Hotels and Services: Growth Drivers Driving sustainable, profitable ...

Hotels and Services: Growth Drivers Driving sustainable, profitable ...

Hotels and Services: Growth Drivers Driving sustainable, profitable ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2<br />

■ €7,622m: up 7.9%<br />

Revenue for the year was up €558<br />

million over the €7,064 million reported<br />

in 2004.<br />

+4.7%<br />

+4.5%<br />

-2.5%<br />

+1.2%<br />

■ €1,986m: up 8.8%<br />

EBITDAR rose by €161 million for the<br />

year, from €1,825 million in 2004. Of<br />

that increase, €115 million was generated<br />

by business growth. Ebitdar<br />

margin amounted to 26.1%, compared<br />

to 25.8% in 2004. Like-for-like, the<br />

increase was 0.4 points.<br />

■ €603m: up 17.6%<br />

Operating profit before tax <strong>and</strong> nonrecurring<br />

items was up €90 million<br />

over the €513 million reported in 2004.<br />

The increase reflected the gradual<br />

improvement in margins <strong>and</strong> the efficient<br />

management of fixed asset holding<br />

costs (rental expense, depreciation,<br />

amortization <strong>and</strong> provision expense,<br />

<strong>and</strong> financial expense), which represented<br />

18.2% of revenue, compared<br />

with 18.6% in 2004.<br />

2005 ANNUAL RESULTS<br />

Accor's results showed sharp improvement in 2005, thanks to a more<br />

favorable hotel cycle <strong>and</strong> sharp growth in the services business. The<br />

balance sheet was also considerably strengthened.<br />

Like-for-like<br />

Expansion<br />

Disposals<br />

Currency impact<br />

+7.9% Total (reported)<br />

Breakdown of 2005<br />

revenue growth<br />

LETTER TO SHAREHOLDERS - APRIL 2006<br />

■ €333m: up 42.9%<br />

Net profit, Group share increased by<br />

a sharp €100 million to €333 million,<br />

from €233 million in 2004. Earnings<br />

per share rose to €1.55 from €1.17<br />

in 2004, based on the weighted average<br />

214,782,601 shares outst<strong>and</strong>ing<br />

in 2005.<br />

■ €935m: up 9.6%<br />

Funds from operations increased by<br />

€82 million over the €853 million<br />

reported in 2004.<br />

■ €449m: up 43%<br />

Expenditure for renovation <strong>and</strong><br />

maintenance of assets increased by<br />

€135 million for the year, in line with<br />

Group strategy, <strong>and</strong> represented<br />

5.9% of revenue, versus 4.4% in<br />

2004.<br />

■ €479m: up 28.8%<br />

Excluding €308 million for the acquisition<br />

of a stake in Club Méditerranée,<br />

development expenditure rose by<br />

€107 million over the €372 million<br />

reported in 2004.<br />

■ 32% versus 71%<br />

The net debt-to-equity ratio improved<br />

significantly, as equity rose by €822<br />

million, while net debt declined to an<br />

all-time low of €1,420 million, from<br />

€2,244 million in 2004.<br />

■ 10.7% versus 10.0%<br />

Return on capital employed improved<br />

in both the <strong>Hotels</strong> <strong>and</strong> <strong>Services</strong> businesses.<br />

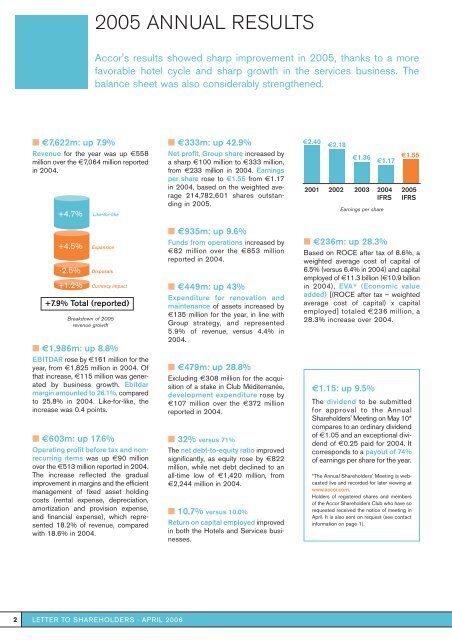

€2.40 €2.18<br />

€1.15: up 9.5%<br />

€1.36 €1.17 €1.55<br />

2001 2002 2003 2004 2005<br />

IFRS IFRS<br />

Earnings per share<br />

■ €236m: up 28.3%<br />

Based on ROCE after tax of 8.6%, a<br />

weighted average cost of capital of<br />

6.5% (versus 6.4% in 2004) <strong>and</strong> capital<br />

employed of €11.3 billion (€10.9 billion<br />

in 2004), EVA ® (Economic value<br />

added) [(ROCE after tax – weighted<br />

average cost of capital) x capital<br />

employed] totaled €236 million, a<br />

28.3% increase over 2004.<br />

The dividend to be submitted<br />

for approval to the Annual<br />

Shareholders' Meeting on May 10*<br />

compares to an ordinary dividend<br />

of €1.05 <strong>and</strong> an exceptional dividend<br />

of €0.25 paid for 2004. It<br />

corresponds to a payout of 74%<br />

of earnings per share for the year.<br />

*The Annual Shareholders’ Meeting is webcasted<br />

live <strong>and</strong> recorded for later viewing at<br />

www.accor.com.<br />

Holders of registered shares <strong>and</strong> members<br />

of the Accor Shareholders Club who have so<br />

requested received the notice of meeting in<br />

April. It is also sent on request (see contact<br />

information on page 1).