Guidelines on the Differential Premium Systems - PIDM

Guidelines on the Differential Premium Systems - PIDM

Guidelines on the Differential Premium Systems - PIDM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

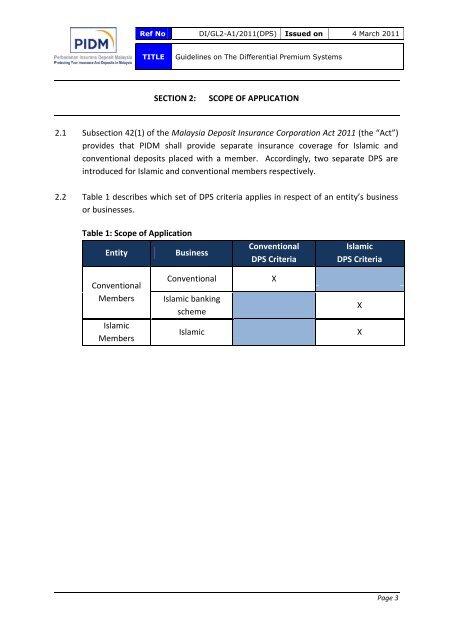

Ref No DI/GL2-A1/2011(DPS) Issued <strong>on</strong> 4 March 2011TITLE<str<strong>on</strong>g>Guidelines</str<strong>on</strong>g> <strong>on</strong> The <strong>Differential</strong> <strong>Premium</strong> <strong>Systems</strong>SECTION 2:SCOPE OF APPLICATION2.1 Subsecti<strong>on</strong> 42(1) of <strong>the</strong> Malaysia Deposit Insurance Corporati<strong>on</strong> Act 2011 (<strong>the</strong> “Act”)provides that <strong>PIDM</strong> shall provide separate insurance coverage for Islamic andc<strong>on</strong>venti<strong>on</strong>al deposits placed with a member. Accordingly, two separate DPS areintroduced for Islamic and c<strong>on</strong>venti<strong>on</strong>al members respectively.2.2 Table 1 describes which set of DPS criteria applies in respect of an entity’s businessor businesses.Table 1: Scope of Applicati<strong>on</strong>EntityBusinessC<strong>on</strong>venti<strong>on</strong>alDPS CriteriaIslamicDPS CriteriaC<strong>on</strong>venti<strong>on</strong>alMembersIslamicMembersC<strong>on</strong>venti<strong>on</strong>alIslamic bankingschemeIslamicXXXPage 3