2010 Annual Report and Financial Statements - UBA Plc

2010 Annual Report and Financial Statements - UBA Plc

2010 Annual Report and Financial Statements - UBA Plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

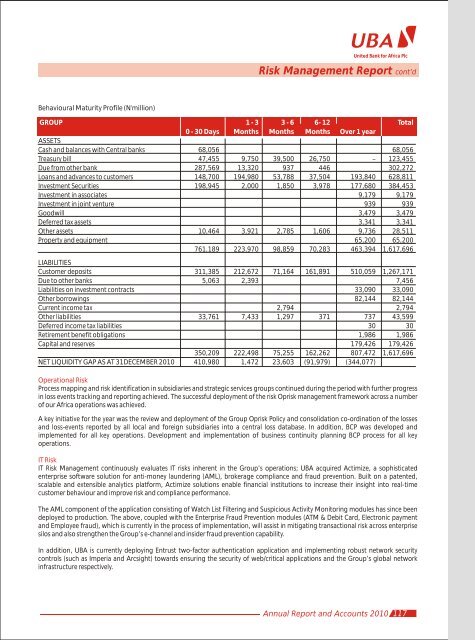

United Bank for Africa <strong>Plc</strong>Risk Management <strong>Report</strong> cont’dBehavioural Maturity Profile (N'million)GROUP 1 - 3 3 - 6 6- 12 Total0 - 30 Days Months Months Months Over 1 yearASSETSCash <strong>and</strong> balances with Central banks 68,056 68,056Treasury bill 47,455 9,750 39,500 26,750 – 123,455Due from other bank 287,569 13,320 937 446 302,272Loans <strong>and</strong> advances to customers 148,700 194,980 53,788 37,504 193,840 628,811Investment Securities 198,945 2,000 1,850 3,978 177,680 384,453Investment in associates 9,179 9,179Investment in joint venture 939 939Goodwill 3,479 3,479Deferred tax assets 3,341 3,341Other assets 10,464 3,921 2,785 1,606 9,736 28,511Property <strong>and</strong> equipment 65,200 65,200761,189 223,970 98,859 70,283 463,394 1,617,696LIABILITIESCustomer deposits 311,385 212,672 71,164 161,891 510,059 1,267,171Due to other banks 5,063 2,393 7,456Liabilities on investment contracts 33,090 33,090Other borrowings 82,144 82,144Current income tax 2,794 2,794Other liabilities 33,761 7,433 1,297 371 737 43,599Deferred income tax liabilities 30 30Retirement benefit obligations 1,986 1,986Capital <strong>and</strong> reserves 179,426 179,426350,209 222,498 75,255 162,262 807,472 1,617,696NET LIQUIDITY GAP AS AT 31DECEMBER <strong>2010</strong> 410,980 1,472 23,603 (91,979) (344,077)Operational RiskProcess mapping <strong>and</strong> risk identification in subsidiaries <strong>and</strong> strategic services groups continued during the period with further progressin loss events tracking <strong>and</strong> reporting achieved. The successful deployment of the risk Oprisk management framework across a numberof our Africa operations was achieved.A key initiative for the year was the review <strong>and</strong> deployment of the Group Oprisk Policy <strong>and</strong> consolidation co-ordination of the losses<strong>and</strong> loss-events reported by all local <strong>and</strong> foreign subsidiaries into a central loss database. In addition, BCP was developed <strong>and</strong>implemented for all key operations. Development <strong>and</strong> implementation of business continuity planning BCP process for all keyoperations.IT RiskIT Risk Management continuously evaluates IT risks inherent in the Group’s operations; <strong>UBA</strong> acquired Actimize, a sophisticatedenterprise software solution for anti-money laundering (AML), brokerage compliance <strong>and</strong> fraud prevention. Built on a patented,scalable <strong>and</strong> extensible analytics platform, Actimize solutions enable financial institutions to increase their insight into real-timecustomer behaviour <strong>and</strong> improve risk <strong>and</strong> compliance performance.The AML component of the application consisting of Watch List Filtering <strong>and</strong> Suspicious Activity Monitoring modules has since beendeployed to production. The above, coupled with the Enterprise Fraud Prevention modules (ATM & Debit Card, Electronic payment<strong>and</strong> Employee fraud), which is currently in the process of implementation, will assist in mitigating transactional risk across enterprisesilos <strong>and</strong> also strengthen the Group’s e-channel <strong>and</strong> insider fraud prevention capability.In addition, <strong>UBA</strong> is currently deploying Entrust two-factor authentication application <strong>and</strong> implementing robust network securitycontrols (such as Imperia <strong>and</strong> Arcsight) towards ensuring the security of web/critical applications <strong>and</strong> the Group’s global networkinfrastructure respectively.<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> Accounts <strong>2010</strong> 117