Guidelines on the Differential Premium Systems - PIDM

Guidelines on the Differential Premium Systems - PIDM

Guidelines on the Differential Premium Systems - PIDM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

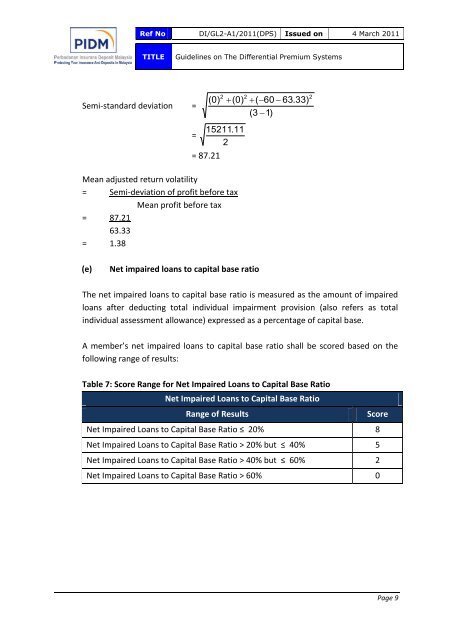

Ref No DI/GL2-A1/2011(DPS) Issued <strong>on</strong> 4 March 2011TITLE<str<strong>on</strong>g>Guidelines</str<strong>on</strong>g> <strong>on</strong> The <strong>Differential</strong> <strong>Premium</strong> <strong>Systems</strong>Semi-standard deviati<strong>on</strong> =(0)2(0)2(60 63.33)(3 1)215211.11=2= 87.21Mean adjusted return volatility= Semi-deviati<strong>on</strong> of profit before taxMean profit before tax= 87.2163.33= 1.38(e)Net impaired loans to capital base ratioThe net impaired loans to capital base ratio is measured as <strong>the</strong> amount of impairedloans after deducting total individual impairment provisi<strong>on</strong> (also refers as totalindividual assessment allowance) expressed as a percentage of capital base.A member’s net impaired loans to capital base ratio shall be scored based <strong>on</strong> <strong>the</strong>following range of results:Table 7: Score Range for Net Impaired Loans to Capital Base RatioNet Impaired Loans to Capital Base RatioRange of ResultsScoreNet Impaired Loans to Capital Base Ratio ≤ 20% 8Net Impaired Loans to Capital Base Ratio > 20% but ≤ 40% 5Net Impaired Loans to Capital Base Ratio > 40% but ≤ 60% 2Net Impaired Loans to Capital Base Ratio > 60% 0Page 9