996 - Banca Antonveneta

996 - Banca Antonveneta

996 - Banca Antonveneta

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

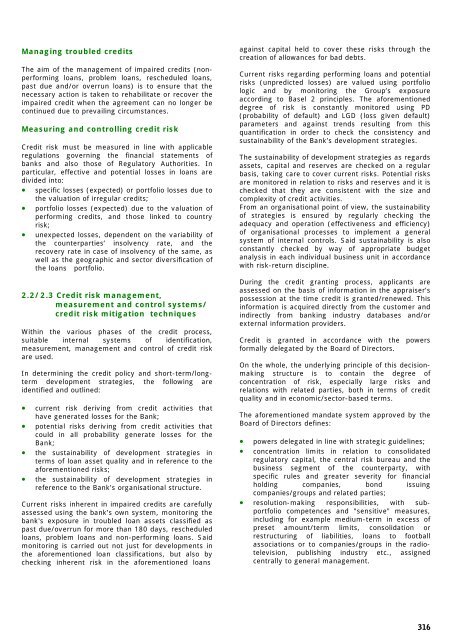

Managing troubled creditsThe aim of the management of impaired credits (nonperformingloans, problem loans, rescheduled loans,past due and/or overrun loans) is to ensure that thenecessary action is taken to rehabilitate or recover theimpaired credit when the agreement can no longer becontinued due to prevailing circumstances.Measuring and controlling credit riskCredit risk must be measured in line with applicableregulations governing the financial statements ofbanks and also those of Regulatory Authorities. Inparticular, effective and potential losses in loans aredivided into:• specific losses (expected) or portfolio losses due tothe valuation of irregular credits;• portfolio losses (expected) due to the valuation ofperforming credits, and those linked to countryrisk;• unexpected losses, dependent on the variability ofthe counterparties’ insolvency rate, and therecovery rate in case of insolvency of the same, aswell as the geographic and sector diversification ofthe loans portfolio.2.2/2.3 Credit risk management,measurement and control systems/credit risk mitigation techniquesWithin the various phases of the credit process,suitable internal systems of identification,measurement, management and control of credit riskare used.In determining the credit policy and short-term/longtermdevelopment strategies, the following areidentified and outlined:• current risk deriving from credit activities thathave generated losses for the Bank;• potential risks deriving from credit activities thatcould in all probability generate losses for theBank;• the sustainability of development strategies interms of loan asset quality and in reference to theaforementioned risks;• the sustainability of development strategies inreference to the Bank’s organisational structure.Current risks inherent in impaired credits are carefullyassessed using the bank’s own system, monitoring thebank's exposure in troubled loan assets classified aspast due/overrun for more than 180 days, rescheduledloans, problem loans and non-performing loans. Saidmonitoring is carried out not just for developments inthe aforementioned loan classifications, but also bychecking inherent risk in the aforementioned loansagainst capital held to cover these risks through thecreation of allowances for bad debts.Current risks regarding performing loans and potentialrisks (unpredicted losses) are valued using portfoliologic and by monitoring the Group’s exposureaccording to Basel 2 principles. The aforementioneddegree of risk is constantly monitored using PD(probability of default) and LGD (loss given default)parameters and against trends resulting from thisquantification in order to check the consistency andsustainability of the Bank’s development strategies.The sustainability of development strategies as regardsassets, capital and reserves are checked on a regularbasis, taking care to cover current risks. Potential risksare monitored in relation to risks and reserves and it ischecked that they are consistent with the size andcomplexity of credit activities.From an organisational point of view, the sustainabilityof strategies is ensured by regularly checking theadequacy and operation (effectiveness and efficiency)of organisational processes to implement a generalsystem of internal controls. Said sustainability is alsoconstantly checked by way of appropriate budgetanalysis in each individual business unit in accordancewith risk-return discipline.During the credit granting process, applicants areassessed on the basis of information in the appraiser’spossession at the time credit is granted/renewed. Thisinformation is acquired directly from the customer andindirectly from banking industry databases and/orexternal information providers.Credit is granted in accordance with the powersformally delegated by the Board of Directors.On the whole, the underlying principle of this decisionmakingstructure is to contain the degree ofconcentration of risk, especially large risks andrelations with related parties, both in terms of creditquality and in economic/sector-based terms.The aforementioned mandate system approved by theBoard of Directors defines:• powers delegated in line with strategic guidelines;• concentration limits in relation to consolidatedregulatory capital, the central risk bureau and thebusiness segment of the counterparty, withspecific rules and greater severity for financialholding companies, bond issuingcompanies/groups and related parties;• resolution-making responsibilities, with subportfoliocompetences and "sensitive" measures,including for example medium-term in excess ofpreset amount/term limits, consolidation orrestructuring of liabilities, loans to footballassociations or to companies/groups in the radiotelevision,publishing industry etc., assignedcentrally to general management.316