Guidelines on the Differential Premium Systems - PIDM

Guidelines on the Differential Premium Systems - PIDM

Guidelines on the Differential Premium Systems - PIDM

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

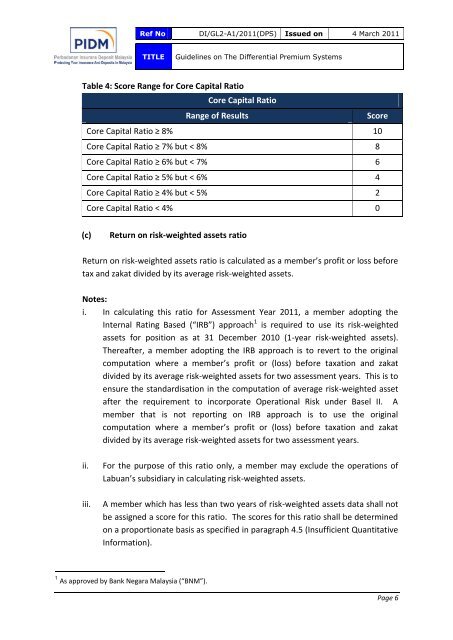

Ref No DI/GL2-A1/2011(DPS) Issued <strong>on</strong> 4 March 2011TITLE<str<strong>on</strong>g>Guidelines</str<strong>on</strong>g> <strong>on</strong> The <strong>Differential</strong> <strong>Premium</strong> <strong>Systems</strong>Table 4: Score Range for Core Capital RatioCore Capital RatioRange of ResultsScoreCore Capital Ratio ≥ 8% 10Core Capital Ratio ≥ 7% but < 8% 8Core Capital Ratio ≥ 6% but < 7% 6Core Capital Ratio ≥ 5% but < 6% 4Core Capital Ratio ≥ 4% but < 5% 2Core Capital Ratio < 4% 0(c)Return <strong>on</strong> risk-weighted assets ratioReturn <strong>on</strong> risk-weighted assets ratio is calculated as a member’s profit or loss beforetax and zakat divided by its average risk-weighted assets.Notes:i. In calculating this ratio for Assessment Year 2011, a member adopting <strong>the</strong>Internal Rating Based (“IRB”) approach 1 is required to use its risk-weightedassets for positi<strong>on</strong> as at 31 December 2010 (1-year risk-weighted assets).Thereafter, a member adopting <strong>the</strong> IRB approach is to revert to <strong>the</strong> originalcomputati<strong>on</strong> where a member’s profit or (loss) before taxati<strong>on</strong> and zakatdivided by its average risk-weighted assets for two assessment years. This is toensure <strong>the</strong> standardisati<strong>on</strong> in <strong>the</strong> computati<strong>on</strong> of average risk-weighted assetafter <strong>the</strong> requirement to incorporate Operati<strong>on</strong>al Risk under Basel II. Amember that is not reporting <strong>on</strong> IRB approach is to use <strong>the</strong> originalcomputati<strong>on</strong> where a member’s profit or (loss) before taxati<strong>on</strong> and zakatdivided by its average risk-weighted assets for two assessment years.ii.iii.For <strong>the</strong> purpose of this ratio <strong>on</strong>ly, a member may exclude <strong>the</strong> operati<strong>on</strong>s ofLabuan’s subsidiary in calculating risk-weighted assets.A member which has less than two years of risk-weighted assets data shall notbe assigned a score for this ratio. The scores for this ratio shall be determined<strong>on</strong> a proporti<strong>on</strong>ate basis as specified in paragraph 4.5 (Insufficient QuantitativeInformati<strong>on</strong>).1 As approved by Bank Negara Malaysia (“BNM”).Page 6