority, associated and joint-control interests, privateequity investments included, as well as the quota ofsubscribed syndicated loans that is ever since disposedof.Recognition and derecognition criteriaFinancial assets are first recognised under thiscategory on the settlement date of debt and equitybasedsecurities and on disbursement date of loans.When first recognised, financial assets are valued atcost (i.e. the instrument’s fair value), includingtransaction expenses or income directly attributable tothe instrument itself. If the recognition is due to areclassification of Assets held to maturity, the bookvalue corresponds to its fair value upon disposal.Financial assets are derecognised upon expiry ofcontractual rights on cash flows generated by theassets themselves or when the financial asset is sold,thus substantially transferring all the relevant risksand benefits.Valuation criteria and recognition of incomeOnce they are first recognised, assets available for saleare still designated at fair value and their interest isrecorded in the income statement (as per theapplication of the amortised cost), while the profit orloss generated by changes in fair value are booked in aspecific Shareholders’ Equity Reserve until the financialasset is derecognised or an impairment is recorded. Atthe time of disposal or recognition of a loss of value,238