Guidelines on the Differential Premium Systems - PIDM

Guidelines on the Differential Premium Systems - PIDM

Guidelines on the Differential Premium Systems - PIDM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

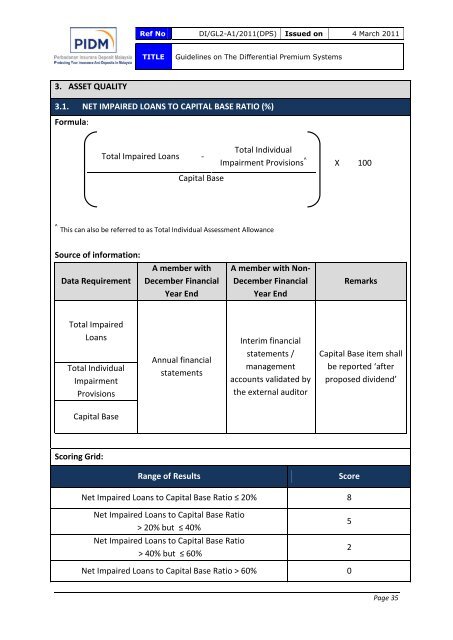

Ref No DI/GL2-A1/2011(DPS) Issued <strong>on</strong> 4 March 2011TITLE<str<strong>on</strong>g>Guidelines</str<strong>on</strong>g> <strong>on</strong> The <strong>Differential</strong> <strong>Premium</strong> <strong>Systems</strong>3. ASSET QUALITY3.1. NET IMPAIRED LOANS TO CAPITAL BASE RATIO (%)Formula:Total Impaired Loans -Total IndividualImpairment Provisi<strong>on</strong>s^X 100Capital Base^ This can also be referred to as Total Individual Assessment AllowanceSource of informati<strong>on</strong>:Data RequirementA member withDecember FinancialYear EndA member with N<strong>on</strong>-December FinancialYear EndRemarksTotal ImpairedLoansTotal IndividualImpairmentProvisi<strong>on</strong>sAnnual financialstatementsInterim financialstatements /managementaccounts validated by<strong>the</strong> external auditorCapital Base item shallbe reported ‘afterproposed dividend’Capital BaseScoring Grid:Range of ResultsScoreNet Impaired Loans to Capital Base Ratio ≤ 20% 8Net Impaired Loans to Capital Base Ratio> 20% but ≤ 40%Net Impaired Loans to Capital Base Ratio> 40% but ≤ 60%52Net Impaired Loans to Capital Base Ratio > 60% 0Page 35